A comprehensive guide to spot trading, futures trading, leverage, and its platform features in the cryptocurrency market.

A Comprehensive Guide to Spot Trading, Futures Trading, and Leverage in the Cryptocurrency Market.

Understanding Spot Trading

Spot trading involves buying and selling assets at the current market price for immediate delivery, allowing traders to profit from daily market movements through a series of small transactions. In the realm of cryptocurrencies, spot trading can be conducted on centralised trading platforms (CEXs), decentralised exchanges (DEXs), and over-the-counter (OTC) markets.

Start trading Spot with Bitget

Crypto Spot Trading on CEXs

Despite the rapid evolution of Decentralised Finance (DeFi), centralised trading platforms remain immensely popular due to their high liquidity and enhanced security measures. CEXs employ the order book system to match buy and sell orders, ensuring a liquid market that facilitates smooth trading. These platforms also provide fiat-crypto trading pairs, making it easier for beginners to enter the crypto market. One prominent player in the crypto spot trading exchange space is Bitget, which boasts 8 million users and ranks third in terms of liquidity.

DEXs and their Advantages

Decentralised exchanges (DEXs) are preferred by advocates of decentralisation due to their non-custodial nature. In DEXs, users retain control of their private keys and personal information, eliminating the need for KYC compliance. DEXs can be categorised into two types: those with an order book system (e.g., LoopRing, Gnosis Protocol, IDEX) and those utilising innovative automated market makers. DEXs offer a broader range of trading pairs as the listing process is less stringent compared to CEXs. However, challenges such as blind signing, lower liquidity, and slippage (price differences between submitted and confirmed prices on the blockchain) are common in DEXs.

Go to Bitget’s Official Website

Spot Trading versus Futures Trading

In traditional finance, futures markets play a crucial role in hedging and price discovery. Investors often use futures contracts to mitigate their exposure in spot markets by locking in favourable prices for underlying assets in the future. Furthermore, futures markets often open before traditional stock markets, allowing traders to gauge market sentiment and place corresponding spot trade orders.

The key distinction between spot trading and futures trading lies in asset ownership. Spot traders gain actual ownership of the assets upon transaction completion, whereas futures contracts are settled exclusively in cash. Moreover, spot trading does not impose minimum equity requirements, unlike certain futures contracts that necessitate a minimum investment.

Trade Cryptocurrencies on Bitget

Comparing Spot Trading and Margin Trading

Spot trading and margin trading both involve price speculation, but margin trading allows traders to amplify their potential profits when market conditions are favourable. However, this strategy also exposes traders to amplified losses if the market moves against their positions. Margin trading is often used as part of a diversification and hedging strategy to protect capital during market downturns. Risk management tools, such as stop-limit orders, can help mitigate potential losses associated with margin trading.

Spot Trading with Bitget

For an optimal crypto trading experience, Bitget stands out as a leading crypto exchange serving a vast customer base of 8 million users across 100 countries worldwide.

