What is an altcoin?

Bitcoin’s share of cryptocurrencies is so large that all other cryptocurrencies are simply known as altcoins.

Some altcoins attempt to fix perceived weaknesses in the Bitcoin protocol, while others pursue completely different goals and subjects.

In this section, we will take a look at some of the famous altcoins and briefly introduce their differences from Bitcoin.

Bitcoin Fork

Although Bitcoin forks aren’t the first both temporally and logically, they become the best protocol once you get started.

A Bitcoin Fork is roughly defined as changing something or adding a rule to the main protocol.

Occasionally, the entire community will agree to the changes and switch to an improved version.

In other cases, disagreements may lead to the division in the community. In this case, a new version of Bitcoin is created.

The process can be imagined as a genealogy.

Taking the tree as an example, each branch represents a unique individual or a different version of Bitcoin, while the trunk represents their original underlying protocol or root.

Again, whenever a part of the community chooses to follow new rules that others don’t, a fork is created.

As we will see, forking is a process that can happen to any unique cryptocurrency or even any other fork.

Go to Huobi’s Official Website

Bitcoin Cash

There are over 100 projects that have been forked by Bitcoin (to date), but of these, Bitcoin Cash is the most successful fork project.

BCH belongs to the category of altcoins that seek to improve the limitations of Bitcoin.

The current theoretical block size of Bitcoin is 4 MB, but in practice, it is said to be closer to 2 megabytes.

Remember that transactions are grouped into blocks, so the size of a block is directly related to the number of transactions that can be verified and added to the blockchain in a given period of time.

Currently, Bitcoin processes about 7 transactions per second (tps), which is very low compared to the average of 24,000 tps for Visa cards.

As Bitcoin’s user base grows, the time and identity issues become more pronounced.

Concerned about the scalability of such Bitcoin, some developers forked it in August 2017 and created BCH.

The first enhancement added to BCH was the increased block size to 8MB. This has resulted in much faster transaction speeds and lower transaction fees.

If BTC is more commonly used today as a form of digital gold (investment asset or store of value), BCH has the position of an effective payment system in its own right.

In other words, as the name (CASH) suggests, it is designed to be used as easily as cash.

Nevertheless, BCH also faces challenges and drawbacks.

Perhaps the most important of the problems is the low level of awareness (compared to Bitcoin) and investor confidence.

People within the cryptocurrency community may be familiar with BCH, but others (= ordinary people) are not.

In situations where there are relatively few users, the average block size mined on the blockchain is actually smaller than that of Bitcoin.

It should allow more transactions through larger blocks, which means that even that hasn’t been properly verified.

In addition to this, other altcoins have emerged to challenge BCH’s ambition to become a ubiquitous medium for daily tradability.

Finally, just as BCH was caused by disagreement over the future direction of Bitcoin, BSV was created through another fork due to disagreement over the direction of BCH.

The intensity of competition from BSV, combined with other security and safety concerns, will likely hamper BCH’s success for some time to come.

Unlike Bitcoin forks, various altcoins have their own blockchains.

However, altcoins are still created and operating systems based on Bitcoin’s original protocol.

They still maintain a system that creates new coins, mainly by mining or solving complex mathematical puzzles.

Invest in Bitcoin Cash on Huobi

Litecoin

Litecoin is also the first surviving and successful Bitcoin alternative to date.

It was once widely accepted as the second best cryptocurrency after BTC, but at the time of this writing, the cryptocurrency is ranked 12th by market cap.

Like Bitcoin Cash (BCH), Litecoin (LTC) prioritizes speed.

Litecoin transactions are verified about 4x faster than Bitcoin transactions.

Another fundamental difference between the two comes in terms of the mechanism for proving work.

Litecoin uses a much simpler algorithm known as a script.

As Bitcoin’s algorithms become more complex, miners are increasingly finding highly specialized tools and equipment inaccessible to ordinary users.

On the other hand, much of Litecoin’s mining can and continues to be done through standard CPUs and GPUs.

Because of this, you can think of Litecoin (LTC) as a much more accessible project, and in terms of accessibility, Litecoin is an easier version of Bitcoin. Also, at one time many people believed that Bitcoin and Litecoin were the gold and silver of cryptocurrencies. called it.

Ethereum

Ethereum has had a major impact on the development of mining-based altcoins.

Unlike Litecoin (LTC) and many other altcoins, which we will not cover here, Ethereum speaks of several fundamentally new concepts and goals that set it apart from Bitcoin.

