What is Dai (stablecoin) and how does it work? Table of Contents

What is Dai (DAI) and How Does It Work?

The recent cryptocurrency market, led by Bitcoin, is growing rapidly. Multinational financial companies started investing huge amounts of money in Bitcoin, which can be seen as a movement that occurred before cryptocurrency was introduced in earnest.

Some individuals, characterized by greater volatility, particularly for day traders (traders danta) cryptocurrency is positive and will come in an attractive manner. However, for others, the high volatility of cryptocurrencies is not very welcome. Volatility is often used as a basis to support the claims of those who criticize cryptocurrencies as unstable assets.

Using stablecoins is a solution often used by traders to minimize the risk of extreme price fluctuations. One of the most popular stablecoins right now is the Dai (DAI) token. This guide will help you understand what the Dai (DAI) stablecoin is, how it works, who made it, and where to find it.

What is a stablecoin?

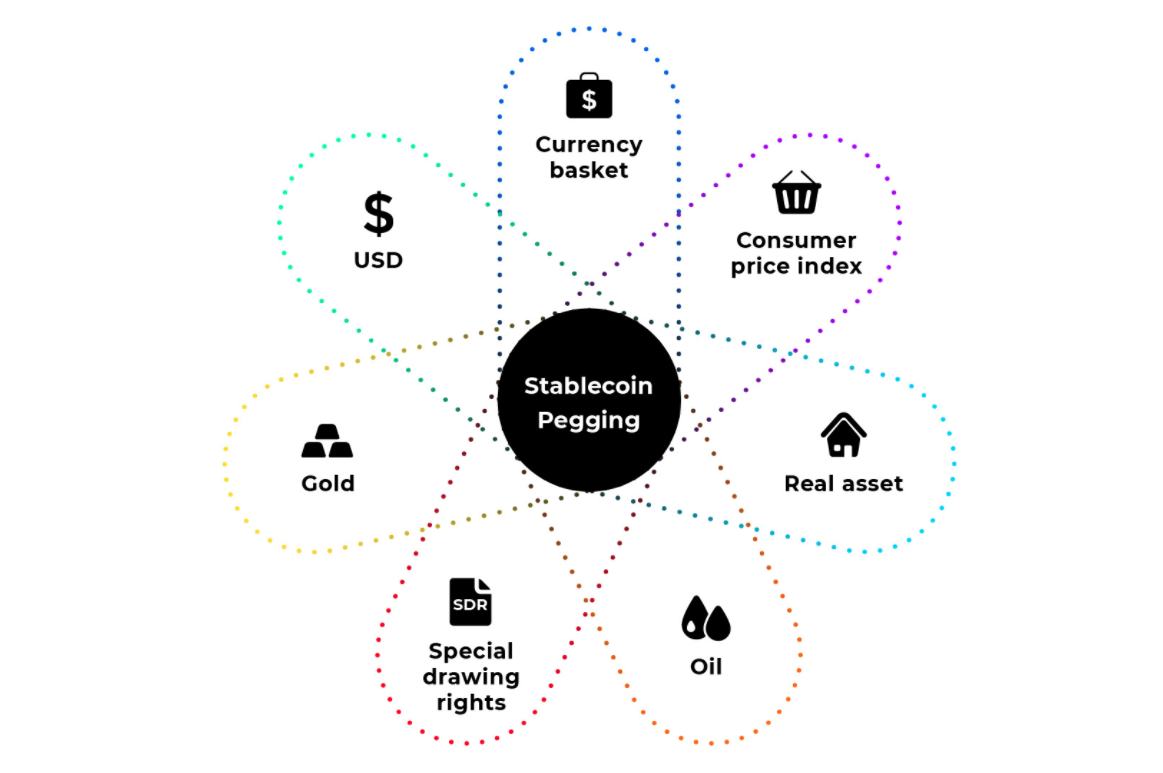

A stablecoin is a form of cryptocurrency that minimizes volatility. For example, stablecoins may be pegged to other assets such as US dollars or gold.

Bitcoin and Ethereum are the most popular cryptocurrencies in the digital asset space, but volatility can also be high. This price behavior can prevent the asset from becoming mainstream in the financial system or being widely used as a means of payment. For example, if the price of a cryptocurrency continues to fluctuate, businesses will be reluctant to pay salaries in Bitcoin.

Cryptocurrency volatility is a major obstacle to blockchain and predictive market-based lending. Volatility can also be a stumbling block for other long-term smart contracts that require stability. And obviously, there are users who want to store money on assets, using them as a store of value.

