In the era of digital innovation, trading in financial markets has evolved from traditional broker-based models to contemporary digital platforms that harness the power of algorithms and automation. One such strategy that has garnered significant interest among traders is grid trading. A strategic tool for automated trading, grid trading involves buying and selling futures contracts at preset intervals around a predetermined price range.

Especially effective in ranging markets, grid trading enables traders to profit from small price fluctuations. A key player in this space, Binance Futures, has developed a user-friendly tool to automate the process of setting buy and sell orders. In a few clicks, users can create an automated strategy, streamlining the trading process. This article will delve deeper into the world of grid trading and how to utilize Binance Futures to your advantage.

Go to Binance’s Official Website

Understanding Grid Trading

Grid trading on Binance Futures allows users to trade in the cryptocurrency market autonomously. This feature works under preset parameters, enabling users to leverage price fluctuations within a given range. The aim is to profit from small price movements, an opportunity that arises when a cryptocurrency remains stagnant, trading within a price pocket, for a longer duration.

The trading grid executes limit orders systematically at preset intervals within a set price range. Traders can opt between two predefined modes: arithmetic and geometric. The former establishes each grid with an equal price difference, while the latter creates each grid with an equal price ratio difference.

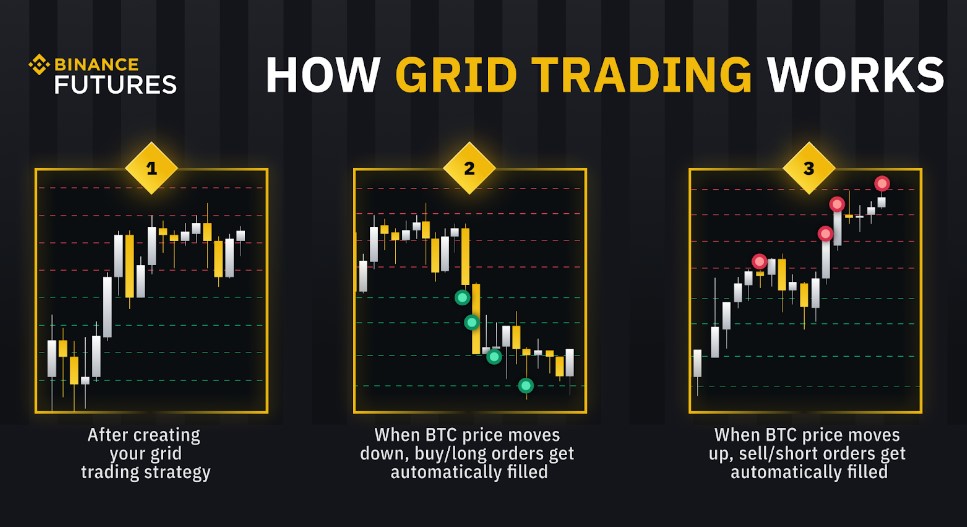

In essence, grid trading follows a simple principle: when the price of a given cryptocurrency drops, a buy order is executed, and a sell order is placed immediately at a higher price. Conversely, when the price of a given cryptocurrency rises, a buy order is placed immediately at a lower price as soon as a sell order is executed. This systematic approach to buying low and selling high capitalizes on market volatility to yield potential profits.

Start Grid Trading with Binance

Embracing Systematic Trading

A significant advantage of grid trading is the ability to trade systematically, without needing to predict market trends. Instead of continuously monitoring real-time market movements, a trader can set up a grid trading strategy and leave it to execute transactions.

While price consolidation can occur even in trending markets, grid trading takes advantage of these small price changes on lower time frames. Nonetheless, defining a reasonable price range in any time frame is crucial to ensure the success of a grid trading strategy.

Given the market’s inherent volatility, traders must exercise caution in selecting suitable market conditions for their strategy. Risk management measures, understanding the degree of acceptable leverage, and setting conservative take-profit and stop-loss orders are crucial components of effective grid trading.

Practical Implementation of Grid Trading

A grid trading bot can further streamline the process of setting multiple orders within a price range, facilitating profit-making from upward and downward price movements.

For instance, trading pairs with good liquidity and decent fluctuations are desirable for grid trading. A pair like ETH/BTC, comprising Ethereum and Bitcoin—two major cryptocurrencies with high trading volumes for futures contracts—is popular among futures grid traders. Buying and selling ETH/BTC contracts at different price levels may be easier due to the significant trading volumes, making this pair preferable for grid trading.

Furthermore, the volatile nature of ETH and BTC prices could create ample opportunities for grid trading. Factors such as market sentiment, news events, and changes in the broader market can cause rapid fluctuations in the relative value of ETH and BTC. These movements, confined within a defined range, could be leveraged for profitable grid trading.

Go to Binance’s Official Website

Grid Trading on Binance Futures

On Binance Futures, users can set up grid trading using automated parameters or manual indicators. Advanced traders can visit the Trading Bots page to customize and set grid parameters according to their indicators.

For those unfamiliar with setting parameters to build a grid trading strategy, Binance Futures offers a set of predefined auto parameters to ease the learning curve. These include the lower price limit, upper price limit, and grid count. The auto parameters function allows users to establish a grid trading strategy with just one click.

The systematic approach of grid trading can significantly leverage market volatility. Binance Futures offers options suitable for various skill levels, simplifying the grid trading process.

Start Grid Trading with Binance

A Closer Look at Crypto Futures Trading

Trading futures contracts allow traders to gain exposure to cryptocurrencies without needing to possess the underlying asset. They can sell high and buy low to profit from the price difference, a method known as short selling. Leverage is another attractive feature drawing traders to the futures market, making it highly capital-efficient.

Crypto futures work by allowing traders to take risks on the price changes without holding the actual cryptocurrency. When a crypto futures contract expires, the trade is settled in cash rather than the actual digital asset.

For instance, if a trader expects BTC to hover in a price range between $40,000 to $50,000 in the next 24 hours, they can set up a grid trading strategy within this predetermined price range. As the price of BTC drops towards $45,000, the grid trading system will set up buy orders on the way down at a lower price than the market. When prices start to recover, the grid trading system will place sell orders on the way up at a higher price than the market, leveraging price fluctuations.

Traders must familiarize themselves with essential concepts involved in crypto derivatives to better understand these financial products. Key terms include leverage, margin requirements, and funding rates.

Starting Futures Trading on Binance

Trading crypto derivatives contracts on Binance Futures is a simple process. Existing users can follow these steps:

- Open a futures trading account on Binance Futures. You must enable 2FA verification to fund your futures account before you start trading.

- Deposit funds into your futures wallet. This can be in USDT, BUSD, or any other cryptocurrencies supported by Binance Futures.

- Choose between the two derivative contracts available on Binance Futures: USDⓈ-M Futures and COIN-M Futures.

- Select the appropriate amount of leverage for your position.

- Place buy-limit, buy-market, or any other type of orders available on Binance Futures.

Binance Futures’ user-friendly interface and simplified grid trading process make it an ideal platform for both beginner and experienced traders. By leveraging the systematic approach of grid trading, traders can take advantage of the volatile nature of the crypto market to generate potential profits. Start setting up your grid trading strategy today!

Start Grid Trading with Binance

Please check Binance official website or contact the customer support with regard to the latest information and more accurate details.

Binance official website is here.

Please click "Introduction of Binance", if you want to know the details and the company information of Binance.