Which Cryptocurrency exchange offers the best condition to invest in dYdX (DYDX) tokens?

The Best Exchanges to buy and hold dYdX (DYDX)?

Do you want to buy and hold dYdX (DYDX)? Now you are looking for an exchange to invest in dYdX (DYDX)?

Check out the 3 best exchanges to buy dYdX (DYDX) today.

| Best Exchanges to buy and hold dYdX (DYDX) | Description |

|---|---|

| 1. Bybit | Bybit offers stablecoin-margined Options contracts to help you expand trading opportunities, and Portfolio Margin to help you maximize capital efficiency. |

| 2. Binance | The largest Cryptocurrency exchange in the world. Buy, trade, and hold 600+ cryptocurrencies on Binance |

| 3. Huobi | Huobi, a Leading Digital Asset Trading Platform. A wide array of digital asset trading and management services to satisfy diverse trading needs. |

| 4. BitMEX | Supporting more than 30 Cryptocurrencies. Get crypto’s most advanced trading platform on your device. |

Launched in 2017, dYdX is a decentralized exchange (DEX) that utilizes smart contracts on the Ethereum (ETH) blockchain to provide perpetual contract trading, margin trading, spot trading, lending and borrowing services. The platform has already launched DYDX, a governance token, via airdrop, and launched on the market in September 2021.

dYdX is different from other DEXs

dYdX is a hybrid exchange that operates by combining centralized and decentralized components. dYdX aims to provide the security and transparency of a decentralized exchange through the speed and usability of a centralized exchange. Centralized features include call- taking and matching engine services, and decentralized components include smart contracts.

Unlike the two most popular DEXs, Uniswap (UNI) and SushiSwap (SUSHI), dYdX is not based on Automated Market Maker. Instead, dYdX relies on the order book model commonly found on centralized exchanges. According to the development team, the platform uses an order book as it is an already established model within the cryptocurrency world that traditional market makers should be familiar with. Also, dYdX founder Antonio Juliano believes that the ask-and-take is more efficient than the AMM. He argues that the order book is not capital intensive in that it requires less funds to achieve the same level of liquidity as AMM.

Go to Bybit’s Official Website

What does dYdX offer?

dYdX provides decentralized finance (DeFi) services such as isolated margin trading, cross-margin trading, spot trading, perpetual contract trading, and lending and borrowing services. The detailed features of the platform are as follows:

- Margin Trading:

- Users can borrow funds from other users to buy more assets. There are two types of margin trading on dYdX. Isolation and cross-margin. In isolated margin trading, users utilize a single position. In cross-margin trading, the margin is shared across all open positions in the account. So far, margin trading on dYdX only supports three assets. ETH, DAI and USDC. The trading pairs are ETH-DAI, ETH-USDC and DAI-USDC and users can leverage these pairs up to 5x.

- Spot Trading:

- Similar to centralized exchanges, users can buy and sell cryptocurrencies by posting market orders, limit orders and stop orders. dYdX’s spot trading platform supports the same 3 pairs as margin trading.

- Perpetual Contract Trading:

- In perpetual contract trading, users can hold long or short positions similar to futures contract trading. Typically, users take a long position by buying a contract in anticipation of future price increases. Conversely, the user sells the contract in anticipation of a fall in price and takes a short position to repurchase it at a lower price. However, unlike futures contracts, perpetual contracts cannot specify an expiry date. As a result, users can hold their positions indefinitely. dYdX supports perpetual contract trading of 22 crypto assets from projects such as Ethereum (ETH), Bitcoin (BTC) and Cardano (ADA) with up to 25x leverage.

- Lending and Borrowing:

- Users can deposit their assets into a loan pool and earn interest every time a new block is mined. Users can also borrow funds from these pools for use in other services on the platform.

