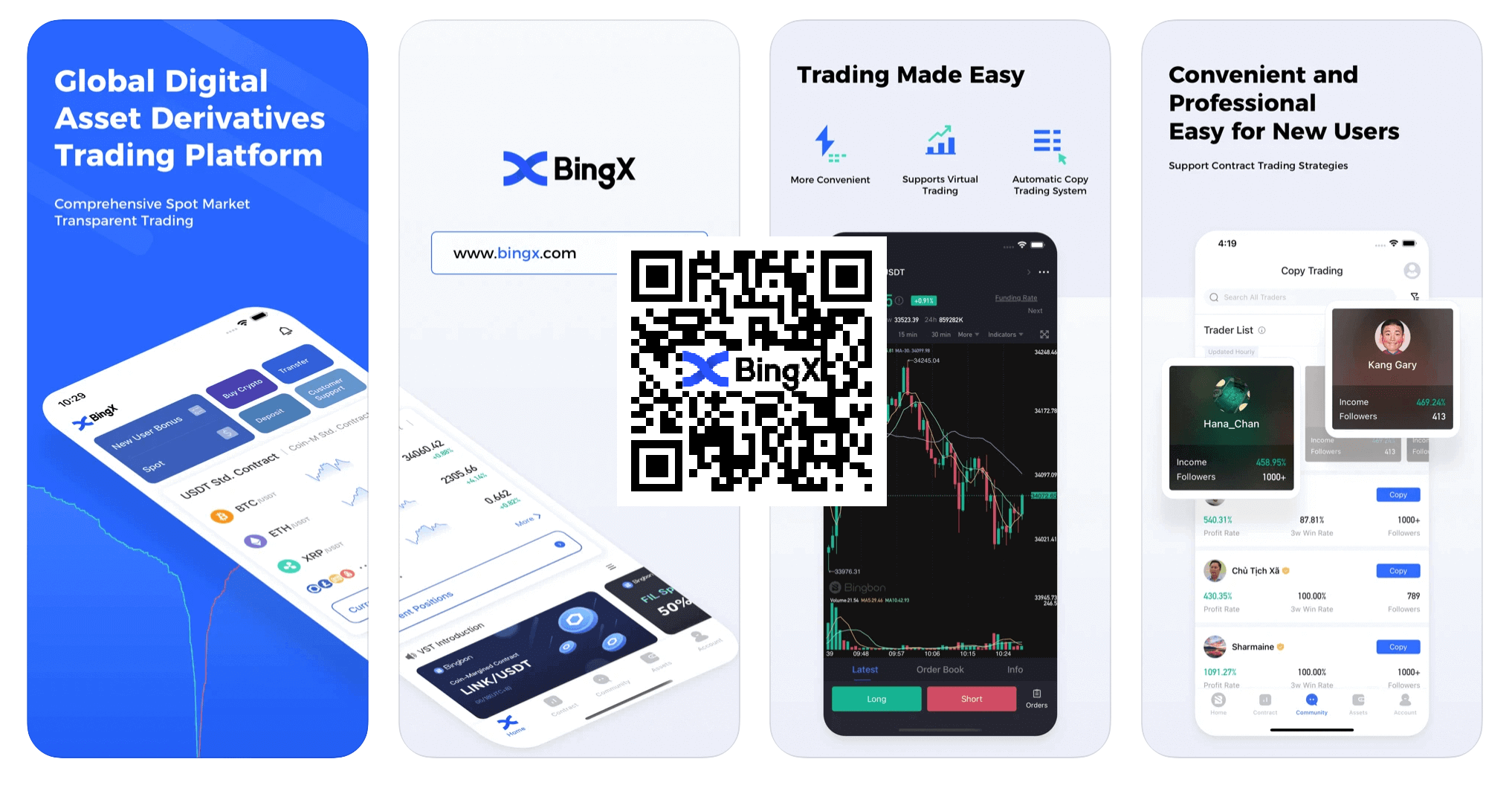

Let’s explore cryptocurrency spot and derivative trading, along with practical trading instructions for the BingX platform.

