Paypal now accepts Cryptocurrency transfer

Payments giant PayPal has launched a much-anticipated cryptocurrency feature that allows users to transfer cryptocurrencies between PayPal and other wallets and exchanges. PayPal users can now send platform-supported digital assets, namely BTC, ETH, BCH, and LTC, to external addresses, including those associated with exchange accounts and cold wallets. Since its first cryptocurrency feature in late 2020, PayPal has made steady progress toward its goal of building a “more inclusive and efficient financial system.”

The main cryptocurrency market rallied late Tuesday when two U.S. senators unveiled a cryptocurrency bill that finally gave birth to the much-anticipated regulatory framework. The crypto community on Twitter sees the bill as being more friendly to the crypto community. The bill also proposes that the Commodity Futures Trading Commission (CFTC) take over from the U.S. Securities and Exchange Commission (SEC) with most of the regulatory responsibilities for the crypto industry. However, investors mired in stagflation anxiety, coupled with ongoing geopolitical turmoil, saw sharp swings in early Asian trade on Wednesday. BTC briefly recaptured $31,000 before falling back below key psychological support at $30,000. At the time of writing, BTC is up 3.4% in the past 24 hours and has now climbed back above the $30,000 mark. ETH remains in step with BTC, returning to above $1,800 after a 3% gain over the same period, but has yet to gain a foothold. Major non-major coins also largely turned from losses to gains, with many large and mid-cap coins returning to their earlier prices.

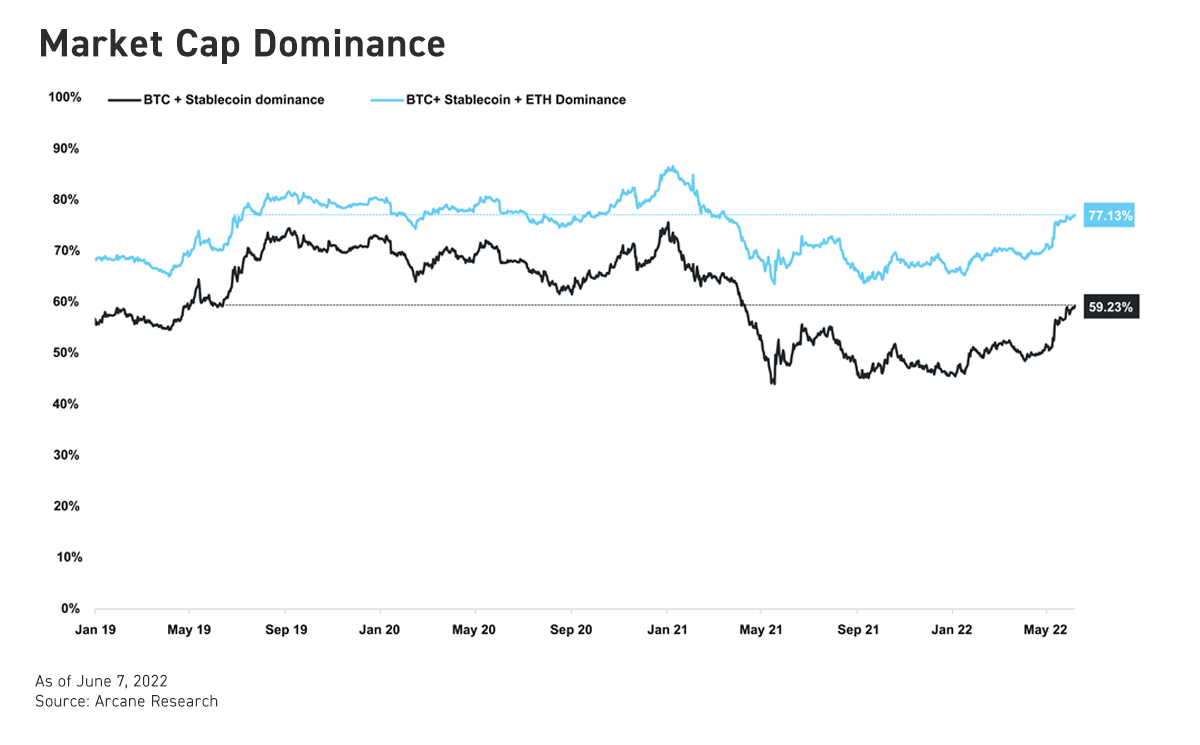

Meanwhile, BTC’s market cap dominance continues to rise, with the latest reading at 46.13%, a level last reached in October 2021. The combined dominance of BTC plus major stablecoins, the risk-averse fire product in the cryptocurrency market, has followed a similar trend. The current combined dominance of 59.2% has reached a 16-month high, but it is still a little short of the average dominance during the summer DeFi boom of 2020.

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...