A step-by-step guide on how to trade both spot and futures markets on CoinEx, covering account registration, asset deposit, spot trading, futures trading, and risk management.

How to trade Spot on CoinEx?

Spot trading on CoinEx involves directly exchanging one cryptocurrency for another. For instance, when using USDT to value CET, a CET/USDT trading pair is formed. Transactions are matched based on price and time priority, enabling direct exchanges between digital currencies.

CoinEx users can pay transaction fees using an equivalent amount of CET and enjoy special fee discounts. Additionally, users holding a specific amount of CET can become CoinEx VIPs.

Here is a beginner’s guide on how to conduct spot trading on CoinEX:

Go to CoinEx’s Official Website

I. Overview of the spot trading page

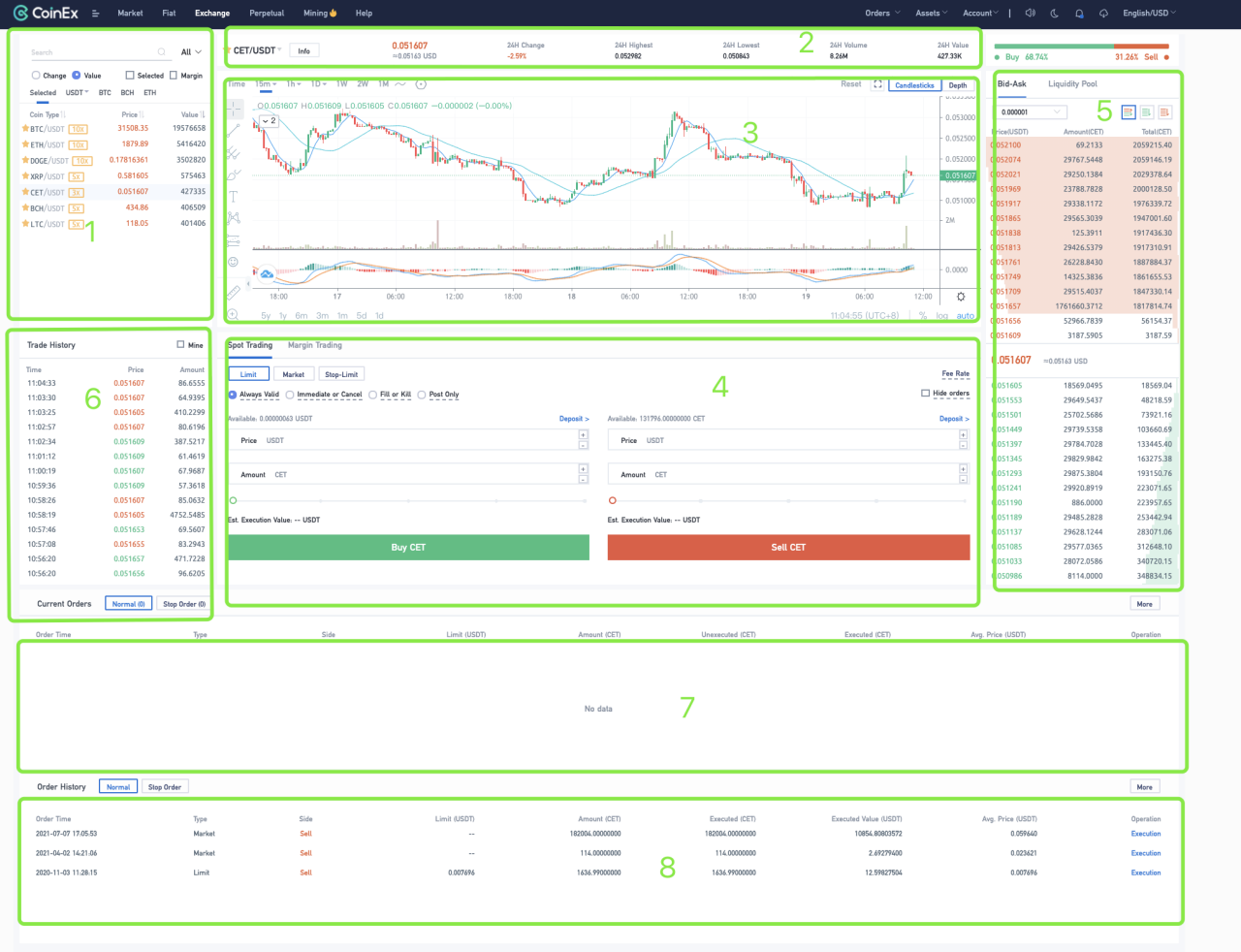

As displayed in the illustration:

