A Futures (Perpetual Contract) is a financial derivative of a digital currency.

Based on the judgment of the price rise and fall, investors can buy and do long to obtain the rise or sell short to obtain the income brought about by the fall.

In addition, leverage can also be set to obtain the possibility of excess profits.

CoinEx supports Linear contract and Inverse contract. The Linear contract uses USDT as the margin and settlement currency, while the Inverse contract uses the trading currency as the margin and settlement currency.

Go to CoinEx’s Official Website

The Comparison of Linear Contract (USDT-M Contract) and Inverse Contract (Coin-M Contract)

| Type | Linear Contract USDT-M Perpetual Contract | Inverse Contract Coin-M Perpetual Contract |

|---|---|---|

| Margin | Pricing Coin(USDT) | Trading Coin(BTC, etc.) |

| Settlement Date | – | – |

| Contract Loss Mechanism | Auto-Deleveraging(ADL), Insurance Fund |

Auto-Deleveraging(ADL), Insurance Fund |

| Liquidation Price | Reasonable Price Index | Reasonable Price Index |

| Price Balance Mechanism | Funding Rate | Funding Rate |

The following takes the Linear contract (BTC/USDT) as an example to introduce how to conduct contract transactions

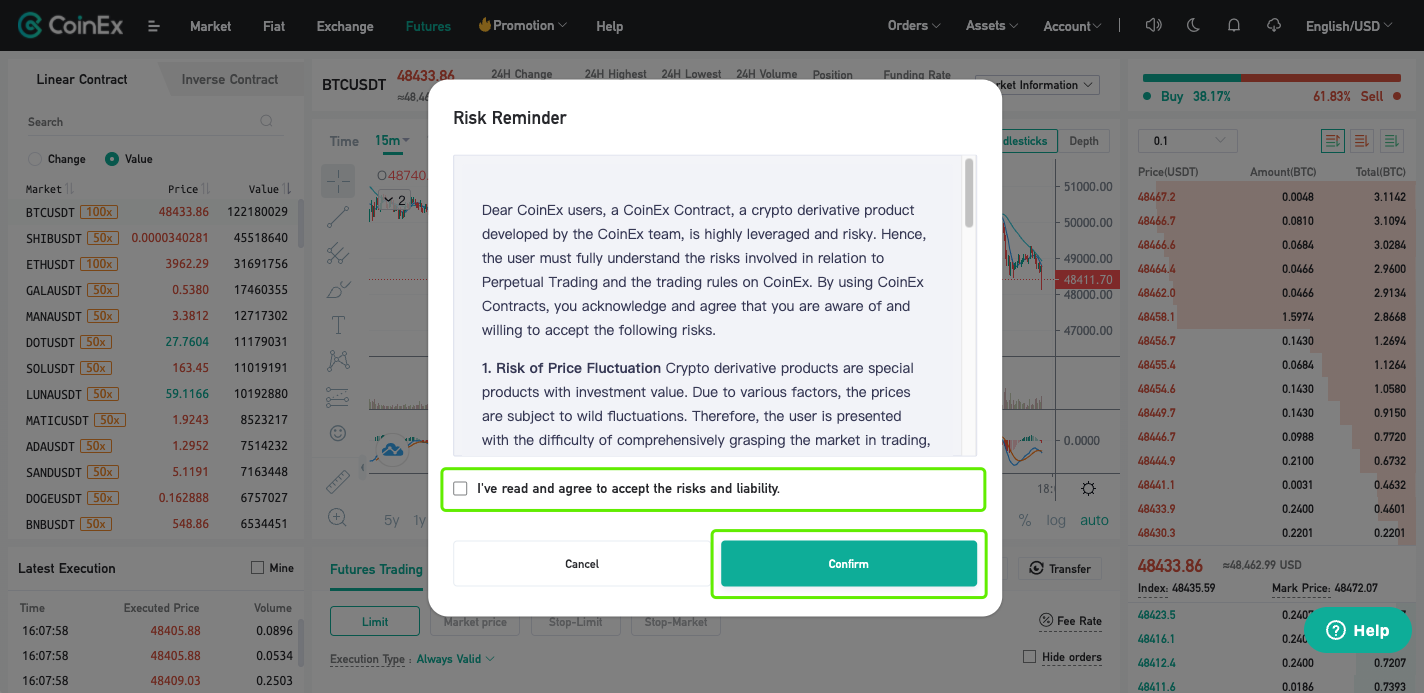

1. Log in to your CoinEx account

Log in to the official website of CoinEx (https://www.coinex.com), enter the [Futures] page, read the [Futures Risk Warning] and click [Confirm] to open a Perpetual Contract account.

