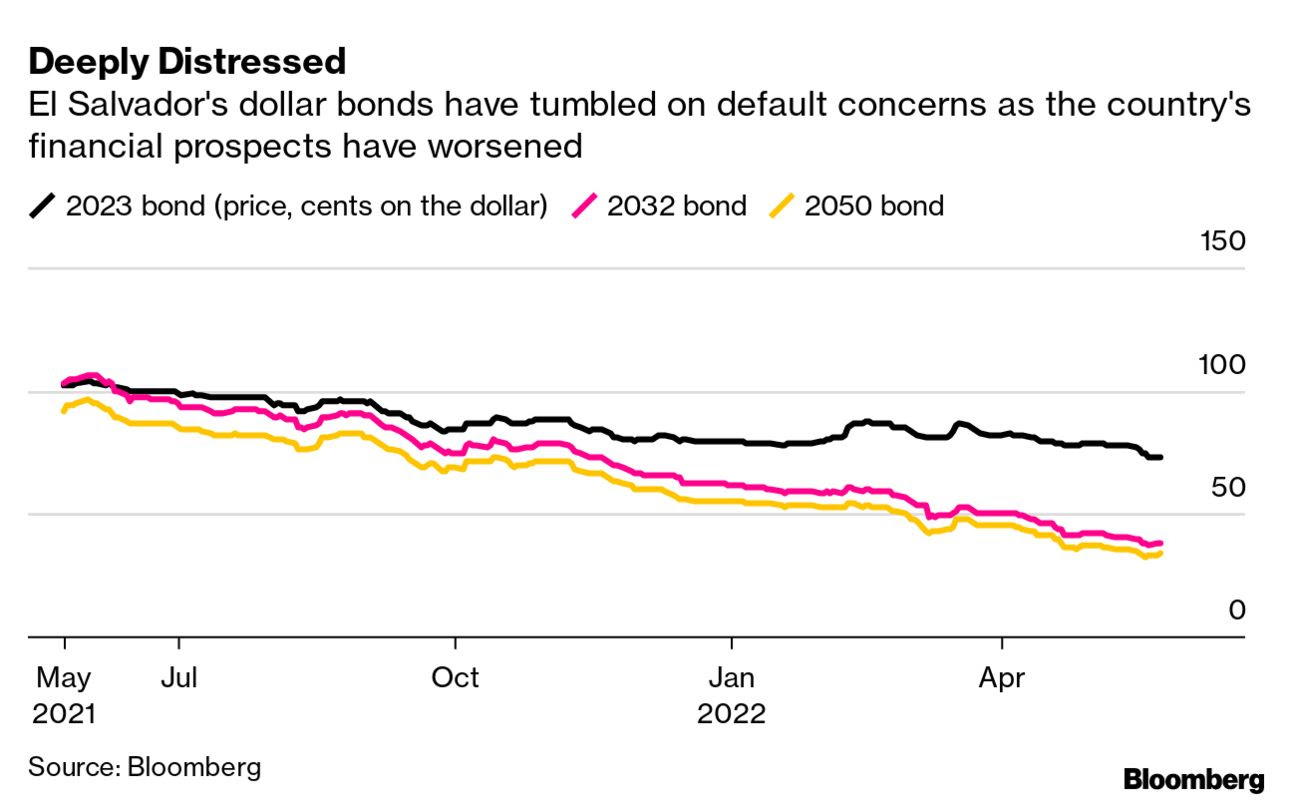

El Salvador Dollar Bonds at all-time lows

The eight-week slump saw the value of BTC drop by around 55% from its all-time high, deepening the cumulative loss of BTC held by the El Salvador government. That loss, at about $40 million at the time of writing, is a bit more than the cash-strapped country’s next interest payment on its foreign debt, according to Bloomberg. In the latest bearish run, volatility in the BTC market appeared to spook potential buyers of the planned $1 billion BTC-backed bond. In addition, the country boasted earlier this month that another dip was bought at the cost of a loss of IMF support and a downgrade from a rating agency. Since then, El Salvador’s dollar bonds have been at historic lows.

