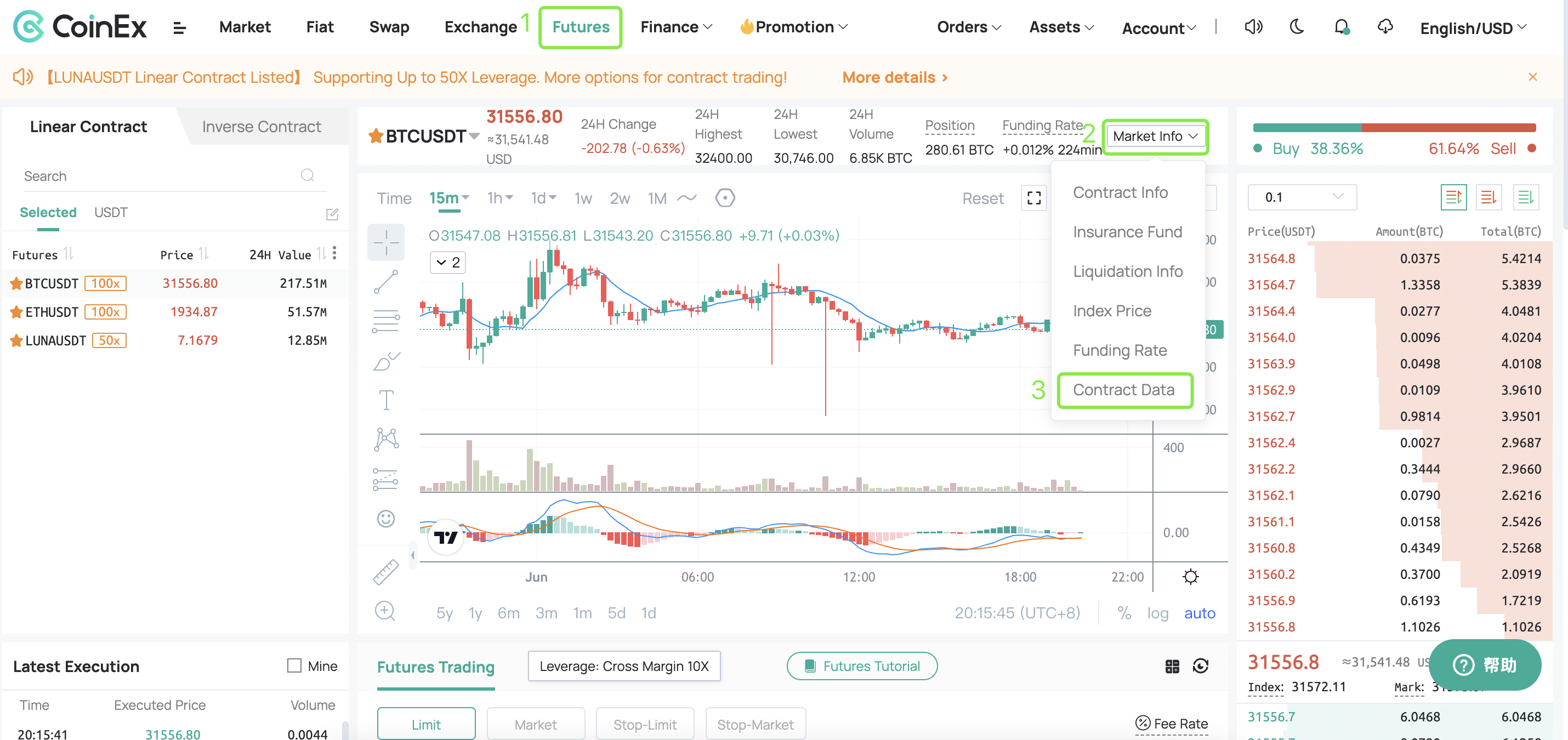

How to view contract data on CoinEX?

Log in to the official website of CoinEx (https://www.coinex.com), click [Contract] – [Market Information] – [Contract Data] on the navigation bar.

Go to CoinEx’s Official Website

1. Open Interest and Trading Volume

Holdings: the number of positions held by all users at the corresponding time node.

Transaction volume: Displays the total transaction volume of the contract per unit time.

Looking at the position and transaction volume together, CoinEX can perceive the amount of liquidation and liquidation in the market.

If the trading volume rises at the same time and the open interest decreases, it means that a large number of orders are closed or liquidated;

2. Taker Buy/Sell Volume

Active buying: Refers to the trading volume of Taker buying orders, that is, the amount of capital inflow.

Active Selling: Refers to the trading volume of Taker’s order selling, that is, the amount of capital outflow.

A large volume of active buying indicates that the bullish sentiment in the market is high; a large volume of active selling indicates that the market is clearly bearish and a large number of users are actively shorting.

Go to CoinEx’s Official Website

3. Long/Short Ratio (Account)

Ratio of long and short positions: refers to the ratio of the number of people holding long positions to the number of short positions of the contract at the corresponding time node.

Through this data, we can see the tendency of retail investors and large investors.

In the contract market, the total position value of the long side and the short side is always equal.

If the long-short ratio is 150%, that is, the number of people who open long orders is 1.5 times the number of people who open short orders, then the number of short orders is small, and the positions are heavy, indicating that large positions are mainly held; the number of long orders is large and the positions are small, and retail investors are mainly holding positions.

4. Top Trader Long/Short Ratio (Account)

Long-to-short ratio of large trades: refers to the ratio of the number of accounts with long positions to the number of accounts with short positions among large trades.

Contract account refers to the top 20% of the users in the number of positions, one account is recorded once, and the specific position is not calculated.

In contract trading, the trading habits of large investors and their sensitivity to trends are better than those of retail investors, and the opening of positions by top users has certain reference value for retail investors.

However, it should be noted that some large households and institutions will regard the contract as a hedging tool and use the contract to hedge the spot.

We should also add our own thinking while making reference.

Go to CoinEx’s Official Website

Please check CoinEx official website or contact the customer support with regard to the latest information and more accurate details.

CoinEx official website is here.

Please click "Introduction of CoinEx", if you want to know the details and the company information of CoinEx.

Comment by cryptoloversofxm

February 19, 2025

I just saw that XMTrading now supports cryptocurrency deposits and withdrawals. No fees, instant transactions, and up to $30K per month. Each deposit gets a unique wallet addres...