Have you ever heard this foreign nursery rhyme?: “Let’s go catch a bear. I’m going to catch a big bear. The weather is really nice too! Bears are not scary.”

In financial markets, ‘bear trap trading’ or ‘bear trap trading’ means trying to catch a big bear. Perhaps the bull market will suddenly stop and the bull market will start to reverse. You think you will make a significant profit in these markets, and you can sell cryptocurrencies and possibly short sell in the futures market. Suddenly the price will soar. If so, now would be a good time to ask for help. Because you just fell into a bear trap.

In this post, we will cover what bear traps look like, especially in cryptocurrency trading, and how to avoid them.

What exactly is a bear trap?

A bear trap is a pattern seen when a new bearish trend appears in the price of a stock or cryptocurrency, often caused by a short-seller who lowers the market price, causing a reversal and a return to an uptrend in price.

A short squeeze is similar to a bear trap, except that the short squeeze effect has a greater tendency to cause prices to go up very quickly in a very short amount of time.

Bear traps can also panic traders, especially amateurs and novice investors. This could lead to a sell-off of cryptocurrencies, expecting the bearish (bearing) market to continue. A bear market may not eventually happen, but instead, the market reverses again and turns upside down, trapping sellers short. In this case, you should get out of the bullish rebound before it passes the sell point. Otherwise, you may lose your funds.

Unlike bull traps, bear traps are particularly lethal for short positions. To recap on short positions, short positions take advantage of a market downtrend as investors borrow and sell shares and then buy them back later (hopefully at a lower price). In general, you can sell short by using futures of major coins in the cryptocurrency market.

In traditional stock markets, financial institutions often buy larger amounts of stock, triggering a bear trap price reversal. Furthermore, they may have started a bear trap by first short selling at a higher level and then buying the stock back at a lower level. As short-sellers, you have pulled the market down. As financial institutions have higher trading volumes, these flows have the potential to move the market towards retailers and amateur investors.

The problem is, this type of bear traps or fire trap is there can be applied to the passwords money market (bull trap). Unfortunately, in an unregulated cryptocurrency market, whales are much easier to adjust than traditional regulators. Lack of liquidity (reducing the number of buyers and sellers in the order book) also makes market manipulation easier.

If you want to know that the volatility in the cryptocurrency market is far higher than that of the stock market, just watch the cryptocurrency market for a few hours. Given the high volatility of cryptocurrencies, shorting can be very risky. Getting caught in a bear trap would be very painful.

How does a bear trap happen?

As opposed to bull traps, bear traps can be set up by short sellers or large traders trying to filter out smaller traders. Starting a bear trap can be as simple as a financial institution selling or shorting a stock to amateur investors. This offloading cause the market to crash, causing panic and selling among inexperienced investors.

When the price falls below a certain level, the institution can buy back its shares and raise the price again. At this point, the rest of the market buys again due to Fear Of Missing Out (FOMO), pushing up the price.

Simply put, institutions aim to increase demand and lower prices to make the market appear bearish. When the market is bearish, investors buy assets at progressively lower prices and wait for the price to rebound higher.

Indicators that can identify bear traps

Bull traps and bear traps are unavoidable, and while it can be tricky to know when to trade, it’s not impossible to verify using technical analysis. Here are some technical indicators to help you reduce your risk exposure by noticing what’s happening before a bear trap occurs:

1. Volume Indicator

Looking at your volume can help you spot potential bear traps.

Generally, when the market is strongly rising or falling, you will notice the high volume of these movements.

The reason is simple. Whether the market is strongly rising or falling, traders will use these opportunities to invest or make up for losses.

However, the downtrend seen in low volume indicates a potential bear trap. This may indicate that a small number of investors (or institutions) have sold and the price has fallen.

2. Fibonacci Retracements

The Fibonacci retracement level is a horizontal line indicating where the price is expected to meet a support or resistance level.

If the price of a stock (or the price of a coin in the cryptocurrency market) is falling but does not break the Fibonacci line, then at least we can assume that the price decline is suspicious and may not continue.

3. RSI Index (Relative Strength Index)

RSI, or Relative Strength Index indicator, is a momentum oscillator that tracks the speed and change of price movements. An RSI of less than 25 usually indicates an oversold condition ready for an upward move, and an RSI > 75 indicates an overbought condition ready for a downward move.

A relative strength index indicator, which can be used as a tool to avoid falling into a bear trap, can help predict price reversals.

The red trend line at the bottom of the example shows the two oscillators, MACD and RSI indicators. Both show a noticeable uptrend before the price drop.

Bear Trap Chart and Pattern Example

It can be a bit more difficult to spot bear traps in crypto chart patterns than in the stock market. This is because there is no central authority to disclose transaction information. So, you have to follow the market closely to know where the bear traps are.

