On Thursday, Meta announced that the company is preparing to expand NFT support on Instagram from the US to more countries around the world. This feature allows users to connect digital wallets and display their digital collections in updates, limited-time updates or messages, while automatically tagging creators and collectors for clear attribution. Meta first tested NFT support in May of this year, and this global expansion will cover more than 100 countries across multiple continents, marking another step forward in Meta’s plans to enter Web3 through NFTs.

The world’s largest asset management company, BlackRock, announced a partnership with Coinbase to provide bitcoin products for institutional clients. As soon as the news came out, $COIN’s stock price soared by 35%. However, this disruptive partnership has not brought much momentum to the main cryptocurrency market. BTC closed down again on Thursday, extending its losing streak to seven days. At the time of writing, however, the largest cryptocurrency by market capitalization is up slightly over the past 24 hours, and appears to have no problem stabilizing above $23,000. If a firmer foothold can be established above $23,500, BTC is likely to accelerate its gains.

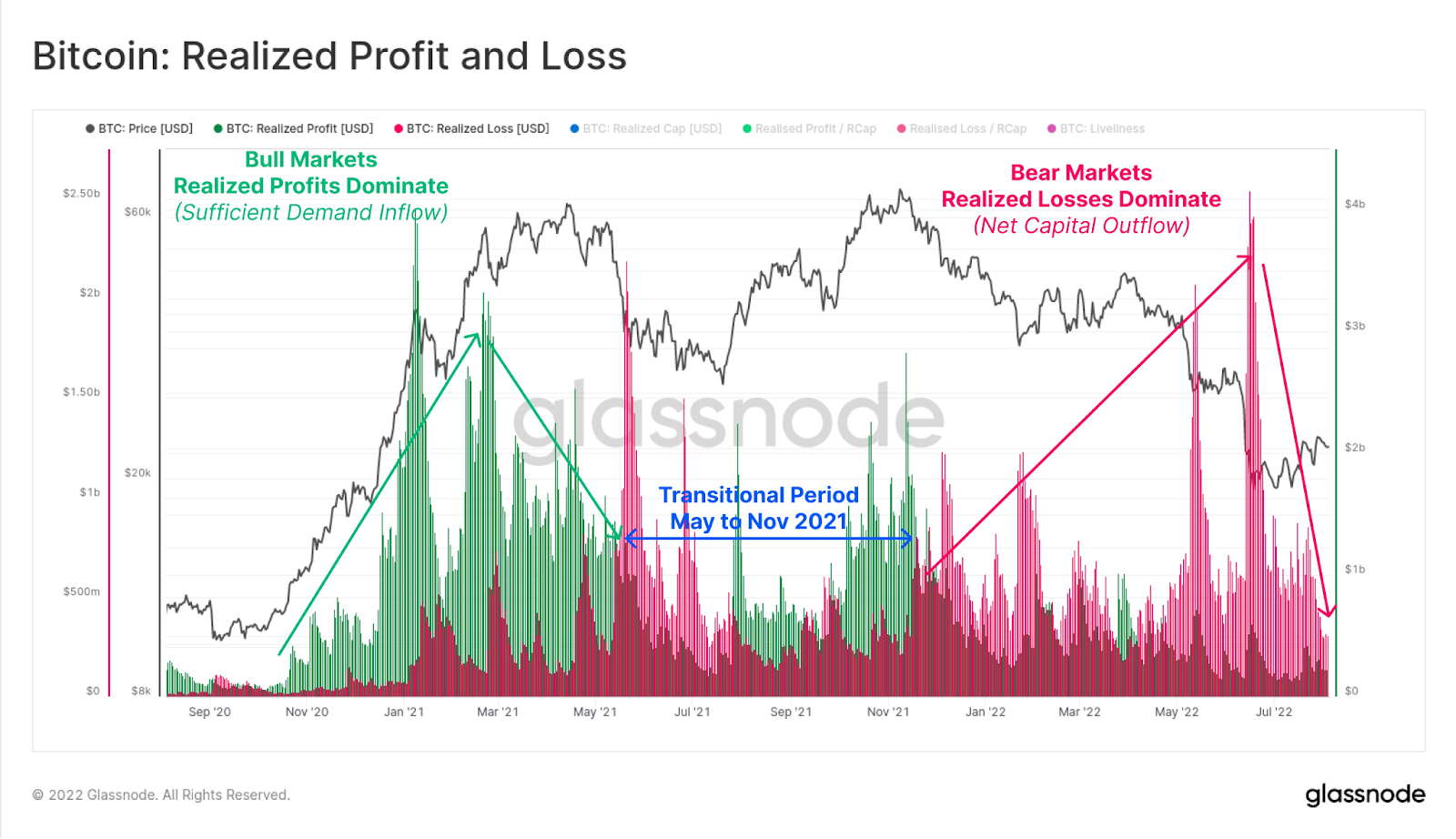

On-chain, BTC investors continued to cash in more losses, which is common during long bearish periods. A reversal of the situation is often related to a recovery in demand or macro signals that can affect the general trend of the market. For example, upcoming monthly unemployment and nonfarm payrolls data may provide some guidance on the Fed’s action to fight inflation in September.

Similar to BTC, ETH is now above the $1,650 mark and the 100 hourly moving average after gaining 2% over the same period. An upper shadow candle over the past hour has penetrated a major bearish trend line on the hourly chart of ETH. The second-largest cryptocurrency by market capitalization is set for a fresh rally if it can break the $1,670-1,680 range. At the same time, most of the major non-mainstream coins turned their losses into gains, with BNB and SOL leading the gains with a 4% increase over the same period.