Capital Inflows into Crypto Market Remain Strong; Grayscale Pushes for BTC Spot ETF.

Over the weekend, the main cryptocurrency market was struggling to maintain its recovery momentum as investors began to digest the impact of escalating geopolitical tensions and the possibility of a 0.5 percentage point rate hike in May.

The result is that, as of this writing, BTC has failed to hold the psychological $40,000 mark after falling for two days in a row.

The top cryptocurrency by market cap is currently struggling to defend the $39,000 level after losing 1.27% in the past 24 hours.

Several key technical indicators point to a short-term bearish formation forming on the hourly chart, while also suggesting that BTC could fall further once support in the $37,500-$38,800 area is broken.

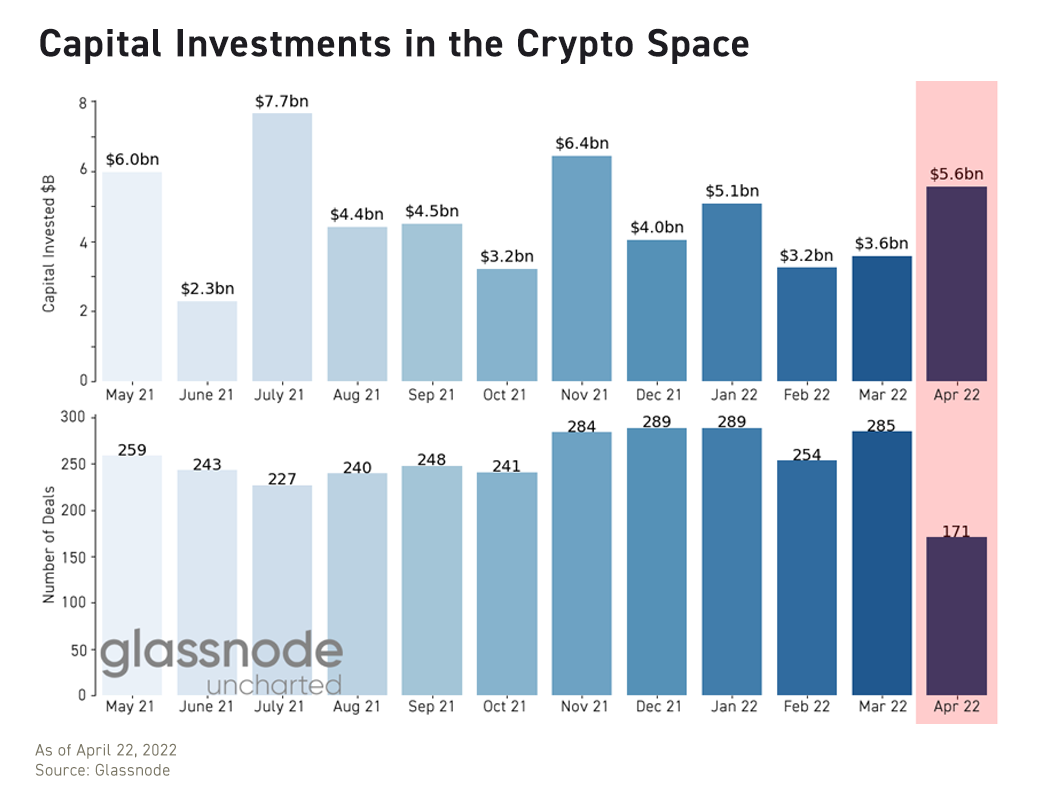

The good news at the macro level shows that capital inflows into the cryptocurrency market remain strong.

Venture capital investment in the crypto space in 2022 is around $17 billion so far, with more than 1,000 deals closed.

The highest median deal this year also set a new record, at $4.5 million.

Similar to BTC, ETH plummeted after falling below $3,000. At the time of writing, ETH has lost 2.7% of its market cap in a day and is currently trading below $2,900.

Most altcoins are also in decline, with NEAR, the top-performing tier coin in March, down 7.6% in 24 hours.

Futures Review

The Fed’s increasingly aggressive stance on curbing inflation is ultimately affecting the main cryptocurrency market.

Previously, the cryptocurrency market has been lagging behind traditional assets in its reaction to the aforementioned monetary policies.

Among them, BTC is most affected by the upcoming rate hike.

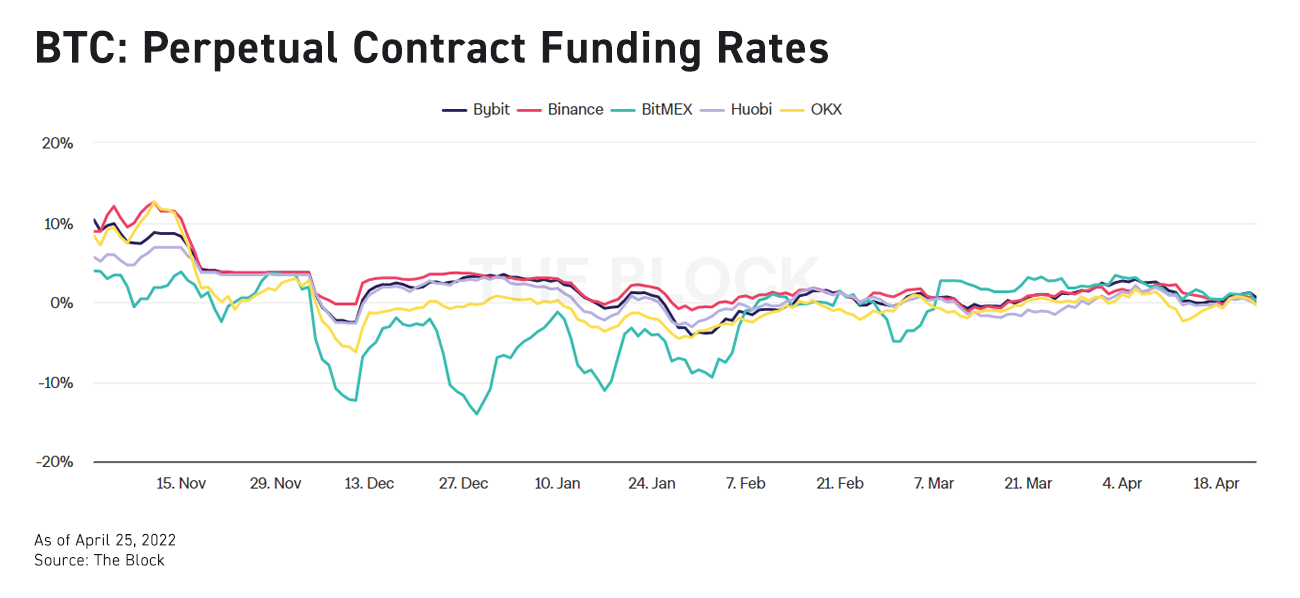

As bitcoin spot prices continued to weaken over the weekend, so did funding rates in the derivatives market.

Meanwhile, in the options market, the overall term structure has moved up from a lower starting point, suggesting that volatility levels in the cryptocurrency market have plenty of room to surge in the short term.

Hot Topic

Asset manager Grayscale is back in action, pushing the U.S. Securities and Exchange Commission (SEC) to approve its $40 billion Bitcoin Trust (GBTC) conversion into an exchange-traded index fund (ETF).

In a letter to the SEC last week, Grayscale’s legal counsel said that now that the SEC recently approved the Teucrium BTC futures fund under Acts 33 and 34, the SEC should also reconsider approving Grayscale’s spot-based ETF.

Grayscale CEO Michael Sonnenshein said he would consider legal action against the SEC if the application is denied.

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...