Completing the KYC with Binance is a required step to start investing in Cryptocurrency markets.

Just like other financial institutions, KYC verification must be completed in order to use the service unimpeded on major cryptocurrency exchanges around the world. Why is KYC verification necessary? How does it benefit cryptocurrency traders? How is it different from anti-money laundering regulations? Does KYC verification run counter to the purpose of decentralizing cryptocurrencies on public chains? We will discuss these issues in this article.

Go to Binance’s Official Website

What is KYC?

KYC is short for Know Your Customer, but it can also stand for Know Your Customer. It refers to a mandatory verification of customer identity, usually performed by financial institutions. It includes information such as an ID card, a utility bill with an address, or a Social Security number that can be used to verify your identity.

Clients are usually required to submit KYC details when opening an account and when changing information . For example, if you change your name a few months after opening your account, you will need to update your KYC information.

If you do not complete the KYC procedure, you may not be able to fully use all the functions of a cryptocurrency exchange. Binance.com , for example, allows users to create accounts, use basic functions, and perform limited transactions without submitting KYC information. To gain full access and increase deposit and withdrawal limits, customers need to complete KYC verification .

What is the general procedure for KYC?

KYC procedures may vary depending on the nature of the business , but generally they achieve similar goals. KYC includes basic functions such as data collection and verification. It also includes customer due diligence and ongoing monitoring.

KYC verification is usually divided into three parts and procedures:

1. Customer Identity Program (CIP)

This is the first and most intuitive KYC procedure. It only involves collecting and verifying customer data. For banks, this stage is usually performed when opening an account. For cryptocurrency exchanges and less strictly regulated financial institutions, this is usually done after registration.

2. Customer Due Diligence (DD)

After verifying identity, the company may decide to conduct background checks on customers. The purpose of a background check is to perform a risk assessment. If a customer has been registered for financial fraud or is under investigation, it will be flagged during background checks.

3. Continuous monitoring

Continuous monitoring ensures that KYC information is up-to-date and enables the system to continuously scrutinize suspicious transactions. For cryptocurrency exchanges, large transactions are flagged if they are sent to countries on the U.S. terrorist watch list. Depending on the investigation, the exchange may temporarily suspend customers’ accounts and report the case to the necessary regulatory and enforcement units.

Go to Binance’s Official Website

Why do most cryptocurrency exchanges mandate KYC?

Know Your Customer (KYC) regulations are mandatory for most cryptocurrency exchanges in order to comply with regulatory rules and laws. In the past, cryptocurrency exchanges rarely required KYC details. As the price and popularity of cryptocurrencies have risen, so have concerns about money laundering and other illegal activities that have brought greater scrutiny.

In 2001 , KYC verification was introduced and relevant regulations were added to the US Patriot Act. But the update was not passed until after the 9/11 terrorist attacks. The purpose of KYC is to curb illegal behavior and flag suspicious behavior as early as possible. Cryptocurrency exchanges will use this data to track transactions to ensure that there is no money laundering or terrorist financing.

Without KYC verification, cryptocurrency exchanges could be held accountable in the event of a user committing a crime and successfully escaping because the exchange did not complete due diligence. Since then, most exchanges have preferred to follow anti-money laundering (AML) norms.

However, KYC and AML are not exactly the same.

What is the difference between KYC and AML?

Know Your Customer (KYC) is part of the umbrella term Anti-Money Laundering (AML). The concept of AML encompasses a number of regulatory procedures aimed at preventing money laundering. Other AML procedures include software filtering, records management, and criminalization. KYC is just AML procedures involving identity verification and perfect due diligence.

KYC , AML , and other procedures implemented by regulators make it more difficult for organized crime and terrorists to hide their illegal activities. They will not be able to disguise illegally obtained funds as legitimate funds. While doing so has the aforementioned benefits, some members of the cryptocurrency community are divided on whether exchanges should enforce KYC compliance. Their argument is that KYC and AML go against the concept of decentralization.

