Leveraged trading is to magnify the principal several times, make larger investments with small funds, and realize small profits and double profits.

But at the same time, you must bear the risk of doubling the possible losses.

Because the price of digital assets fluctuates greatly, please be sure to use it carefully after fully understanding the risks of leveraged trading.

Go to CoinEx’s Official Website

What are the risks of leveraged trading?

Leverage uses less capital to realize the possibility of obtaining greater returns.

However, if the wrong trading direction is judged, the loss will also be magnified year-on-year.

Therefore, ordinary traders try to avoid heavy trading with high leverage to prevent forced liquidation or even liquidation.

How to reduce leverage risk rate?

- Reasonable use of leverage multiples to control positions.

- Timely stop profit and stop loss, and spontaneously close positions.

- Add margin in time to ensure that the ratio of total assets/leverage limit is greater than 110%.

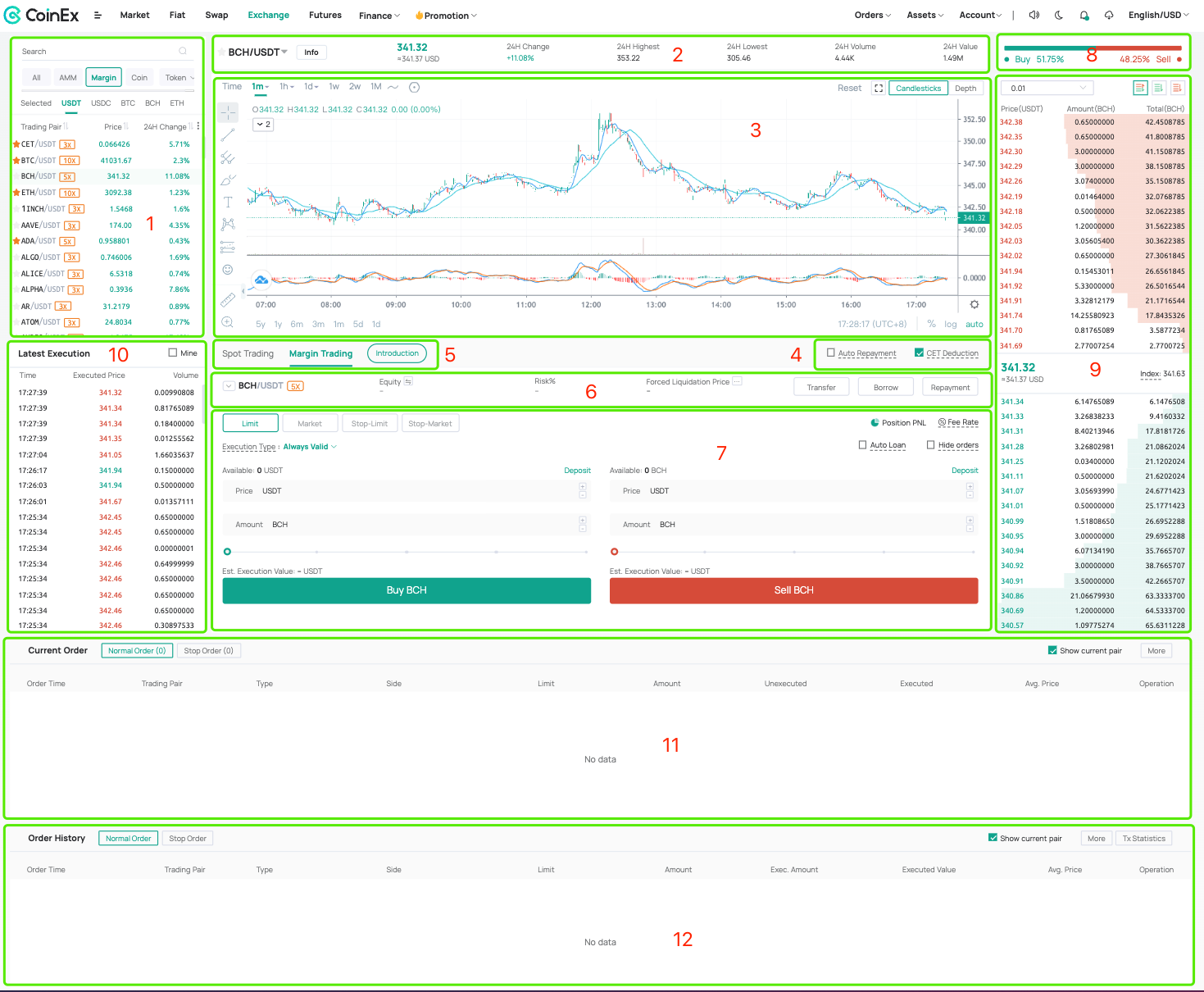

Introduction to the leveraged trading page:

- Search bar and market query area.

