Which Crypto exchange has the best condition for Spot and Futures trading?

The Best Exchanges Spot and Futures trading

Do you want to start Spot and Futures trading? Now you are looking for an exchange to invest in the Spot and Futures market?

Check out the 3 best exchanges to invest in the Spot and Futures market today.

| Best Exchanges to trade Spot and Futures markets | Description |

|---|---|

| 1. Bybit | Bybit offers stablecoin-margined Options contracts to help you expand trading opportunities, and Portfolio Margin to help you maximize capital efficiency. |

| 2. Binance | The largest Cryptocurrency exchange in the world. Buy, trade, and hold 600+ cryptocurrencies on Binance |

| 3. Huobi | Huobi, a Leading Digital Asset Trading Platform. A wide array of digital asset trading and management services to satisfy diverse trading needs. |

| 4. BitMEX | Supporting more than 30 Cryptocurrencies. Get crypto’s most advanced trading platform on your device. |

Trade Spot and Futures on Bybit

Cryptocurrency Spot Trading vs. Futures Trading

As cryptocurrencies continue to gain popularity, attention and more trust from the public, the markets where these assets can be purchased and invested are becoming increasingly important. Therefore, understanding these dynamic markets is essential for both beginners and advanced investors alike to trade the best.

Since 2018, the cryptocurrency trading landscape has evolved into a hybrid system featuring complex and popular derivatives in the spot market. The shift to a more diversified spot and derivatives landscape in the traditional spot market has skyrocketed the crypto industry as a whole for exchanges and general investors alike.

What is Spot trading?

Spot trading is the most basic type of trading in cryptocurrency. Cryptocurrency trading essentially involves buying a cryptocurrency like Bitcoin and holding it until its value rises. This includes trading strategies in which investors buy other altcoins they believe will appreciate in value. The spot market is the underlying market where cryptocurrency assets are instantly exchanged and settled. Bybit offers 52 coin transactions including BTC, ETH, LINK, USDT and XRP. It also allows users to purchase cryptocurrencies directly with a credit card. You can buy or sell cryptocurrencies against USDT at any time, depending on trends and strategies. The best benefit of trading cryptocurrencies on Bybit is that if you are a premium member, you do not have to worry about transaction fees.

Advantages and disadvantages of spot trading

Advantages of spot trading?

One of the positive aspects of trading in the spot market is that investors are trading real assets rather than future contracts. Besides, investors have direct ownership of the coins. In particular, these two aspects provide traders with a greater sense of safety and a simpler way of investing.

Disadvantages of spot trading?

When it comes to trading, the spot market requires higher fees to use leverage and offers a lower level of leverage due to the limited supply of coins in the loan pool. One of the potential drawbacks of spot-traded cryptocurrencies is that investors must first set up a digital wallet with an online platform and exchange. This process can be difficult for those unfamiliar with the crypto environment. Second, certain web-based exchanges are more susceptible to technical errors, app freezes, and security issues. Therefore, leaving cryptocurrencies in an exchange spot wallet can be potentially risky as they may not be accessible when the market is very active.

Trade Spot and Futures on Bybit

What is futures trading?

The basic concept of futures trading is that an investor places a bet on an asset such as gold or bitcoin and bets when the price rises or falls. Futures contract trading differs from spot trading in that you do not need to own the underlying asset. Consider, for example, a gold/USD contract. When trading this commodity, you are not actually buying or selling the gold itself. However, the contract amount is determined by the price of gold. This means that whenever the value of gold rises and falls, the value of the contract rises and falls. In this way, you can profit from the price trend of gold without actually buying or selling gold. Of course, this is simplistic and trading contracts are much more complex. But the basic idea is that you can bet on the price of an asset depending on the price of gold or bitcoin. Profits or losses depend on the accuracy of my predictions. Cryptocurrency prices can rise or fall dramatically in a short period of time, so you need to be careful when investing.

Advantages and Disadvantages of Futures Trading

Advantages of futures trading?

In particular, when you use leverage to trade cryptocurrencies on futures, the profits are much higher than in the spot market. In addition, futures trading gives investors the ability to use more flexible trading strategies such as short and long hedging against different price movements. So you can do more than simply buy and sell cryptocurrencies.

