What's Binance Futures? Table of Contents

- Difference between Binance Futures and other platforms

- The synergy between Spot and Futures markets

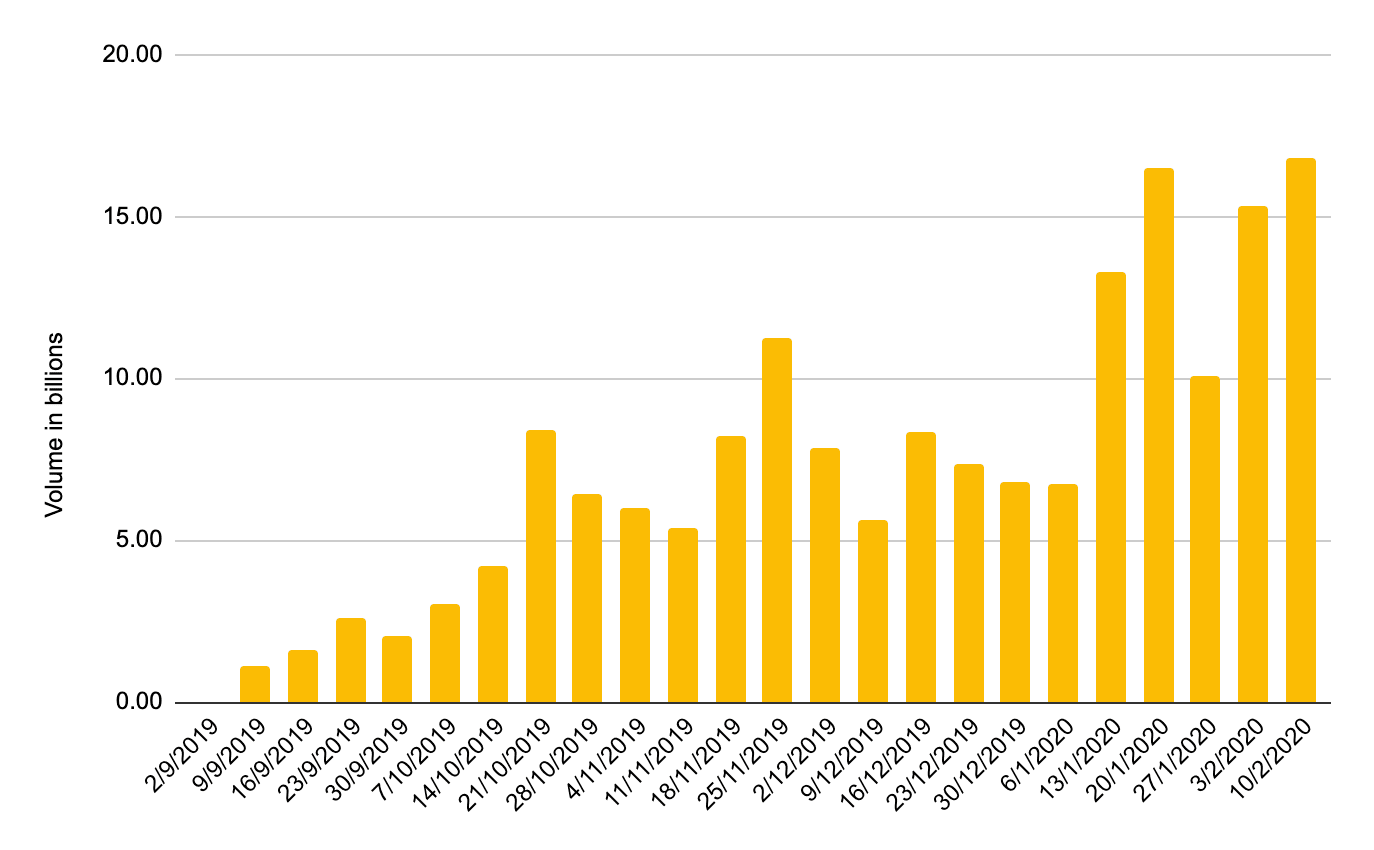

- Chart 1 - Weekly trading volumes on Binance Futures

- Two key factors contribute to the successful integration of both platforms

- Arbitrage and Real-Time market data

- Cross collateral

- Binance Futures’ Growing Altcoin Portfolio

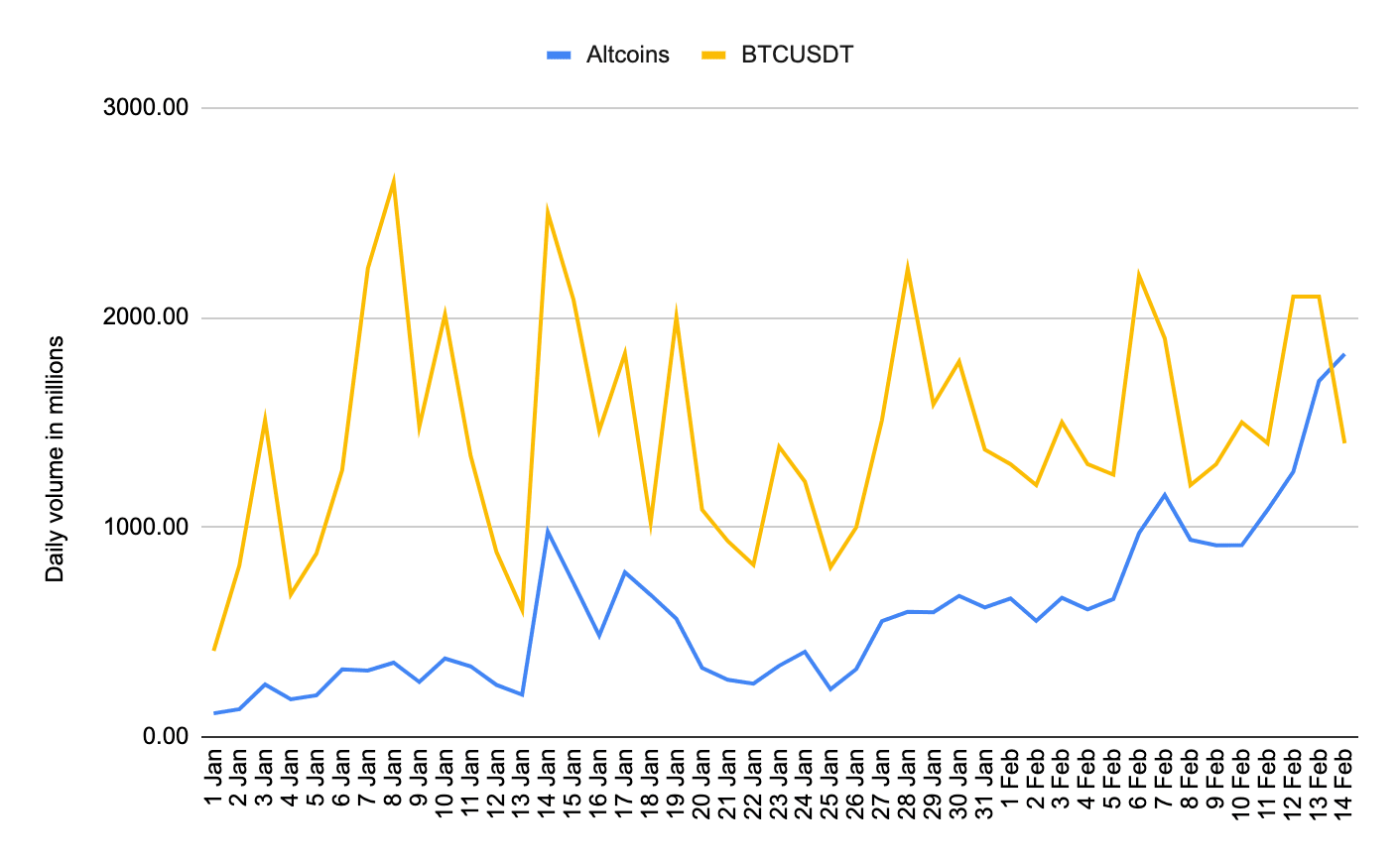

- Chart 2 - Daily volume of BTCUSDT vs. Altcoin perpetual contracts

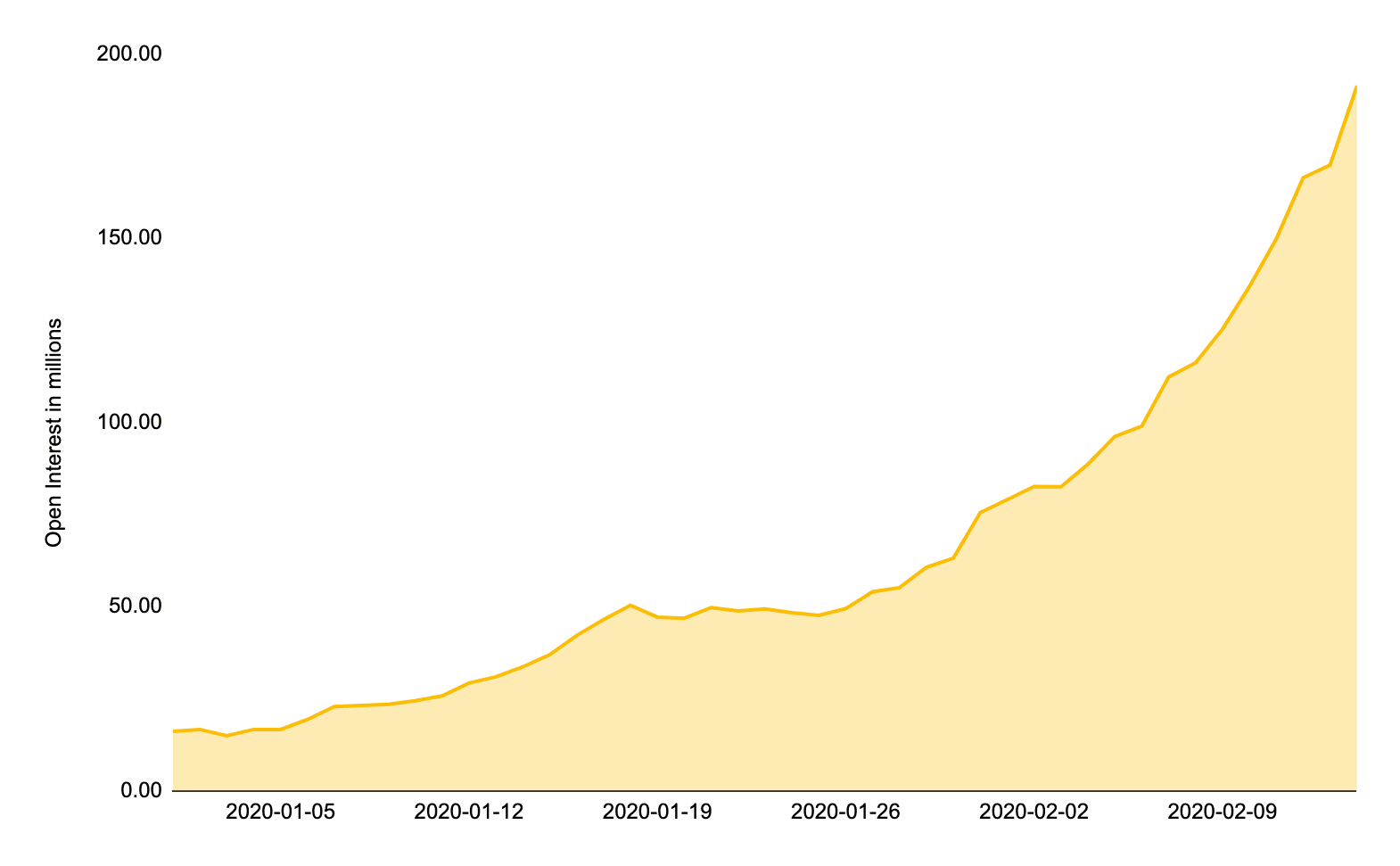

- Chart 3 - Open interest in Altcoin perpetual contract

- Conclusion

Difference between Binance Futures and other platforms

As cryptocurrency trading platforms rush to launch new products and new features to attract users, competition in the entire cryptocurrency Futures trading field has become increasingly fierce. Today, users can choose between multiple trading platforms. However, good and bad trading platforms are mixed.

Most native cryptocurrency trading platforms only provide one of the following three products:

- Fiat to crypto trading

- Crypto-crypto trading

- Crypto-derivatives trading