- Currency information and basic market display area.

- K-line market and depth chart.

- CET deduction and automatic repayment area.

- Leverage introduction and market selection area.

- Leverage information display area.

- Entrusted order area.

- The ratio display area of buying volume & selling volume.

- Market order depth display area.

- The latest transaction display area.

- Current entrusted inquiry area.

- Historical entrustment inquiry area

Go to CoinEx’s Official Website

How to use margin to magnify gains if you think the price will go up?

Judging the rise of currency prices, how to use leverage to achieve multiple profits?

Judging that the price of BCH will rise, that is, when doing long BCH, you need to borrow USDT from the platform, use your own USDT plus the borrowed USDT to buy BCH at a lower price, and sell it at a higher price after the currency price rises to the expected price Withdraw BCH and return the borrowed currency and interest to realize profit.

Take 100 USDT, 5 times leverage to do long BCH as an example:

Query the trading pairs (BCH/USDT) that support leveraged trading.

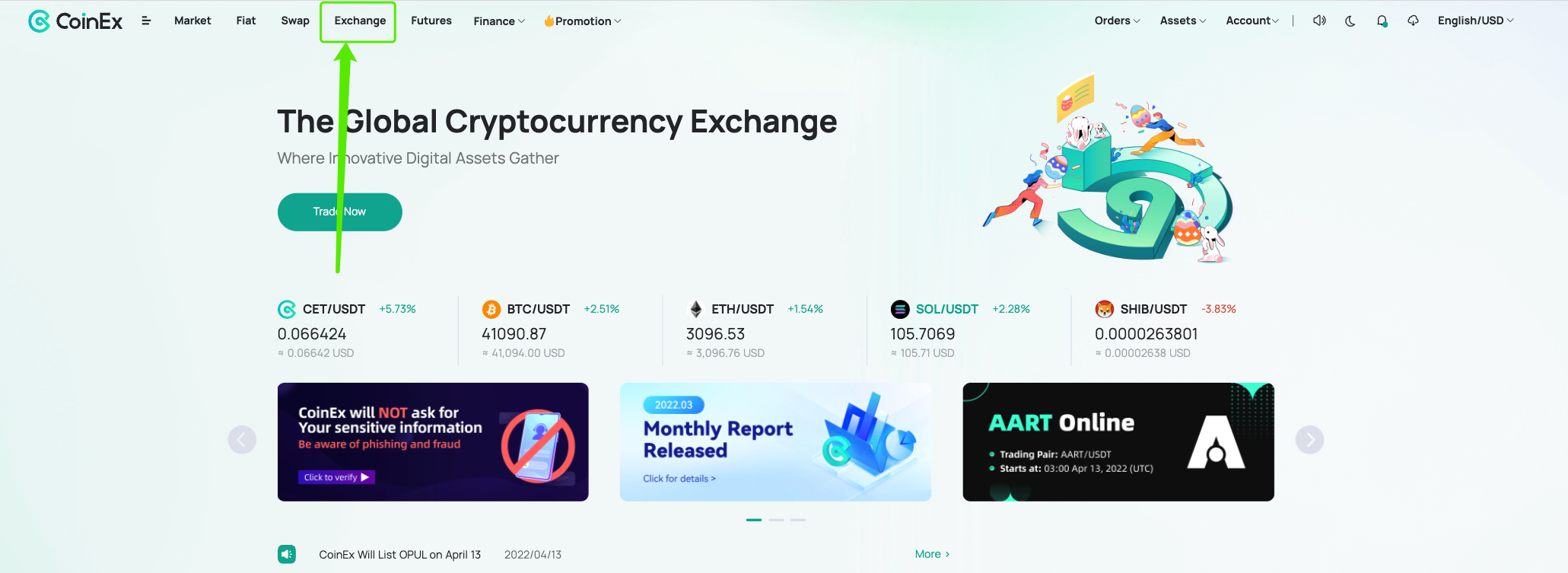

Access the official website of CoinEx (https://www.coinex.com) through a browser, and after successful login, click [Coinex] on the top navigation bar to enter the coinex trading area;

