What is Auto-Deleveraging (ADL) system?

In the event of a forced liquidation, if the position cannot be liquidated at a price higher than the liquidation price, and the balance of the insurance fund is not enough to cover the loss of the position, the Auto-Deleveraging (ADL) system will deal with the trader holding the position in the opposite direction leverage up.

Precautions for the Auto-Deleveraging (ADL) process are:

- The trader with the highest ranking in the system will be selected by the Auto-Deleveraging (ADL) system first; traders can check the priority level of their Auto-Deleveraging (ADL) through the “Auto-Deleveraging (ADL) ranking” indicator.

- The ranking of Auto-Deleveraging (ADL) is based on the profit and loss of the position and the effective leverage used. The more profit and the greater the leverage used, the higher the ranking.

- The selected position will be reduced according to the bankruptcy price of the position to be liquidated.

- The reward of the liquidity provider will be given back to the selected trader, and the liquidity extractor’s fee will be charged from the trader’s account that triggered the liquidation.

- Traders who experience Auto-Deleveraging (ADL) will receive an email/SMS notification, and all activity orders will be canceled, and traders can freely re-enter the market to trade.

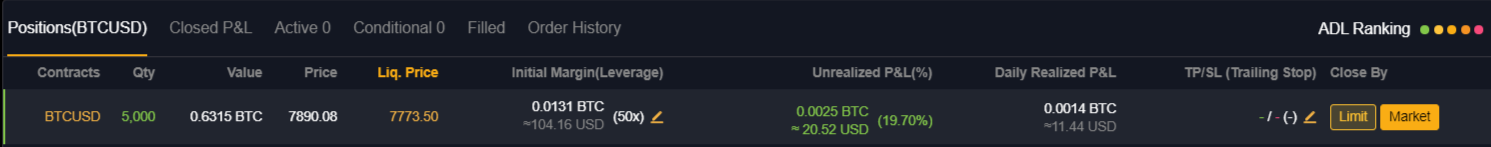

For example, a trader buys a 5,000 BTCUSD contract with $7890.08 and 50 times leverage, and the liquidation price is $7773.50.

First, let us calculate the bankruptcy price.

Calculate with the multi-position bankruptcy price formula:

Long/buy:

Bankruptcy price = (entry price x leverage) / (leverage + 1)

=(7,890.08 x 50)/(50 + 1)

= 7,735.372549 USD

≈7,735.50 USD

After the forced liquidation is triggered, if the system cannot close the position at a price better than 7,735.50 USD (bankruptcy price), and the insurance pool amount is not enough to cover the loss of the position, the Auto-Deleveraging (ADL) system will take over the position.

Assuming that there are currently six short-selling (opposite-direction) positions on the exchange, the trader with the highest ranking in the system will be selected first by the Auto-Deleveraging (ADL) system. The ranking of Auto-Deleveraging (ADL) depends on the profit and a loss percentage of the position and the effective leverage used, that is, the higher the profit percentage and the greater the leverage used, the higher the ranking. The selected position will be reduced according to the bankruptcy price of the position to be liquidated.

| Traders with existing short positions | The quantity of selling contracts | Ranking = P&L Percentage x Effective Leverage | Percentile |

|---|---|---|---|

| Trader A | 5500 | 6 (highest) | Top 20% (5 lights) |

| Trader B | 2500 | 5 | Top 40% (4 lights) |

| Trader C | 2000 | 4 | Top 60% (3 lights) |

| Trader D | 3000 | 3 | Top 60% (3 lights) |

| Trader E | 2000 | 2 | Top 80% (2 lights) |

| Trader F | 5000 | 1 (lowest) | Top 100% (1 light) |

According to the above table, Trader A is ranked the highest in the Auto-Deleveraging (ADL) queue. Trader A will be selected by the ADL system, and 5,000 contracts will be forcibly matched at 7,735.50 USD (the bankruptcy price of the forced liquidation position). Trader A’s remaining 500 contracts will be retained. After being automatically reduced, Trader A uses the same margin but holds fewer contracts. Therefore, he may no longer be the highest-ranked in the Auto-Deleveraging (ADL) queue. In the same example, suppose that if there are 10,000 contracts that need to be automatically reduced, then traders A, B, and C will all be selected.

The rewards of the liquidity provider will be given back to the selected trader, and the liquidity extractor’s fee will be charged from the trader’s account that triggered the liquidation. Traders who experience Auto-Deleveraging (ADL) will receive an email/SMS notification, and all activity orders will be canceled, and traders can freely re-enter the market to trade.

All traders can check the priority level of their Auto-Deleveraging (ADL) through the “Auto-Deleveraging (ADL) queue” indicator.

For USDT Contract

In the case of position-by-position, individual long/short positions may be Auto-Deleveraged.

Under the full position margin, the Auto-Deleveraging (ADL) mechanism will not select fully hedged positions. If there is an incomplete hedging position, only the incompletely hedged excess position may be affected by the Auto-Deleveraging (ADL), and the hedged position will not be affected.

Go to Bybit’s Official Website

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...