The Solana-based NFT marketplace has raised $130 million in a funding round with a valuation of $1.6 billion.

Magic Eden, the leading NFT platform on Solana, is gearing up for multi-chain scaling. The Solana-based NFT marketplace platform has successfully raised $130 million in a new funding round at a post-money valuation of $1.6 billion. After the financing, Magic Eden said that in addition to pushing boundaries in the gaming vertical, it also plans to invest in other blockchains to strengthen support for NFTs. With its current market share of over 90% in Solana’s NFT secondary market, once Magic Eden successfully integrates with other platforms, it may have the strength to challenge OpenSea’s dominance.

On Tuesday, U.S. stocks rebounded strongly after last week’s rout, and the main cryptocurrency market also rose slightly. BTC rose for the third day in a row, successfully establishing support above the $21,000 mark. However, the largest cryptocurrency by market capitalization was down slightly in early Asian trading on Wednesday, but for the past 24 hours it has generally seen a slight uptick and is now consolidating around the $20,300 mark. BTC’s current major resistance is near the $21-21,200 area. Once the breakout of this resistance zone fails, BTC is likely to pull back again and retest support in the $20,000 area.

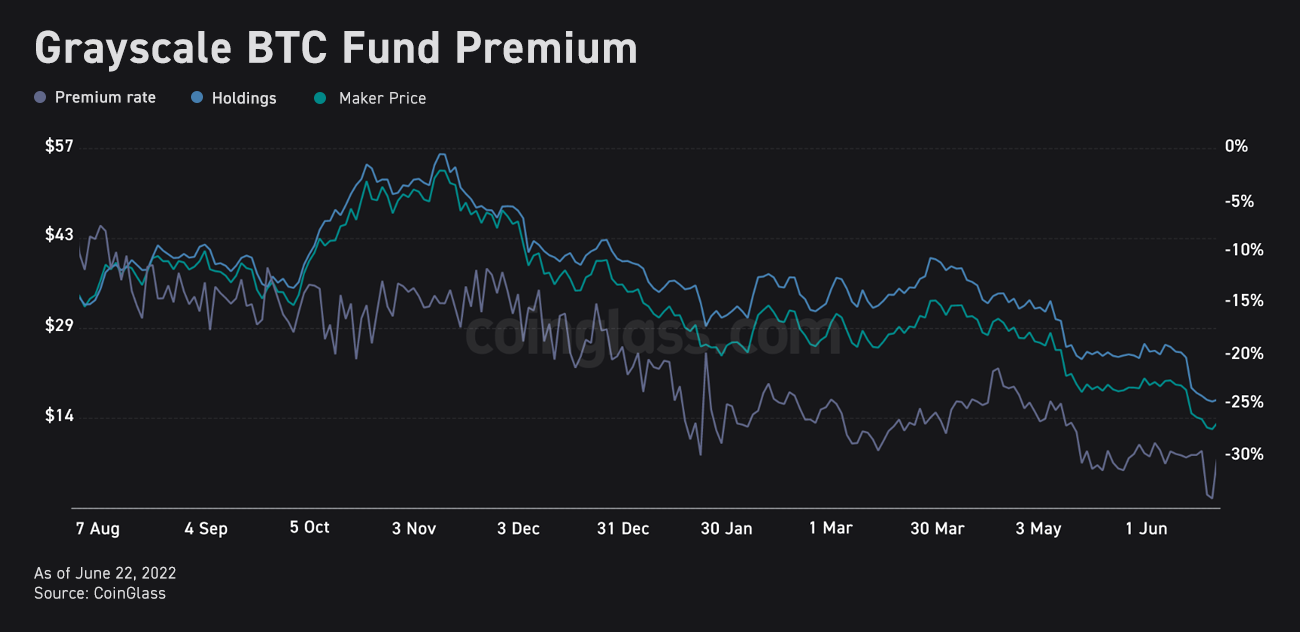

Under the pressure of multiple liquidity crises and debt liquidation, this rebound made the market seem to have seen the dawn of recovery. But some analysts are pessimistic about the continuation of the current rally. It also drew attention to the quiet rise in market volatility due to aggressive dip-hunting and a deteriorating macro situation. In addition, the liquidity risk contagion crisis affecting the entire market has not yet subsided. On the one hand, the Grayscale Bitcoin Fund (GBTC) has seen its net asset value plummet since the Three Arrows Capital storm. At one point, the fund was trading at a 34% discount, dropping its value to an all-time low. On the other hand, bid-ask spreads on major centralized exchanges have reached new highs, indicating that liquidity continues to exit the market.

Similar to BTC, ETH experienced a more severe downside correction on Wednesday. The second-largest cryptocurrency by market cap is now below the $1,100 mark after losing 2.4% in value over the same period. Many large and mid-cap altcoins turned up and down, with the exception of canine-inspired meme coins and Uniswap. The former rose on the back of the latest rumors related to the Twitter acquisition, while the latter surged 7% after Uniswap Labs acquired the NFT aggregation platform.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...