Another stablecoin lost its peg over the weekend.

aUSD depegged from the $1 mark

Just this past weekend, another stablecoin decoupled. Polkadot and Kusama’s decentralized stablecoin aUSD was decoupled from the U.S. dollar due to a bug in the support protocol Acala Network, which once fell from $1 to $0.58. According to Acala’s tweet, the team has determined that the source of the problem is a “misconfiguration of the iBTC/aUSD liquidity pool”, which in turn caused the system to incorrectly mint a large amount of aUSD. The Acala team confirmed that the configuration error has been corrected, and an on-chain investigation is underway with the goal of identifying the affected addresses.

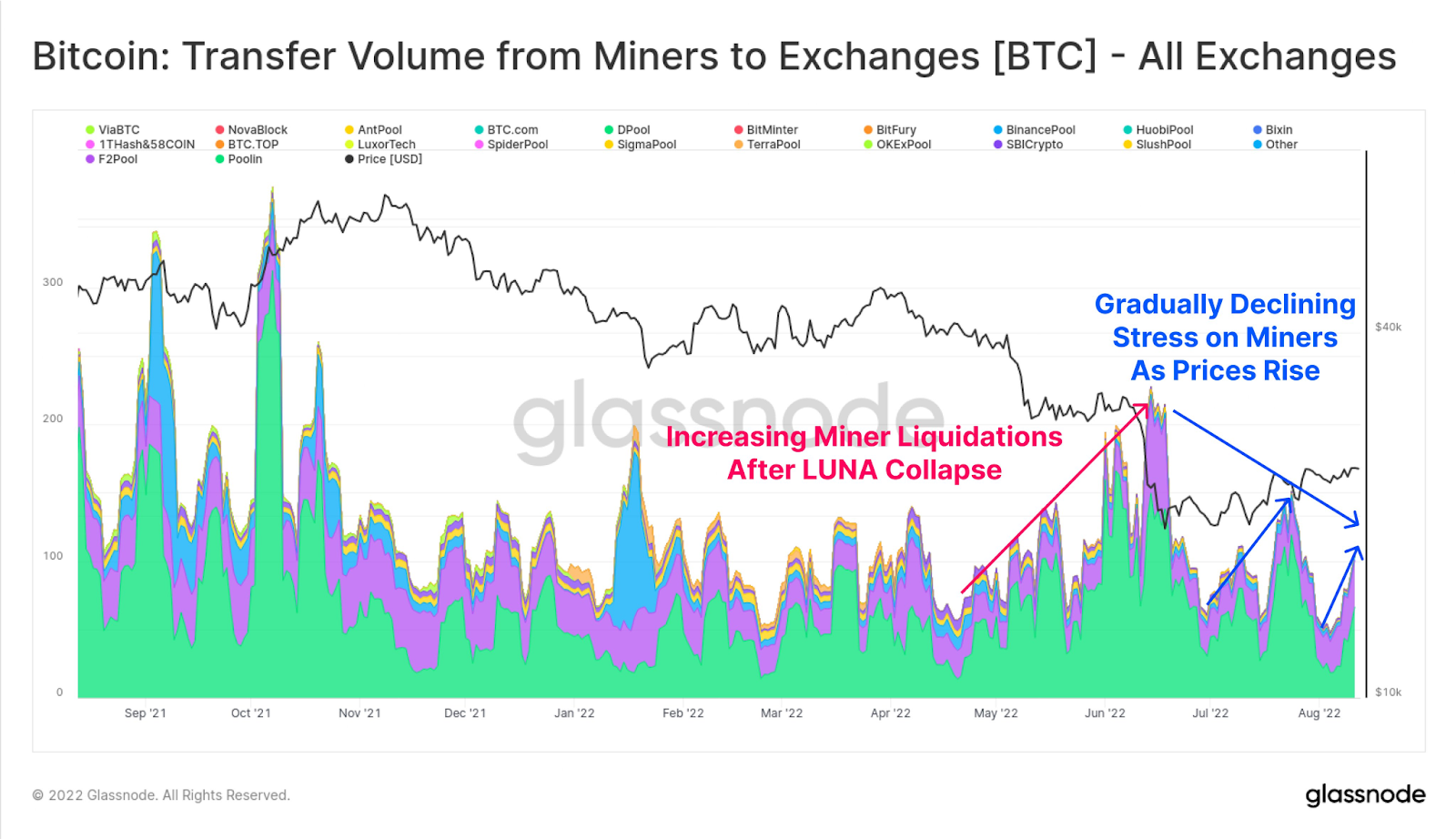

Over the weekend, the main cryptocurrency market was largely sideways with thin trading. BTC breached the $25,000 mark, reaching a local peak near $25,045 before pulling back to consolidate at the previous support level. At the time of writing, the largest cryptocurrency by market capitalization has gained 1.2% in the past 24 hours and is currently in the high $24,000 range. A key bullish trend line is forming with support near $24,400 on the hourly chart of BTC. With the exponentially smoothed moving average (MACD) gaining pace in bullish territory on the hourly chart, the bulls are likely to drive a stronger upward momentum if BTC manages to close above the key $25,000 resistance zone. Meanwhile, transfers from miners to exchanges have fallen sharply over the past few weeks, suggesting that selling pressure has eased despite continued pressure from miners to support mining operations.

