American video game retailer GameStop has finally launched the public beta of its highly anticipated NFT platform.

The company first proposed the idea of an NFT platform in 2021 when the development of NFT reached its peak, but the launch of the platform today coincides with the crypto winter.

Currently, there are more than 200 NFT collectibles and about 53,000 individual NFTs listed on the NFT platform.

In addition to its growth strategy, GameStop has a bigger plan for platform development.

According to previous news, GameStop intends to “expand functions” to enter the field of Web3 games, aiming to become a major player in the field of NFT games.

For now, the prospects for a quick recovery in the stock market and cryptocurrency markets are dimming, with the former in particular posting its worst performance in at least 30 years.

In addition, cryptocurrency markets fell further in early Asian trading on Tuesday as investors awaited the latest inflation data and more signals to see if the economy was heading for a recession. BTC’s pullback wiped out its gains of the past week, which sent a shock to the main cryptocurrency market. At the time of writing, the largest cryptocurrency by market cap has lost 2.8% of its value in the past 24 hours, falling below the psychological $20,000 mark, and is consolidating below that level. If BTC fails to break out of the immediate resistance zone near the $2.01-20.5k area, it could revisit the $1.95k support.

Similar to BTC, ETH failed to hold $1,100 after falling 5% over the same period. Just last week, though, funds focused on ETH investments saw inflows of around $7.6 million, breaking an 11-week streak of outflows, a well-timed influx that suggests a slightly better sentiment. Most major non-mainstream coins are in deep losses, with UNI leading the decline with an 11% drop over the same period.

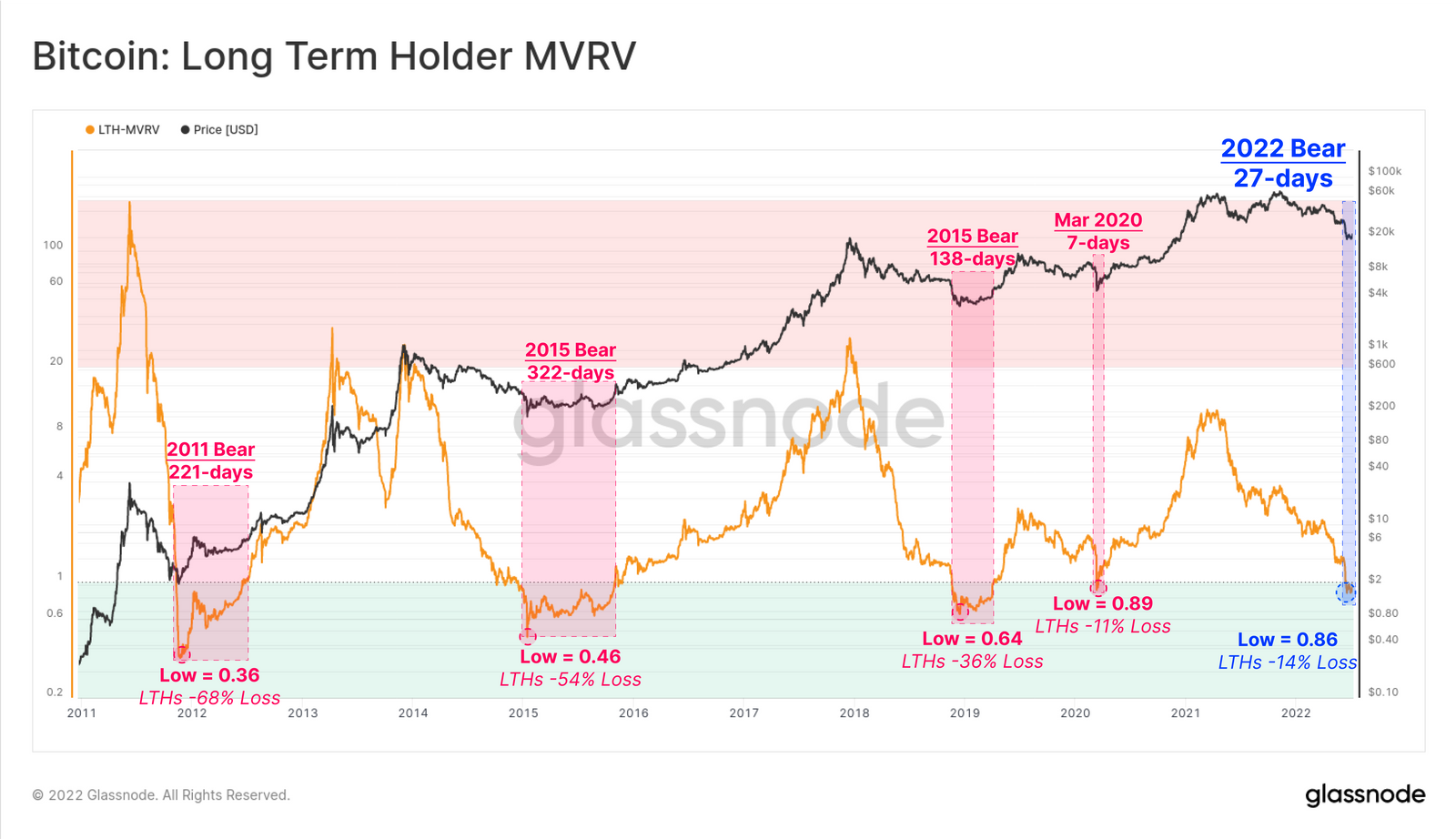

Meanwhile, long-term BTC holders were further under pressure as spot prices fell below the average cost basis. Overall, the group has a combined 14% of outstanding losses, and its market-to-real value (MVRV) ratio has also plunged into oversold territory, reaching levels seen during the 2020 liquidity crunch.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...