What is a Decentralized Exchange – A Decentralized Exchange (DEX) is a peer-to-peer marketplace that allows you to conduct trades without a centralized intermediary.

Bitcoin cannot be traded directly on the DEX. However, for example, Wrapped Bitcoin (WBTC) makes it possible to use Bitcoin ( BTC ) on the Ethereum blockchain.

There are three types of decentralized exchanges (DEXs): order book exchanges, AMM exchanges, and DEX aggregators.

What is a Decentralized Exchange (DEX)?

Decentralized exchanges, also known as DEXs, are peer-to-peer marketplaces that allow trading without centralized intermediaries such as banks or brokers. Most DEXs run on the Ethereum blockchain. With the rise of Decentralized Finance (DeFi), the use of DEX has exploded. According to Coinbase, $ 217 billion was traded on DEX in Q1 2021, with over 2 million DeFi traders by April, a tenfold increase from May 2020.

How do decentralized exchanges work?

DEX relies on smart contracts to maintain decentralization , pricing cryptocurrencies through an algorithm. To facilitate these trades, liquidity pools (LPs) are also used, where investors stake their assets in return for rewards . Like many DeFi (Decentralized Financial System) products, DEX was built with innovation and development in mind. For this reason, they are primarily built on open source code, allowing anyone to create new competing projects. Therefore , Pancakeswap , Bakeryswap , and Sushiswap will appear in Uniswap .

Learn more about Crypto with Phemex

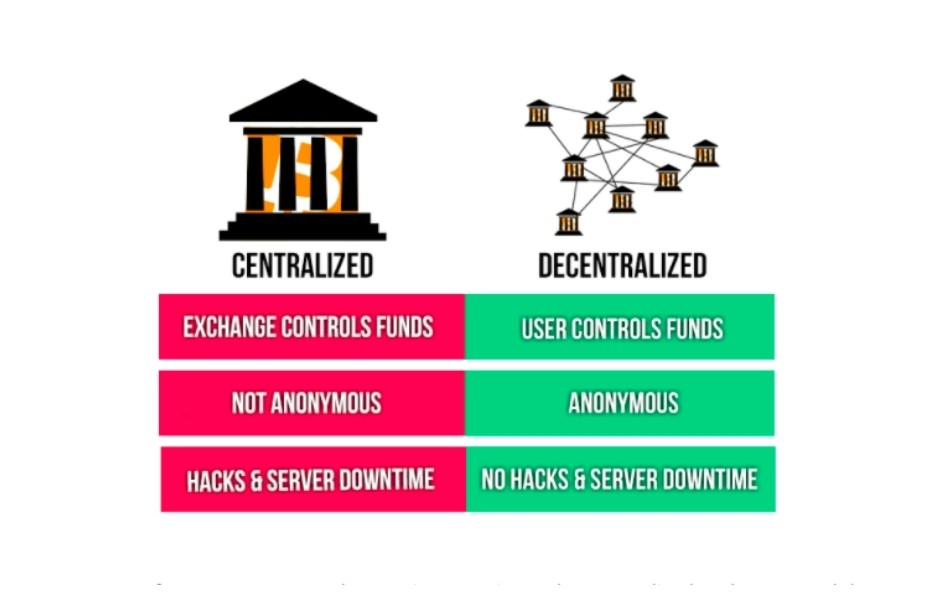

Decentralized Exchanges vs. Centralized exchange, what is the difference?

Broker or smart contract

Unlike centralized exchanges (CEXs), which require intermediaries such as companies, brokers, and banks to transact, DEXs rely only on blockchain technology and traders.

Private database or blockchain

CEX transactions are recorded in the company database and require identification (ID). CEX is known to have weaker security than DEX because it has had previous experiences with personal mistakes or hacking. In addition, DEX does not require identity authentication, and all records are safely stored on the blockchain.

Fiat or Cryptocurrency

DEX only handles cryptocurrencies and cannot be exchanged with fiat currencies, but CEX can do both.

Commission

DEX relies on automation, whereas CEX has an overhead (system latency) despite having enough manpower. Currently, DEX is on the expensive axis compared to CEX. However, it is expected that this will be addressed by the ongoing upgrade from Ethereum to Ethereum 2.0 and a layer 2 solution. After the upgrade, Ethereum’s gas fee will be reduced, and it will not only improve transaction speed, but also reduce emissions by up to 90%.

What are the downsides of DEX?

DEX offers many advantages including speed, confidentiality, complete user independence as well as decentralization, but it still has some limitations.