- Search bar and market section

- Token and basic market data

- Candlestick and depth chart

- Market selection area

- Market handicap depth

- Latest transactions

- Current orders

- Order history

II. Conducting spot trading on CoinEx

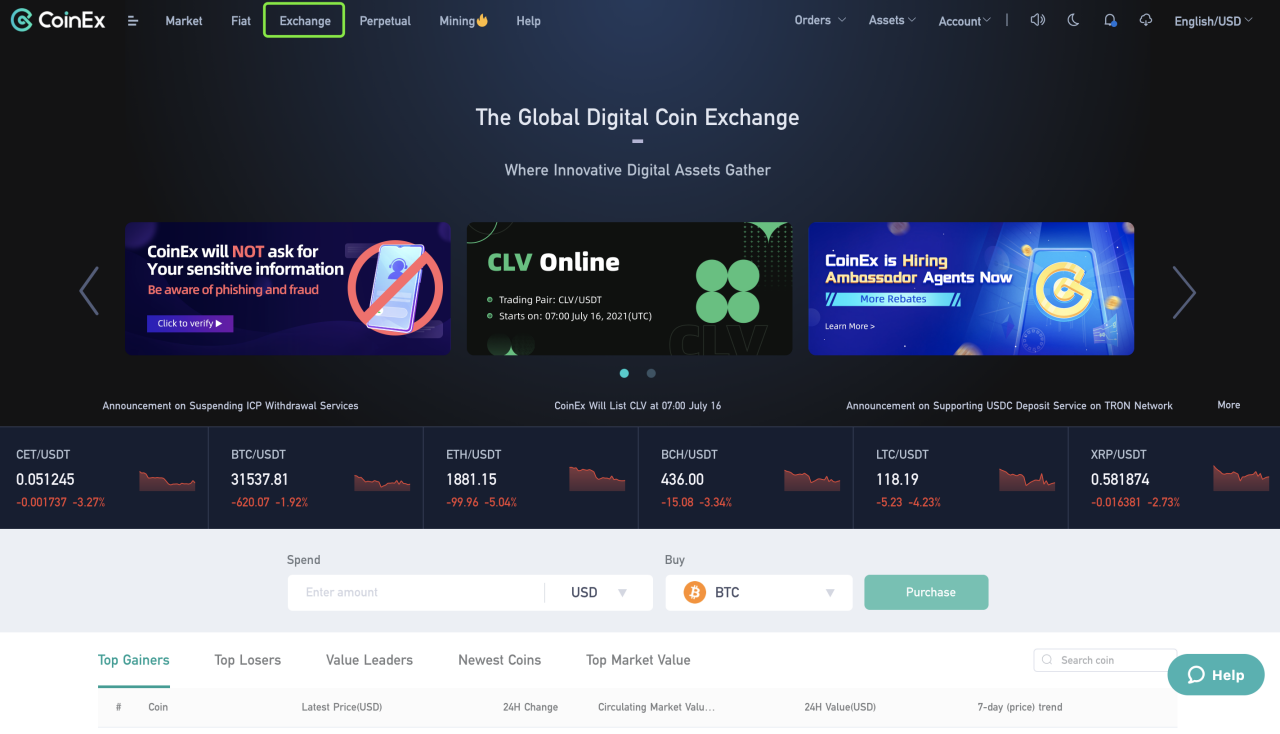

Go to the CoinEx website, log in, and click [Exchange] on the top navigation bar to access the spot trading section.

