This article explains what funding fees are in Binance Futures, which is a type of derivatives trading platform.

Funding fees are periodic payments that long and short traders make to each other in order to keep the price of futures contracts aligned with the price of the underlying asset.

Funding fees are determined by a variety of factors, including the demand for the contract and the difference between the price of the contract and the price of the underlying asset.

We also explain how funding fees are calculated, how they are charged and paid, and provides an example to illustrate their impact on a trader’s position.

Go to Binance’s Official Website

What are Binance Futures Funding Fees?

Funding rates determine periodic payments between traders holding positions in perpetual contracts. The periodic payments that traders make or receive are called funding fees.

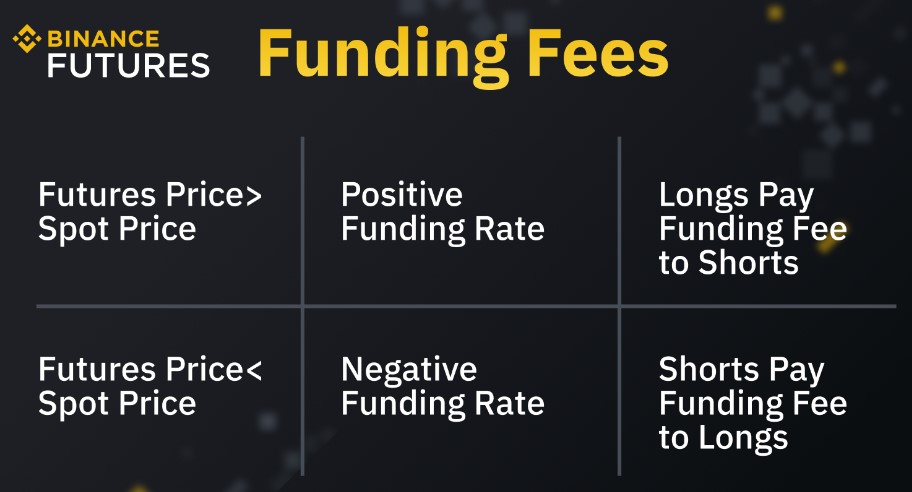

If the price of the perpetual contract is higher than the spot price of the underlying asset during the funding period, the long trader will pay the short trader the funding fee. Conversely, if the spot price is higher than the contract price, the short trader pays the long trader a funding fee.

High funding costs will reduce profits or increase losses, which will affect the performance of traders and may lead to an increase in the probability of forced liquidation.

Binance Futures implements a funding rate mechanism to ensure that the price of the perpetual contract is aligned with the spot price of the underlying cryptocurrency associated with the contract. In this article, we’ll explore the fundamentals of funding rates and the impact of this mechanism during periods of high volatility.

Traditional contracts and perpetual contracts

The contracts offered by Binance Futures are pegged to the prices of cryptocurrencies traded on the spot market. Traditional futures contracts, also known as delivery contracts, have a fixed expiration date and are usually delivered monthly or quarterly. At expiration, the contract price matches the price of the underlying asset, and all open positions are settled.

Unlike traditional contracts, perpetual contracts have no expiration date, which means traders can hold positions forever. Without a suitable price anchor mechanism, the contract price and spot price will not be consistent.

In Binance Futures, the mechanism that keeps the contract price in a perpetual contract in balance with the index price is the funding rate.

The funding rate determines the payment between traders who hold long or short positions in perpetual contracts during the funding period.

A funding period is a periodic event in which funding fees are paid between traders with long and short positions. Usually paid every 8 hours. The notional amount paid or received by the user is called a funding fee.

Note that the funding fees for Binance Futures are not fees paid to the Binance platform, but are paid between traders. This mechanism is to maintain the balance of cryptocurrency prices in the contract market and the spot market.

Go to Binance’s Official Website

How is the cost of funding determined?

The funding rate determines which trader pays or receives funding, and the percentage of the position involved.