Go to Binance’s Official Website

How does KYC affect decentralization and anonymity?

One of the most attractive features of cryptocurrencies and blockchain technology is decentralization. This means that no authority has ultimate control over the system. Transactions on the blockchain are stored on multiple computers around the world through various peer-to-peer nodes, rather than in a single database. KYC requirements make cryptocurrency exchanges more like traditional financial institutions because it creates centralized authority.

For users who value anonymity through a decentralized blockchain, the loss of anonymity is a high price, especially when they need to send KYC details to centralized cryptocurrency exchanges in this way. Even though cryptocurrency exchanges promise to be careful about their users’ privacy, many people still distrust exchanges and want to maintain anonymity. These concerns are not unfounded either, as many exchanges still do not have robust KYC systems that protect customer information.

There have been cases where hackers obtained KYC information of cryptocurrency users through loopholes in exchange software . Binance is one of the few exchanges that has a secure and dedicated KYC profile collection and management system.

Binance’s Responsibilities and Obligations for KYC

Binance is the world’s largest cryptocurrency exchange by market capitalization. Based on this status, Binance is committed to following KYC norms. KYC not only protects the exchange, it also provides additional security to each user’s account and allows users to use Binance’s services without any hassle.

Go to Binance’s Official Website

Benefits of Verifying on Binance: Enjoy Upgrades

One of the main benefits of KYC verification on Binance is that users can enjoy upgrades, which can be applied to lower fee rates and higher withdrawal limits. Unverified users can only withdraw up to 0.06 BTC per day , while verified users can withdraw up to 100 BTC per day.

KYC is primarily for users who wish to transact using credit and debit cards. For users who wish to perform large-value transactions on a regular basis, completing KYC verification on Binance will also help. Users who have not completed verification may experience problems withdrawing funds from their Binance account , so Binance encourages all users to complete the KYC procedure as soon as possible.

How to KYC on Binance?

Binance ’s KYC verification process is intuitive. The following steps will show you how to verify your Binance account .

1. Go to Binance.com

If you are a new user, you will need to create an account with your email address and password. The account creation process takes less than 5 minutes. If you are already our user, you only need to log in.

2. Click on Identity Verification

Click on the profile image in the upper right corner of your computer screen. This is your user center. After your user profile you will see a row of options. Click Authentication to proceed to step 3 .