Disadvantages of futures trading?

One of the main drawbacks of futures trading is that investors do not own the underlying asset and the second is that they can use high leverage, which puts them at risk of being asked for and taking large losses from bad speculation.

The popularity of Bitcoin Derivatives

Bitcoin derivatives are rapidly gaining popularity as one of the highest trading volumes, opening a new chapter in the financial markets. At the forefront is Bitcoin Futures, the most traded cryptocurrency derivative since 2017. The average daily volume of Bitcoin futures is about 3,500, with a cumulative total of over $100 billion (USD). Considering that Bitcoin’s value in the spot market has continued to decline since December 2019, this is a very impressive number. Statistically, as investors’ confidence in derivatives increases, the number of cases where they choose to trade derivatives rather than spot market trades is also increasing. In Bitcoin futures, for example, traders can hedge against the price of Bitcoin in a highly volatile market.

Join Bybit for Leveraged Trading

A Guide to When to Buy Bitcoin

Bitcoin (Bitcoin) has crossed 40K, the SEC has filed a lawsuit against Ripple (XRP), and the price is showing a surge due to the release of Ethereum 2.0.

As more and more people become interested in cryptocurrencies, experienced traders often advise new traders to buy Bitcoin from the bottom.

What exactly does this mean, and how can you buy bitcoin from the bottom?

Let’s take a step back for a moment.

As you already know, the first thing we need to do is buy Bitcoin.

Now that you understand this, let’s take a look at the bottom part, shall we?

Trade Spot and Futures on Bybit

What is the floor price?

When trading cryptocurrency, there are always ways to find out the market and price through visual indicators. Most platforms offer candlestick charts.

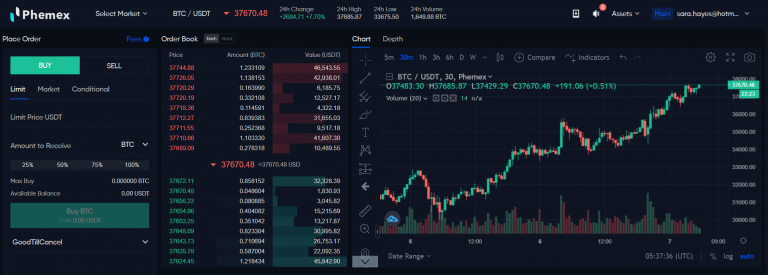

Also, look at the BTC/USDT chart provided by the exchange on Bybit.

As you can see, candlestick charts are candles that contain two colors, red and green, and there are many candles on the chart. Each candle has a thin line protruding from the top or bottom the candle.

This is known as the tail of a candle.

Each candle represents the indicated price range when an asset was traded over a specific time period.

The time frame can be changed with candles representing the desired period.

You can use 1 minute, 4 hours or 1-day candles depending on the steps in the details.

One-minute candles will reveal much more volatility as the price can fluctuate significantly within a few minutes.

The higher the time frame, the lower the number of candles as it indicates a long-term trend.

For example, if you look at the chart by day, a 1-hour candle is represented by 24 candles, whereas a 1-day candle is represented by only one red or green candle.

When is the Floor Price to buy Bitcoin?

You can easily see the Floor Price through the candles.

A green candle means that the price has risen from the moment the candle started.

Conversely, a red candle indicates a decline in price.

Depending on the time period you are viewing, you can distinguish a floor when it appears in succession with one or several red candles.

The idea is to buy the asset at the bottom of the last red candle before the trend reverses and the price rises.

Who is buying from the floor?

People who trade on a daily basis (day traders) buy from the bottom and take profit.

They look at the charts all day long, buying lower and selling higher than they bought, accumulating more profits.

Long-term investors who aren’t interested (and can’t) watch the market (price) on a daily basis, the goal is to raise a lot of money that will be worth much more in the future.

If you are initially satisfied and do not have the funds to buy, you will need to accumulate your assets over time.

The best strategy is to buy more each time the price goes down, instead of buying coins when the price peaks.

Depending on how much money you have and the amount of time you need to monitor the market, you can set the RBI you want.

For example, for every $500 or $1,000 drop-in price, you can buy more. Of course, there’s no guarantee you’ll get it at the lowest price, but at least you won’t get it at the highest price.

