The full version of the app BitMEX Mobile is now ready for download, bringing with it all-new features – spot and crypto derivatives trading.

BitMEX Mobile App

The full version of the mobile app – BitMEX Mobile – is now available for download and brings a brand new feature – spot and cryptocurrency derivatives trading.

This new addition makes trading on BitMEX easier and more convenient. What’s more, the app provides all the tools you need to execute trades, track open interest, and monitor price dynamics.

Download and trade on BitMEX Mobile, get 10 BMEX Tokens today or read on for a primer on the new trading features.

Summary of the new trading features

Monitor market trends in real time

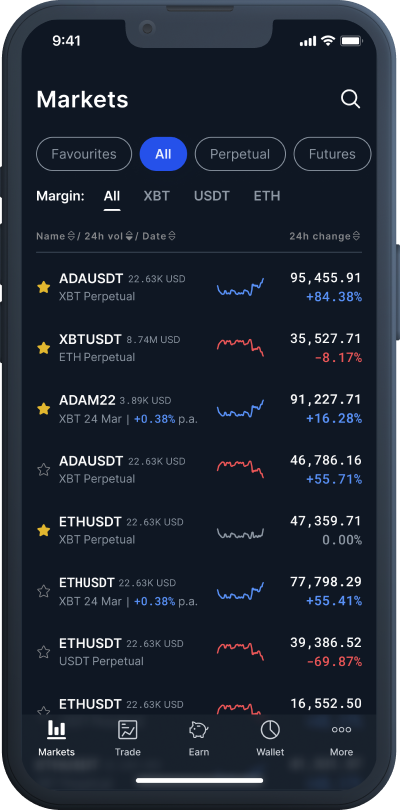

With BitMEX Mobile, users can stay informed about their favorite cryptocurrencies and contracts by accessing the “Market” feature.

This is a handy feature that allows you to quickly monitor market movements, select a specific crypto derivatives contract or spot pair via the ‘Markets’ page, or click on the ‘☰’ / magnifying glass icon to find it in seconds.

The app also allows users to create a custom watch list quickly and easily. To save a derivatives contract or spot pair to your “Favorites” list, simply click on the star icon at the top right of the specific contract or spot pair page. The contract will immediately be added to your “Favorites” list, which you can access through the “Market” section of the APP.

Go to BitMEX’s Official Website

Stay on top of your trades and open positions

Market volatility can change your outlook, so it’s important to pay close attention to your positions and open orders. BitMEX Mobile gives you the freedom and flexibility to manage your open positions anytime, anywhere – even when you are away from your computer.

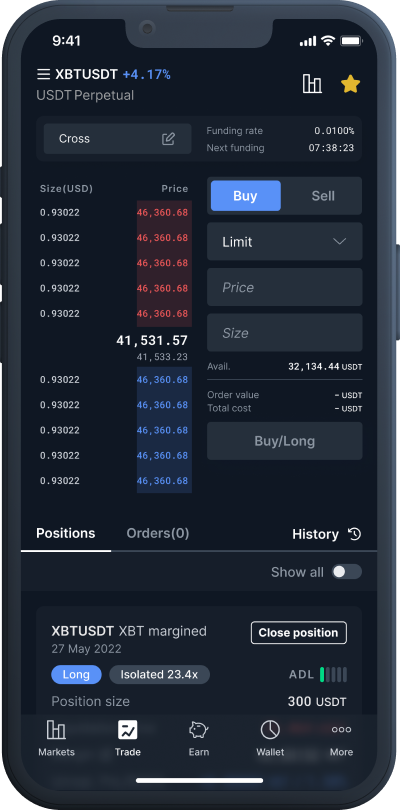

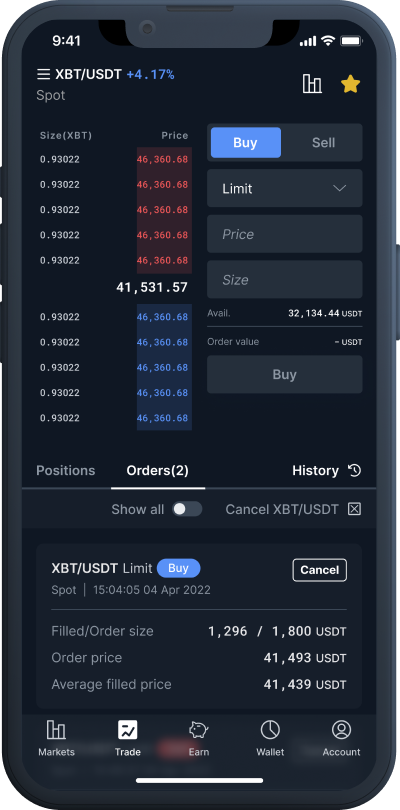

For example, you can view key details about your open orders by visiting the “Trades” section of the app, selecting a contract or spot pair, and then clicking “Orders”. If you think it’s time to cancel an order, simply click the “Cancel” button – or click “Cancel All” under the “Orders” tab to cancel all of your orders.

To monitor your open positions, click on “Positions” – which you can find at the bottom of each contract and spot pair page. For example, if you are looking at the current status of a particular future/perpetual contract, you will see your unrealized PnL/ROE %, realized PnL, automatic deleveraging ( ADL ) and margin mode (isolated/full margin). To cancel an open position, click “Close Position”.