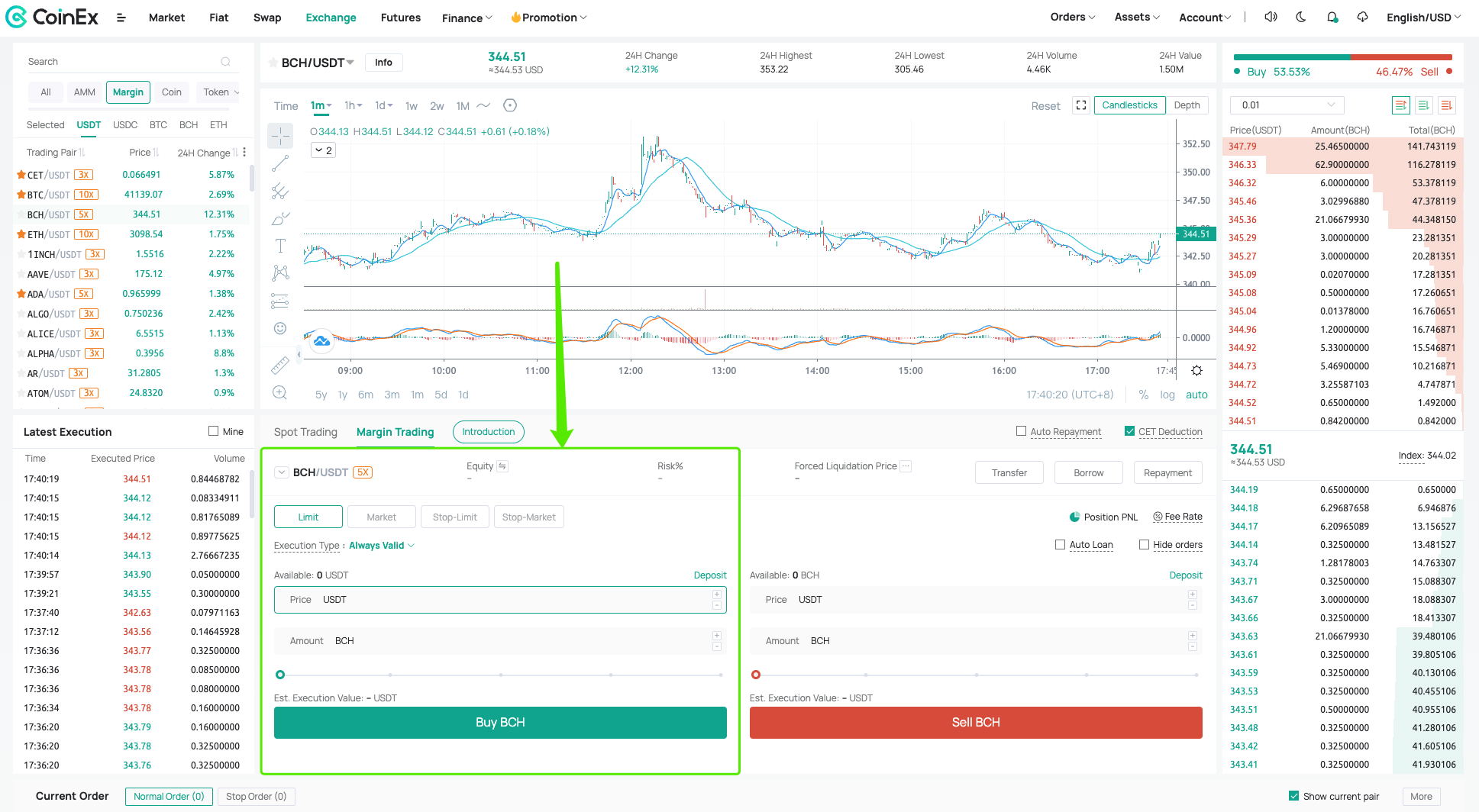

After entering the currency trading page, select the [Leverage] option in the market display area, query and select the trading pairs that support margin trading, enter the trading pair and select [Margin Trading] in the market selection area to enter the margin trading page;