Taking the purchase/placement of a CET/USDT limit order as an example:

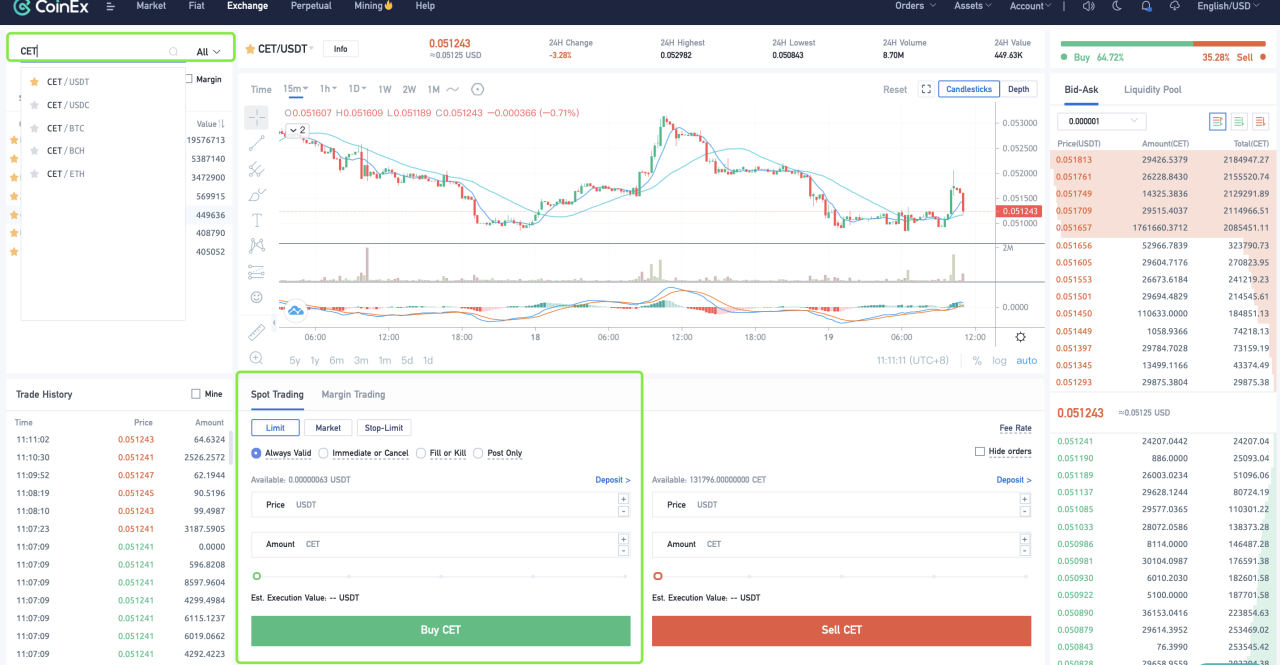

Search for CET, select [CET/USDT], click [Spot Trading], choose [Limit] type and [Always Valid] (default status). Set [Price] and [Amount]. Confirm the details and click [Buy CET];

(Your order will only be executed when the market price reaches your specified buying price.)

