What is the Futures Insurance Fund?

When the contract order is forced to liquidate, the liquidation process will be triggered, and the forced liquidation process will be triggered, and the forced liquidation Dutch auction strategy will be used to match the transaction in the market.

During the transaction process, the balance generated will be deposited into the Futures insurance fund.

Dutch Auction: The auctioneer starts with a high asking price at the time of sale and then bids lower until some participants accept the price or a predetermined reserve price is reached.

The first bidder to respond wins and pays the bid price at that time.

Go to CoinEx’s Official Website

What is the purpose of Futures insurance fund?

CoinEx uses Futures insurance funds to prevent investors’ positions from being automatically reduced.

When you trigger the forced liquidation process, use the forced liquidation Dutch auction strategy to match the transaction in the market.

During the transaction process, the Futures insurance fund will be used to advance the liquidation part.

How many pricing methods are there for Futures insurance funds?

CoinEx Futures Insurance Fund supports three pricing methods: USDT, BTC, and ETH.

How to check the Futures insurance fund details?

Method 1: Click here to directly view the Futures insurance fund details.

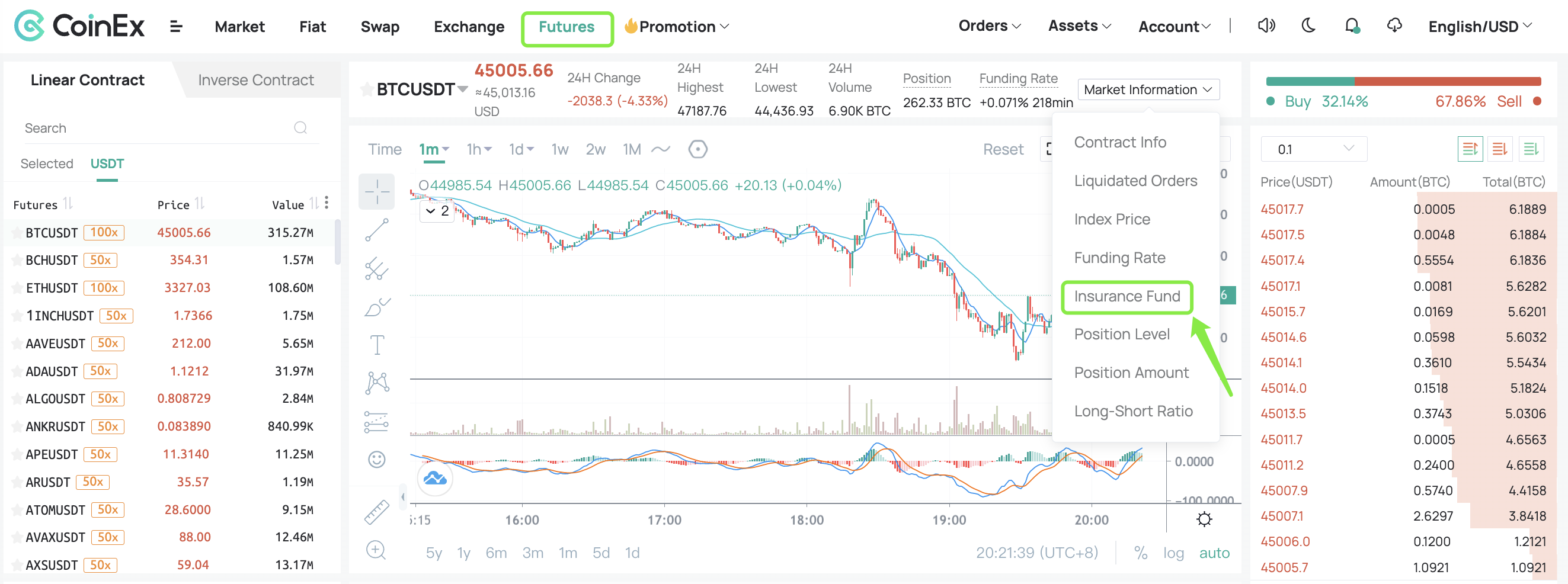

Method 2: Click [Futures] on the navigation bar, and find [Insurance Fund] in the [Market Information] of the Futures page to view the details of the Futures insurance fund.

Go to CoinEx’s Official Website

Please check CoinEx official website or contact the customer support with regard to the latest information and more accurate details.

CoinEx official website is here.

Please click "Introduction of CoinEx", if you want to know the details and the company information of CoinEx.