![2. Tick the [Margin] option in the market display area to check and select trading pairs supported, click [Margin Trading] in the market selection area.](https://mobie.io/wp-content/uploads/2023/01/2.-Tick-the-Margin-option-in-the-market-display-area-to-check-and-select-trading-pairs-supported-click-Margin-Trading-in-the-market-selection-area..png)

Go to CoinEx’s Official Website

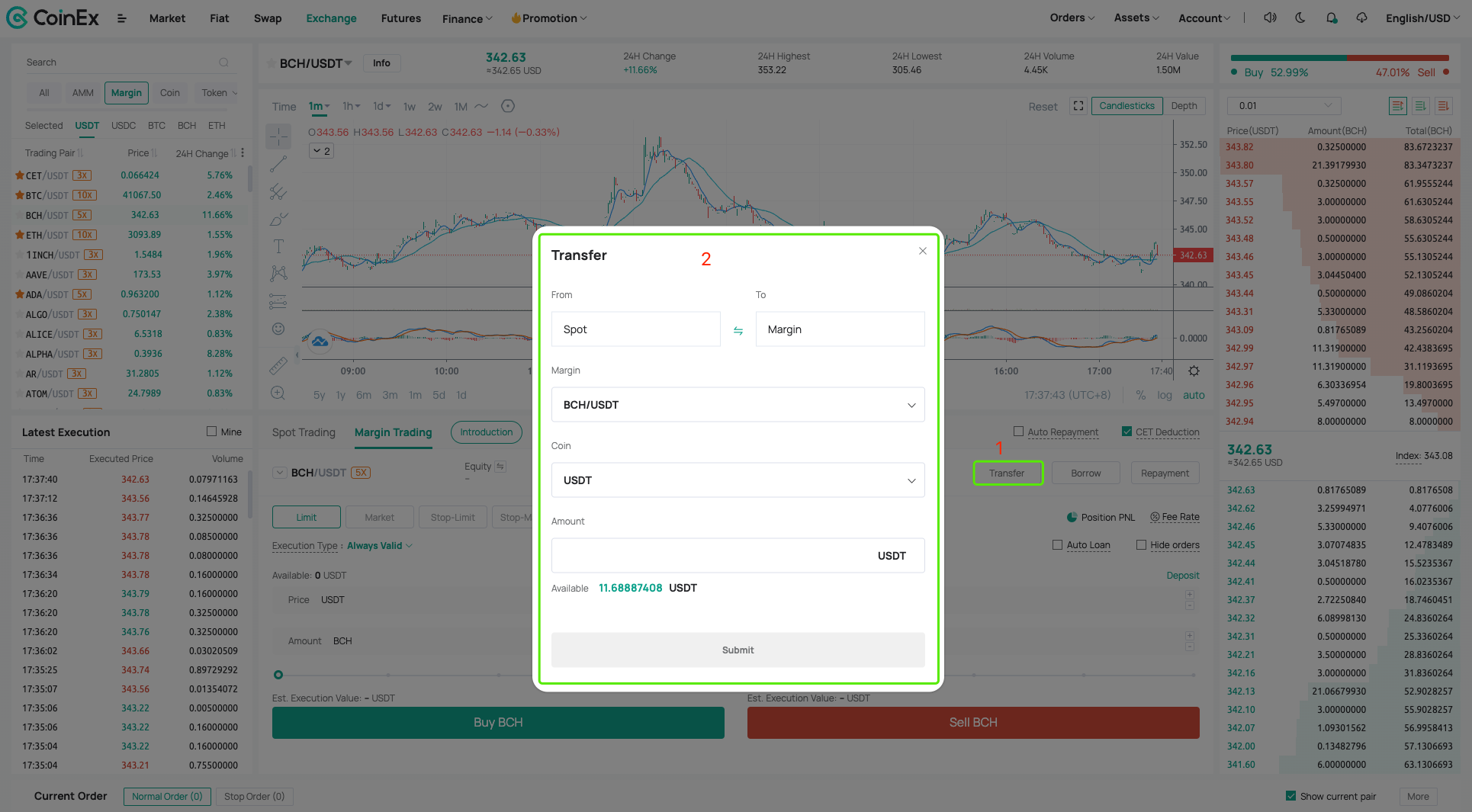

2. Transfer assets to the margin account

Click [Transfer] on the margin trading page, select the direction from [spot account] to [margin account] in the asset transfer pop-up window, select [BCH] or [USDT] as the currency, set the transfer [quantity] and click [Submit] to complete the transfer.

