Crypto pairs you can trade on Deriv

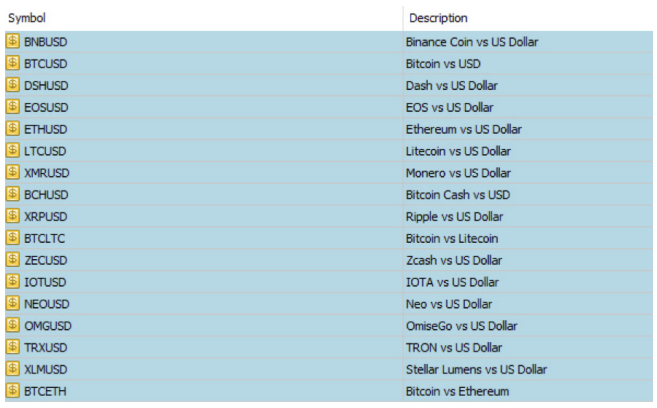

With Deriv, you can trade the following Cryptocurrency CFDs:

- ALG/USD

- ADA/USD

- AVA/USD

- BAT/USD

- BCH/USD

- BNB/USD

- BTC/USD

- BTC/ETH

- BTC/LTC

- DOG/USD

- DOT/USD

- DSH/USD

- EOS/USD

- ETC/USD

- ETH/USD

- FIL/USD

- IOT/USD

- LNK/USD

- LTC/USD

- MKR/USD

- MTC/USD

- NEO/USD

- OMG/USD

- SOL/USD

- TRX/USD

- UNI/USD

- XMR/USD

- XLM/USD

- XRP/USD

- XTZ/USD

- ZEC/USD

Open Deriv’s Trading Account for free

With Deriv, you can trade a derivative known as a contract for difference (CFD), so the actual Bitcoin or any other cryptocurrency never changes hands (read more about CFDs in the next section).

In other words, you trade on the price of the underlying cryptocurrency rather than owning it.

Deriv plans to introduce cryptocurrency trades on its multipliers too, which are accessible on DTrader and the Deriv GO mobile app.

One of the major appeals of cryptocurrency trading is that it is available 24 hours a day, 7 days a week. The market is never closed, nor is Deriv.

Regardless of your time zone, you can always trade. Major cryptocurrencies have deep liquidity, which means you can buy and, more importantly, sell them even in large volumes.

Like any regular currency trade, a cryptocurrency trade consists of a trading pair, where each part illustrates the relative worth of an asset.

The US dollar remains the world’s reserve currency for trade settlements.

Such assets as gold and oil, for example, are priced in USD. Deriv uses USD to price most cryptocurrencies too, e.g. BTC/USD shows the price of Bitcoin in USD.

Of course, cryptocurrencies can be priced in other currencies, such as Euro or British pound, but the US dollar remains the main counterparty currency.

Deriv is also adding cryptocurrency trades that offer two digital currencies paired together, for example, ETH/BTC and LTC/BTC.

Go to Deriv’s Official Website

No Crypto wallets required

You might have heard about people who have invested in Bitcoin but lost their private keys or had their accounts hacked. Luckily, trading a CFD eliminates this threat as you don’t own the coin.

You are trading on the price difference of the cryptocurrency, and your trade will be settled (credited or debited) in US dollars.

Start trading Cryptos with Deriv

Types of Cryptocurrencies you can trade

Cryptocurrency is a secure digital or virtual currency protected by cryptography, which prohibits users from counterfeiting or double-spending it.

Decentralised networks such as bitcoin and many other cryptocurrencies are built on blockchain technology — a distributed ledger enforced by a large number of computers all around the world.

Cryptocurrencies are identified by the fact that they are generally not issued by a central power, and for that reason, they are theoretically immune to government control or manipulation of their value.

Central banks are able to print fiat currency that is based on faith and not backed by commodities, such as the US dollar, the euro, and the British pound, in unlimited quantities.

Throughout history, all fiat currencies have eventually failed, as governments tend to overprint them. Since cryptocurrencies are not controlled by authorities, they do not suffer from this problem.

Go to Deriv’s Official Website

1. Bitcoin

Bitcoin is the best-known cryptocurrency and the largest by market capitalisation (i.e. total equivalent value in USD). It was launched in 2009 by an individual or group known by the pseudonym Satoshi Nakamoto.

The original Bitcoin white paper is available in open access.

Although it is not legal tender, Bitcoin is extremely popular and has sparked hundreds of other cryptocurrencies, collectively called altcoins. “BTC” is the symbol used for Bitcoin.

There have also been spinoffs or forks from the original Bitcoin, such as Bitcoin Cash. However, whilst the names are similar, they are priced very differently and should not be confused.

At the time of writing this book, Bitcoin is trading at over $40,000, making owning 1 Bitcoin unaffordable for many. Fortunately, Bitcoin is divisible into Satoshis, and you can buy as little as $5 worth of Satoshis with many online brokers.

What makes Bitcoin unique is that only 21 million Bitcoins will ever be available. Each Bitcoin is divisible into 100 million units, or Satoshis, and one Satoshi is worth $0.0004 as I am writing.

Bitcoin can be accessed using a private key which is a series of numbers and letters. If you lose this key, you lose access to that amount of Bitcoin.

Whilst still relatively new, Bitcoin is building up momentum with more and more financial institutions seeing the potential and a growing number of companies and respected investors announcing that they have large holdings in Bitcoin.

Compared to other financial markets, the cryptocurrency market is still in its infancy, which opens up many opportunities. However, you will also notice that these markets can be very volatile.

2. Ether

Another popular cryptocurrency is based on the Ethereum blockchain system, a decentralised open-source ledger.

It’s worth noting that this digital coin is sometimes called Ethereum, but the correct name for the cryptocurrency is Ether; Ethereum is the name of the network. Ether is commonly abbreviated as ETH.

At the moment, Ether is the second-largest cryptocurrency after Bitcoin. It was first described in a 2013 white paper by Vitalik Buterin.

The Ethereum platform, first described in a 2013 white paper by Vitalk, has been a launchpad for many other cryptocurrencies. It is currently working on ETH 2.0, which is aiming to make processing faster and less power-intensive.

3. Altcoins

Cryptocurrencies other than Bitcoin are collectively called altcoins. Most of these digital coins use a technology called blockchain that allows secure peer-to-peer transactions.

Altcoins can provide massive gains if you get the right project; however, they are also subject to high risk since many fail and become worthless.

The smaller altcoins can also be quickly manipulated (similar to smaller cap companies or penny shares). Buyers push the price up to attract more buyers.

Then, the initial buyers cash out at a profit, leaving the new investors holding worthless cryptocurrencies.

Deriv currently offers the more established cryptocurrency pairs, and they are all traded against the US Dollar.

It is expected more digital currencies will be added to the trading platform in due course, including cryptocurrencies paired together, as explained in more detail in the next chapter.

Table 1 shows cryptocurrency pairs that are currently available for trading on the Deriv MT5 platform. MT5 can be downloaded free of charge from the Deriv website to a computer or as a mobile app and is accessible round the clock.

Please check Deriv official website or contact the customer support with regard to the latest information and more accurate details.

Deriv official website is here.

Please click "Introduction of Deriv", if you want to know the details and the company information of Deriv.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...