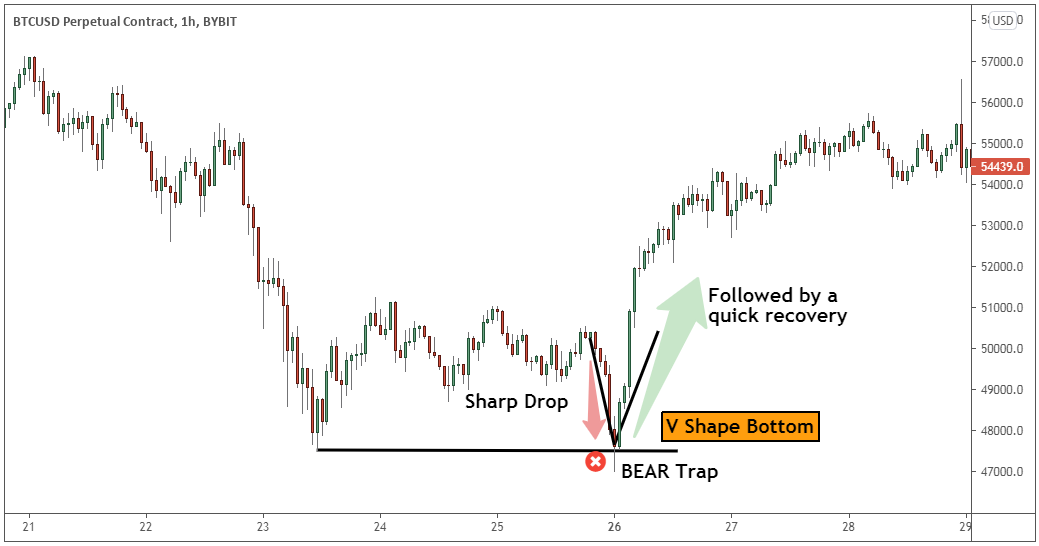

Check out the Bitcoin price chart below. You can clearly see the bear trap at the end. Mark the border with a downward-pointing line and then flip it upwards.

The number of trades represents a TD sequential indicator (designed by Thomas DeMark, also known as DeMarker or DeMark), also known as a top-and-bottom signal. The number of trades also indicates that multiple bear traps have been initiated.

Even in early 2021, the Bitcoin price continued to rise steadily. Then, in just 32 hours, the price of Bitcoin plummeted by $11,000. As you can see from the chart, this trend has quickly reversed. From late February to early March, the price of Bitcoin rose again, reaching nearly $10,000 in just a few days. The bear trap was set several times before hitting an all-time high of $63,558 in mid-April. If you were caught in a bear trap for fear of a market correction, you may have sold Bitcoin (BTC) to prevent losses. And the value of the sold coin would have tripled in three months.

Whales steer away from the weak hands (when they lack the confidence to stick with an investment or trading plan or lack the funds to do it) and prepare a foothold for the next bullish run. I’ve been using this bear trap. Market prices do not move in a straight line, but there are natural declines and flows that create price movement. In an uptrend, retracements tend to be rapid and can be mistaken for a reversal, making it difficult to identify.

A bear trap can happen at any time. Even during the day. This trend can be seen as a short squeeze, where there may initially be a price plunge resulting from potential selling pressure. This could be followed by a trend reversal. A bear trap is the opposite of a bull trap, which occurs when a seemingly bullish trend resumes its previous downtrend.

Why Bear Trap ends in Rally?

Bare traps often end in rallies due to short squeezes, which is likely because institutions are buying on a larger scale. Short traders choose to take advantage of a bearish market to take profit, and buyers are also stepping in.

The situation worsens as more investors realize that this uptrend is not just a short-term price rise. As more sellers flock in, the rally gains momentum.

How to trade on Bear Trap

Bare traps are a common pitfall in the cryptocurrency market. You should consider your risk before trading, especially before taking a short position. You can spot a bear trap and try to trade with a broader trend, taking profit before a reversal. Timing is key.

Another strategy is to get out of the bear trap as soon as you spot it. One way to do this is to place a Stop Order as soon as you see an upward reversal. When trading cryptocurrencies, you need to be agile in order not to be at a disadvantage.

Price Action

Technical traders can spot and avoid bear traps in real-time by reading the price action. It is difficult to guarantee that a bear trap will be avoided by the usual technical indicators. However, the price action is a great tool you can use to identify these patterns.

Most of the time, a full bear trap is established when there is a sudden and sharp price movement against an uptrend. This price action is easy to understand.

A sharp drop in price frightens traders, creating a trap. Typically, during this phase, price action deepens below key lines such as support, large rounds, moving averages, and other technical indicators.

However, these traps often lead to sharp rallies.

Studying the price action reveals that a complete bear trap occurs in two stages.

- There is a sudden and sharp price drop.

- A sharp decline in prices leaves a “V” bottom and is often followed by a sharp recovery.

The risk of a bear trap is to sell too late and buy back at a higher price because of the short-lived rallies that are likely to occur after a decline. If you don’t hedge your bear trap risk, you’ll have to cover the short and take the loss when the price goes up.

For example, you see the market go down and take a short position at $50. When the price goes down to $40, you can cover the short and make $10, but when you try to buy the short again, if the market goes up to $60 and goes up, you will lose $20.

How to avoid a bear trap?

First, try to spot bear traps using the volume or technical indicators described above. The simplest way to avoid a bear trap, which can be very painful, is to avoid shorting. This can lead to big losses if the price goes higher.

If you are trading short, understand the risk and place a stop-loss order. Based on your tolerance, you determine how much portfolio risk you can afford and size your positions accordingly.

Bare traps are more common in illiquid markets where there are not many traders. Avoiding illiquid markets is one way to avoid bear traps.

In general, managing risk is paramount in any trade management. Even seasoned investors have a hard time winning every time. Don’t risk more than you’re prepared to lose, and be systematic about reducing your losses when you’re wrong.

Conclusion

By nature, trading involves risk. Especially in cryptocurrency. You might one day become the prey of the Bear Trap. The trick is to learn from experience, minimize losses, and then get back on track. You may be swept away in a bear hunt, but be quick to avoid getting trapped.