- They do not deal with fiat currencies.

- DEX does not deal with fiat currencies. This is because problems may arise because the products and services provided in exchange for cryptocurrency are limited. Therefore, before using the assets in real life, users need to convert cryptocurrencies into fiat currencies.

- They do not support margin trading.

- As there is no margin trading option, users cannot borrow for investment.

- The amount of tokens that can be traded is limited.

- DEX simplifies the whole process and serves as the backbone of decentralization, but because it utilizes smart contracts, the tokens that can be traded are limited. DEX is suitable for trading ERC-20 tokens, but not for trading BTC or other non-Ethereum tokens.

Go to Phemex’s Official Website

Is it possible to trade bitcoin on DEX?

In February 2021, X9 developers first started operating BTC trading on DEX, which succeeded in building DEX on the Bitcoin blockchain , but popular and trusted DEX platforms were built on Ethereum. Cross-transactions between blockchains were not possible until very recently due to the immaturity of blockchain infrastructure, but all of this is changing rapidly now.

For example, Wrapped Bitcoin ( WBTC ) allows the use of Bitcoin ( BTC ) on the Ethereum blockchain. While this suggests that trading BTC on DEX may become increasingly possible, WBTC still requires a centralized platform for minting and storage. Meanwhile, Badger DAO , one of the new crypto suites added in 2021, will allow BTC trading on Ethereum DEX.

Although BTC cannot be fully used on the Ethereum blockchain, BTC can now be used as collateral on other blockchains by using a fully decentralized DIGG token that works in a similar way to WBTC. After these steps, it is only a matter of time before BTC can be traded on the Ethereum DEX.

Learn more about Crypto with Phemex

How to make money on a decentralized exchange

Traditional exchange method

The most traditional way to make money on a decentralized exchange (DEX) is to use the DEX the same way you do currency exchange. By observing markets and conversion rates, individuals can quickly buy and sell cryptocurrencies to make a profit.

Spot transaction fee 0

Fees paid for P2P transactions are split among liquidity providers, which is good for making money . These fees vary among different DEXs, and although the rewards are usually very high, they are also risky. Different DEXs have different ways of making money as a liquidity provider. Some require the same amount of value for different tokens, while others offer higher rewards only for the underlying token.

What types of DEX are there?

There are several types of DEX, but three are dominant at the moment.

- Order book exchanges:

- Order book exchanges work in a way that is closer to traditional exchanges. They organize assets and trade pairs based on trade prices and external information. This means higher volatility on exchanges. In addition, users are required to deposit their assets on the exchange before trading. In this rapidly changing cryptocurrency market, extending the deposit time of assets may be disadvantageous for traders.

- Automated Market Maker ( AMM ) Exchanges (=Swap exchanges):

- AMM exchanges such as Uniswap, a fully automated platform, enable instant swaps with low fees. Also, there is no need to deposit assets on an exchange before swapping. It also relies on pricing algorithms rather than external information to influence costs and lead to bullish or bearish results. This makes it more transparent than an order book exchange. They also make transactions more transparent than order book exchanges by relying on pricing algorithms rather than external information that can affect costs and cause bullish or bearishness.

- DEX aggregators:

- DEX aggregators use technology to monitor crypto prices across all DEX markets, providing buyers with the lowest exchange rates.

