The article provides a step-by-step guide on how to trade spot on the Huobi platform, covering the process of placing different types of orders, navigating the interface, and managing funds and order statuses.

Trading Spot on Huobi: A Step-by-Step Guide

1. Sign in to your Huobi account, and from the main page, select “Trade” at the bottom, followed by “Spot.”

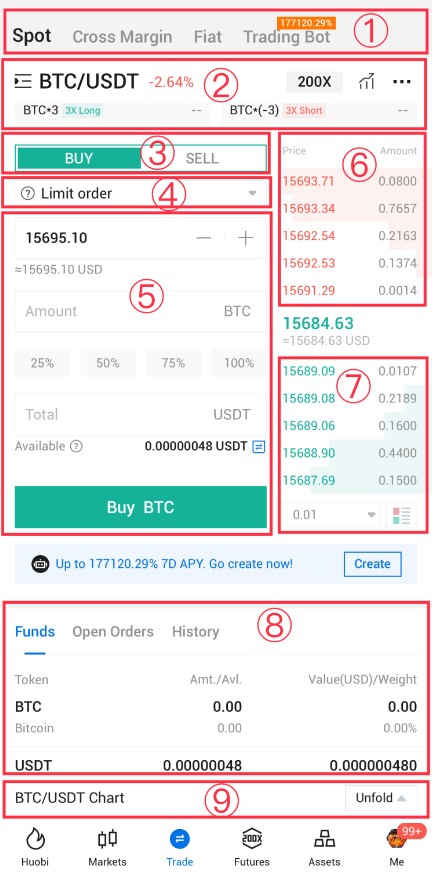

2. In vertical view, the Spot trading page is comprised of 9 sections:

(1) Types of trading

(2) Trading pairs, 24-hour price changes for spot and margin trading, etc.