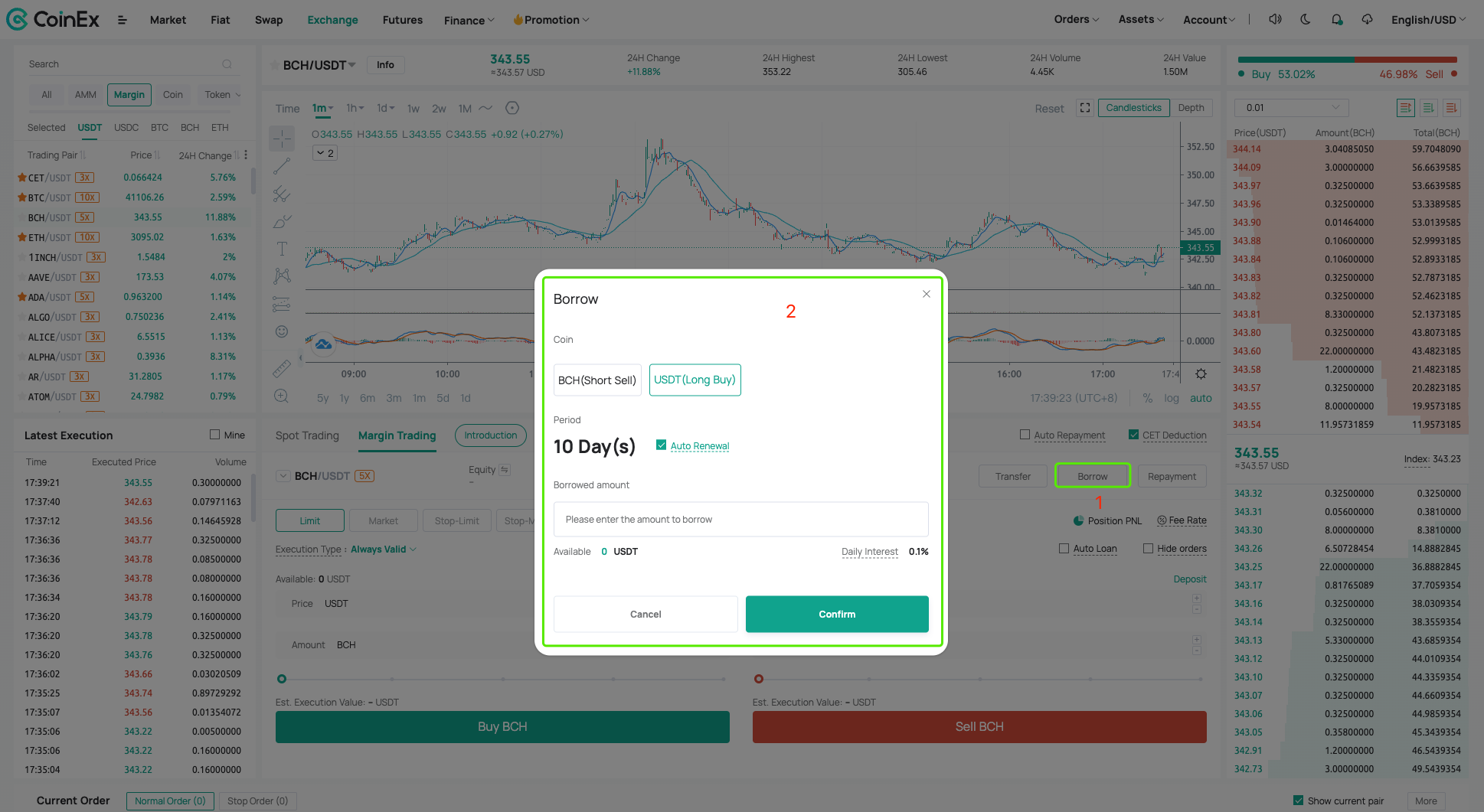

3. Borrow USDT using leveraged currency

Click Borrow on the margin trading page, select [USDT (Long)] as the currency in the pop-up window of Borrow, check [Automatic Renewal] (on by default), enter the [Amount] of the loan, and click OK to complete the loan currency;

Reminder: The principal is 100 USDT, the loan is 400 USDT, the total is 500 USDT, and the principal is enlarged by 5 times, which is 5 times leverage.