This is a service available to users on dYdX. (Source: dYdX) dYdX’s margin trading, spot trading, lending and borrowing services are based on Ethereum’s Layer 1 main chain. Conversely, in February 2021, we moved perpetual contract transactions from Ethereum Layer 1 to Layer 2 scaling solutions. This was done to avoid slow transaction speeds and the significant gas charges that plagued DeFi at the time. Together with StarkWare, dYdX has built a Layer 2 protocol to increase scalability by bundling multiple transactions together using ZK-Rollups.

You can find dydx coins on the Bybit’s spot market. Users can trade dydx coins spot on Bybit without commission.

What is dYdX’s Governance Token?

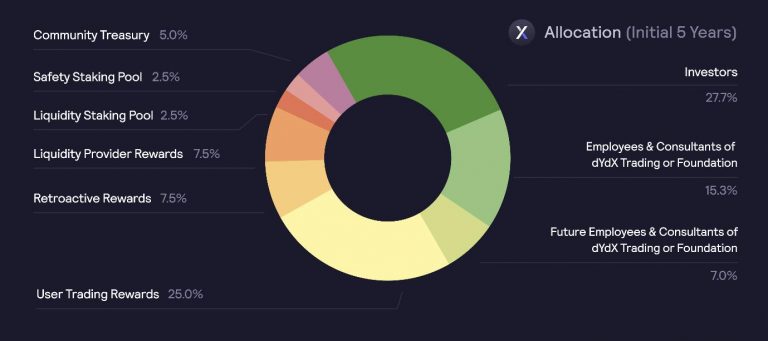

On August 1, 2021, dYdX announced the launch of the Governance Token DYDX. The total supply is 1 billion tokens, which will be approached gradually over 5 years. After 5 years, dYdX will implement a perpetual inflation of 2% per year, ensuring that there will always be enough DYDX tokens to reward the community’s contribution.

DYDX token holders have the right to propose and vote for the Layer 2 protocol. They can determine the allocation of community treasury funds, vote on new token lists, and change risk parameters. In addition, DYDX token holders receive a discount on transaction fees based on their holdings.

Along with the DYDX token, the platform has launched a liquidity staking pool where users provide liquidity by staking USDC and are rewarded in return. A safe staking pool is also in the works, where users can stake DYDX tokens to provide security to the network and receive rewards. The safe staking pool will be online when DYDX tokens become available for transfer on September 8, 2021.

Go to Bybit’s Official Website

How does dYdX work?

Like most DEXs, dYdX utilizes smart contracts for its services. Users can trade on the platform without any third party or intermediary. Smart contracts mean that dYdX is a non-laundry exchange, so your funds are under 100% user control. Smart contracts allow users to deposit, withdraw and transact at any time without having to wait. Users only need to pay gas fees and transaction fees used by the platform.