Similar to BTC, ETH surged above the psychological $2,000 mark over the weekend before retreating to consolidate around the $1,980 range. Lido’s staked ETH is still trading at a small discount to ETH as The Merge upgrade nears, but the spread appears to be gradually narrowing. The performance of major non-mainstream coins was mixed, with the meme coin Shiba Inucoin topping the gainer list with an astonishing 30% gain over the past 24 hours.

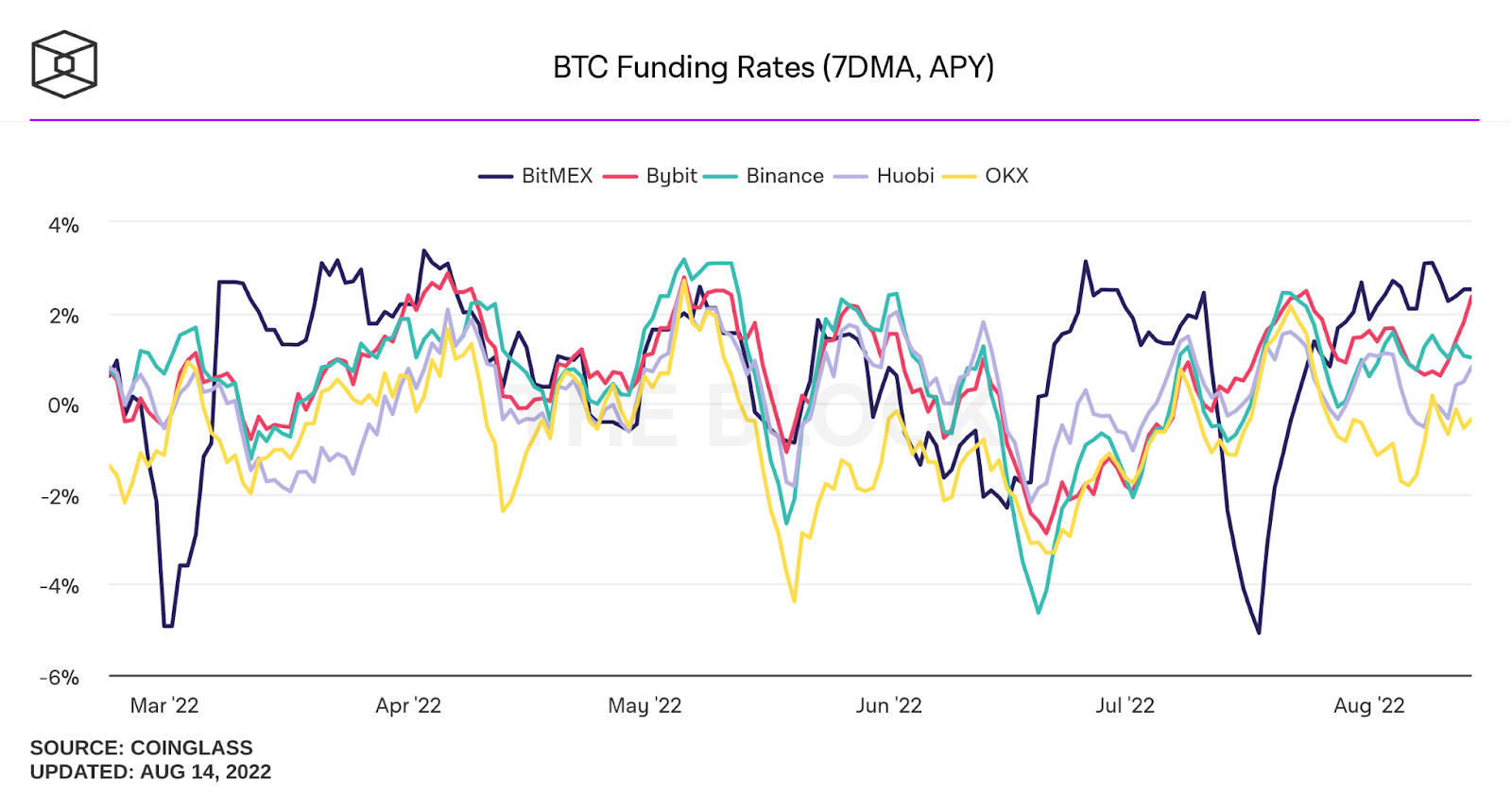

Favorable macro data last week brought some long-awaited turnarounds for the market, with expectations of a contraction in inflation returning some positive sentiment in risk asset markets. The decline in the number of BTC perpetual swap contracts with negative funding rates reflects growing confidence in a market driven by alternatives. Upside demand in the futures market has increased as the number of open interest surged and the basis widened. September’s The Merge upgrade was seen as a major catalyst, as evidenced by ETH options open interest hitting new highs and investors willing to drop real money on this exposure.

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...