The performance of various currencies in the crypto market was mixed on Tuesday, as investors appeared to be choosing to play cautiously ahead of Thursday’s FOMC minutes. At the time of writing, BTC remains below $30,000 support despite a 1.7% gain in market cap over the past 24 hours. The largest cryptocurrency by market cap remains range-bound with key resistance above $30,600. A smooth breakout of this range could bring better momentum to Bitcoin, which is likely to push BTC above the $31,200 resistance. Despite the lull in the spot market, the number of BTC-denominated perpetual open interest (OI) is rapidly approaching new highs. Combined with funding rates in the middle, this increase in open interest could signal a big move in the market.

As usual, ETH, the second-largest cryptocurrency by market capitalization, remains in step with BTC. At the time of writing, ETH had experienced a small loss in the 24 hours and failed to hold the $2,000 mark. While the BTC market share index rose to a one-year high and the total value locked in DeFi protocols was trending down, most major altcoins were also largely on the rise as investors appeared to be gearing up for a new altcoin season prepare.

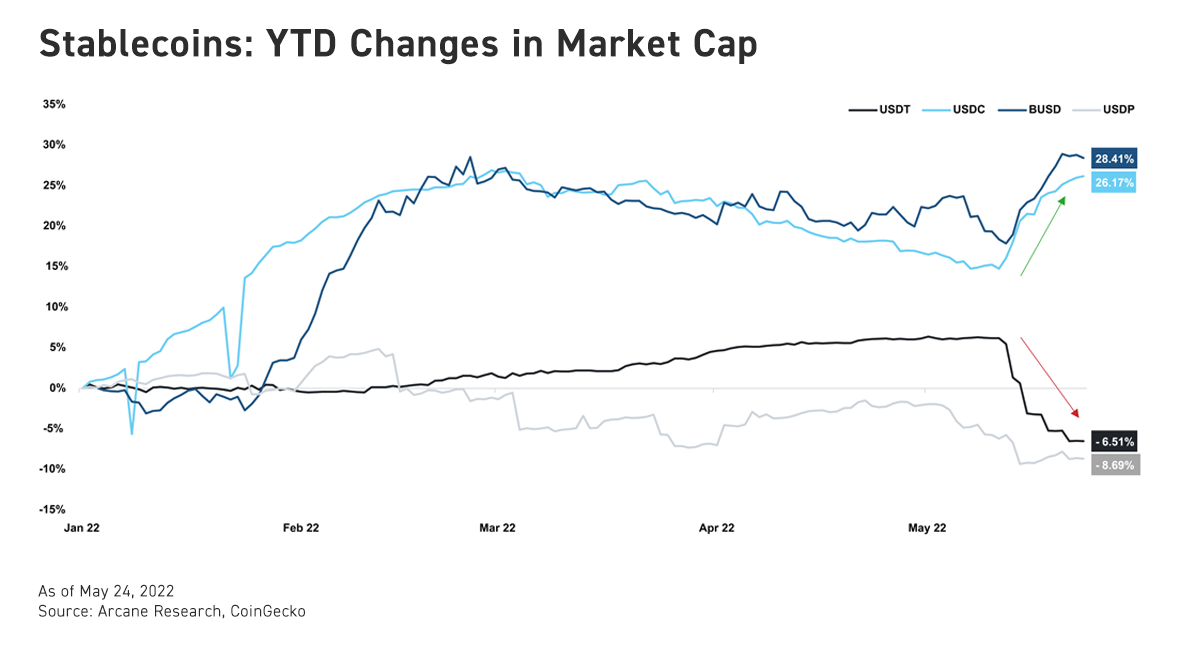

Tether subsequently experienced massive redemptions of up to $10 billion due to a brief decoupling of USDT last week. At the time of writing, Tether circulation has now dropped to 6.51%. The churn rate is particularly high for addresses on the Ethereum network that hold large amounts of USDT and USDC. On May 12, the number of addresses holding at least $1 million in USDC on Ethereum had exceeded the number of addresses holding the same amount of USDT, suggesting that some of these large accounts were selling their USDT and opting for USDC they deem guaranteed Fully supported.

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...