As with all trades, no strategy will fit every situation.

So you should take the time to think about how much loss you can tolerate and how much time and resources you can invest.

Trade Spot and Futures on Bybit

Buy on the rumors and sell on the news

It refers to a trading strategy similar to the name “buy on the rumor, sell on the news”, and this is easiest to understand by looking at the example below.

What does “buy on the rumor, sell on the news” mean?

Imagine you have shares in company X. It also assumes that there are rumors circulating that the stock price of Company X will rise. Hearing these rumors, he invests more money in the company (lives on the rumors). When the rumors are confirmed to be true and the company’s stock price suddenly rises, you sell (sell on the news) the profits you had at this point.

Naturally, it is not surprising that this strategy is used a lot in the world of cryptocurrencies, where rumors abound.

However, it is difficult to find concrete evidence that this strategy is actually being implemented because most of the information has to be guessed because the intentions of many people are unknown. Perhaps you are looking at a coin that gets a lot of attention and performs well and then suddenly underperforms. One example of this could be Dogecoin.

Join Bybit for Leveraged Trading

Buying and Selling Dogecoin Rumors

Between April and June 2021, Elon Musk tweeted about the coin, causing a lot of changes to Dogecoin. The price rose from 0 to $0.75. However, since the end of May, the price has gradually declined and is likely to drop below $0.15 soon. What is important in this price movement is that it started when Elon Musk tweeted about the coin. Then he started spreading rumors about whether Tesla would accept Dogecoin as a payment option for Tesla cars. During this early stage of Musk’s tweet, the price suddenly rose, then fell as soon as Tesla said it would not make it a viable payment option.

Failure of investment advice

What is important in a “buy the rumor, sell the news” trading strategy is to make it clear that many investors are not very interested in developing their own strategy. After all, this trading strategy is fundamentally the answer to the specific question of “how best to invest my assets?” The problem here is that when people ask this question, they ignore the opportunity to truly explore it and experiment for themselves to see what works for them. They usually look around (the Internet) to find quick and easy answers. Then, instead of developing an understanding of how markets work, you have a crafted vision that fails far more often than they offer and benefit. Do you think Warren Buffett listens to those around him for investment advice? Or do you think he has experimented and developed his own strategies on how to invest his money?

Following the “buy on the rumor, sell on the news” investment strategy is risky. There is nothing in it but uncertainty. The amount of research that needs to be done to keep someone informed at a level that can reliably predict what will happen soon is just too much work. Therefore, this investment strategy for new investors is not the best starting point.

Trade Spot and Futures on Bybit

What is margin trading?

Margin trading refers to the act of buying securities (bonds, derivatives, options, stocks) by borrowing money.

The biggest advantage of buying with margin is that it increases your buying power and thus increases your chances of investment success.

On the other hand, the risk of loss due to margin also increases. If you want to sell a security in your margin account, the proceeds will be used first to repay the loan.

The first thing you need to know is that traditional margin trading and virtual currency margin trading in a foreign exchange have completely different meaning. In this article, we will look at the former first and also cover the regulations of the Financial Industry Regulatory Authority (FINRA).

Margin (margin) trading refers to buying securities (bonds, derivatives, options, stocks) by borrowing money. The key is that if you only have a fraction of the funds you need to make a purchase, you can fill the rest using “margin”. Currently, the minimum required by FiNAR as an initial margin is 50% of the purchase price.

For example, if you want to buy a stock worth $1,000, that means you must have at least $500 in your own money.

This is the most basic part of margin trading. In reality, if you want to trade with margin, you will have to consider many more factors.

Terms and concepts related to margin trading:

The terms and concepts related to margin trading are as follows:

- Margin Account:

- You must create a separate margin account for margin trading. You cannot use a regular broker (cash) account. It’s like debit and credit card accounts are different. Securities purchased as margin will be kept in the margin account.

- Initial Margin:

- The amount you need to buy. This must be at least 50% of the total you want to buy under FINRA. Some intermediaries require more than that, but this will be confirmed and agreed upon when creating a margin account.

