Difference Between IEO and ICO

As is common in the tech world, the cryptocurrency field has a lot of abbreviations, jargon, and slang. In the past, we looked at slang terms such as Fud and FOMO, along with some jargon related to spot trading and futures. In time, we would like to explore two key acronyms in the cryptocurrency space: ICO and IEO.

What is ICO?

ICO is a similar concept to crowdfunding and is an abbreviation for “initial offering of coins”.

This typically includes a company or project that publishes a whitepaper detailing the idea of an emerging coin.

Investors then sponsor projects that allow for the issuance of coins and the infrastructure needed to operate them.

In return for this investment, they receive a certain number of tokens corresponding to their contribution to the project.

If this business succeeds, investors are quite likely to become wealthy, as did the early Bitcoin investors.

If the project fails, they lose their initial investment.

This method is the most common way new cryptocurrency projects are born, and given the very indefinite nature of the cryptocurrency industry in its infancy, the probability of success and failure is the same.

When looking at an ICO, it is essential to review the team behind the project and their motives, background, technologies used, and ultimate goals.

What is IEO?

IEO is an acronym for initially offering coins on an exchange.

The big difference between ICOs and IEOs is where exactly the investment takes place.

IEO is similar to crowdfunding.

An ICO is where people invest money in a new coin or token in exchange for the coin or token itself. However, with IEO, only users of that exchange can participate, as it is distributed only through a specific exchange. Theoretically, these particular exchanges are more secure if you trust them.

Additionally, exchanges would have researched and due diligence IEOs in advance to minimize risk as much as possible.

With that in mind, in the past exchanges received coins or received incentives instead of listing them, so the reliability of coins was not guaranteed. However, now it is easier to purchase with IEO than with ICO, as all you need to do is go through the formal procedure of purchasing coins/tokens through an exchange.

What is Bitcoin?

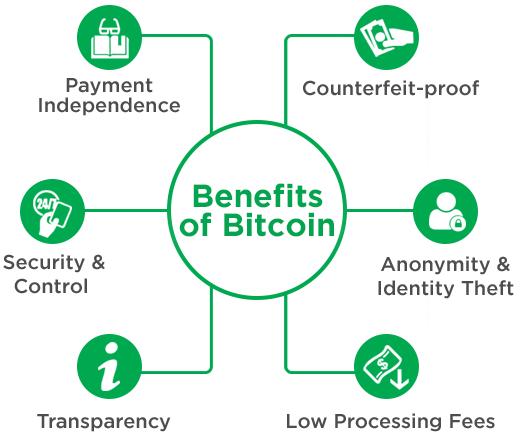

Bitcoin (BTC) is the first and the most well-known cryptocurrency in existence today. As a cryptocurrency, Bitcoin uses cryptographic proof as a security measure and can be used as a currency to pay for products and services. Like any other currency, Bitcoin allows users to store, measure, and transfer wealth, without the need for an intermediary. Moreover, Bitcoin is digital, meaning it doesn’t have a physical form. Instead, it’s represented as code stored on computers, unlike other stores of value such as gold and oil. Currently, one Bitcoin is worth around $40,000.

ICO- Initial coin offering

You need to do some research on the project and the team to determine if the project is a scam or not.

Exchanges may have already done due diligence to protect themselves and their customers.

Tokens must be purchased or obtained on the project’s separate, own platform.

IEO- Initial Exchange Offer

You buy tokens through an exchange in the same way as any other token.

To trade, you have to wait for the token to be registered on the exchange.

Tokens can be traded immediately after the IEO is over.

Coin Burning

Coin burning is the process by which digital currency miners and developers remove tokens or coins from circulation.

Coin burning slows the inflation rate and reduces the total supply of coins in circulation.

Coin burn is a concept similar to share buyback, and by reducing the number of tokens supplied, developers and miners can create fewer tokens and create value.

How do we burn coins?

Cryptocurrency coin incineration does not destroy its existence by burning it as it was originally meant, but rather sending the cryptocurrency to an address where it cannot be obtained and making it impossible to find any more.

These coins or tokens are first purchased in the market and then sent to a specific address where the incineration address or private key is unknown.

After this, transaction cancellation or withdrawal of coins is not possible.

Does burning a coin affect the price of cryptocurrencies?

Coin burning for anti-inflation and data purposes has the advantage of increasing transparency. When a coin is burned, the transaction is made public because its history is posted on the blockchain.

When will the token burn be done?

Token burn occurs in two forms. This is caused by built-in protocol structures such as proof-of-incineration or economic policies. Coin burns are usually caused by economic policy issues and are used to influence the price, inflation and circulation of coins.

In particular, many examples of coin burns can be found in Bitcoin Cash, crypto mining pool Antpool, Binance Coin (BNB), Ripple, Stellar, stablecoin USDT, USDC, etc.

What is the purpose of burning cryptocurrency?

Coin burning is usually done to create new tokens or coins, and is used to reward token or coin holders through toknomics through Proof-of-Burn.

In other words, it is done by burning supply to influence price and demand, and destroying unsold tokens or coins after ICO (virtual currency disclosure).

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...