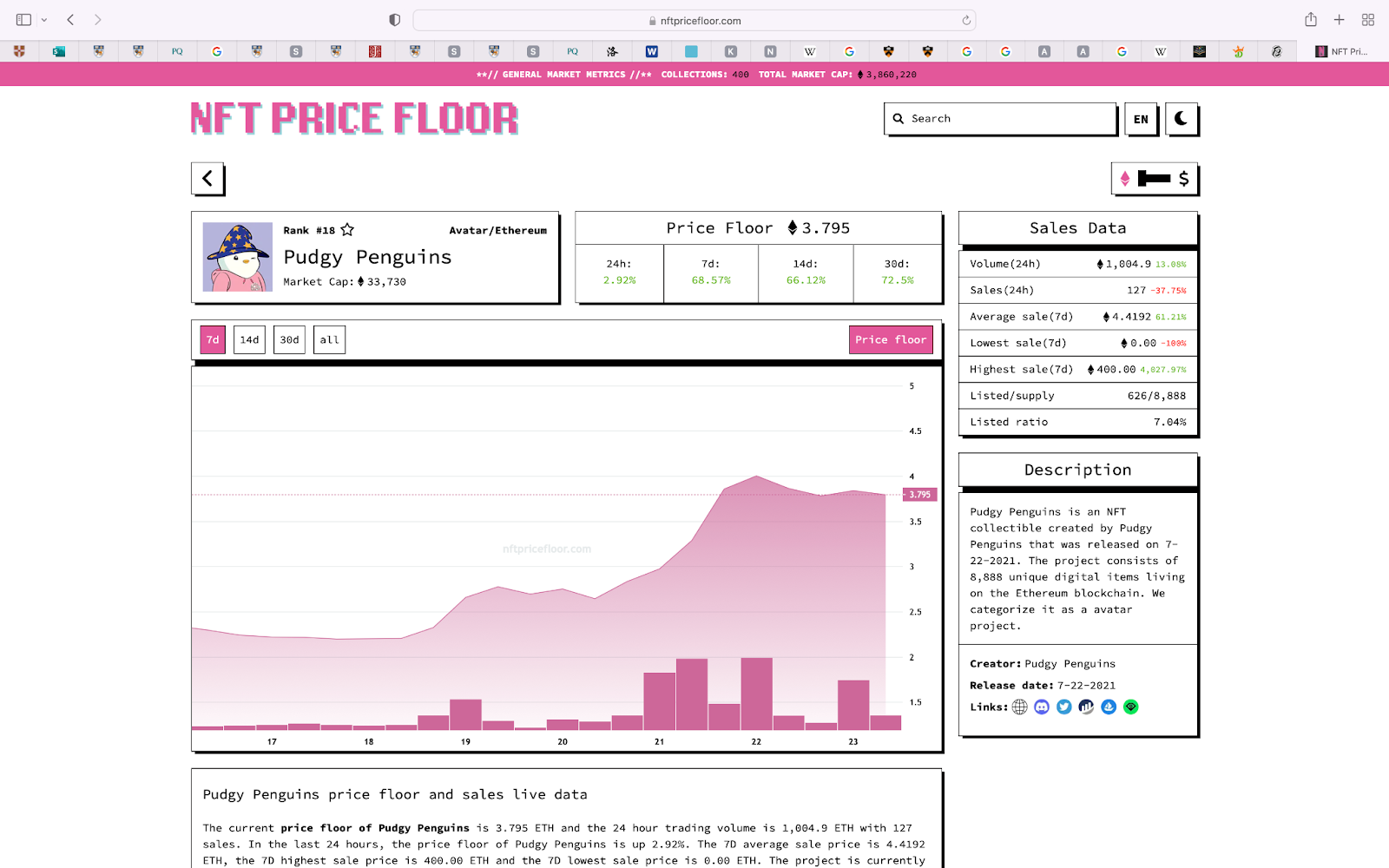

Pudgy Penguins Floor Price Triples

Pudgy Penguins put a lot of effort into launching its own marketplace platform and expanding the brand’s reach, and it’s now paying off. The collection’s floor price has tripled in the past few weeks, a bittersweet event after it was mired in an alleged “leek-cutting” scam earlier this year. Over the weekend, the NFT collection continued to be hot and prices climbed after Pudgy Penguins announced the hiring of tech industry heavyweights and executives to their advisory board. Pudgy Penguins’ rarest penguin sold for 400 ETH on Monday, the highest transaction record for the collection to date.

“Risk assets continued to fall as investors brace for possible hawkish policy from Fed officials later in the week. As earnings season draws to a close, the stock market’s wild rush since June is losing steam. Major tech stock indexes underperformed as U.S. Treasury yields soared above 3%. Crypto markets’ relief rally came to an abrupt end as bearish sentiment resurfaced. BTC found support near $20,700 in recent sell-off and managed to stay above the $21,000 mark on Monday. The largest cryptocurrency by market cap has dipped slightly over the past 24 hours at the time of writing and is now sitting below $21,500. However, BTC’s price has recovered at 100 hours The simple moving average and the $21,500-$22,000 range are facing major hurdles. If the bears continue to be active in the range, BTC could drop to the previous support around $20,800.