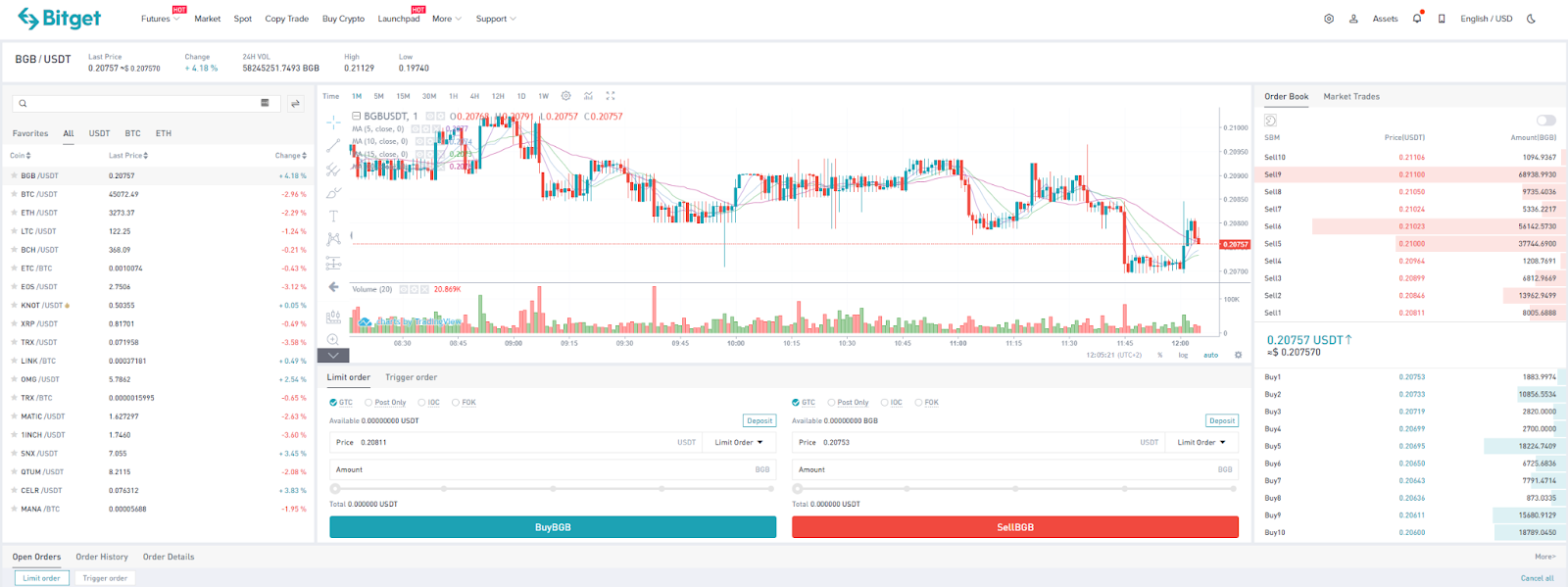

Trading Pairs, Limit Order, and Trigger Order

Bitget offers over 300 trading pairs on its spot trading platform, providing traders with a wide array of options. Users can take advantage of features like Limit Orders and Trigger Orders to effectively manage their portfolios.

Copy Trade

Bitget has established itself as the world’s largest digital copy trading exchange, enabling over 80,000 professional traders to share profits amounting to $20 million with their 380,000 followers. Bitget Copy Trade caters to both seasoned traders and newcomers, with beginners learning by copying orders from their chosen professionals and profiting from their expertise. Crypto enthusiasts can generate passive income by becoming professional traders on the Bitget Copy Trade platform. Professional traders can earn commissions of up to 10% of their followers’ profits, fostering a mutually beneficial environment for all users.

Start Copy Trading with Bitget

Bitget Launchpad & Bitget Innovation Zone

Bitget Launchpad, introduced in early 2022, serves as a platform connecting investors with promising projects in the crypto space. By establishing a stringent vetting process, Bitget ensures project quality and supports marketing and awareness campaigns for listed projects. All projects launched on Bitget Launchpad are also listed on the Bitget Innovation Zone, which regularly adds new tokens, providing investors with fresh opportunities to diversify their portfolios.

Trading Futures on Cryptocurrencies

Cryptocurrencies have emerged as a prominent asset class, attracting individuals eager to own and trade digital assets such as Bitcoin and Ethereum. The crypto market offers various trading options, including spot trading, derivatives trading, margin trading, and leverage trading.

Spot trading involves purchasing and owning cryptocurrencies at their current market value, while derivatives trading, such as futures trading, allows traders to speculate on price movements without owning the underlying asset. Leverage trading enables traders to borrow capital to magnify potential returns, although it also carries an increased risk of amplified losses.

The Role of Leverage in Crypto Trading

Leverage has been a topic of debate in futures trading due to its ability to magnify gains and losses. Responsible and mindful trading is crucial when employing leverage to avoid undesirable outcomes. Margin and leverage are two fundamental concepts in futures trading. Margin refers to the amount of capital traders must deposit into their margin accounts before initiating new positions. With collateral as proof of their ability to fulfil contract obligations, traders can leverage borrowed capital from exchanges to make investments.

Leverage allows traders to borrow funds to invest in assets, potentially generating significant returns. For instance, if Peter has $100 and wants to go long on Bitcoin, he can enter a position with 125X leverage, allowing him to trade with a position value of $12,500. If the price of Bitcoin increases as anticipated, Peter’s profit would be 125 times higher compared to a trade without leverage. However, it’s crucial to approach leverage with caution and employ effective risk management strategies to mitigate potential losses.

Margin requirements and leverage levels vary among exchanges, with higher leverage typically available for less volatile assets. Proper risk management practices, including position sizing and stop-loss orders, are essential when utilising leverage.

Start leveraged trading with Bitget

Please check Bitget official website or contact the customer support with regard to the latest information and more accurate details.

Please click "Introduction of Bitget", if you want to know the details and the company information of Bitget.