An introductory guide for beginners on how to trade USDT-settled futures contracts on the Bitrue platform, covering the basics, funding, trading mechanics, and risk management.

Bitrue allows trading of over 100 USDT perpetual futures pairs, and we’ve created a helpful guide to help newcomers grasp the essentials of futures contracts.

This guide presumes you have a basic understanding of cryptocurrency and focuses on introducing new concepts specific to futures trading.

Account Funding

To trade futures, you must first fund your futures account, which is separate from your regular account. This segregation helps determine the amount you’re willing to risk, which affects the margins on your trades. Remember to only transfer funds you’re prepared to lose, as futures trading carries higher risks than standard cryptocurrency trading.

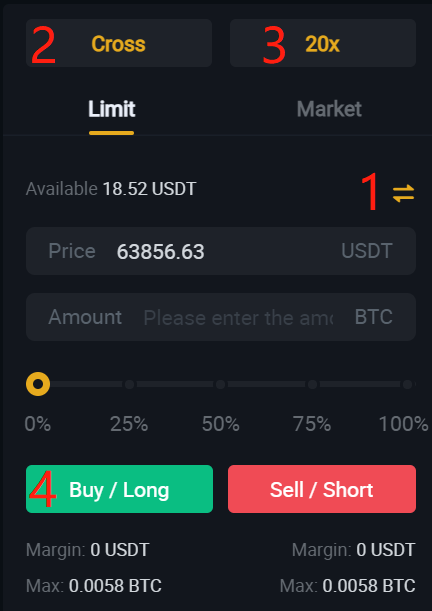

On the trading interface’s right side, find the two-arrow icon to start the funding process, allowing USDT transfer between your current and futures accounts. To purchase a USDT perpetual contract, choose your desired coin pair (e.g., BTC/USDT) and input your purchase details.

Go to Bitrue’s Official Website

Margin Modes

Bitrue offers Cross and Isolated margin modes. Cross margin utilizes all available funds in your futures account, including unrealized profits from open positions. Conversely, Isolated margin only employs an initial amount specified by you.

Leverage Multiples

Leverage in USDT perpetual contracts enables multiplication of profits and losses. For instance, with 3x leverage, a $1 increase in the underlying asset’s value results in a $3 gain, while a $1 decrease leads to a $3 loss. The maximum leverage depends on your chosen asset and position size, with larger positions having access to smaller leverage multiples to minimize significant losses.

Long/Short Positions

Perpetual contracts offer long and short positions, unlike traditional spot trading. Buying long indicates your belief that the asset’s value will rise, with leverage multiplying your profits. However, falling asset value will result in multiplied losses. Buying short, on the other hand, signifies your expectation of a decrease in asset value, leading to profits when the value falls and losses when it rises.

After opening your position, familiarize yourself with other essential concepts in futures trading.

Invest in Bitrue’s USDT Futures

Funding Rate and Countdown Timer

The trading interface displays a Funding Rate and Countdown timer, which helps ensure contract prices align with the underlying asset. When the timer reaches zero, users with open positions are assessed for the percentage fee listed. Long positions pay the fee to short position holders if the contract price exceeds the underlying asset’s price, and vice versa. Funding fees are collected every 8 hours at 00:00, 08:00, and 16:00 UTC, calculated as follows:

Fee = Position quantity * Value * Mark price * Capital expense rate

These fees are user-to-user, with Bitrue not collecting any.

Mark Price

Mark Price, a modified version of the contract’s actual price, is more resistant to sudden changes and high volatility, preventing unexpected liquidations due to abnormal events. It’s calculated using the median value from Latest Price, Reasonable Price, and Moving Average Price.

Index Price

Index Price represents the contract’s value across multiple market locations, including Bitrue, making price manipulation difficult for malicious attackers who can’t affect multiple locations simultaneously.

Ladder Reduction

If a position reaches an unacceptable loss based on available margin, it may undergo partial liquidation rather than complete liquidation through a tiered ladder system. This protects individual users’ positions and overall market health by preventing large chain reaction liquidations.

Partial liquidations occur until the margin is sufficient for the maintenance margin rate. The related formulas are:

Initial margin = Position value / leverage

Maintenance margin = Position value * Current tiered maintenance margin rate

Invest in Bitrue’s USDT Futures

Maintenance Margin Rate

Maintenance Margin Rate is the minimum margin rate required to keep a position open. If the margin rate drops below this threshold, Bitrue’s systems will liquidate or reduce the position.

Take Profit/Stop Loss

Bitrue enables automatic setup of price points at which the platform will sell all or part of a position when the asset’s mark price reaches a specific value, similar to Trigger Orders in spot trading. After opening a position, locate the TP/SL button in the Positions tab to enter your order details, including trigger price, trade type (limit or market), and the portion of holdings to sell.

Example:

For a long BTC/USDT position with an opening price of 25,000 USDT:

A stop-limit order with a 30,000 USDT trigger price will automatically close the position when the mark price reaches 30,000 USDT.

A stop-loss order with a 20,000 USDT trigger price will automatically close the position when the mark price reaches 20,000 USDT.

Unrealized Profit and Loss

To calculate the current profit or loss on a position, subtract the purchase price from the current price and multiply by the chosen leverage. This value, called Unrealized PnL, represents the change in your overall portfolio value if you closed the position immediately.

Go to Bitrue’s Official Website

Please check Bitrue official website or contact the customer support with regard to the latest information and more accurate details.

Bitrue official website is here.

Please click "Introduction of Bitrue", if you want to know the details and the company information of Bitrue.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...