What is Stop-Market function?

In order to improve the user’s transaction efficiency and trading experience, the CoinEx web terminal has launched the “Stop-Market order” function on August 24, 2021, and the APP terminal does not support it temporarily.

The Stop-Market order is a kind of planned order, which means that the user sets the trigger price and order quantity in advance. When the latest market price reaches the trigger price set by the user, the system will automatically set the market price order. Trading strategy sent to the market.

How to set up a Stop-Market order?

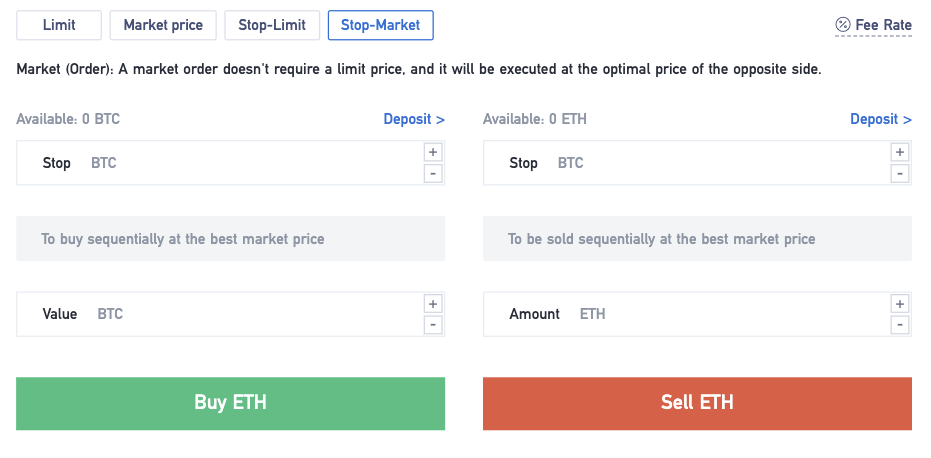

Select “Stop-Market order” in the Order Type column and set the trigger price and order quantity.

Assuming that the current market price of BCH is 500 USDT, user A thinks that BCH is likely to continue to rise when it rises to 600 USDT, then user A can set the trigger price to 600 USDT through the “Stop-Market order” function, and the transaction volume is 10 BCH.

When the latest market price reaches 600 USDT, the Stop-Market order will be triggered, and the system will send its pre-set market order into the market.

Your assets will not be frozen after you set up a stop order. When the stop order is triggered, please ensure that your account has sufficient assets, otherwise, the order will not be sent to the market.

Go to CoinEx’s Official Website

Please check CoinEx official website or contact the customer support with regard to the latest information and more accurate details.

CoinEx official website is here.

Please click "Introduction of CoinEx", if you want to know the details and the company information of CoinEx.