These cryptocurrency trading platforms either specialize in fiat currency and spot cryptocurrency products, or specialize in cryptocurrency derivative products, such as Futures transactions. Therefore, users of these platforms can only trade on spot trading platforms or derivatives trading platforms. Users’ choices of using cryptocurrency assets are restricted, and they cannot efficiently hedge or arbitrage risks.

If users want to use cross-market trading strategies, they need to open accounts on different platforms that provide corresponding products. Due to the existence of handling fees, the cost of transferring funds between accounts on different platforms is very high. In addition, since the transfer of funds takes time, the timeliness of operations is also greatly reduced. Therefore, traders cannot efficiently carry out arbitrage or hedging on these platforms.

One of Binance’s key competitive advantages is that it provides users with a complete trading ecosystem. On the Binance Futures trading platform, users can directly access the spot and Futures trading markets.

Unlike other trading platforms that only provide limited product types, the Binance platform allows users to access more than 100 spot trading markets and more than 20 perpetual contract trading markets, and these markets not only provide trading opportunities for cryptocurrency traders, It also provides miners with opportunities for risk hedging.

Go to Binance’s Official Website

The synergy between Spot and Futures markets

Binance provides traders with a complete ecosystem where users can make full use of crypto assets and manage the risks of cryptocurrency asset portfolios well. The integration of Binance’s spot trading platform and Futures trading platform makes this possible. Such a complete trading experience has attracted more and more traders to join. Since its launch, the trading volume and market share of the Binance Futures trading platform have maintained exponential growth.

Chart 1 – Weekly trading volumes on Binance Futures

In the first six months of operation, the weekly trading volume of the Binance Futures Trading Platform increased from less than US$50 million in the first week to US$16 billion on February 10, 2020. After the launch of new products at the beginning of the year, the weekly trading volume of the platform doubled.

Two key factors contribute to the successful integration of both platforms

First of all, the Binance Futures trading platform allows users to realize instant fund transfers between spot trading accounts and Futures trading accounts so that they can seize the opportunity to realize cash. In addition, the transfer of funds between Binance spot-Futures trading accounts does not charge a handling fee, while other platforms require users to open multiple trading accounts to enter the Futures trading market. Finally, the Binance Futures Trading Platform does not limit the number of fund transfers between spot-Futures trading accounts. For example, users can enter the Futures trading market multiple times in a day and use intraday price fluctuations for cashing operations.

Second, the trading Futures design of the Binance Futures Trading Platform is similar to that of spot trading to facilitate transaction conversion between the two markets. For example, the pricing rules of perpetual contract are very clear, and each Futures only represents a basic asset, which is similar to the spot market. In addition, the platform’s perpetual contract are priced and settled in USDT, which is the same as the spot market.

These factors all play a key role in platform integration. Users can efficiently switch between the two markets and get the same trading experience in the two markets.

