Learn how to start spot and margin trading on Gate.io Exchange by following a step-by-step guide to creating an account, depositing funds, and placing trades.

Understanding Spot Trading for Beginners

Spot trading is a type of transaction involving the immediate exchange of spot assets. In this process, assets are delivered promptly following the completion of the transaction, with the buyer acquiring the spot assets and the seller obtaining the corresponding currency.

Go to Gate.io’s Official Website

An Overview of Spot Trading and Its Significance in the Financial Market

Spot trading is a crucial trading method in the financial market, contributing to its overall development with its simplicity, efficiency, and promptness. It plays a key role in facilitating capital flow, value realization, and balancing supply and demand. In spot trading, assets are directly traded, and the delivery of these assets occurs promptly after the transaction is finalized. Buyers acquire spot assets while sellers receive the respective currency. Spot trading typically takes place in the spot market, where assets like cryptocurrencies, commodities, forex, and stocks are traded.

How to start Spot & Margin trading with Gate.io

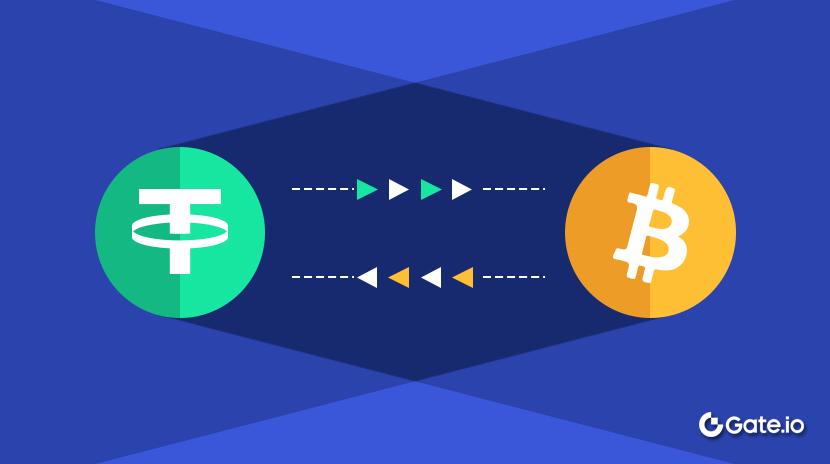

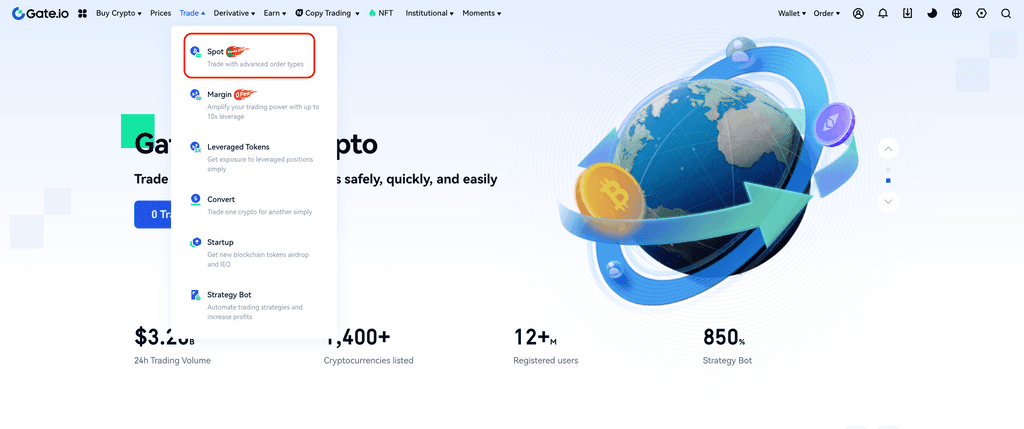

Step 1: Sign in to your account and select “Spot” from the “Trade” menu in the top navigation bar.

Step 2: In the Market section on the left, search for and input the trading pair you wish to trade.

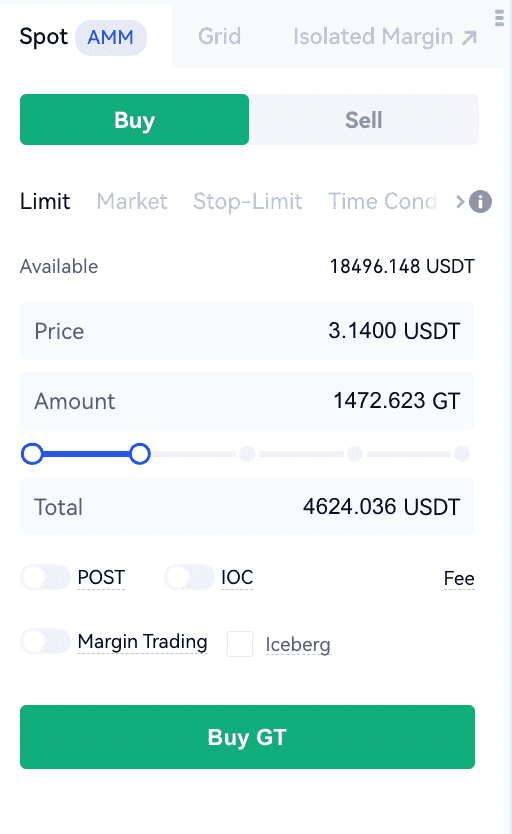

Step 3: In the order placement section on the right, set your desired buy/sell prices and buy/sell quantity/total. Click on the “Buy” or “Sell” button.

Step 4: For a more convenient method of setting buy/sell prices, click on the most recent transactions in the order book.

You can also execute a market order by inputting the quantity and clicking “Buy” or “Sell.”

