KuCoin Futures offers a platform for trading Bitcoin futures, both Quarterly Delivery and Perpetual, with features like risk hedging, two-way profit, high leverage up to 100x, a user-friendly interface and diverse contract types.

Understanding Futures Trading on KuCoin: A Comprehensive Guide

Futures trading presents an attractive opportunity for investors to speculate on the future price of an asset, thereby creating potential for substantial profits. KuCoin Futures is a platform that provides users the ability to trade in Bitcoin futures, including Quarterly Delivery Futures and Perpetual Futures.

What Are Futures?

Futures are financial contracts obligating the buyer to purchase, or the seller to sell, an asset at a predetermined price and date in the future. On KuCoin, users can trade both Quarterly Delivery Futures and Perpetual Futures, each with distinct features and benefits.

Start trading Futures with KuCoin

Delivery Futures

A Delivery Future is an agreement to buy or sell a particular commodity or asset at a preset price at a specific future date. This date, known as the delivery date, is the point when the Delivery Future is settled. The XBT Delivery Future, quoted in USD and denominated in Bitcoin, is a popular form of Delivery Future traded on KuCoin.

The price at which the Delivery Future is settled is calculated as a 30-minute Time-Weighted Average Price (TWAP) of the Bitcoin Spot Index at 12:00 UTC on the delivery date, which is the last Friday of the Futures month. Users can identify the Futures month by the ticker symbol. For instance, a Bitcoin Future set to settle in December 2019 would carry the ticker XBTZ19.

Perpetual Futures

Unlike Delivery Futures, Perpetual Futures have no expiration date. The Bitcoin mini Perpetual Future, for example, is designed to closely track the Bitcoin Spot Index through a Funding Rate mechanism, providing a flexible leverage option.

The Perpetual Future is also quoted in USD and denominated in Bitcoin. Its underlying price is the volume-weighted average USD price of Bitcoin across six major exchanges, including Coinbase Pro, Bitstamp, Kraken, Gemini, Liquid, and Bittrex. Profits and losses (PNL), as well as margin calculations, are also denominated in Bitcoin.

Investors who buy Perpetual Futures profit from a rise in the Bitcoin/USD price, while those who sell profit from a decrease in the Bitcoin/USD price.

Start trading Perpetial Futures with KuCoin

Understanding Leverage in Futures Trading

KuCoin Futures offers leverage on all Futures and Perpetual Swap products. Leverage is defined by the Initial Margin and Maintenance Margin levels, which stipulate the minimum funds required to open and maintain a position.

In KuCoin Futures, leverage is divided into initial leverage and actual leverage. The initial leverage is manually set when opening a position, and can range from 0.01x to 100x. The actual leverage changes as the unrealized profit and loss fluctuates, potentially exceeding 100x.

