There has always been a series of exploits targeting blockchain companies and the cryptocurrency space. Recently, the decentralized trading platform Curve Finance has become the latest victim. Hackers launch attacks on the front end of the Curve website, redirecting unsuspecting users to malicious destinations. According to on-chain detective Zachxbt, attackers may have stolen up to $570,000 in ETH and transferred it to FixedFloat for laundering. During early Asian trade on Wednesday, Curve Finance announced in an update statement that it had found and fixed the vulnerability that led to the hack, while asking users to revoke any contracts approved on its platform.

The CPI data is about to be released, uncertainty has prompted some investors to start selling risk assets, and the main cryptocurrency market fell slightly. Major cryptocurrencies gave back some gains in the past week. BTC fell 3.8% in the past 24 hours. , ended a four-day winning streak and is now below the $23,000 mark. The largest cryptocurrency by market cap is facing immediate resistance near the $23,200-$23,500 range. If the price closes above this resistance zone, then Bitcoin A steady uptrend is expected. Conversely, BTC may fall and test the previous support in the $22-22,500 range. In the derivatives market, although leverage is still high, the underlying margin seems to be more stable as it is driven by Bitcoin The supported margin ratio has returned to its normal baseline of around 40%.

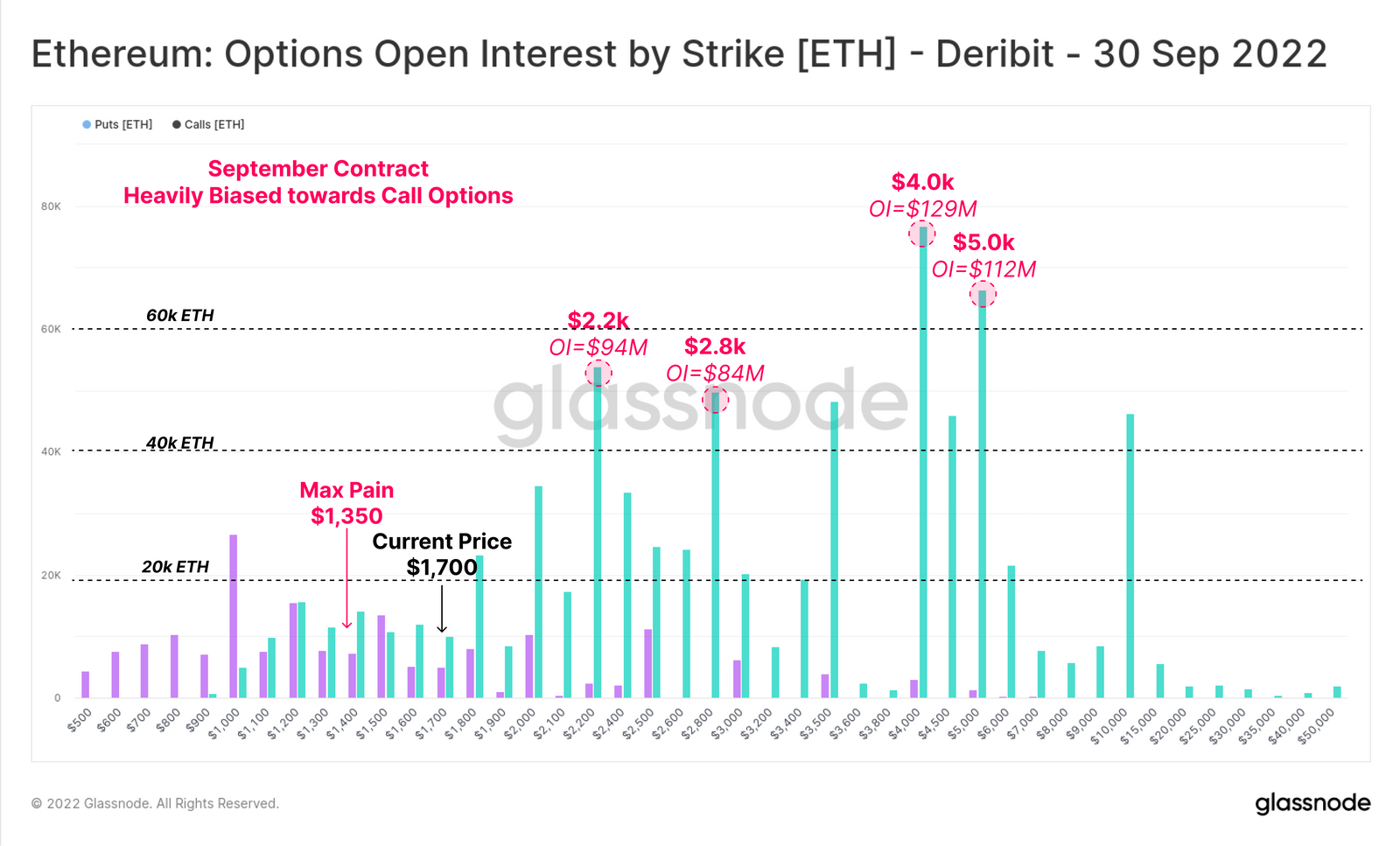

Similar to BTC, ETH’s market cap is now above the $1,600 mark after losing 6% over the same period. Negative basis in the ETH futures market has yet to improve as investors anticipate a bout of upside speculation following The Merge upgrade and also predict that sellers may come under pressure after this. The biggest pain point is near $1,350, well below the current spot price, which could lead to a dramatic price move afterward. Coins that were previously at the top of the gainer list are giving back their gains. For example, FIL fell by 8% during the same period, and most major non-mainstream coins have also turned up and down.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...