3. Click Verify

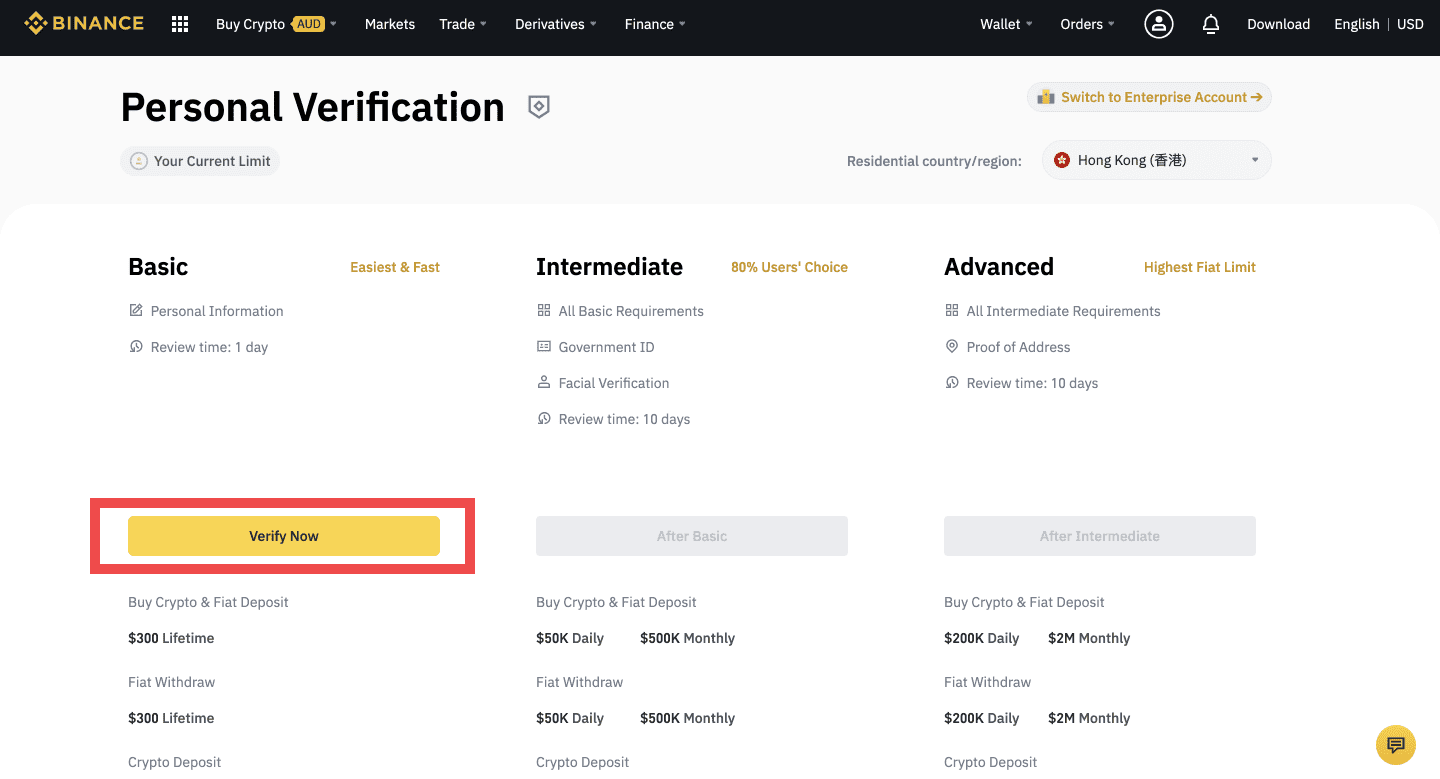

On the next page, you’ll see a prominent yellow button that says Verify. Click to start the verification process. Please note that verification documents will vary depending on your nationality. So, after choosing your nationality, upload your government-issued ID, name, address, photo ID, zip code, and other information.

4. Complete the verification

Verify that all the information you submitted is correct to ensure that your verification will pass. Complete the procedure and continue trading. Alternatively, you can choose Advanced Verification after completing Basic Verification.

Binance has three verification levels: Basic, Intermediate, and Advanced.

Submitting all required information for verification takes no more than 1 hour. After this, you need to wait for the verification to finish processing.

Submit your KYC verification on Binance. If you don’t already have a Binance account, you can get started by signing up.

Go to Binance’s Official Website

Conclusion

KYC is an important part of AML in both the financial sector and the cryptocurrency sector. These financial regulations create a safe and crime-free environment for businesses to thrive. You may not enjoy complete anonymity when trading cryptocurrencies, but Binance and most other exchanges try to follow KYC to protect users.

Ready to start your crypto journey at Binance?

Sign up for a Binance.com account or download the Binance cryptocurrency trading app to get started. Next, verify your account to increase your cryptocurrency purchase limit.

Complete basic and advanced verification on Binance

After completing the account verification, you have two main methods for you to buy cryptocurrencies with cash on Binance , you can buy cryptocurrencies with cash on Binance via bank transfer or card channel, or you can buy cryptocurrencies on Binance C2C from other Sellers buy cryptocurrency with cash.

Please check Binance official website or contact the customer support with regard to the latest information and more accurate details.

Binance official website is here.

Please click "Introduction of Binance", if you want to know the details and the company information of Binance.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...