- Maintenance Margin:

- Also known as the minimum maintenance or maintenance requirement. This is the minimum amount of money you need to deposit in your margin account after buying. This must be at least 25% of the total purchase amount under FINRA. Again, depending on the intermediary, you can claim up to 30/40%. If the purchase amount increases or decreases, the maintenance margin will also move.

- Margin Call:

- Occurs when the funds deposited in the margin account fall below the maintenance margin. A margin call is a reminder to increase the account deposit above the maintenance margin. Otherwise, the broker may liquidate some of the securities in the account.

Pros and Cons of Margin Trading

Advantages of margin trading:

The biggest advantage of buying with margin is that it increases your buying power and thus increases your chances of investment success. If you need to buy for a relatively small amount, you can use margin to increase your profits or diversify your portfolio.

Disadvantages of margin trading:

Disadvantages: The biggest disadvantages are also equal to the advantages. On the other hand, the risk of loss due to margin also increases. Proceeds from selling securities held in margin accounts are used to pay off margin loan expenses. This means that if you make a loss, you may not even have an initial margin left. No matter which loan you use, interest accrued over the term of the loan is also charged. Therefore, margin trading is more suitable for short-term investments.

Trade Spot and Futures on Bybit

Margin trading with Bybit

Cryptocurrency margin trading is similar in that you can use the loan to increase your purchasing power beyond your financial limits.

Margin vs. Crypto Exchanges

The main difference between the two is that crypto trading has a low barrier to entry and is easy to make a profit. However, since the crypto market is very volatile, it is easy to lose money.

Join Bybit for Leveraged Trading

What is leveraged trading?

Leveraged trading is a system that allows traders to open positions much larger than their capital. Traders only actually invest a certain percentage of their total positions. The ratio between the value of an investment and the investment required to do so is called leverage, and the required position percentage is called margin.

Terms related to leveraged trading

- Purchasing power

- Circumstances in which the total amount an investor can purchase (including leverage) stocks is greater than their total account balance.

- Coverage

- A fundamental indicator that investors should always keep in mind. It is the ratio of your total leverage to your net account balance, i.e. the amount you owe later.

- Margin call

- When the coverage or risk ratio is lower than the minimum required to hold a leveraged position, BBVA traders send a margin call notification. A margin call alerts you that your current exposure has reached a level of risk that exceeds the limit allowed by the bank.

- Position liquidation

- Position liquidation occurs when BBVA cancels all outstanding orders for that client once the BBVA sees the exposure level and issues a corresponding warning. These orders are orders that have been placed on the market but have not yet been executed. If all of these orders are canceled and the total leverage is not covered by 100%, the stock positions held by the investor in the portfolio will be automatically liquidated in a certain order. When determining the order to close these positions, the system utilizes a so-called LIFO (last in, first out) approach. Starting with the most recent purchase, stocks are sold until the coverage ratio reaches an acceptable level. It is important to understand that the automatic position closing executed by BBVA is not a Stop Loss order or a form of order for investor protection. Investors must manage their own market risk on their own. This will force you to close your position before the coverage rate drops to the minimum required level.

Advantages and disadvantages of leveraged trading

Leveraged trading has several advantages.

1. Leveraged trading minimizes the capital a trader needs to invest

Traders do not pay the total price of a financial instrument, but only a percentage of it.

Let’s take an example: If your position is $3,000 at the time of opening, you can leverage 400:1 leverage instead of paying all of it. In other words, for every $400 of real value an investor would have to invest in their own capital at $1: ie, when opening this position, the required capital is $7.50.

2. Some of the leveraged trading products are relatively cheap

Some goods are relatively cheap. This means that almost any trader can trade with ease. In other words, some are more valuable and may cost more depending on the frequency of transactions or other factors. Rather than investing large sums to participate in the market, you can use leverage to enjoy the price fluctuations displayed by various instruments.

Trade Spot and Futures on Bybit

Disadvantages of leveraged trading:

Although leveraged trading has the advantage of requiring less capital for the trader to invest, there is also the risk of failure. Just as leverage has the potential to yield significantly greater returns than your initial investment, you may also incur losses for the same reasons. The key is to open positions, apply a Stop Loss price, and record/track all of your other buys to avoid massive losses. For this reason, even if you are an expert in leveraged trading, you should use a crypto exchange platform such as Bybit to make safer and more accurate trades.

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.