Recently, Phantom, the popular wallet on the Solana blockchain, introduced NFT destruction and improved phishing alerts as part of its efforts to combat wallet spam NFTs. While the number of NFTs on Solana is growing rapidly, the problem of fraud has inevitably arisen. Among them, the more and more attack methods used by scammers are spam NFTs. Scammers take advantage of Solana’s low fees to send junk NFTs to wallets. Users of these wallets can be attacked after inadvertently clicking on a link in the collection’s description, which often induces users to “mint” or “claim” new NFTs. Through the NFT destruction function, users are free to delete any junk NFT and will receive a small amount of SOL as a reward. In addition, Phantom is also working to build an open-source block list of malicious NFT collections that alerts users to potential threats.

The Nasdaq 100 fell 1.21% overnight, and the main cryptocurrency market also turned gains to losses. The minutes of the Fed’s July meeting released on Wednesday showed that the Fed will continue to raise interest rates as inflation shows no sign of cooling. The Nasdaq 100 index charted in favor of bears, with technical indicators in overbought territory and the cryptocurrency’s upward momentum undermined. At the time of writing, BTC is trading at $23,500 after losing 2.5% over the past 24 hours. The largest cryptocurrency by market capitalization has fallen below the 20-day moving average (EMA), and the trend is likely to turn bearish. The next level of strong support will be the 50-day EMA at $22,200, and only when the price bounces back to $25,000 will the bulls regain the upper hand.

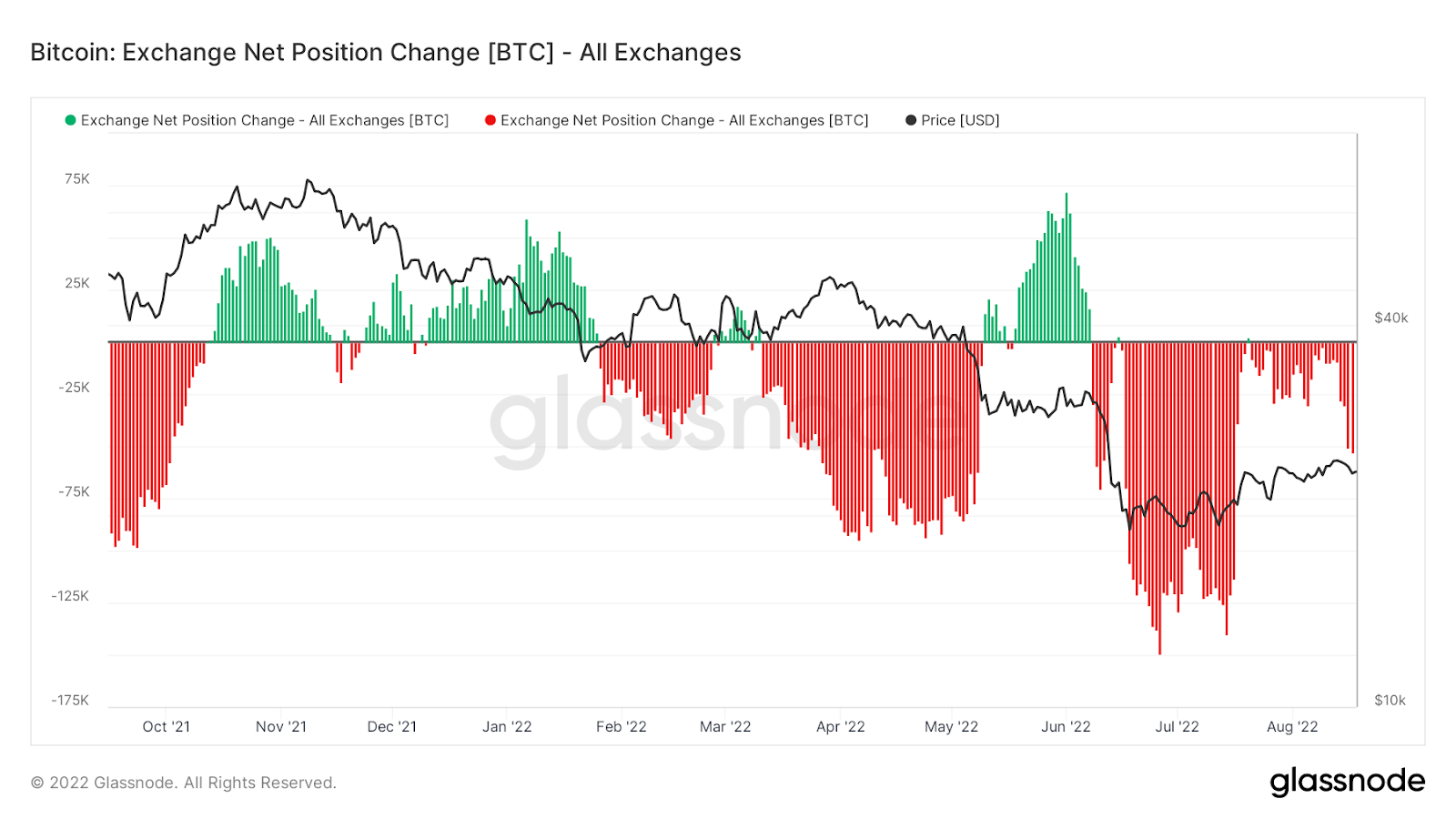

Meanwhile, BTC exchange balances have continued to decline since the trend formed in mid-June. If history is any guide, the continuous outflow of funds from exchanges is largely a positive sign, revealing the structural accumulation behavior of investors.

Similar to BTC, ETH is down 2.6% over the past 24 hours, falling below the $2,000 psychological barrier and trading at $1,850 at the time of writing. Most of the major non-mainstream coins are also in a downward trend, with SOL and AVAX leading the decline, down 7.2% and 6.5% respectively. Interestingly, there was a lively discussion among investors about “whether the recent meme coin rally is a sign of a market top”, with more people arguing that the rally was driven by good news rather than a speculative boom.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...