ProShares, a provider of exchange-traded index funds (ETFs), has announced a new product that allows investors to hedge against cryptocurrency exposure in bear markets.

ProShares introduces a new product

ProShares, a provider of exchange-traded index funds (ETFs), has announced a new product that allows investors to hedge against cryptocurrency exposure in bear markets. The first U.S. ETF to short bitcoin futures, the ProShares Short BTC Strategy ETF, is scheduled to launch on the New York Stock Exchange later today under the symbol BITI. The product is designed to provide investors with an opportunity to profit from falling BTC spot prices during a bear market. Notably, the company launched the new product just eight months after launching its first BTC futures-backed ETF in November 2021.

The main cryptocurrency market was busy consolidating gains on Monday, with BTC continuing to trade in a tight range after gaining a foothold above the key psychological support level of $20,000 and the 100-hour moving average. At the time of writing, the largest cryptocurrency by market cap is now just below the $21,000 mark after gaining 4% over the past 24 hours. A connecting bullish trend line is forming on the hourly chart of BTC with support near $20,700 and immediate overhead resistance in the $21,000 area. If BTC can break through this resistance level in one fell swoop, it may help accelerate its rise. Conversely, if BTC fails to break the $21,000 resistance, it may retest the $20,000 support.

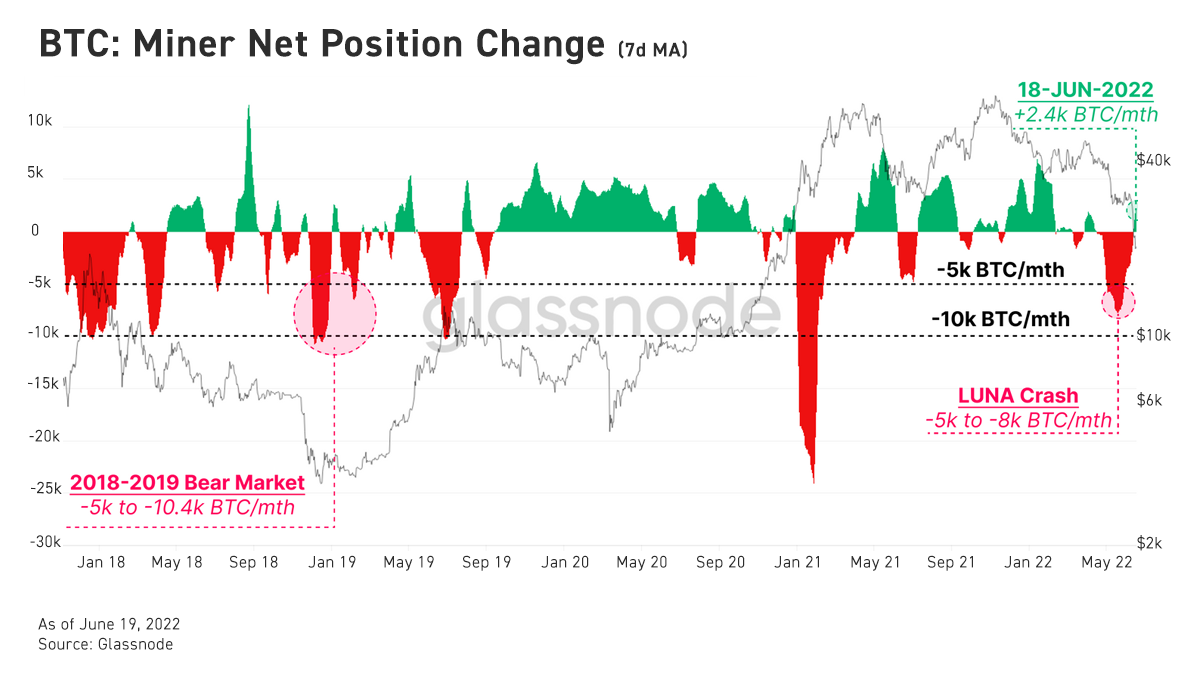

Due to the recent liquidity crisis, the vast majority of miners have faced considerable financial pressure, resulting in a massive outflow of their Bitcoin reserves on a scale comparable to the capitulation sell-off during the 2018-2019 bear market. Fortunately, after the weekend sell-off, miners stopped selling and returned to the accumulation phase, and their account balances also gradually increased at a rate of 2,200 BTC per month.

Similar to BTC, ETH is now gaining a foothold above $1,100 after jumping 6% over the same period. Most major altcoins also rose, with SOL and MATIC leading the pack with double-digit percentage gains over the same period.

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.

Comment by cryptoloversofxm

February 19, 2025

I just saw that XMTrading now supports cryptocurrency deposits and withdrawals. No fees, instant transactions, and up to $30K per month. Each deposit gets a unique wallet addres...