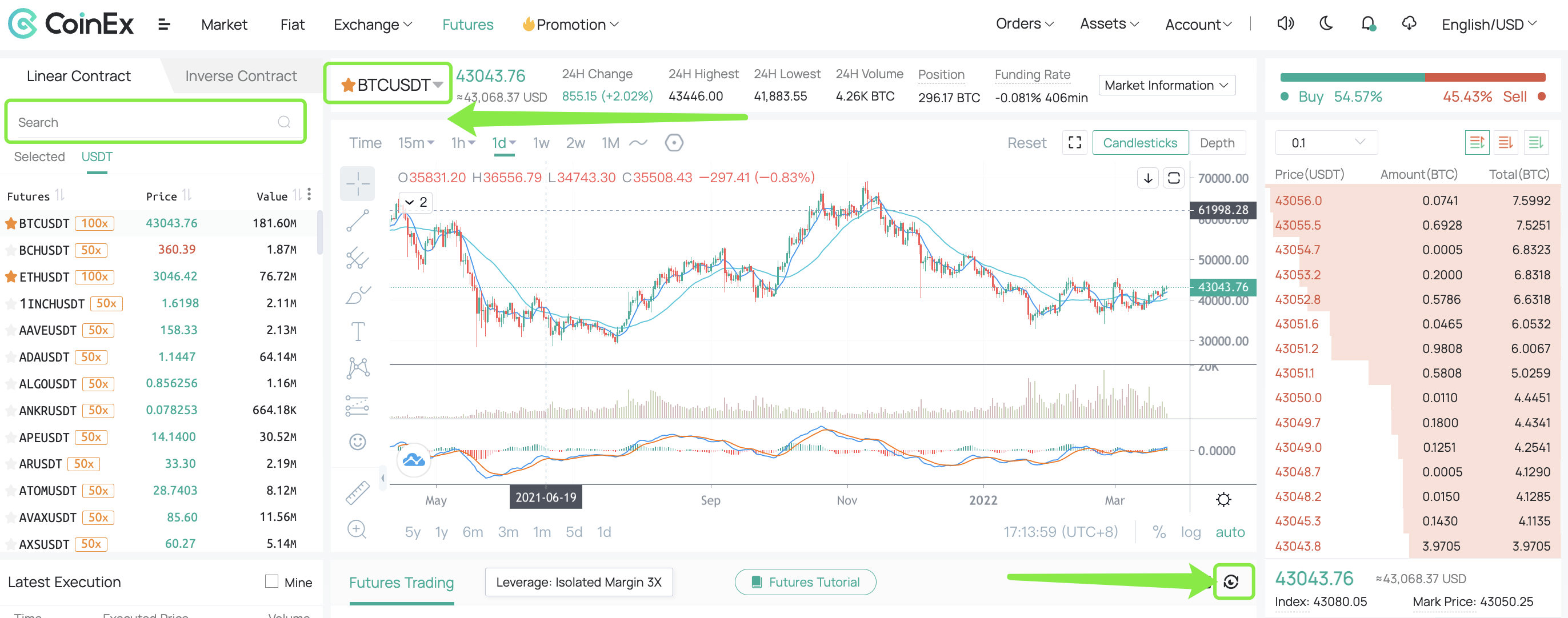

2. Select the Futures trading market and the trading pair.

In order to ensure that you fully understand the potential risks of Perpetual Contract transactions, you need to complete the following two things and click [Start Now].