What’s more, BitMEX Mobile has intuitive chart display options, so you can track real-time price movements with just a few clicks. To access the candle chart section, simply select a contract or spot pair and click on the chart icon at the top right of the page. You can also view order book data for a specific list by clicking on “Order Book” – both in list form and order book depth graphs.

Execute trades and take action quickly from your phone

Cryptocurrency Derivatives Trading

With BitMEX Mobile, you can quickly go long or short cryptocurrencies from your mobile phone – and choose leverage up to 100x. That way, you don’t have to take advantage of wild price swings in front of your computer.

Creating a long/short order via BitMEX Mobile is easy and straightforward. First, select a derivatives contract. Then, choose your desired margin mode:

- In isolated margin mode, the margin allocated to a position is limited to a certain amount. If the margin falls below the maintenance margin level, the position will be liquidated. However, with this method, you can add and remove margin at will. To adjust your leverage, drag the slider on the Adjust Margin Mode page to display your desired leverage.

- In cross margin mode, margin is shared among open contracts with the same settlement cryptocurrency. When needed, the position will draw more margin from the total account balance of the corresponding cryptocurrency to avoid liquidation.

Then, fill in the “price” and (contract) “size”, enter your market/limit long or short order. View your order details and click the ‘Buy/Long’ or ‘Sell/Short’ button to execute.

What do “long” and “short” mean in cryptocurrency derivatives trading?

Simply put, in a long position, the trader hopes that the price of the cryptocurrency will rise from a given point. Conversely, in a short position, the trader expects the price to start falling from a certain point (i.e. the trader “shorts” the cryptocurrency).

Go to BitMEX’s Official Website

Spot Trading

Spot trading on BitMEX has never been easier. Through the BitMEX mobile app, users can choose to create limit and market orders:

Limit Order: This order type allows users to prepare spot trades in advance. Place limit orders allow traders to set their own price to buy or sell cryptocurrencies. If the market reaches the limit price, the trader’s order will be executed.

Instructions: Select “LIMIT” in the drop-down menu at the top right of the XBT/USDT page, enter 30,000 in the “Price” column, and enter 10 in the “Amount” column. Click the ‘Buy’ button to place a limit order.

Market Order : A market order is an order that is executed immediately at the current market price. Traders use this order type when they want to fill their orders as quickly as possible. Traders who create market orders do not need to enter a price.

Instructions : Select “MARKET” in the drop-down menu at the top right of the XBT/USDT page, enter 1 in the “Amount” column, check the approximate USDT amount displayed next to “Order Value”, and click “Buy” to place a market order.

Unmissable offers await BitMEX mobile users

From July 6, 2022 04:00 UTC to July 31, 2022 23:59 UTC, the first 10,000 users who downloaded BitMEX Mobile, if they did the following through the app within 30 days of their first login Things that will get you 10 BMEX:

- Trade spot currency pairs worth at least $50 on BitMEX Spot; or

- Trade any derivatives contracts worth at least $5,000.

What is the meaning of cryptocurrency derivatives trading?

Cryptocurrency derivatives are financial contracts set up between two or more parties that track the price of a cryptocurrency (such as Bitcoin); in other words, their value is derived from the underlying asset without requiring traders to own said asset. BitMEX offers two types of cryptocurrency derivatives contracts:

- Futures Contract: This type of crypto-derivative product represents an agreement to buy or sell a commodity, currency, or other instrument at a predetermined price at a specific time in the future. Note: It can be settled in advance.

- Perpetual Contracts: This type of contract is similar to a traditional futures contract, but has several distinct features:

- There is no expiration or settlement (but it is settled early).

- They mimic a margin-based spot market and trade close to the underlying reference index price.

- Funding mechanisms are used to tie contracts to their underlying spot price. In contrast, futures contracts may trade at significantly different prices due to a “base” – the base represents the difference between an asset’s spot price and its futures price.

When trading futures and perpetual swap contracts on BitMEX, users do not need to put 100% of their collateral as margin, which means they can trade with up to 100x leverage on some of the contracts. In other words, users can trade in notional amounts that are multiples of their collateral.

What is spot trading?

In the cryptocurrency space, spot trading is the buying and selling of tokens and coins at current market prices (or “spot prices”) – with the aim of delivering the underlying asset immediately. Spot trading is different from derivatives trading because you need to own the underlying asset to place a buy or sell order.

Coming Soon: More BitMEX Mobile Features

As BitMEX rolls out new products and features, you’ll see them respond in future updates to the app. Here are the features you can look forward to in the coming weeks and months:

- Support biometric login

- BMEX Staking

- and more

Download BitMEX Mobile today, or sign up for a BitMEX account here.

To be the first to hear about the app, as well as the contracts, new listings, product launches and giveaways, you can connect with BitMEX on Discord, Telegram, and Twitter.

Go to BitMEX’s Official Website

Please check BitMEX official website or contact the customer support with regard to the latest information and more accurate details.

BitMEX official website is here.

Please click "Introduction of BitMEX", if you want to know the details and the company information of BitMEX.

Comment by cryptoloversofxm

February 19, 2025

I just saw that XMTrading now supports cryptocurrency deposits and withdrawals. No fees, instant transactions, and up to $30K per month. Each deposit gets a unique wallet addres...