The fascinating world of cryptocurrency trading never sleeps. Unlike traditional financial markets, the cryptocurrency market operates 24 hours a day, 7 days a week, all year round. This unparalleled availability presents unique opportunities and allows for the buying and selling of cryptocurrencies at any given moment, from anywhere across the globe. However, to fully exploit the benefits offered by this non-stop operation, it’s imperative to gain a robust understanding of the inner workings of crypto trading. This comprehensive article look deep into the two pivotal financial instruments in the realm of cryptocurrencies – the “Spot” and “Derivatives”. By providing you with a detailed introduction and explanation, this guide aims to equip you with the essential knowledge you need to embark on your cryptocurrency trading journey.

Invest in Spot & Derivatives on BingX

A Detailed Look into Spot Trading

Spot trading in the context of cryptocurrencies refers to the direct and immediate purchase or sale of a specific cryptocurrency. In a typical spot trading transaction, both the buyer and seller are obligated to immediately deliver the involved cryptocurrency upon the completion of the transaction. This feature of instantaneous delivery defines spot trading and caters to the immediate trading needs of both parties involved.

For instance, let’s imagine a scenario where the spot price of Bitcoin, one of the most popular cryptocurrencies, stands at $40,000. In such a situation, a buyer who decides to engage in spot trading purchases one BTC directly in the spot market for the stated price of $40,000. This straightforward transaction has the following possible outcomes:

- If the price of Bitcoin experiences a surge, rising to $60,000 a month later, the buyer has the opportunity to sell the BTC they purchased earlier. Doing so would result in a significant profit of $20,000, calculated using the formula [Profit and Loss Amount = (Selling Price – Buying Price) * Trade Volume].

- On the other hand, if the price of Bitcoin experiences a downturn, falling to $20,000 a month later, the decision to sell the BTC would result in a loss. In this case, the loss would amount to $20,000, calculated using the same formula as above.

Go to BingX’s Official Website

Experience Spot Trading on BingX

The BingX trading platform is equipped with a state-of-the-art K-line service that meticulously synthesizes spot market data gathered from a multitude of mainstream exchanges. This advanced feature ensures the provision of a fair and accurate K-line. To engage in spot trading on BingX, all you need to do is visit BingX App [Buy/Sell – Spot] and click on the “Spot” button to initiate your trade. For beginners and those looking for guidance, BingX also provides a highly informative tutorial video on Spot Trading that walks you through the entire process.

Introduction to Derivative Trading: Beyond Basic Trading

Derivatives, despite being a relatively new addition to the cryptocurrency market, have been an integral part of the traditional financial industry for a long time. The domain of derivatives is incredibly vast and encompasses a wide range of assets. These include various financial products like stocks, bonds, commodities, traditional currencies, market indices, and now, cryptocurrencies.

Derivative trading offers the exciting option of leveraged trading, which essentially means the potential profits for investors are significantly amplified. However, investors must tread carefully and remember that margin trading, a trading strategy that involves trading with borrowed funds, also heightens investment risk. If not managed correctly, the margin may be liquidated. Thus, derivatives are often considered high-risk assets and should be approached with caution and a sound understanding of their intricacies.

Invest in Derivatives on BingX

What are Futures?

The category of “Futures” is a key constituent of the broader derivatives category. A futures contract, in its simplest form, is a legal agreement made between two parties who agree to buy or sell a particular asset, such as Bitcoin, at a predetermined price and a specific future date. This agreed-upon future date is known as the delivery date.

For instance, if an investor expects the price of Bitcoin to rise, they can choose to enter into a “long” position. This involves buying a Bitcoin futures contract that locks in a specific price, which is expected to be lower than the future price of Bitcoin. If the Bitcoin price does indeed increase, they can then sell the futures contract and earn a profit. Similarly, if they expect the price to fall, they can enter into a “short” position by selling a futures contract.

Futures contracts come in two flavors – Perpetual Futures and Standard Futures. Each offering has unique features and is suitable for different trading strategies and risk appetites.

Perpetual Futures are unique in that they do not have an expiry date. Instead, traders can hold these contracts for as long as they desire, provided they can manage to fund the margin and withstand potential price fluctuations. This type of futures contract is often favored by traders who prefer to maintain their position for an extended duration.

