In May of last year, Galaxy Digital announced the industry’s first acquisition of up to $1 billion, before the major digital asset soared to a new all-time high, and now, just as the cryptocurrency market is beginning to recover from a series of implosions, the deal came abruptly. On Monday, Galaxy Digital announced that it had terminated its $1.2 billion acquisition agreement for cryptocurrency custodian BitGo after it failed to provide audited financial statements for 2021 within a specified deadline. BitGo disputes the disclosed deadlines and intends to pursue legal action seeking $100 million or more from Galaxy Digital to cover losses from its exit from the acquisition.

“Cryptocurrency markets turned down this week after a promising start. Even traditional markets are showing signs of entering buy exhaustion territory after U.S. manufacturing fell to a five-year lo.The major digital assets followed, and it’s no surprise that this bear market rally may have come to an abrupt end. After several unsuccessful attempts to break the $25,000 mark, BTC turned down and tested previous support levels. As of writing , the largest cryptocurrency by market cap is sitting just above the $24,000 mark and below the 100-hour moving average after losing 3.5% in market cap over the past 24 hours. Looking up, BTC is facing immediate key resistance near $24,500. If BTC is unable to hold above this level and could see further downside and test support in the $23,500-$23,700 range.

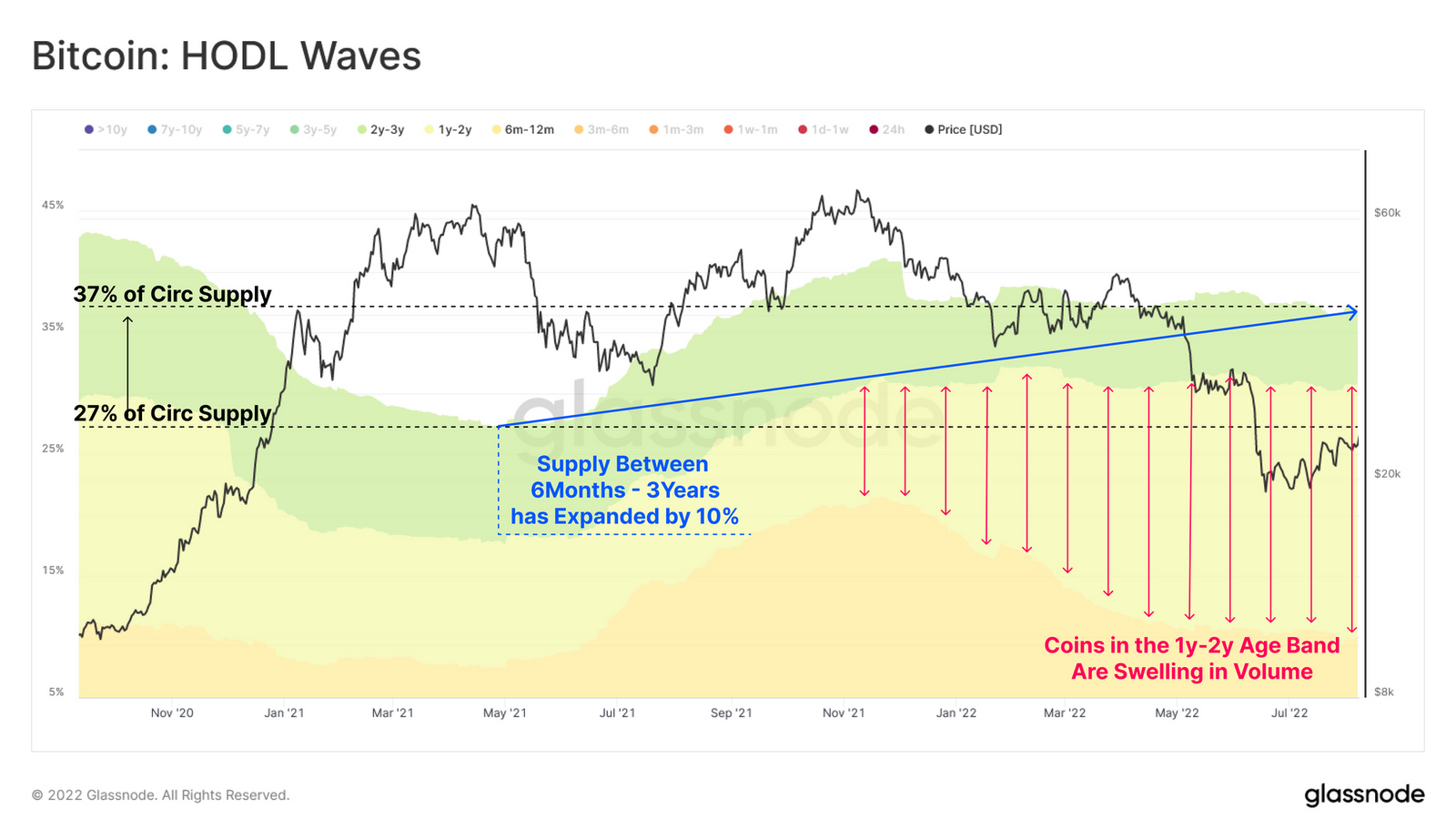

On-chain indicators release constructive signals, and for investors entering the market in 2020-2022, this bear market may be the first bear market cycle they experience. This group of holders showed great faith in the baptism of the bear market, they refused to sell at the low point, and their Bitcoin holdings are entering the next coin age, which is from 1-2 years old Bitcoin The rapid growth in the number of coins can be seen.

Similar to BTC, ETH is gradually making its way towards the $1,900 mark after falling 5% over the same period. Despite the recent dip, the second-largest cryptocurrency by market capitalization remains steady above key support levels amid growing enthusiasm for The Merge’s upgrade. Major non-mainstream coins turned from rising to falling, and several L1 tokens led the downward correction with a 5% decline over the same period. “

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...