What are Isolated Margin and Cross Margin of Bybit? Table of Contents

- What is the relationship between leverage and margin?

- Bybit Adopts 2 Margin Systems

- What is the Isolated Margin mode?

- What is the Cross Margin mode?

- Is cross margin and isolated margin interchangable when having an open position?

- Can trader change Leverage under Cross Margin mode?

- How is the leverage calculated under the cross margin mode?

- How does leverage affect the unrealized P&L?

- How does leverage used affect ROI?

What is the relationship between leverage and margin?

All transactions or investments are divided into two parts, profit and loss and risk management, and leverage is the main tool to weigh these two parts.

In Bybit, the main function of leverage is to adjust the initial margin rate used.

Margin is equivalent to a kind of collateral, and it also represents the risk that traders are willing to take on this investment.

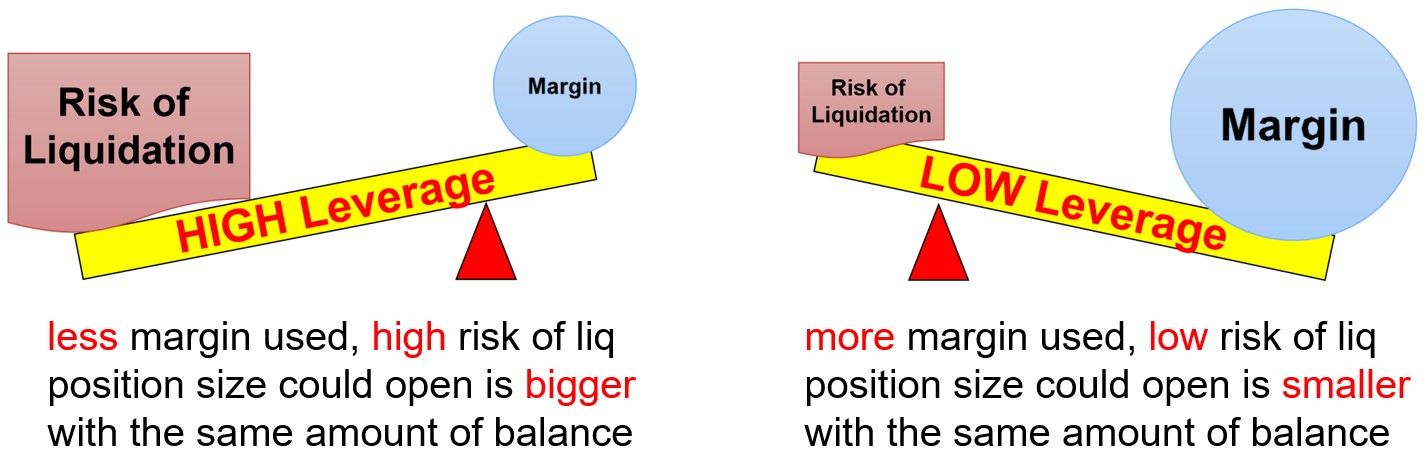

The greater the leverage, the smaller the margin used.

Under the same balance, traders can trade more contracts and amplify their profits.

But at the same time, the liquidation price of the position will be closer to the opening price, that is, there is not much room for loss in the position, and it will be easier to liquidate.

The smaller the leverage, the greater the margin used.

With the same balance, the number of contracts that a trader can trade is relatively limited, which may not allow the trader to magnify the gains.

However, the liquidation price of the position will be further away from the opening price, that is, the position has a larger loss-making space and will not be liquidated easily.

Bybit Adopts 2 Margin Systems

Bybit has two types of margin modes, namely, the margin-by-margin mode and the full-margin mode.

What is the Isolated Margin mode?

The margin-by-money mode means that the margin of the position is separated from the trader’s account balance.

In this margin mode, traders can freely decide the leverage multiples used.

If the position is forced to close, the trader’s maximum loss is the position margin.

Example: A trader uses 1x leverage to open a position of 1500 BTCUSD at a price of 10,000 US dollars.

The initial margin for opening a position is 0.15 BTC.