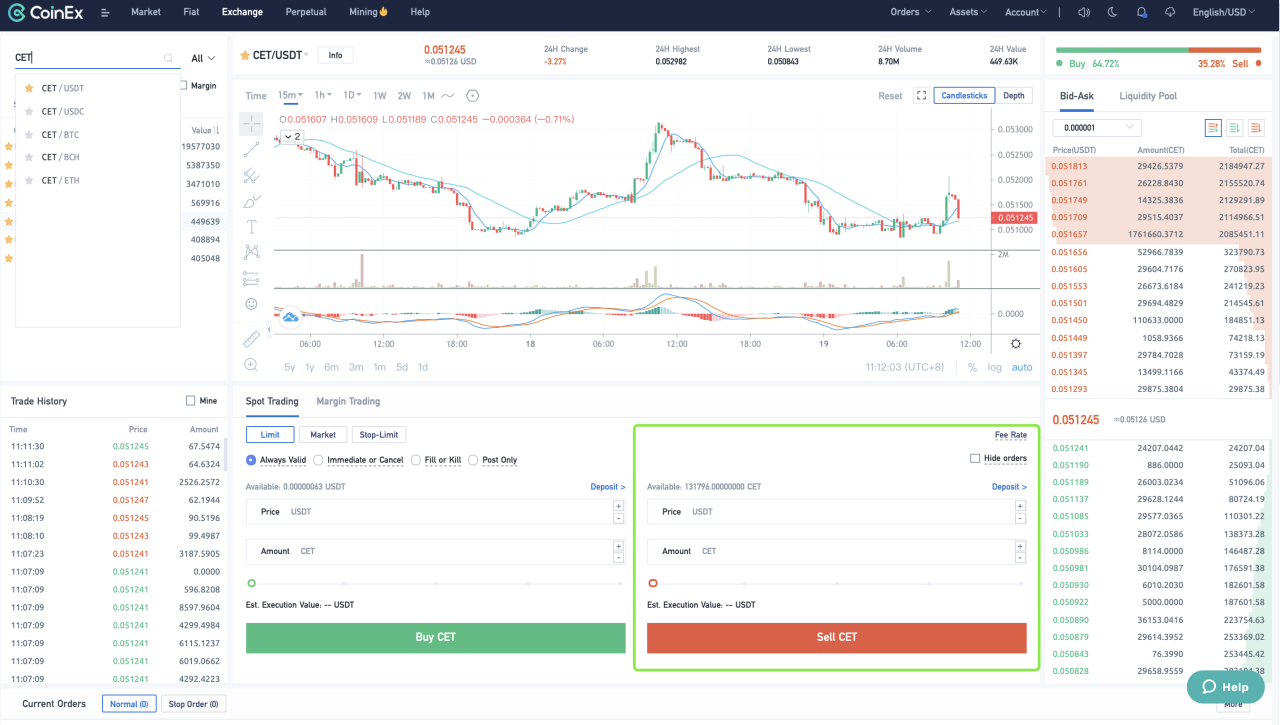

Using the sell/placement of a CET/USDT limit order as an example:

Choose [Spot Trading] market, [Limit] type, and [Always Valid] (default status). Set [Price] and [Amount]. Confirm the details and click [Sell CET];