On the other hand, Standard Futures contracts have a defined expiry date. At the end of the contract, the transaction is settled based on the contract terms. Typically, these contracts involve either cash settlements or physical delivery of the underlying asset.

Go to BingX’s Official Website

Trading Futures with Leverage on BingX

On BingX, investors can trade futures contracts with the added benefit of leverage. Leverage in trading refers to the use of borrowed capital as a funding source to expand the potential return of an investment. It magnifies both potential profits and potential losses, making it a double-edged sword. BingX offers leverage of up to 125x, providing a dynamic and high-stakes trading environment for the savvy investor.

Unpacking the Intricacies of Options

Options, like futures, are a type of derivative contract. However, they offer the unique feature of providing traders the right, but not the obligation, to buy or sell an asset at a specific price in the future. This distinguishes options from futures contracts in a fundamental way – the holder of an option is not obliged to settle the contract.

To gain the rights provided by an option, the trader must pay a premium. This payment is required even if they ultimately choose not to exercise their rights at the end of the contract. Options can be broadly divided into two types – Call Options and Put Options.

BingX: A Leader in Derivative Trading Services

As a leading derivatives trading platform globally, BingX offers a superior suite of derivatives trading services. These services are designed to cater to the diverse needs of various types of investors – from beginners just stepping into the world of crypto trading to advanced investors seeking sophisticated trading strategies.

BingX offers Standard Futures that support both USDT-Margined Contracts and Coin-Margined Standard Futures. These features are designed to be user-friendly and intuitive, allowing beginners or ordinary investors to get started quickly and effortlessly.

On the other hand, BingX’s Perpetual Futures support USDT-Margined Standard Futures and allow users to implement tighter limit strategies. They also provide robust tools to manage positions effectively. This suite of features makes BingX’s Perpetual Futures suitable for advanced investors who require a higher degree of control and flexibility in their trading strategies.

Invest in Derivatives on BingX

How to start trading Spot and Derivatives with BingX

Starting to trade on BingX requires several steps, which can be broken down into a few basic sections:

1. Creating an Account

Go to BingX Official Website and click on “Sign Up” at the top right corner of the page.

You’ll need to enter your email, create a password, and agree to the terms of service.

You will then receive an email to verify your account. Click the link in this email to activate your account.

2. Funding your Account

After your account has been activated, you’ll need to deposit funds into it.

To do this, navigate to the “Assets” tab in your account dashboard and click on “Deposit”.

You can deposit cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), or USD Tether (USDT). Copy the deposit address provided and use it to transfer the funds from your personal wallet to your BingX account.

3. Spot Trading

After you’ve funded your account, you can start spot trading. Navigate to the “Trade” section of the platform and select “Spot Trading”.

Here, you’ll see a list of available trading pairs. Choose a pair you’re interested in, for instance, BTC/USDT.

Enter the amount of cryptocurrency you want to buy or sell, and the price at which you want the trade to occur.

Click “Buy” or “Sell”, review your trade, and then click “Confirm”. Once your trade is executed, the funds will be deducted from or added to your account balance.

4. Derivatives Trading

If you want to start trading derivatives, you would first need to understand the basics of futures and options contracts.

To trade these, navigate to the “Trade” section and select “Derivatives Trading”.

Choose whether you want to trade futures or options. You’ll then see a list of available contracts.

For futures, you’ll need to specify whether you want to take a long (betting the price will rise) or short (betting the price will fall) position, the amount you want to trade, and the leverage you want to use. Confirm and place your order.

For options, you’ll need to choose between a call option (betting the price will rise) or put option (betting the price will fall), the strike price (the price at which the option can be exercised), and the expiry date. After entering these details, you can place your order.

Invest in Spot & Derivatives on BingX

Please check BingX official website or contact the customer support with regard to the latest information and more accurate details.

BingX official website is here.

Please click "Introduction of BingX", if you want to know the details and the company information of BingX.

Comment by cryptoloversofxm

February 19, 2025

I just saw that XMTrading now supports cryptocurrency deposits and withdrawals. No fees, instant transactions, and up to $30K per month. Each deposit gets a unique wallet addres...