People have been coming up with ideas for stable-priced cryptocurrencies for a while. However, the main challenge was price stability. Therefore, many consider the creation of stablecoins to be the best achievement in the cryptocurrency space.

The goal of stablecoins is to minimize volatility by maintaining stability. So, how do stablecoins achieve this? Stablecoins are centrally managed by pegging external assets, and asset stability is maintained by a central authority.

For example, fiat currency values can fluctuate rapidly, but central authorities control supply and demand to stabilize prices. Since cryptocurrencies are not controlled by anyone, this is impossible, and thus price fluctuations are easy to occur.

There are different types of stablecoins.

- Fiat-Based Stablecoins

- Stablecoins based on currencies such as USD, EUR, and GBP. Fiat-based stablecoins are fiat and convertible (1:1 ratio). Thus, one stablecoin is equivalent to a unit of that currency.

- Commodity-based stablecoins

- Stablecoins based on commodities such as gold. One unit of pegged product (such as 1 ounce of gold) is equal to the value of each coin.

- Cryptocurrency-based stablecoins

- Stablecoins based on other cryptocurrencies. To reduce the volatility risk of cryptocurrencies, cryptocurrency-based stablecoins are usually over-collateralized. This means you need a 1:2 ratio instead of a 1:1 ratio. It is usually associated with reputable cryptocurrencies such as Bitcoin or Ethereum. Cryptocurrency-backed stablecoins are decentralized, and the most popular of these types of stablecoins is the DAI stablecoin. Dai is pegged to the dollar (USD) and is built on top of the Ethereum network.

Unsecured stablecoins – These types of stablecoins require no collateral. It relies on smart contracts to maintain stability of value. Stablecoin supply will vary depending on market demand.

Learn more about Stablecoins with Bybit

What is DAI?

There are many types of stablecoins, but Dai (DAI) is a particularly unique stablecoin. Dai (DAI) is an Ethereum-based stablecoin (ERC-20 token) that aims to maintain the value of one dollar (USD). This is done through the smart contract automation system of the Ethereum blockchain. The DAI stablecoin price is indirectly pegged to the US dollar, collateralized by a mix of other cryptocurrencies.

Since cryptocurrencies are highly volatile, Dai (DAI) can be used as a risk hedge against volatility in situations where traders believe that the price of cryptocurrencies can plummet. Dai tokens are soft-pegged to the US dollar, maintaining the value of one dollar. Dai currently has a market cap of $2.8 million and is expected to grow.

Find out more about DAI on Bybit’s Official Website

Who made DAI?

The DAI stablecoin was created by MakerDAO, a decentralized autonomous company. It operates in a decentralized way using smart contracts. MakerDAO was founded in 2014 by Danish entrepreneur Loon Christensen.

MakerDAO is governed by a democratic system in which MKR holders vote on MakerDAO, Maker Protocol, and Dai (DAI) changes. Voting power is proportional to the number of Maker Tokens they own.

‘Dai Token’ and ‘Dai Token Smart Contract’ were officially launched on the Ethereum blockchain on December 18, 2017 . Venture capital firm Andreessen Horowitz invested $15 million in MakerDAO in September 2018, holding 6% of all MKR tokens. Despite the sharp drop in price of Ethereum (ETH) that year, Dai (DAI) successfully maintained its value of $1.

There was a split within MakerDAO in 2019. This is because founder Christensen wanted to create a more favorable environment for assets other than cryptocurrency to be collateral for DAI. After discussions , the Chief Technology Officer (CTO) left MakerDAO.

11 Best Altcoins to invest in 2021

How does Dai (DAI) work?

When a user borrows Dai (DAI) as collateral, Dai is created, and when the loan is paid off, Dai disappears. A new Dai (DAI) is created by depositing Ether or other cryptocurrencies as collateral. When the borrowed Dai is paid off, the collateral deposited is recovered.

As mentioned above, Dai is pegged to the US Dollar. Dai (DAI) uses a Target Rate Feedback Mechanism (TRFM) to maintain its value. Therefore, the goal pursued by Dai (DAI) is to keep the value of Dai at $1. If the target price is below $1, the TRFM will rise to push the price up again. If the price rises again, Dai cryptocurrency holders will make a profit, and demand will increase. When demand increases, users borrow and buy Dai (DAI) from the market through a Collateralized Debt Position (CDP), which reduces supply. Thus, the DAI price will rise again to the target price.