In fact, Ethereum’s impact on the cryptocurrency space is so great that our article warrants it.

However, as a basic concept, it should be understood that Ethereum refers to a blockchain or cryptocurrency platform with smart contract functions.

A smart contract is basically a set of conditions that automatically executes a specific task when the conditions are met.

They also allow developers to create special decentralized applications that run on the Ethereum network.

For example, financial services such as loans can be created and automated through smart contracts that eliminate the need for third-party intermediaries.

For these programs to run, they must pay the network for computing power in the form of Ethereum (ETH).

ETH is the cryptocurrency of the Ethereum network and the fuel that underpins contracts.

Ethereum’s goal is not to create another version of a digital currency like Bitcoin, but rather to utilize blockchain technology in a variety of decentralized, tamper-resistant applications.

Stablecoins

Stablecoins are designed to minimize price volatility and reduce financial risk.

Bitcoin and most altcoins are highly volatile and have a lot to do with each other.

Bitcoin price fluctuates greatly in minutes or even seconds.

When the price of Bitcoin is volatile, many altcoins also follow the price of Bitcoin.

Stablecoins provide investors with an escape route that protects them from falling prices by offering an alternative that is not exposed to these risks.

These altcoins are backed by low-volatility assets such as commodities, fiat currencies, or other carefully selected cryptocurrencies.

The value of the commodity-backed stablecoin is pegged to alternative commodities such as gold, silver and other precious metals and is redeemable.

For example, DGX (Digix Gold Token) is linked to gold.

As always, the holder of DGX should be able to exchange it for the same value as gold.

Commodity-linked stablecoins are the most vulnerable to inflation in the sense that it is much more difficult for central banks to mine and increase their supply of metals than it is to print more money.

Invest in Stablecoins on Huobi

Backed by fixed values

TrueUSD (TUSD), USD Tether (USDT), USD Coin (USDDC), etc. are all stablecoins pegged to the value of the US Dollar.

As such, the value of one of the above coins should always be as close as possible to one US dollar (1USDT = $1).

For more of these tokens to be issued, companies must first deposit the same amount in dollars into the reserve.

However, USDT has been criticized for being unable and unwilling to provide audit reports proving the value of its holdings.

Go to Huobi’s Official Website

Cryptocurrency Support

As expected, these are generally stablecoins based on a portfolio of other cryptocurrencies.

The implementation of this system is far more complex than its financial and commodity competitors.

This is because, unlike these two options, the collateral of this stablecoin is done using smart contracts on the blockchain.

In order to achieve price stability, additional financial products and incentives beyond collateral are required.

We will learn more about these stablecoins later in this series.

Since there are currently over 5000 altcoins, it is impossible to know all of them.

The purpose of this article is not to provide comprehensive guidance on all Bitcoin alternatives, but rather to summarize some of the more prominent projects in altcoin history.

Many of the top 10 cryptocurrencies by market cap not mentioned here are likely to be covered in future articles.

However, the basic knowledge and snapshots provided in this article should provide a good starting point for researching and exploring interesting coins that may be other emerging alternatives.

Go to Huobi’s Official Website

Everything you need to know about stablecoins

The advent of stablecoins was special.

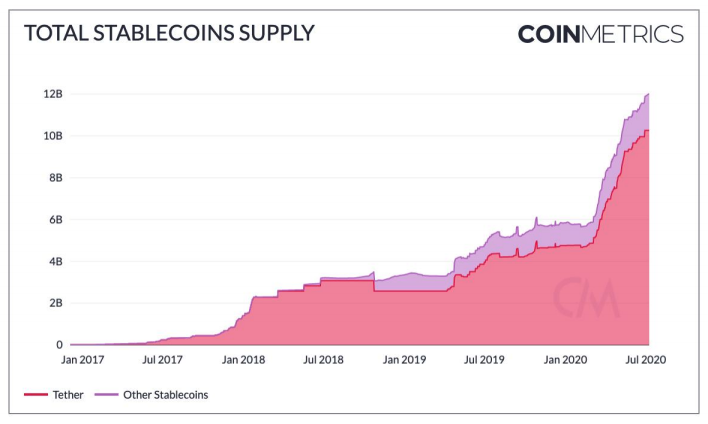

Coinmetrics is a report that shows how the value of Tether (USDT), the largest market cap among stablecoins in July, has risen over time, from $1 million in early 2016 to over $10 billion at the time of publication of the report. has published.

Besides, it’s not just tether that’s growing. Since 2018, new stablecoins from various issuers have been pouring into the market.