When the market is in a state of contract premium, that is, the contract price is higher than the spot price, the funding rate is a positive number. In this case, the long position trader in the perpetual contract will pay the short position trader a funding fee.

Conversely, if the market is in backwardation, that is, the contract price is lower than the spot price, the funding rate will be negative. In this case, the short position trader in the perpetual contract will pay the long position trader a funding fee.

How to check the funding fee?

- Funding Fee:

- The amount ultimately paid or received by the trader during the funding period. Funding fee history can be viewed by going to Transaction History.

- Funding Rate:

- The rate that determines who pays and the amount of the funding fee. The funding rate is determined by the difference between the price of the perpetual contract and the spot price of the underlying cryptocurrency.

- Funding Cap/Floor:

- The maximum funding period that can be charged to a trader during the funding period, especially if the funding rate is very high.

- Funding Interval:

- How often the funding fee is paid between traders. Typically every eight hours, but may be at shorter intervals during periods of high market volatility.

- Funding Period:

- A fixed time between traders to pay funding fees.

Go to Binance’s Official Website

Correlation with Market Volatility

Currencies with smaller market caps in futures contracts are riskier and more volatile because the markets for such currencies are less liquid. That is, fewer buyers and sellers and lower volumes lead to more price sensitivity.

Due to the low liquidity of cryptocurrencies with small market capitalization, their contract prices will be more easily affected by high volatility, and it is even more necessary for Binance Futures to implement additional balancing measures.

Binance Futures implements various measures to control risks and maintain price stability during periods of high volatility. The purpose of implementing these measures is to align the price of futures contracts with the price of the underlying asset in the spot market. Some of these measures include:

- Increase the upper limit of the funding fee:

- Raising the upper limit of the funding fee will result in a higher funding rate, which will increase the funding fee, thereby increasing the adjustment range of the perpetual contract price. An increase in funding fees will encourage traders to take less risk during periods of high volatility.

- Reduced Funding Interval:

- By reducing the funding interval, Binance can determine the funding rate and exchange of funding fees more quickly, thereby improving the effectiveness of this mechanism in maintaining the consistency of contract and spot prices.

Additionally, these measures can insulate traders from excessive risk, encouraging them to trade cautiously during periods of high volatility.

What is the impact of high capital charges?

Traders paying high funding fees can negatively impact their trading performance.

- Reduced profits:

- If traders are the fee payers, high funding fees can reduce their profits, especially if they hold long-term positions. Because the higher the funding rate, the higher the funding costs, reducing the overall profit. However, if the trader is the one collecting the fee, then the funding fee will increase their profits.

- Increased risk of forced liquidation:

- High funding charges can seriously affect a trader’s ability to maintain a position in the market. Funding fees are periodically deducted from a trader’s margin balance and can significantly reduce the margin balance required to maintain a position. If a trader does not have sufficient margin to cover funding charges, it may result in forced liquidation.

Please note:

- Real-time attention:

- Stay informed about the funding rates and funding caps of the perpetual contracts you trade, especially during times of high market volatility. This allows you to anticipate changes and adjust the way you trade before traders pay for their funds.

- Limit holding time:

- Funding fees are charged periodically, so keep holding positions as short as possible. If you do not hold a position during the funding period, you will not be charged funding fees. Fees are charged multiple times for holding a position overnight.

- Maintain Margin Balance:

- Make sure you have enough margin to cover funding charges. A low margin balance may lead to forced liquidation, so it is extremely important to have sufficient margin to cover funding costs and potential losses.

In short, the funding rate and funding fee are crucial to maintaining the contract price in the perpetual contract market. It is recommended to pay attention to the funding rate, the upper limit of the funding fee and the funding period. In addition, by adjusting your holding time and paying attention to your margin balance in real time, you can minimize the impact of funding costs on your trading performance and reduce the risk of forced liquidation.

Go to Binance’s Official Website

Please check Binance official website or contact the customer support with regard to the latest information and more accurate details.

Binance official website is here.

Please click "Introduction of Binance", if you want to know the details and the company information of Binance.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...