Go to Phemex’s Official Website

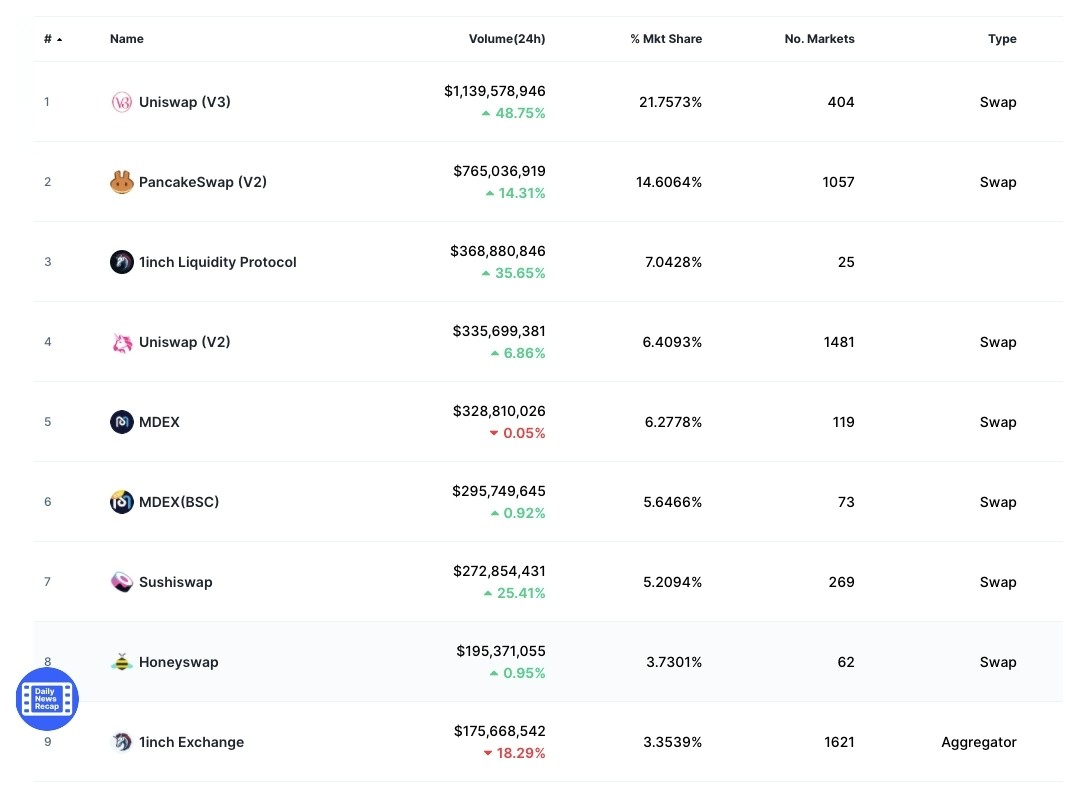

What is the best decentralized exchange in existence?

As you can see from the DEX ranking below, most of the top DEXs are AMM exchanges. Clearly, there is a strong desire among cryptocurrency holders for direct, transparent and realizing transactions as quickly as possible, which is also related to the infamous volatility of cryptocurrencies.

The most used DEXs are:

- Uniswap: Ethereum-based Uniswap has the lowest fees (0.3%) and lists new coins at launch. Dedicated app for analytics and token listings and direct swapping, relatively easy to use.

- Pancakeswap: Operated by BSC, Pancakeswap uses an LP called Syrup Pool and rewards those who offer tokens in unique BEP-20 tokens (CAKE). The staking rewards ofPancakeSwap are very lucrative as some LPs offer annual returns of up to 1300%.

- 1-inch liquidity protocol: Allowing users to connect to an Ethereum wallet means that 1-inch liquidity protocol does not control users’ assets. As an aggregator, 1inch Liquidity Protocol also puts a lot of effort into comparing all prices on DEX, so that we can offer our users the best exchange rates. In addition to this, we introduced a fee-saving Chi Gas token (CHI) and Mooniswap AMM, transforming it into a kind of innovative hybrid.

What is DEX Cryptocurrency?

Although DEX also exists as a cryptocurrency, it cannot be regarded as a really popular coin because it is ranked only 2145 on Coinmarketcap (coinmartketcap.com) . Currently, the DEX cryptocurrency is trading at $0.0006905 with a live market cap of $134,183. Built on the Ethereum network and launched in October 2018, it peaked in the bull market in 2018, but has since dropped well below its launch price of around $0.06.

Learn more about Crypto with Phemex

Summary

Different forms of DEXs provide users with the ability to exchange assets in a fully decentralized manner. This can be seen as a step in the direction of the current cryptocurrency movement, which is focused on governance. Also, with the rise of decentralized finance DeFi, now is the right time for DEX. However, the platform still has some disadvantages, such as not being able to trade cryptocurrency or BTC, or having to pay high fees.

However, a solution to this shortcoming is expected to come soon. As solutions, Badger DAO for BTC trading and Ethereum 2.0 for low-cost fees are likely to be adopted. And moving forward, we hope that the day when cryptocurrencies will be widely used to pay for goods and services may come soon.

The user-friendly interface of the DEX makes it easier for users to access the DEX, but it requires some know-how due to the user’s independence in the distributed realm. Due to these shortcomings of DEX, we believe that CEX, which can accept low fees and fiat currency, can have an edge in this area. However, as DEX supports analytics and forums, and as Ethereum currently upgrades to Ethereum 2.0, it is predicted that DEX usage will probably surpass CEX in the not-too-distant future.

Please check Phemex official website or contact the customer support with regard to the latest information and more accurate details.

Phemex official website is here.

Please click "Introduction of Phemex", if you want to know the details and the company information of Phemex.