Open Binance’s Account for free

Arbitrage and Real-Time market data

With the ability to freely switch between the two markets, users can quickly seize arbitrage opportunities and realize high efficiency. In this way, the inefficiency between the perpetual contract price and the spot price can be eliminated through arbitrage, making the transaction Futures price consistent with the spot market.

Although extreme volatility sometimes leads to price differences between markets, arbitrageurs will quickly seize these opportunities. On other platforms where arbitrage operations are restricted, the Futures trading market may not be able to reflect the true value of the spot market.

In addition, users of the Binance Futures trading platform can obtain real-time market data because the data is updated after each transaction is completed, rather than every 100 milliseconds. Therefore, traders on the Binance Futures trading platform can react to price changes more quickly than traders on other platforms. This further supports users’ arbitrage and hedging operations.

Go to Binance’s Official Website

Cross collateral

Hybrid Margin is a new feature launched by Binance. Users can use crypto assets stored in the wallet of the Binance trading platform to conduct Futures transactions. In this way, users can directly use tokens as order funds without having to exchange them for margin.

Traders can use encrypted assets to borrow tether (USDT) at a zero interest rate, so there is no need to put tokens in Futures trading wallets. Now the cross guarantee function only accepts BUSD, and more tokens will be added in the future.

Cross-guarantee is a long-awaited feature for Binance users. It improves flexibility and provides more options for recharging Futures to open positions. The launch of this feature provides convenience for traders to access the Futures trading platform and further expands the Binance ecosystem.

Binance Futures’ Growing Altcoin Portfolio

Since the beginning of the year, the Binance Futures Trading Platform has actively expanded its perpetual contract products, allowing users to better perform lock-up and risk management. As of February 14, 21 perpetual contract have been launched on the platform, including the latest VETUSDT.

As trading Futures products become more diversified, Binance Futures Trading Platform also positions itself as the preferred platform for cryptocurrency traders to hedge. This is reflected in the growth of the platform’s non-bitcoin perpetual contract holdings and trading volume in the past two months.

Open Binance’s Account for free

Chart 2 – Daily volume of BTCUSDT vs. Altcoin perpetual contracts

In the month before 2020, the gap between Binance’s non-bitcoin perpetual contract trading volume and BTCUSDT perpetual contract trading volume narrowed. Prior to this, BTCUSDT Futures accounted for 70% of the total trading volume on the platform. The launch of new non-bitcoin Futures provides more opportunities for users to participate in the recent non-bitcoin bull market.

Go to Binance’s Official Website

Chart 3 – Open interest in Altcoin perpetual contract

The overall open interest of non-bitcoin perpetual contracts rose from less than 20 million USDT on January 1 to 191 million USDT-an an increase of nearly 10 times compared to two months ago. Year-to-date, the proportion of non-bitcoin perpetual contract holdings has risen from 10% to 40%.

Conclusion

Through the integration of the spot trading platform and the Futures trading platform, Binance has created a complete cryptocurrency trading ecosystem, providing users with a seamlessly connected and complete trading experience. The following two key factors have contributed to the super synergy between the two platforms:

- Ease of transferring funds between platforms

- Intuitive futures contract design

In addition, the Binance Futures Trading Platform continues to expand the ecosystem through new features such as hybrid margin. Hybrid margin is an innovative feature, users can use cryptocurrency assets as collateral for Futures holdings.

The continued growth of non-bitcoin perpetual contract holdings and trading volume proves that this growing ecosystem is a key competitive advantage for Binance. The Binance Futures trading platform will continue to develop innovative features to provide users with more convenience for accessing the Futures trading platform, and at the same time enable better development of the ecosystem.

Go to Binance’s Official Website

Please check Binance official website or contact the customer support with regard to the latest information and more accurate details.

Binance official website is here.

Please click "Introduction of Binance", if you want to know the details and the company information of Binance.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...