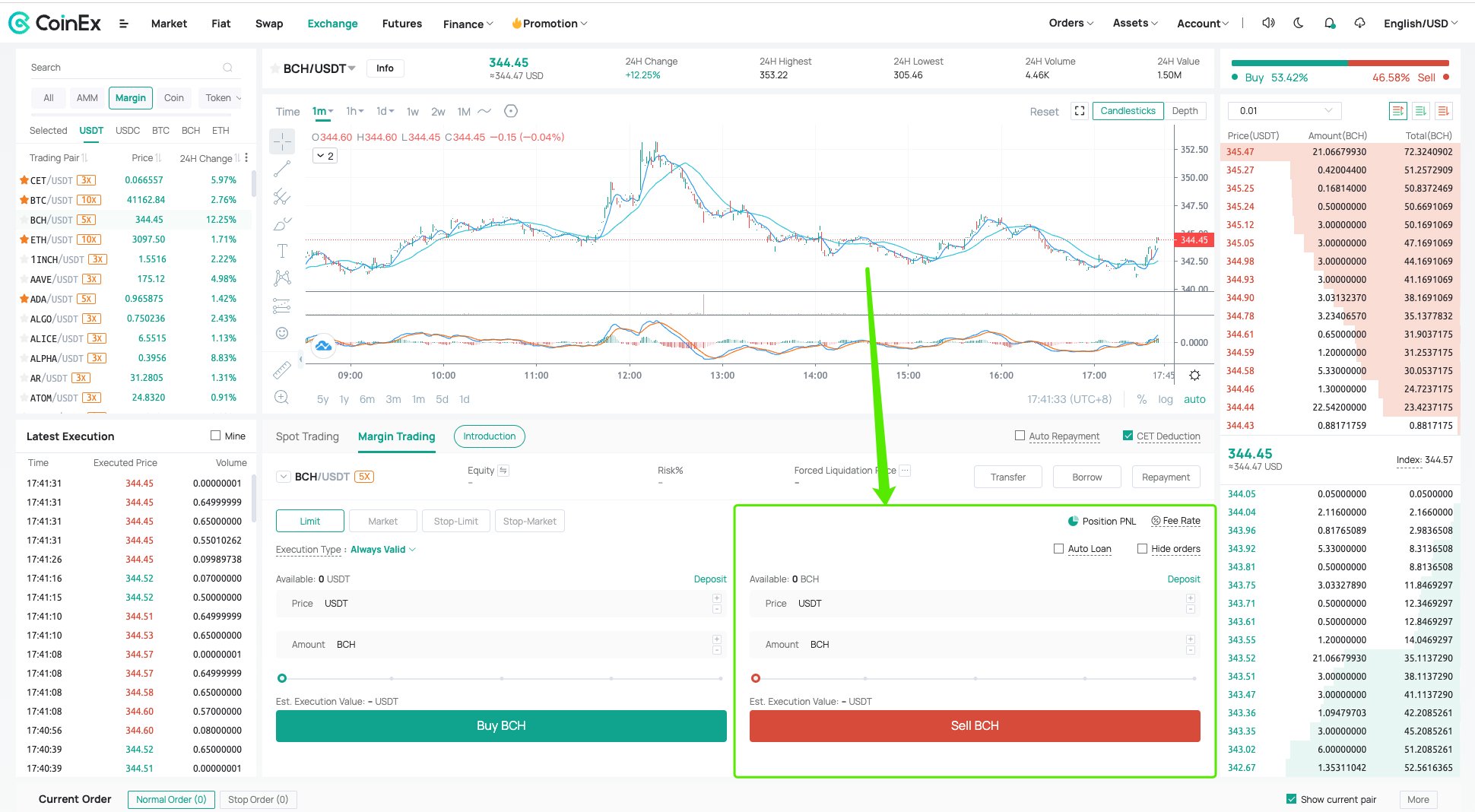

4. Buy BCH at a lower price (here we take a limit order as an example)

Use 500 USDT in the BCH/USDT leveraged trading market to buy 1.17707990 BCH at a unit price of 424.78 USDT to complete the purchase/long position.