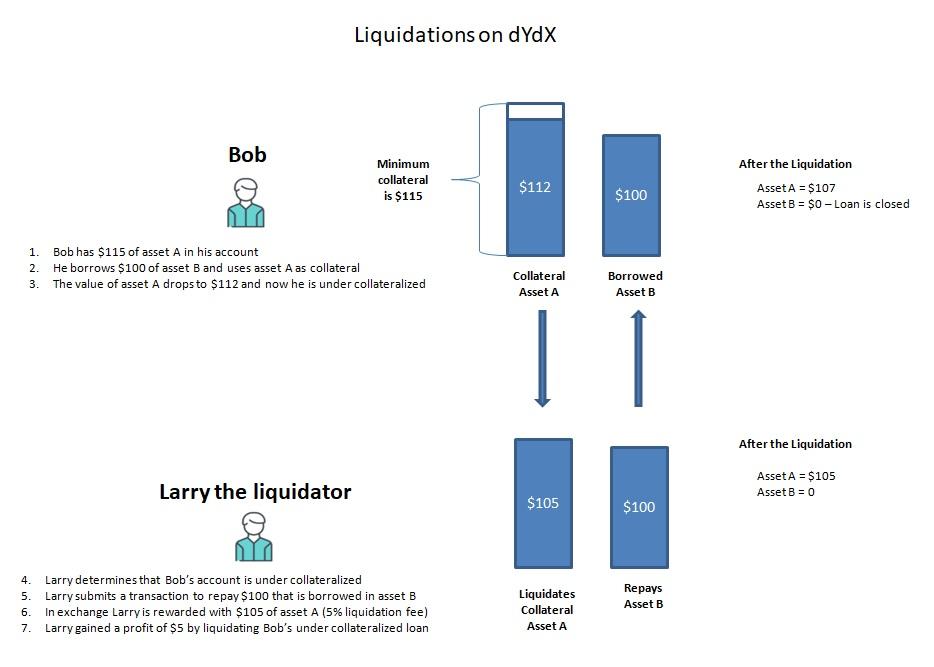

In dYdX, each asset has its own loan pool that manages the smart contract. When a user deposits an asset into a specific pool, it becomes a lender and earns passive interest income. The borrower can then borrow assets from a specific pool. This interaction between lenders and borrowers determines supply and demand, which affects the interest rate of each asset. In order for users to borrow money from a specified pool of assets, they must deposit collateral. dYdX uses an over-collateralization protocol to protect lenders from risky lending. Therefore, the initial collateral ratio must be at least 125%. For example, let’s say a user wants to borrow $100 in Ethereum (ETH). To do so, users must collateralize $125 in other supported assets. Thereafter, users only need to maintain a minimum collateralization ratio of at least 115% to prevent automatic liquidation. To maintain the cryptocurrency price at Layer 1, dYdX relies on various price oracles.

Here is a list of price oracles for layer 1.

- Ethereum (ETH) and Bitcoin (BTC) prices are obtained using the MakerDAO (DAI) V2 oracle system.

- The price of LINK is obtained through the Chainlink (LINK) oracle system.

- dYdX uses its own price oracle system for pricing in DAI.

- The price of USDC is directly related to the price of USD.

For layer 2 cryptocurrency pricing, dYdX is working with StarkWare, ChainLink, and the Maker Oracle team to implement an Oracle system compatible with Stark signatures. Once the price of the oracle is verified using these signatures, the platform uses them immediately without having to wait for the transaction to be validated. This layer 2 solution speeds up price updates.

Go to Bybit’s Official Website

Who is behind dYdX?

In 2017, Antonio Juliano founded dYdX in San Francisco, California. Antonio and his team have worked at Google, Bloomberg, Goldman Sachs and ConsenSys.

dYdX has caught the attention of investors quite a bit. The company made four rounds of funding, raising a total of $87 million. In December 2017, dYdX closed a $2 million stock seeding round led by Andreessen Horowitz and Polychain Capital. In the most recent June 2021 Series C round, dYdX raised $65 million with Paradigm leading the investment.

Go to Bybit’s Official Website

What is the future of dYdX coin?

The launch and liquidity mining of the DYDX token can help increase liquidity and total value lock (TVL), an indicator that users can use to compare the popularity of different DeFi protocols. This happened in September 2020 when Uniswap doubled its TVL just days after launching UNI, governance tokens and liquidity incentives.

dYdX has many competitors as a lending and borrowing protocol. This includes AAVE, COMP, and other similar DeFi platforms. Compared to competitors, dYdX’s loan interest rates are average. For example, the DAI loan rate is only 4.4% versus Ave’s 5%, and the DAI loan rate is 9.62% higher than Compound’s 4.27%. In any case, as more users use lending and borrowing services, dYdX’s interest rate will become more competitive.

Summary

dYdX is a platform that allows users to access DeFi services such as lending, borrowing, margin trading, perpetual contract trading, and spot trading. It relies on the order book model used by centralized exchanges instead of the Automated Market Maker (AMM) used by other decentralized exchanges such as Uniswap and SushiSwap. dYdX recently announced the launch of the DYDX Governance Token and Liquidity Mining. DYDX token holders will receive a discount on transaction fees, vote on proposals and parameter changes, and be rewarded by staking tokens. The launch of tokens and liquidity incentives can increase popularity by attracting users to the platform to provide liquidity. However, only time will tell if the token launch is successful.

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...