Go to CoinEx’s Official Website

III. Using CET as Transaction Fees

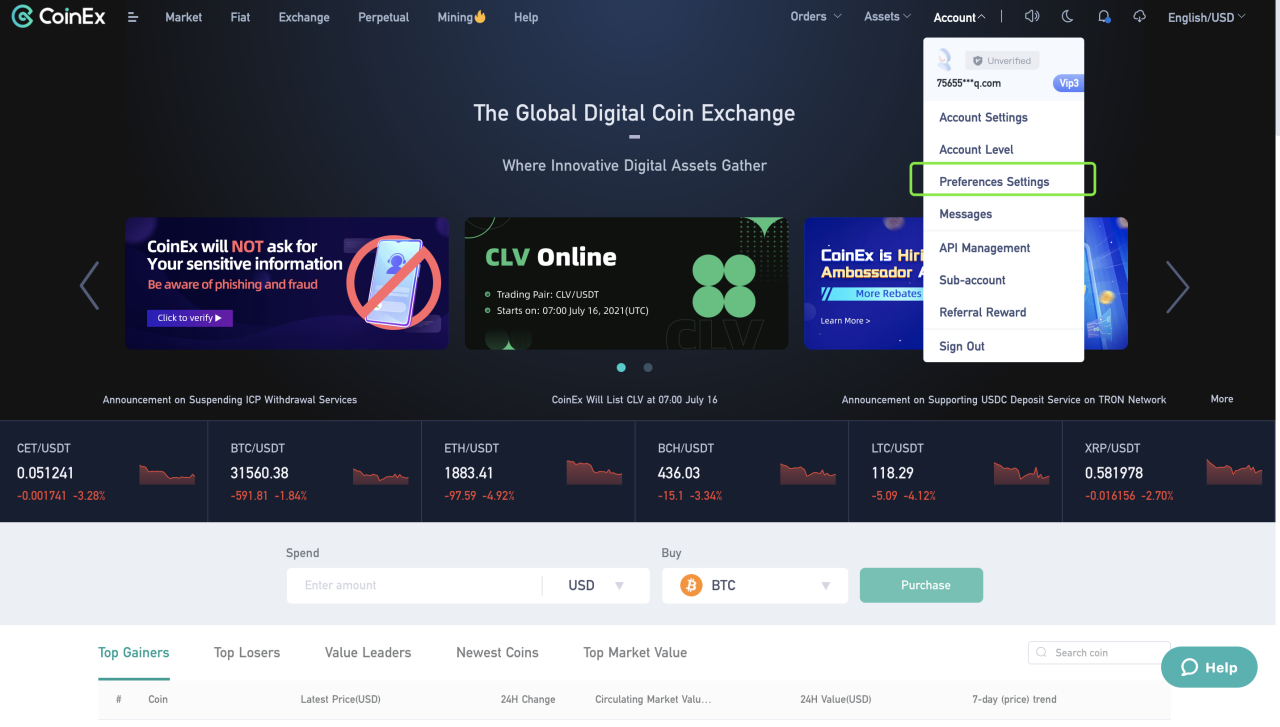

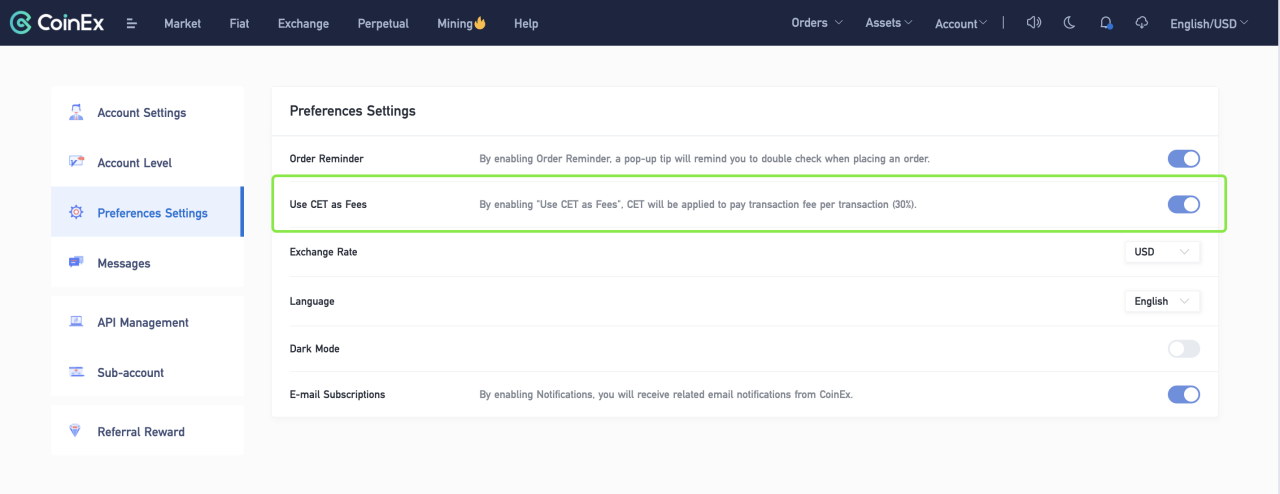

To use CET for transaction fees, click [Account] and select [Preferences Settings] from the drop-down menu.

Slide the button on the right to enable [Use CET as Fees]. CET will now be used to pay transaction fees for spot trading.

To become a top cryptocurrency investor, start with spot trading. Prepare your cryptos and get started!

How to Trade Futures on CoinEx?

Many crypto newcomers are drawn to the potential returns of futures trading but intimidated by its complexity. However, trading futures is not that difficult. This guide will provide easy, step-by-step instructions on trading futures on CoinEx. Make sure to read them if you plan to trade futures.

I. Initiating futures trading on CoinEx & Transferring assets to the Futures Account

Go to the CoinEx website, log in, and click [Futures] on the navigation bar.