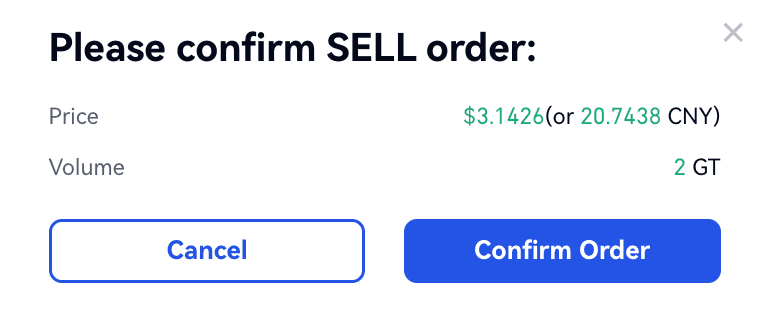

Step 5: Verify the price and quantity, then click on “Confirm Order.”

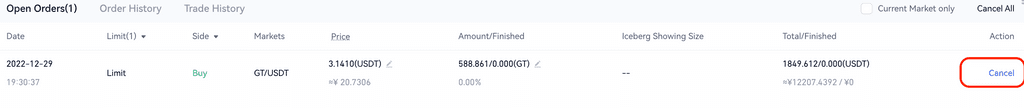

Step 6: Once your order has been successfully placed, you can view it in the order section. If necessary, you can cancel the order by clicking on “Cancel.”

Go to Gate.io’s Official Website

Understanding the Spot Market

A spot market is a financial market centered on spot trading, characterized by its openness, immediacy, and asset delivery. Before delving into the spot market, it is essential to comprehend what a spot is. In traditional markets, spots refer to existing goods such as soybeans, oil, and gold. In the crypto market, spots are cryptocurrencies like BTC, ETH, and USDC, which can be quickly traded and transferred to one’s wallet.

The spot market consists of exchange-based trading and over-the-counter (OTC) trading. Exchange-based trading involves third-party platforms responsible for transaction matching, while OTC trading occurs outside the market, typically via cash on delivery (COD). Intermediary-based trading also exists but carries uncontrollable risks.

Exploring Spot Trading

Spot trading entails direct transactions between buyers and sellers of spots, either as currency-to-good transactions or barter transactions. In the crypto market, spot trading primarily involves crypto-to-crypto transactions, with most trading pairs containing stablecoins like USDC, USDT, and DAI.

Investors can engage in crypto-to-crypto trading after purchasing stablecoins on major platforms. They can select a trading pair (e.g., BTC/USDC) and place a pending order in market/limit mode. The platform automatically matches transactions and closes deals when the BTC price aligns with the pending order price. Users can then access the BTC in their accounts and transfer it to their wallets.

Where to Conduct Spot Trading

Spot trading can be executed via exchanges or OTC trading. Exchange-based trading can be further divided into centralized exchanges (CEX) and decentralized exchanges (DEX), each with its pros and cons.

- Centralized Exchanges

- CEX are managed by a centralized institution that ensures convenient and secure trading for both parties. Trades are aggregated through pending orders in the order book. Users must register a trading account and complete KYC (identity verification) before trading. CEX advantages include convenience, mature technology, high transaction capacity, a large user base, sufficient liquidity, and strict risk control.

- Decentralized Exchanges

- DEX do not involve a centralized institution in matchmaking. Decentralized trading relies on liquidity provided by smart contracts and algorithm-based liquidity pricing. Users can contribute liquidity to the trading pool or trade directly by connecting their wallets to the smart contract. Users’ assets remain in their wallets throughout the process, and no registration or KYC is required. DEX advantages include openness, transparency, secure asset control, and privacy protection.

However, DEXs may also list potentially risky coins due to the lack of required audits. Users should remain vigilant regarding liquidity and risks when trading on DEXs.

Go to Gate.io’s Official Website

Over-the-Counter Trading

Over-the-counter (OTC) trading involves transactions that occur outside a designated trading venue. Contrary to exchange-based trading, OTC trading does not require a fixed location, platform, identity verification, or adherence to strict rules. Trading parties primarily engage in one-to-one negotiations, either privately or through intermediaries, with prices determined through negotiation rather than market pricing.

OTC trading carries certain risks, as it lacks the guarantees provided by centralized institutions. However, its flexibility and openness make it a crucial addition to the financial market and an essential method for spot trading.

Conducting Spot Trading on Exchanges

To engage in spot trading on exchanges, users must first create an account. After depositing or purchasing stablecoins (e.g., USDT/USDC), users can navigate to the spot trading page, select a counterparty, and trade via market/limit pending orders. For example, to buy BTC on Gate.io:

- Visit Gate.io and sign up for an account using your email address.

- Access the “Wallet” to deposit stablecoins if you already possess them, or go to “Buy Crypto” and select “P2P Trading” to purchase stablecoins with fiat currencies.

- Click on “Spot Trading” under “Trade.”

- Search for BTC and locate the desired trading pair.

- Set the buying price and amount in “Limit Order,” and click on “Buy.” The transaction will automatically complete once the BTC price matches or falls below the pending order price.

- Upon completion, the purchased BTC will automatically transfer to the “Wallet” under “Spot Account.” Users can store BTC in the exchange wallet for future trades or withdraw it to their personal wallets for long-term investment.

Spot trading is the most prevalent trading method in the financial market and relatively easy to begin. However, to make informed and profitable investments, a comprehensive evaluation based on fundamental information, market analysis, and strategic planning is necessary. Successful investments result from a combination of comprehensive analysis, rational judgment, and measured decision-making.

Please check Gate.io official website or contact the customer support with regard to the latest information and more accurate details.

Gate.io official website is here.

Please click "Introduction of Gate.io", if you want to know the details and the company information of Gate.io.