3. Select the Perpetual Contract type and trading pair.

If the available assets of the Perpetual Contract account are 0, the assets need to be transferred first.

Go to CoinEx’s Official Website

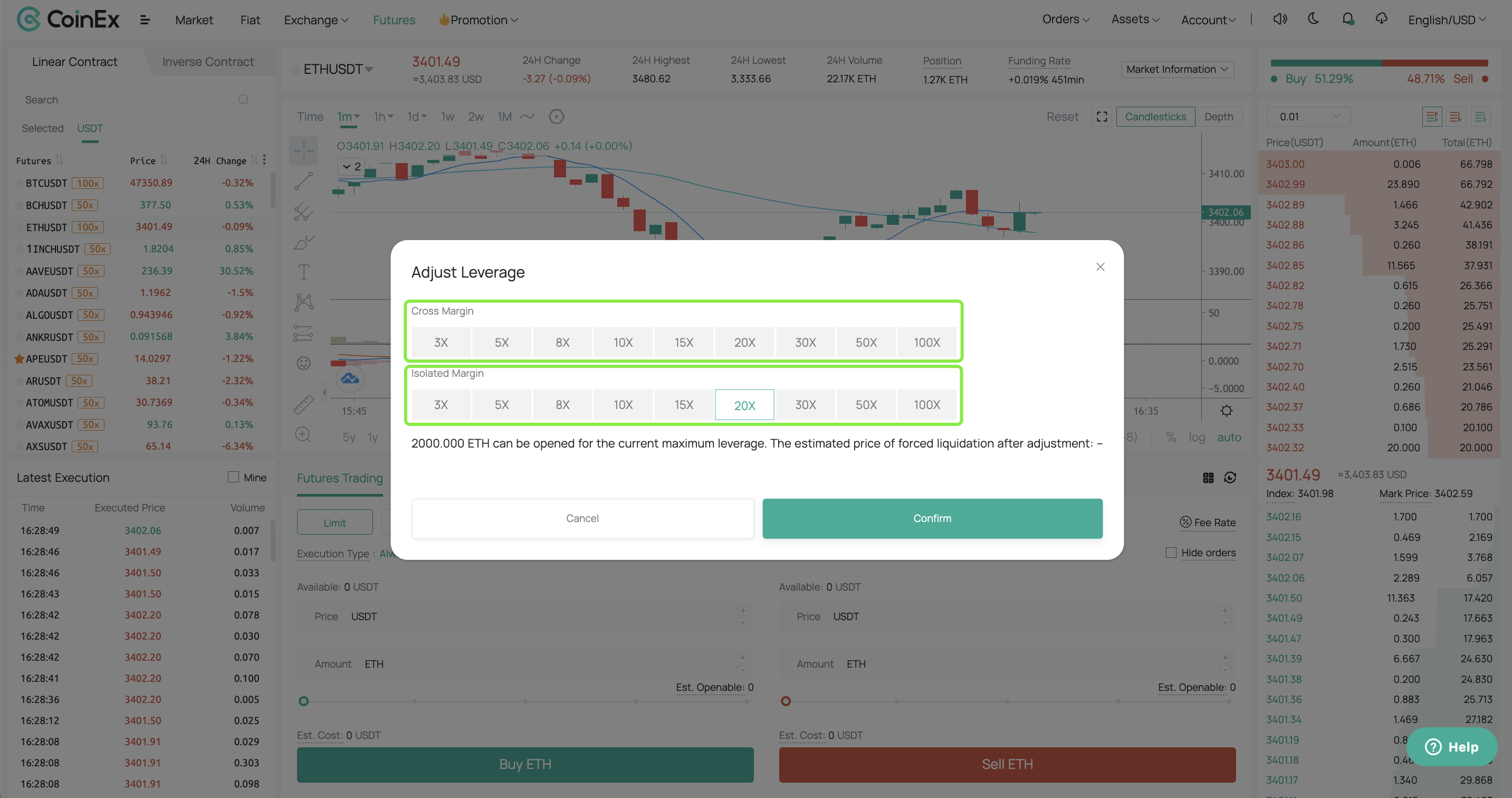

4. Select the margin mode and leverage multiple.

In the isolated-margin mode, only the margin of the current market account is used to maintain the position, which can be added manually later.