If new to futures, carefully read [Risk Reminder], check [I have read and agree to accept the risks and liability.], and click [Confirm] to create a Futures Account;

![coinex read carefully [Risk Reminder], tick [I have read and agree to accept the risks and liability.]](https://mobie.io/wp-content/uploads/2023/05/coinex-read-carefully-Risk-Reminder-tick-I-have-read-and-agree-to-accept-the-risks-and-liability.png)

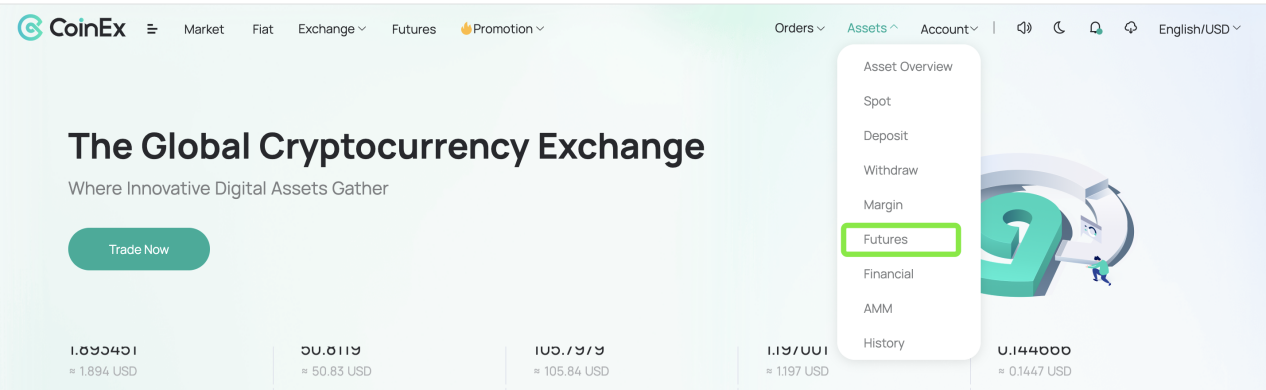

If your Futures Account balance is zero, transfer assets into the account before trading. Click [Assets] on the navigation bar, then [Futures] in the dropdown menu, followed by [Asset Transfer], and finally select a coin to transfer from [Spot] to [Futures];

