BTC Narrative to Unfold in Next Few Days. Google Forms Web3 Team.

The main cryptocurrency market had a very rough weekend. A massive sell-off in U.S. stocks on Sunday followed BTC’s fall below $35,000 for the first time since January. At the time of writing, the largest cryptocurrency by market capitalization continues to slide, currently trading below $33,500 after a 2.4% drop in the past 24 hours. A key bearish trend line has formed on the hourly chart of BTC with an upper limit near $34,200. BTC’s next major support is in the $32,500 area, and if this support falls amid the intense selling pressure and increasingly bearish sentiment, BTC price could fall further.

Historically, the on-chain realization price of giant whales has been a strong support level for BTC in times of crisis. However, these support levels can still fall at times in the face of a deteriorating macro environment. In the case of a bearish cycle, the BTC spot price would fall below the aforementioned support level and reach a long-term bottom. Which direction BTC will take in the end, we will see in the next few days

Similar to BTC, ETH’s market cap is now below $2,500 after losing 3.6% overnight. Most of the major non-mainstream coins are also in deep losses, except for NEAR and TRX, which have made good gains against the trend in the current pessimism prevailing in the main cryptocurrency market.

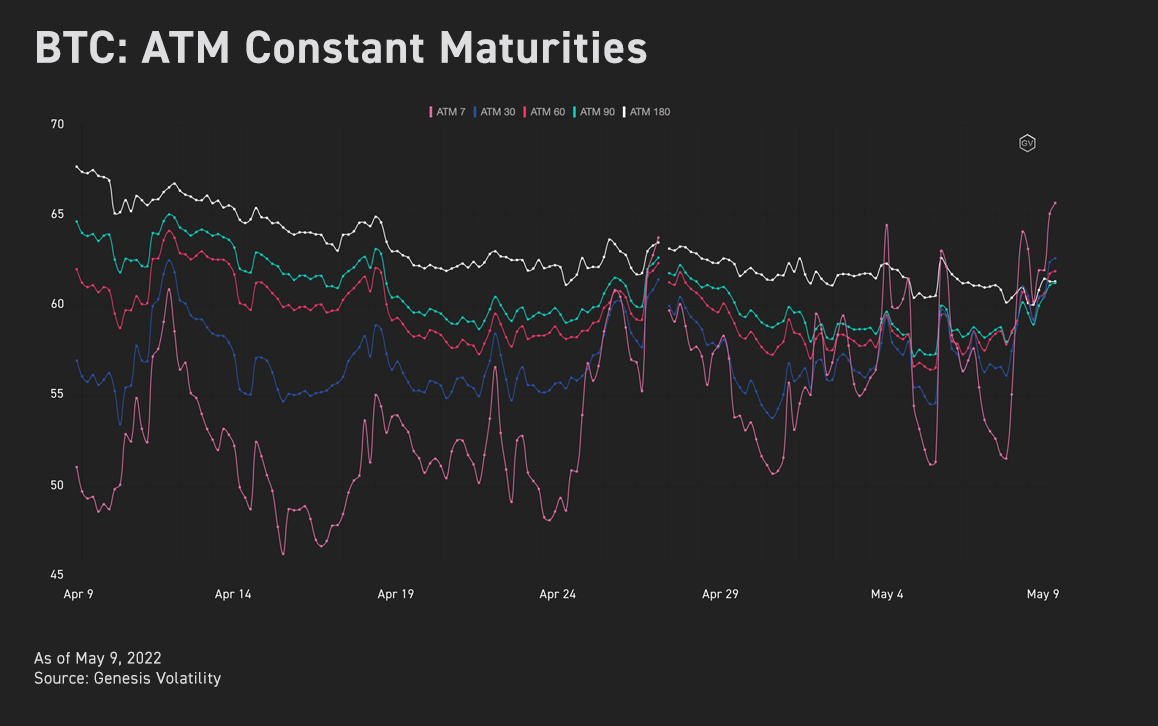

Many leveraged traders seem to be shrugging off the weakness in spot prices and are still going long. Funding rates on major exchanges also trended higher over the weekend, while the BTC futures basis was just above its multi-month lows. In the options market, the volatility of short-term options has risen significantly due to the Federal Reserve’s aggressive interest rate hikes. In fact, the volatility curve for short-term options even exceeds that for far months, suggesting a sharp increase in short-term risk aversion.

Google forms Web3 Team

Three months after Google’s parent company, Alphabet Inc., announced its foray into the web3 space, Google’s cloud computing division has also set up a new team to provide back-end services for developers of web3 applications. The move aims to tap the “huge potential” that web3 and encryption-related technologies have shown in the near future, making Google Cloud Platform the first choice for developers in this field. Going forward, Google will design a system to help make blockchain data more accessible to the masses, while simplifying the process of building and running blockchain nodes.

Invest in Cryptocurrencies on Bybit

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...