(3) Purchasing/Selling virtual assets

(4) Types of orders: Limit order, market order, TP/SL order, and trigger order

(5) Quantity and price of orders

(6) Order book for selling

(7) Order book for buying

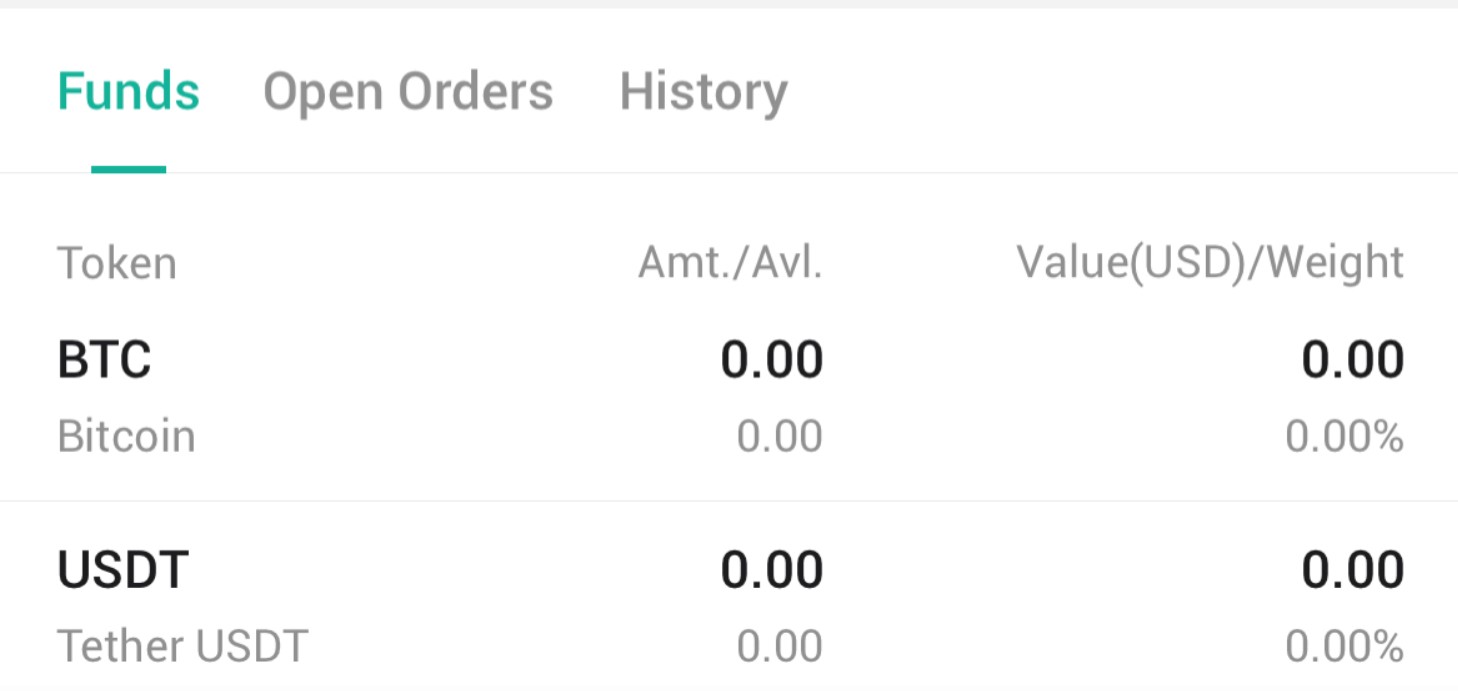

(8) Information on available funds and orders

(9) Real-time chart

3. Conducting a spot trade using the Huobi app

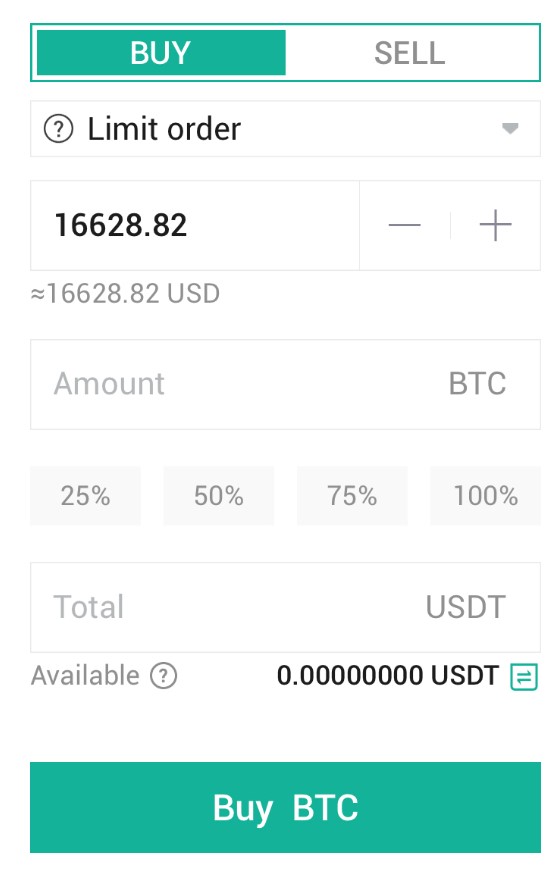

For example, to place a limit order, choose a trading pair in Section ② (e.g., BTC/USDT). Refer to the ask and bid prices in Sections ⑥ and ⑦, and input the order price and quantity in Section ⑤. Click “Buy BTC” to finalize the limit order, ensuring that you have sufficient funds in your account. (These steps can also be followed to sell virtual assets.)

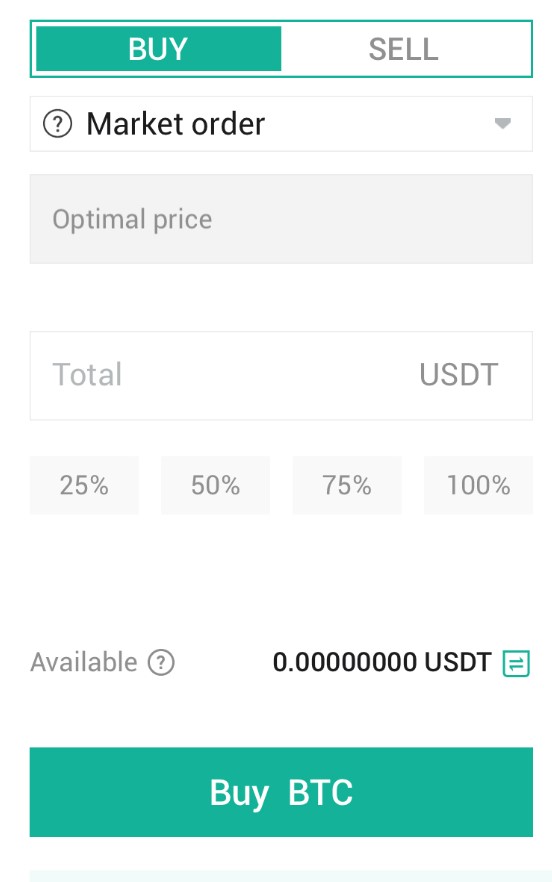

To quickly complete an order, choose “Market Order” and enter the order quantity. Your order will be executed at the most favorable market price.

After trading, you can review your funds and order status in Section ⑧.

Go to Huobi’s Official Website

Spot Transactions vs. Contract Trading: What’s the Difference?

Huobi’s Contract Trading 101 is a beginner’s guide to understanding contract trading, part of the companion series to Blockchain 101. Contract trading serves as a practical tool for hedging, arbitrage, and speculation.

The primary distinctions between spot transactions and contract trading are as follows:

Different underlying assets:

Spot transactions involve the direct trading of a commodity, including physical items and samples. Most everyday transactions fall into this category.

In contrast, contract trading deals with standardized contracts, which contain specific information such as the designated trading category, time, price, and quantity.

Different scopes of objects:

Spot transactions cover all current commodities, while contract trading primarily focuses on physical commodities (e.g., agricultural products, energy resources, and metals) and select financial products (e.g., stocks and bonds).

Different trading rules:

Regardless of the trading duration, spot transactions settle the price once or multiple times immediately upon receiving the commodity.

On the other hand, contract trading involves future delivery, differentiating it from spot transactions.

Different trading objectives:

The primary goal of spot transactions is to transfer ownership of a commodity between two parties.

In addition to delivering physical commodities, contract trading can also transfer the uncertain risks associated with price fluctuations in the spot market or profit from price fluctuations in the contract market.

Please check Huobi official website or contact the customer support with regard to the latest information and more accurate details.

Huobi official website is here.

Please click "Introduction of Huobi", if you want to know the details and the company information of Huobi.

Comment by cryptoloversofxm

February 19, 2025

I just saw that XMTrading now supports cryptocurrency deposits and withdrawals. No fees, instant transactions, and up to $30K per month. Each deposit gets a unique wallet addres...