Later, he raised the leverage to 3 times, and the required initial margin (collateral) was also readjusted from 0.15 BTC to only 0.05 BTC.

In the event of a liquidation, he will only lose 0.05 BTC of the initial deposit (excluding fees).

This allows traders to effectively control risks.

What is the Cross Margin mode?

The wide margin mode is Bybit’s default margin mode.

The whole position margin mode refers to the use of all available balances in the corresponding currency as the position margin to maintain the position and avoid liquidation.

In this margin mode, when the net asset value is insufficient to meet the maintenance margin requirements, the forced liquidation will be triggered.

If the position is forced to close, the trader will lose all assets in the corresponding currency.

Example: A trader opens a position of BTCUSDT.

When the BTCUSDT position is liquidated, he will lose all USDT balance, but the BTC balance will not be affected.

Is cross margin and isolated margin interchangable when having an open position?

Traders can change the margin mode at any time in the order area.

After the change, the mode will apply to open positions and any active orders and conditional orders.

Changing the amount of margin will affect and change the liquidation price of the position.

As long as the account has enough margin and changing the margin will not trigger a liquidation immediately, users can switch between the position-by-money mode and the full-money mode at any time.

Can trader change Leverage under Cross Margin mode?

Can trader change Leverage under Cross Margin mode and how to calculate Initial Margin and Maintenance Margin under Cross Margin mode?

Under the cross margin, traders cannot adjust the leverage by themselves.

The system will use the maximum leverage allowed under the current risk limit to calculate the initial margin by default.

For example, the BTCUSD perpetual contract allows the use of maximum leverage of 100x under the minimum risk limit.

The initial margin for trading this contract is equal to its contract value / 100, which means that the system will use 100x leverage by default when calculating the maximum number of contracts that can be opened in your account.

There is no difference between the method of calculating the maintenance margin in the whole position mode and the case-by-side mode. Maintenance margin = contract value * maintenance margin rate.

How is the leverage calculated under the cross margin mode?

The leverage in the full position mode is based on effective leverage.

Different from the adjustable leverage in the position-by-position mode, the effective leverage in the full position mode is calculated by the system automatically based on the user’s current position value and the actual maximum losable amount of the position (available balance + position margin).

Full margin position with outstanding profit:

Effective leverage = contract value / (position margin + available balance + outstanding profit)

Full margin positions with outstanding losses:

Effective leverage = contract value / (position margin + available balance)

The higher the effective leverage, the higher the liquidation risk and the liquidation price will be closer to the marked price.

How does leverage affect the unrealized P&L?

In fact, the use of leverage will not affect the outstanding profit or loss.

When the leverage of the position is adjusted, the amount of the initial margin will change but the number of positions (QTY) will remain unchanged.

The main function of using leverage is to establish the initial margin rate required to open a position.

When the trader changes the leverage, the outstanding profit and loss will not increase accordingly.

However, as mentioned above, the advantage of using high leverage is that traders can open a larger number of contracts under the same margin amount.

Therefore, the outstanding profit and loss will increase due to the increase in the number of contracts, rather than the increase in leverage.

How does leverage used affect ROI?

Although the open profit and loss will not be affected after the leverage is changed, the open profit and loss percentage (ROI%) will change accordingly.

In warehouse by warehouse mode:

Percentage of outstanding profit and loss = outstanding profit and loss / (initial margin + closing fee + additional margin call for the position) x 100%

In full warehouse mode:

Percentage of outstanding profit and loss = outstanding profit and loss / (initial margin + liquidation fee) x 100%

An increase in leverage will result in a decrease in the required initial margin, and vice versa.

Therefore, under the same outstanding profit and loss, the percentage of outstanding profit and loss has increased.

This is because the initial margin has decreased rather than the actual increase in outstanding profits and losses.

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.

Comment by cryptoloversofxm

February 19, 2025

I just saw that XMTrading now supports cryptocurrency deposits and withdrawals. No fees, instant transactions, and up to $30K per month. Each deposit gets a unique wallet addres...