Ethereum delays the “difficulty bomb”

Ethereum core developers announced on Friday that they had decided to delay the deployment of the “difficulty bomb” yet again, casting a shadow over whether the August upgrade of The Merge could be completed without a hitch. The difficulty bomb was embedded in Ethereum’s code in 2015 to gradually push miners to leave the old chain by increasing the mining difficulty of ETH, so it played an important role in Ethereum’s much-anticipated transition to a proof-of-stake consensus mechanism catalyst effect. Due to some issues with the Ropsten testnet after the merger, the developers proposed to delay the deployment of the difficulty bomb until August 2022, the sixth delay. According to lead developer Tim Beiko’s tweet, the team is “targeting a delay of around 2 months and launching the upgrade in late June.”

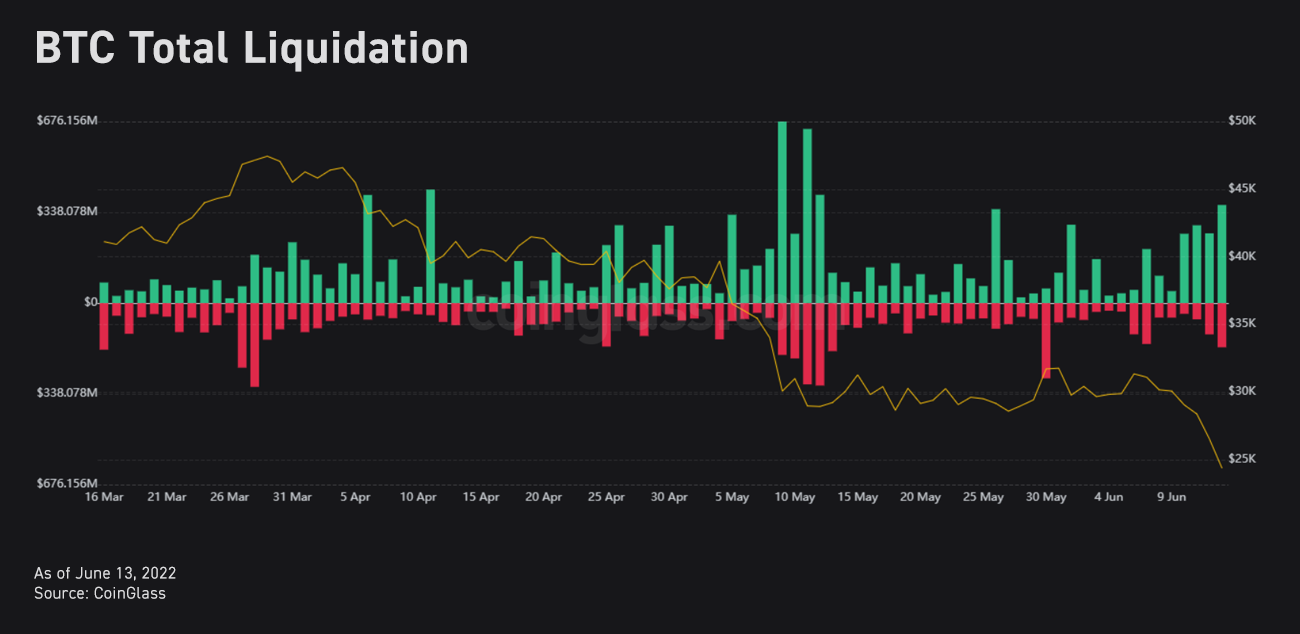

A bloodbath over the weekend has shaken the confidence of speculative traders in derivatives markets. Over the past three days, long positions worth as much as $790 million have been liquidated despite funding rates largely staying in the mid-range, sending BTC and ETH’s Gamma Exposure back into negative territory. Against the backdrop of a slump in spot prices, options markets have seen considerable volatility in implied volatility (IV), suggesting that short-term risk aversion has dominated the market.

Markets plummeted across the board over the weekend as the CPI data released on Friday, June 10 broke the table again. Mainstream cryptocurrencies plunged as investors expected aggressive monetary policy from the Federal Reserve to fight inflation and rushed to do so. BTC dipped below the bottom of its one-month-old range on Sunday, June 12, closing at a one-year all-time low before falling further in early Asian trading on June 13. At the time of writing, the largest cryptocurrency by market capitalization has lost 6% of its value in the past 24 hours and is consolidating above the $25,000 mark. Immediate major support for BTC is currently near $25,000. A break below this level could see BTC accelerate to the downside and test the $23,500 support area in the near term.

Likewise, ETH has lost over 27% in a few days and is currently trading above $1,300. A key bearish trend line is forming with resistance near $1,420 on the hourly chart of ETH. If ETH fails to break above $1,420, it could swing down to the $1,200 support area. At the same time, the combined total market value of the top three stablecoins currently accounts for 72.5% of ETH, an increase from 50% a month and a half ago. Most major non-mainstream coins are also in deep losses, with the market cap of large and mid-cap coins falling by double-digit percentages over the same period.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...