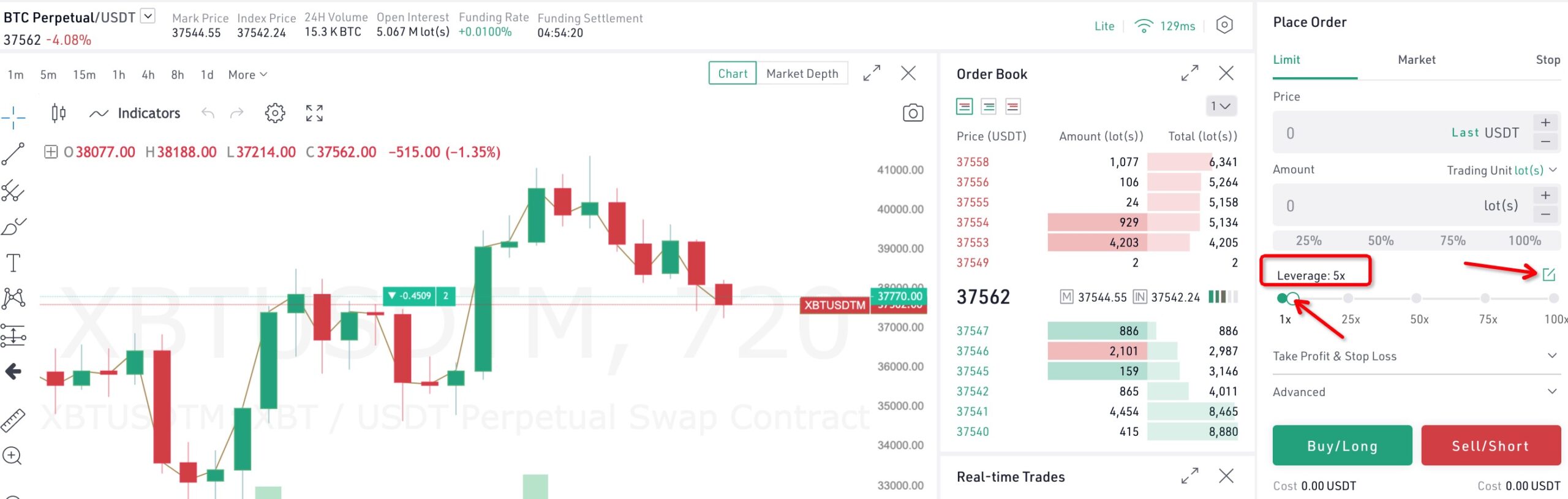

Users can set their preferred leverage by dragging a slider or manually inputting a leverage multiple, which can be a decimal.

1. Please drag the slider to select the leverage you prefer (only support integers).

2. Click the edit button to input the leverage times you prefer(you may input a number with decimals).

Advantages of Futures Trading on KuCoin Futures

KuCoin Futures offers several unique advantages:

- Risk Hedging: Users can mitigate downside risk in the Spot trading market by selling/shorting a Futures contract.

- Two-way Profit: Users can buy/sell Futures contracts to go long or short, earning profit from both uptrends and downtrends. The funding fee is covered based on the price gap between the Spot and Futures market.

- Higher Leverage: KuCoin Futures offers up to 100x leverage, magnifying potential profit with less initial investment.

- User-friendly Interface: The platform’s exclusive Lite version simplifies trading, allowing newcomers to get started easily. Moreover, the Futures Brawl feature provides an engaging trading experience.

- Diverse Contract and Order Types: KuCoin supports both Coin-Margined and USDT-margined contracts, and offers a wide range of order types to cater to various trading needs.

- Robust Indexing Algorithm and Deep Liquidity: With a leading indexing algorithm and top 3 trading depth, users can trade confidently without fear of drastic market fluctuations.

- Incentives for New Users: KuCoin Futures offers airdrop bonuses to every new user, enabling them to start trading for free.

Differences between Delivery and Perpetual Futures

While both types of futures contracts offer their own unique advantages, there are key differences. The primary difference lies in their expiration: Perpetual Futures do not have an expiry date and are available for trading indefinitely, while Delivery Futures have a predetermined expiry date, and are settled based on a prespecified rule derived from the price of the underlying asset.

Moreover, unlike Perpetual Futures, Delivery Futures do not involve a funding mechanism. Their price is ensured to converge with the price of the underlying asset via the delivery mechanism.

A Practical Example of Futures Trading

To illustrate how futures trading works, consider a trader who goes long 5 XBT at a price of 5,000 USD, amounting to a total of 25,000 Futures (5 * 5,000). If the price rises to 6,000 USD after a few days, the trader’s profit will be calculated as follows: 25,000 * 1 * (1/5,000 – 1/6,000) = 0.8333 XBT. On the other hand, if the trader had initially gone short, they would have lost 0.8333 XBT.

Conclusion

Futures trading on KuCoin offers a robust platform for traders to speculate on the future price movements of Bitcoin, while also providing tools for risk management and leveraging. Whether you’re a seasoned trader or a newcomer to the crypto market, KuCoin Futures offers a range of features designed to enhance your trading experience.

Please click "Introduction of KuCoin", if you want to know the details and the company information of KuCoin.