There are also other stablecoins such as Tether (USDT), True USD (TUSD), and Paxos Standard (PAX). All these stablecoins have one thing in common: they are pegged to safe-haven assets (such as US dollars). Dai (DAI) differs from these stablecoins in several ways. Decentralization is the main advantage of Dai. Dai is managed by a decentralized autonomous enterprise through a software protocol. The Dai stablecoin is built on the Ethereum blockchain, allowing anyone to create Dai (DAI) without permission.

All activities on the blockchain are publicly recorded by self-executing smart contracts based on Ethereum. Therefore, the DAI system is transparent and less prone to deterioration.

In addition, within DAI, there is also a democratic governance system in which all changes and decisions are made by voting by regular participants.

What is DAI used for?

Since the Dai (DAI) stablecoin maintains a stable value, it is mainly used as a hedge against volatility. What characterizes these assets is their ability to remain stable even in highly volatile markets. Dai (DAI) represents a stablecoin in that it maintains the price of one dollar under any circumstances.

In addition, Dai (DAI) can be exchanged for real money with relative ease or traded for other commodities. Dai is one of the most popular crypto assets in Decentralized Finance (DeFi). Loans with Dai Deposit also have a number of benefits. In countries like the US, UK, Netherlands, Australia, France, and Spain, people can get interest rates on their Dai deposits of 2% per year by lending through Coinbase.

Dai can also be used for cross-border payments. International money transfers using traditional methods such as Western Union can be very expensive and time-consuming. With the Maker Protocol based on blockchain technology, you can transfer Dai (DAI) in seconds with a fraction of the price paid by conventional methods.

Also, integrating dollars into fintech applications has always been a huge challenge for developers. Dai tokens make this process much easier as developers can get their platform users to trade using Dai (DAI). This is possible because Dai (DAI) exists on the Ethereum blockchain and can be accessed by anyone.

Go to Bybit’s Official Website

How to get Dai (DAI) tokens?

In the early days of cryptocurrency, there were not many cryptocurrency exchanges, so it was not easy to buy Dai. Although the amount of cryptocurrencies currently has increased dramatically, buying Dai is still not easy.

The first place that comes to mind when buying Dai tokens is the MakerDAO platform. However, you can also purchase cryptocurrency on other cryptocurrency exchanges. Exchanges that handle Dai (DAI) are as follows:

- Coinbase Pro

- Huobi Global

- KuCoin

- Kraken

- Binance

- OKEx

- HitBTC

- Gemini

You can also get Dai (DAI) via the Decentralized Finance (DeFi) Token Swap Protocol, such as:

- Uniswap

- Compound

Open Bybit’s Account to invest in DAI

How to store Dai (DAI)?

DAI is an ERC-20 token, such as Atomic, MyEtherWallet, Metamask, Exodus, Jaxx, Mist, and Trust. You can store it in an ERC-20 compatible wallet.

Dai tokens can also be stored in hardware wallets such as Ledger or Trezor. Hardware wallets are safer to store tokens because they are not connected to the internet and cannot be hacked.

Which is the Best Cryptocurrency to buy in 2021?

What is the future of DAI Token?

MakerDAO has made great strides in making Dai a competitive stablecoin. Since Dai was launched on the Ethereum blockchain back in 2017, the token has been quite successful.

Since MakerDAO’s purpose is to make Dai a ‘fair currency’, we even created the Dai logo so that Dai can be recognized at a glance as a currency. It is similar to the logo of fiat currencies such as euros and dollars.

The Dai (DAI) symbol is shown alongside the world-famous currency.

In order to achieve their goal of bringing Dai to millions of people in the future, Makers should focus on token branding and communicate the benefits that will come to those who choose to use the token.

As Dai (DAI) differs from other stablecoins in many ways, this does not seem impossible. Overall, Dai’s future looks very promising as cryptocurrencies are expected to become an important part of the financial world.

3 Best Cryptocurrency pairs to trade

Conclusion

There are many stablecoins in the cryptocurrency world. However, Dai is very unique in that it is an ERC-20 token based on the Ethereum blockchain. What makes Dai even more unique is its democratic governance system.

Dai (DAI) holds the value of a dollar in all circumstances, allowing Dai to be used as a safeguard against inflation. While this may be the goal of all stablecoins, what makes Dai stablecoin special is that Dai is processed through the Ethereum blockchain’s smart contract automation system.

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.

Comment by cryptoloversofxm

February 19, 2025

I just saw that XMTrading now supports cryptocurrency deposits and withdrawals. No fees, instant transactions, and up to $30K per month. Each deposit gets a unique wallet addres...