A stablecoin is a digital token pegged to the value of a secure currency, most commonly the US dollar.

It is designed to overcome the volatility of cryptocurrency, providing a stable medium of exchange and storage of value to cryptocurrency users.

However, not all publishers work the same way.

So, what is the difference between the different types of stablecoins, and how does the underlying mechanism work?

Types of stablecoins

Stablecoins are divided into three main groups.

- Collateralized stablecoins are backed by assets with a guaranteed value to maintain stability.

- Uncollateralized stablecoins are not backed by assets with a guaranteed value, but remain stable by using an algorithm’s directional model to control inflation.

- Hybrid stablecoins use a combination of the above two methods. There is also a reserve asset, but the value can be adjusted through an algorithm.

So far, collateralized stablecoins are the most popular, most widely used, and have the highest share of total market cap.

So far, projects from the other two groups above have not had significant success when compared to collateralized stablecoins.

Fixed-value-collateralized stablecoins

The fiat stablecoin first appeared on the market at this time when Tether launched its first stablecoin, USDT, in 2014.

(Fiat currency: currency whose value is guaranteed by the issuer)

A stablecoin backed by fiat currency as collateral is that $1 worth of stablecoins is backed by $1 as a real reserve.

Although still the largest stablecoin by market cap, Tether has been criticized in recent years for doubts about the fact that it has all the reserves it holds to support the issuance of the coin.

In 2019, the New York Attorney General’s Office filed a lawsuit against Tether’s parent company.

NYAG alleges that Tether gambled with users’ money after lending $1 billion to Bitfinex, whom he had a good relationship with (which he was very close to) this time losing

money.

To date, Tether has declined to undergo an independent audit to prove its reserves.

Although the case is still ongoing, USDT already maintains the top 5 cryptocurrency market cap, which does not affect Tether’s popularity.

Currently, USDT is no longer the only fiat-backed stablecoin.

Since 2018, competitive stablecoins such as USDC issued by Coinbase and Circle, GUSD issued by Gemini, and BUSD issued by Binance have begun to flood the market.

As a way to avoid allegations of reserve issues like Tether, all of the issuers mentioned above have participated in regular audits of their asset holdings.

Go to Huobi’s Official Website

Cryptocurrency-backed stablecoins

Cryptocurrency-backed stablecoins are literally backed by cryptocurrencies.

However, due to the volatility of cryptocurrencies, in general, some kind of price stability protocol is used to obtain the necessary collateral.

By adjusting, the price is fixed at a stable value.

The oldest and most well-known cryptocurrency-backed stablecoin is Maker’s DAI.

The underlying mechanism is technically complex, but to sum it up, users can deposit ETH and other cryptocurrencies into smart contracts known as ‘collateralized debt positions’.

The deposit will issue a DAI stablecoin pegged to the value of the US dollar.

Maker is a project based on Ethereum, which means that it must support issuance of dies using Ethereum-based tokens.

A new project, Kava, is based on the interoperable Cosmos platform.

Therefore, Kava ultimately aims to be a version of the maker that can issue cryptographic stablecoins based on the assets of any blockchain.

How are stablecoins used?

Fiat-based stablecoins have become popular among cryptocurrency traders by providing a stable means of P& L .

If traders choose to close their trades in BTC or ETH, they can even hold profits in USD-based stablecoins until they are ready to enter a new position without the risk of loss from cryptocurrency volatility.

However, the decentralized finance ( DeFi ) movement has created an entirely new use case for stablecoins.

This is mainly due to the unregulated state of stablecoins and DeFi – some require KYC to use DeFi.

Nevertheless, since the demand for stablecoins from traders is high, you can get a loan using the DeFi protocol such as Compound or Ave, and you can get a high rate of return.

Moreover, the advent of liquidity mining using stablecoins in protocols such as uniswap and balancers has created new revenue streams.

When users donate stablecoins to a liquidity pool, those who provide liquidity can also intermittently earn governance tokens from the DeFi protocol.

With over $9 billion in DeFi at the time of this writing, it is becoming a very lucrative industry for those who understand how to use the DeFi platform and are willing to take the risks involved.

It is not yet known whether the DeFi bubble will continue to inflate or not, and whether the stablecoin will remain unregulated.

However, in the meantime, stablecoins remain a very popular and growing cryptocurrency that offers many benefits to traders.

Please check Huobi official website or contact the customer support with regard to the latest information and more accurate details.

Huobi official website is here.

Please click "Introduction of Huobi", if you want to know the details and the company information of Huobi.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...