Go to CoinEx’s Official Website

5. Sell at a higher price after the price of BCH rises to the expected value (here we take a limit order as an example)

Assume that when the unit price of BCH rises to 450USDT, sell 1.17707990 BCH in the BCH/USDT leveraged trading market to get 527.5089225 USDT for repayment.

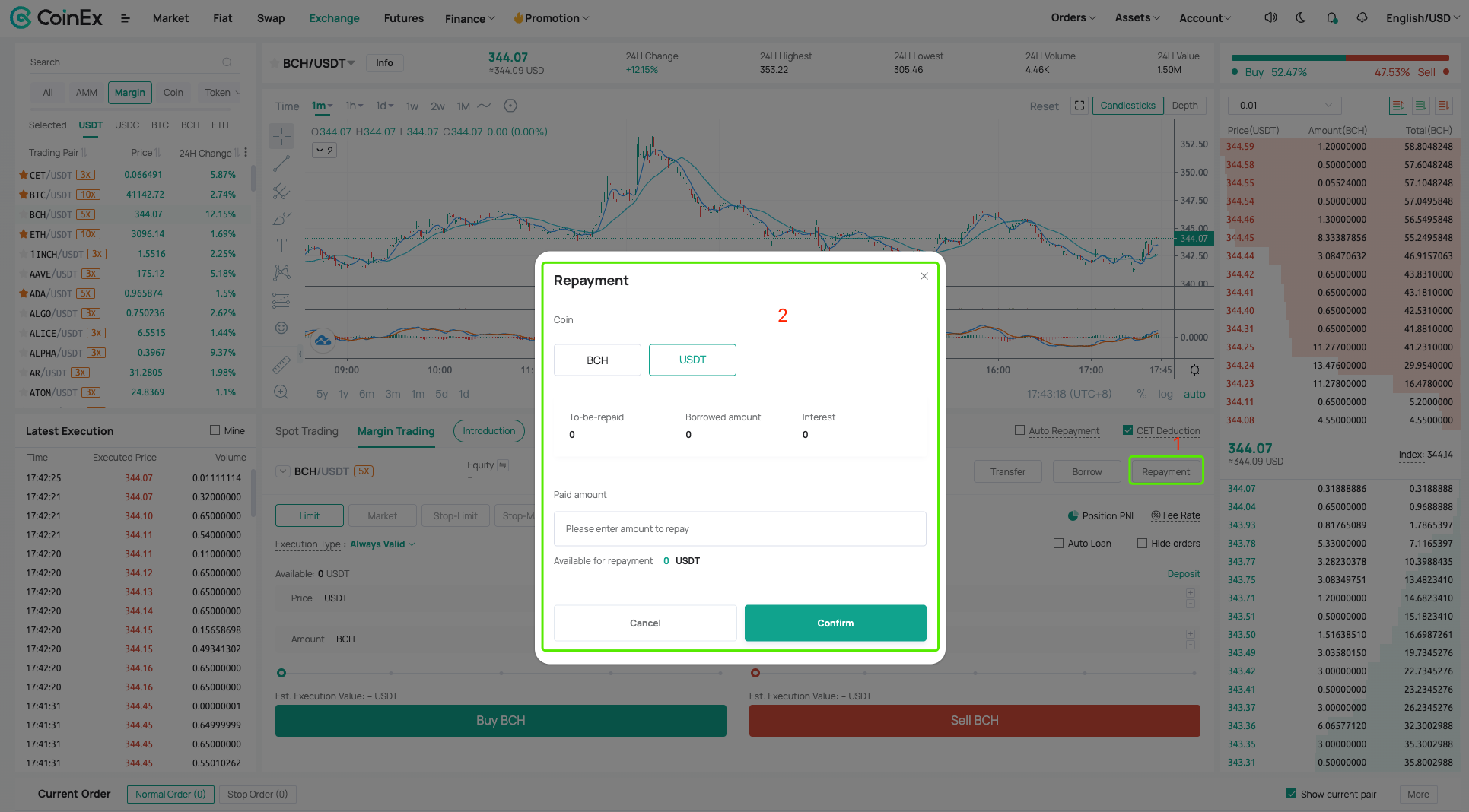

6. Repayment of Loan Currency and Loan Currency Interest

Click [Repay Coin] on the margin trading page, select [BCH] or [USDT] as the currency in the pop-up window, enter the [Token Repayment Amount], and click OK to complete the coin repayment.