ETH breached $1,600 after gaining 1.3% over the same period, showing the potential to enter an early recovery phase. In derivatives markets, ETH open interest fell to a one-month low, but long positions remained in the lower range, suggesting that The Merge upgrade remains a key driver of the current bullish sentiment. Most major altcoins were mixed, with ETC and EOS surging on news of The Merge upgrade and hard fork, while other altcoins struggled to shake off last week’s slump.

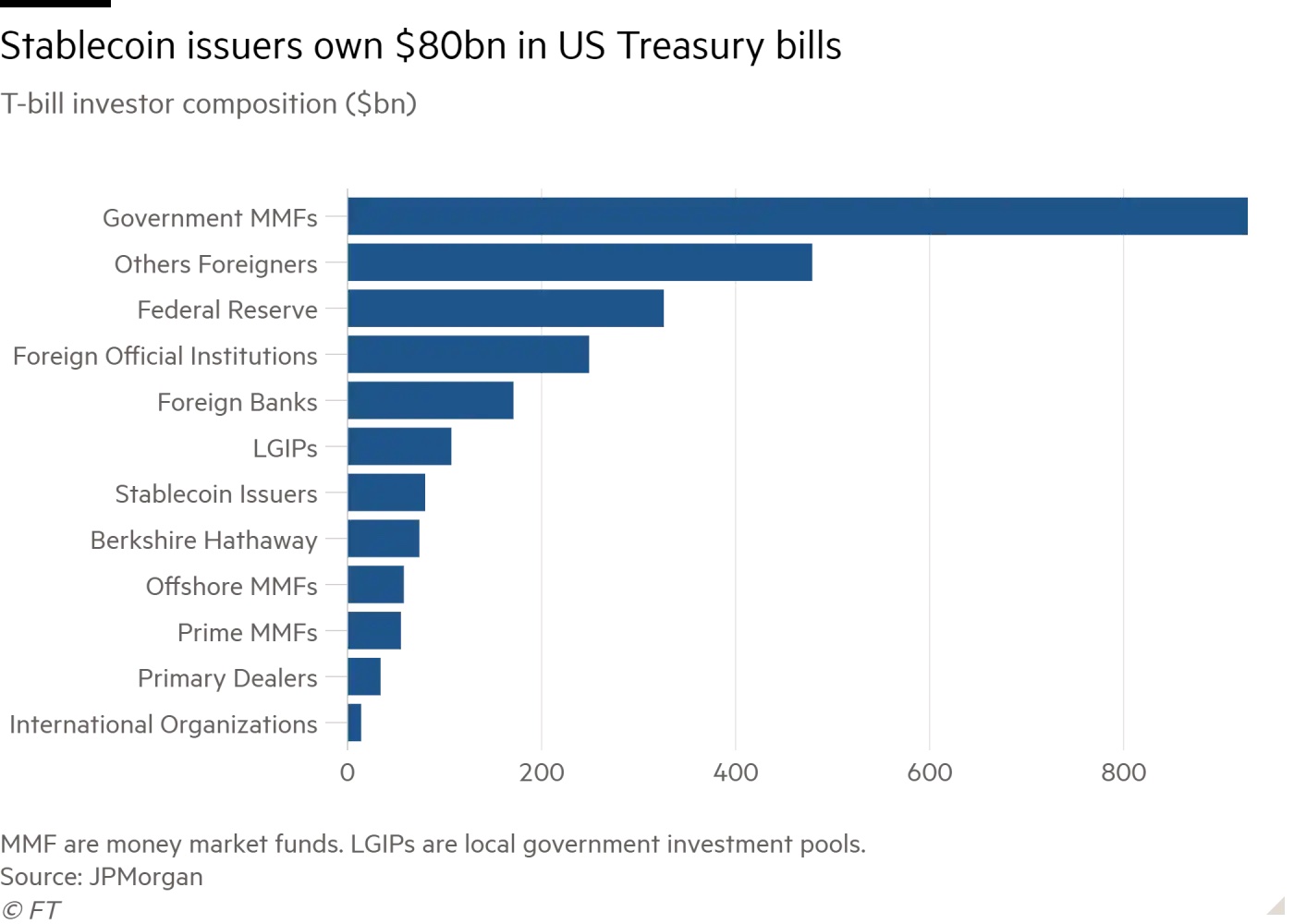

On the other hand, top stablecoin issuers are emerging in a field historically dominated by traditional players with more conservative risk appetites. Tether and other stablecoin issuers now hold $80 billion worth of short-term U.S. Treasuries, a 2 percent market share, and already hold more Treasury bills than investment giant Berkshire Hathaway. The growing role of digital asset players in traditional financial markets points to greater opportunities ahead, along with tightening regulatory scrutiny.

In the cryptocurrency space, the Uniswap vault value has grown by 59% in the market turmoil since April this year, reaching a staggering $3.9 billion. BitDAO is close behind, with vaults worth $1.4 billion. “

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...