Go to CoinEx’s Official Website

II. Choose the futures type, trading pair, and open/close a position

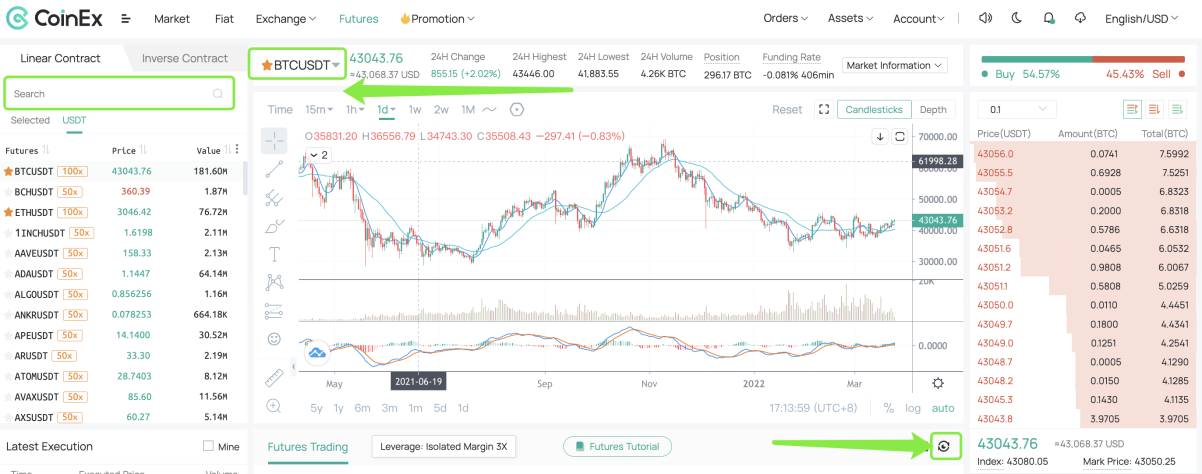

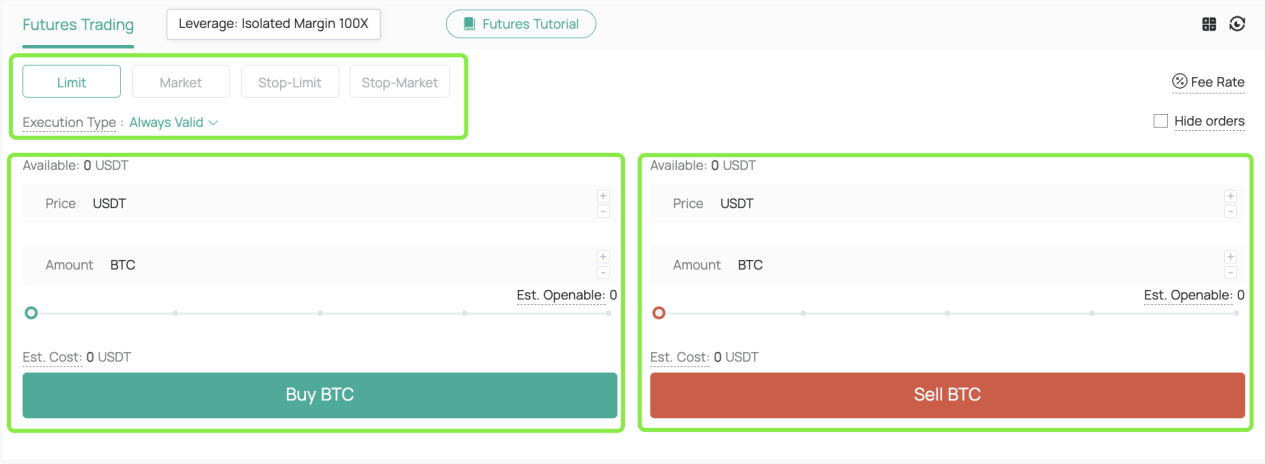

To start a long position in the BTC/USDT linear contract market on CoinEx, first select the futures type and trading pair. In this case, choose the linear contract and BTC/USDT.

Set the margin mode, leverage, and click [Confirm];

(PS: In Cross Margin Mode, the account’s entire available balance can serve as margin for the current position. In Isolated Margin Mode, only the account’s margin in the current market is used to maintain the position, with the option to manually increase the margin. Higher leverage ratios come with increased risk, so new futures traders are advised to select a lower leverage ratio.)

![Set the margin mode and the leverage, and click on [Confirm];](https://mobie.io/wp-content/uploads/2023/05/Set-the-margin-mode-and-the-leverage-and-click-on-Confirm.png)

3. If you anticipate that the BTC price will go up, you can buy long by entering the Price and Amount on the left side of the image below, and then click on [Buy BTC]. The order will be submitted to the market. If the current BTC price is 47,000 USDT and you expect it to reach 50,000 USDT, you can purchase 0.1 BTC at 47,000 USDT;

4. After the order is placed, you can view the position details in [Current Position]. When the BTC price reaches the expected value (50,000 USDT), you may [Close All] or [Close Position];

![coinex check information about the position in [Current Position]](https://mobie.io/wp-content/uploads/2023/05/coinex-check-information-about-the-position-in-Current-Position.png)

Additionally, you can set the liquidation price using the [Take-Profit & Stop-Loss] feature — your position will automatically close once the market price hits the specified price, effectively reducing associated risks.

It is important to note that CoinEx utilizes the Mark Price to determine a position’s PNL and liquidation price — forced liquidation occurs when the Mark Price reaches the liquidation price. To minimize the risk of forced liquidation, you can add more margin ahead of time.

Futures trading isn’t difficult, right? CoinEx now offers 100+ futures markets, allowing you to choose one that interests you to begin trading.

Go to CoinEx’s Official Website

Please check CoinEx official website or contact the customer support with regard to the latest information and more accurate details.

CoinEx official website is here.

Please click "Introduction of CoinEx", if you want to know the details and the company information of CoinEx.

Comment by cryptoloversofxm

February 19, 2025

I just saw that XMTrading now supports cryptocurrency deposits and withdrawals. No fees, instant transactions, and up to $30K per month. Each deposit gets a unique wallet addres...