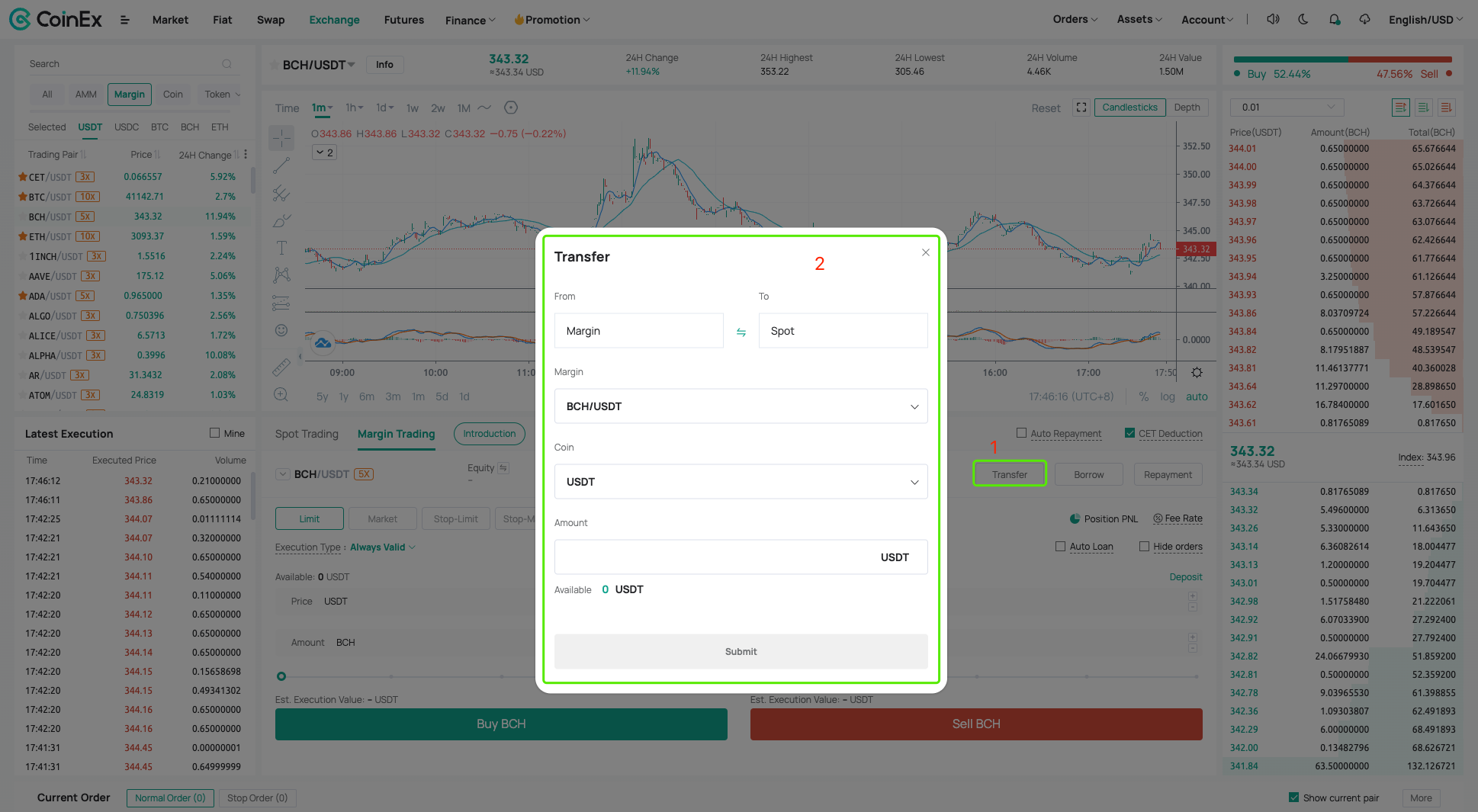

7. Transfer leveraged assets to spot accounts

Click [Asset Transfer] on the margin trading page, select the direction from [Margin Account] to [Spot Account] in the asset transfer pop-up window, select [BCH] or [USDT] as the currency, set the transfer [Amount] and click 【Submit, complete the transfer.

Go to CoinEx’s Official Website

Please check CoinEx official website or contact the customer support with regard to the latest information and more accurate details.

CoinEx official website is here.

Please click "Introduction of CoinEx", if you want to know the details and the company information of CoinEx.