At the Ethereum Community Conference (EthCC) on Tuesday, Polygon announced the launch of the expansion solution Polygon zkEVM, which aims to reduce transaction costs and improve scalability, which can be called a “great leap forward” in the field of zero-knowledge (ZK) technology.

According to a press release, the Polygon team describes zkEVM as “the first Ethereum-equivalent scaling solution that works seamlessly with all existing smart contracts, development tools, and wallets.”

Many had expected a fully functional zk rollup solution to be years away, but the Polygon team says the zkEVM testnet will go live this summer, while the mainnet is expected to launch in early 2023.

The multi-day rally in the cryptocurrency market stalled for the time being as U.S. stocks pared losses on Wednesday.

This week has been Bitcoin’s best week since March this year.

BTC attempted unsuccessfully to rise above the 50-day simple moving average near $24,800, before pulling back to just below $23,000.

At the time of writing, BTC is currently consolidating above $22,800 after losing 2% of its market cap over the past 24 hours.

The largest cryptocurrency by market cap is facing overhead resistance in the $23,200-$23,700 range. Should an attempt to break out of the range fail, BTC could test support near $22,200.

ETH is down 4.7% over the same period and is now just below the $1,500 mark.

An ascending channel is forming with support near $1,480 on the hourly chart of ETH, a key support line to watch if ETH fails to break above major resistance near $1,560 next.

Major non-mainstream coins are currently in a downtrend, with FLOW leading the downward correction with a double-digit percentage drop over the same period.

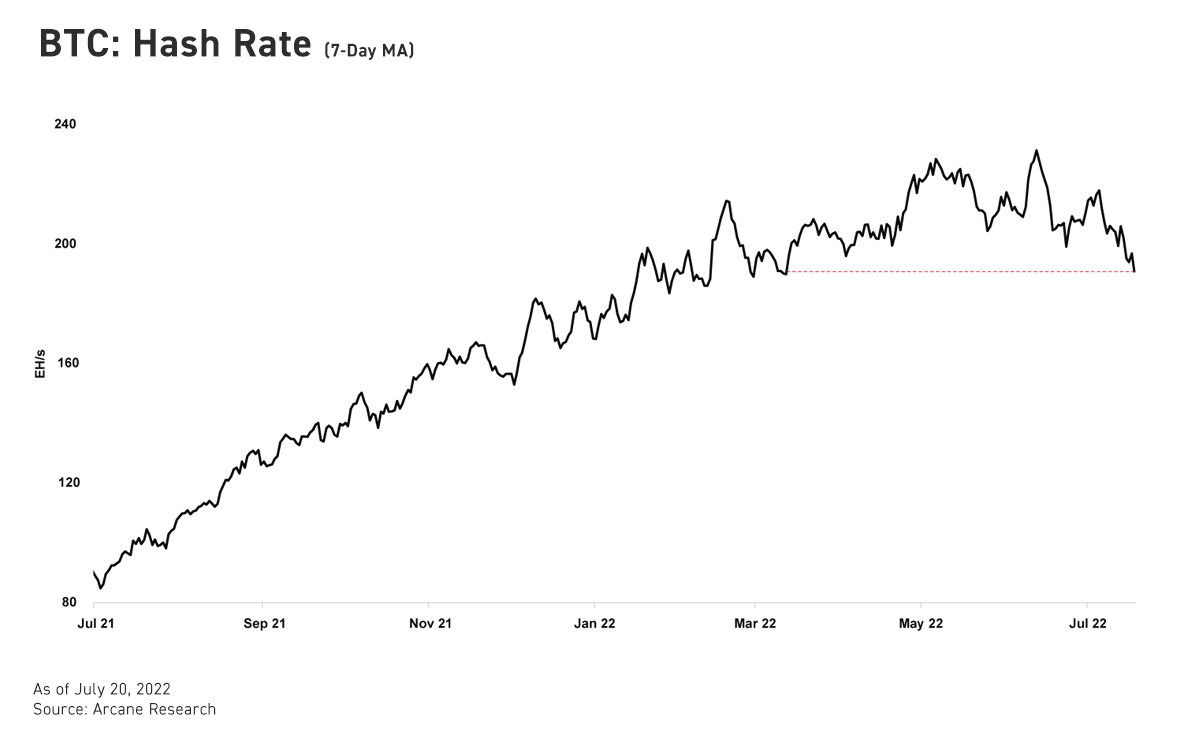

Meanwhile, in the mining sector, BTC’s hash rate continued to decline, which may have led to a third consecutive reduction in mining difficulty on Thursday.

The upcoming difficulty adjustment is expected to be revised down by 5.9%, the biggest drop since July 2021, when hashrate plummeted due to an exodus of Chinese BTC miners.

Comment by cryptoloversofxm

February 19, 2025

I just saw that XMTrading now supports cryptocurrency deposits and withdrawals. No fees, instant transactions, and up to $30K per month. Each deposit gets a unique wallet addres...