The greater the selected multiple, the greater the amount that can be traded and the greater the risk.

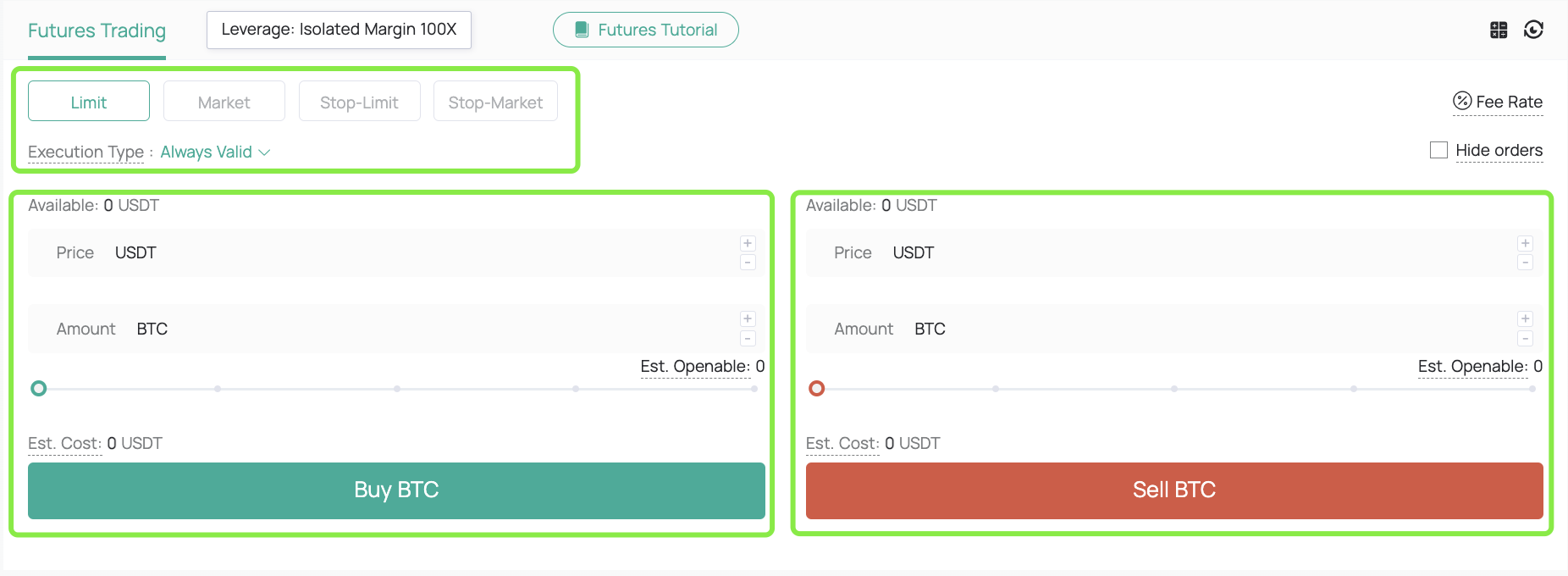

5. Select the buying and selling direction and order type, set the price and quantity, and then place an order.

After placing an order successfully, you can check the position information in [Current Position], and click [One-click Full Close] or [Close Position] to close the position.

Or use the [Stop Profit Stop Loss] function to set the closing price in advance.

When the market price reaches the price you set, it will automatically trigger the market price to close the position.

It should be noted that the CoinEx Perpetual Contract uses the mark price to determine the profit and loss of the position and the liquidation price.

When the mark price reaches the forced liquidation price, a forced liquidation will be triggered, and you can reduce the risk of forced liquidation by increasing the margin in advance.

Go to CoinEx’s Official Website

Please check CoinEx official website or contact the customer support with regard to the latest information and more accurate details.

CoinEx official website is here.

Please click "Introduction of CoinEx", if you want to know the details and the company information of CoinEx.