Which Cryptocurrency exchange offers the best condition to invest in Orbs (ORBS) tokens?

The Best Exchanges to buy and hold Orbs (ORBS)?

Do you want to buy and hold Orbs (ORBS)? Now you are looking for an exchange to invest in Orbs (ORBS)?

Check out the 4 best exchanges to buy Orbs (ORBS) today.

| Best Exchanges to buy and hold Orbs (ORBS) | Description |

|---|---|

| 1. Bybit | Bybit offers stablecoin-margined Options contracts to help you expand trading opportunities, and Portfolio Margin to help you maximize capital efficiency. |

| 2. Binance | The largest Cryptocurrency exchange in the world. Buy, trade, and hold 600+ cryptocurrencies on Binance |

| 3. Huobi | Huobi, a Leading Digital Asset Trading Platform. A wide array of digital asset trading and management services to satisfy diverse trading needs. |

| 4. BitMEX | Supporting more than 30 Cryptocurrencies. Get crypto’s most advanced trading platform on your device. |

Orbs is actually a new open infrastructure designed for use by large corporations that deliver real products around the world. Today, blockchain technology and virtual currency have been recognized for their enormous potential, but still many coins and outcomes are considered only as investment targets. Additionally, many of the companies that could benefit from this technology are out of reach due to its complexity. Orbs wants to change this situation and see an opportunity where blockchain technology can be used to create value for companies in the real world. By integrating its own Orbs Token (ORBS) with the largest blockchains such as Ethereum and Bitcoin, Orbs aims to revolutionize the use of blockchain and bring it to the mainstream.

What is the Orbs Blockchain?

Orbs is an Israeli public blockchain infrastructure launched in March 2019 with the goal of accelerating enterprise adoption of blockchain technology. Therefore, developers can develop their desired backend services (applications) on a decentralized, open, approval-free platform that can maintain governance. The differentiating point of Orbs is that it supports not only DApps, but also applications that require approval developed by existing for-profit companies. Currently, Orbs is focusing primarily on decentralized finance (DeFi ) apps. Not only is it most relevant to businesses, but it’s growing exponentially.

Go to Bybit’s Official Website

How was the Orbs implemented?

Orbs is a hybrid blockchain that enables businesses to build the applications they need. After all, by designing a complete blockchain stack and codebase that includes the entire developer experience from front to back, you can provide everything you need to create and run a blockchain app. As described in the technical overview white paper, it has the following features:

- Hybrid Phase Two Consensus:

- Orbs seeks to bridge the gap between public and private blockchains by allowing approved apps while having a non-approved infrastructure. In this way, Orbs allows for blockchain-level security, but also the governance of app developers. Developers can also later switch to disapproved apps if they wish.

- Virtual Chain:

- Each app in Orbs is independent because it runs on its own virtual chain. This makes it easier to run and protects it from being affected by other apps belonging to other companies. Orbs validators run these virtual chains simultaneously. This means that a non-authoritative pool of validators can be fully shared and stacked across the entire network, ensuring security and decentralization.

- Proof of Stake (PoS) and Proof of Work (PoW):

- Orbs uses a proof-of-stake (PoS) consensus mechanism, but relies on the Ethereum mainnet using a proof-of-work (PoW) network to avoid cheating in the validator election process. This means that PoW supports external proofs, whereas in PoW consensus, the Stacker isis the validator. This can be said to mean that the validator directly verifies his or her election.

- Helix Consensus Algorithm (RPoS):

- This is a consensus protocol to allow for rapid transaction validation. It is a method of verifying through consensus by randomly selecting a fixed set of nodes per block. This common and verifiable randomness can be achieved through Randomized Proof-of-Stake (RPoS), which simultaneously guarantees scalability, fairness and security.

- Polyglot Smart Contracts:

- To make them competitive and accessible to as many companies as possible, Orbs offers smart contracts in multiple languages, including JavaScript and Go. This not only allows you to build more accessible apps, but also encourages the reuse of smart contract libraries. In addition, Orbs provides non-determinism, enabling not only smart contracts on the Ethereum mainnet, but also full interoperability with real apps located in existing systems or databases rather than chains.

- Fees:

- Orbs is trying to attract businesses using private blockchains with these features. However, to be competitive, fees must be similar. Fees on public blockchains are high. It is also unpredictable as it creates a shared bidding market with limited resources. Orbs gives each app an independent virtual chain, allocating separate computational resources for each app. This allows the fees to be predictable and payable in the form of monthly fees as well. By dynamically allocating resources per virtual chain, we can reduce volatility and eliminate scarcity while keeping fees as low as possible.

How does the Orbs blockchain work?

Orbs uses a proof-of-stake consensus system to manage the network and scalability. Along with these systems, members operate the network through incentive programs such as:

- Orbs Delegators:

- Delegators contribute to the network’s success by staking their Orbs Tokens (ORBS). At this time, if you transfer your voting rights to the Guardian, you can receive up to 8% of the Orbs tokens (ORBS) you have staked as an annual reward.

- Orbs Guardian:

- Guardian is the person who represents the staking and acts as an auditor. The Guardian monitors the validators and uses the voting rights transferred by the delegates to hold elections and elect new validators. Guardians must distribute staking rewards to delegates and self-stake 8% of the delegated staking total.

- Orbs Validators:

- Validators are professional node operators that power the system. They use the fee to run the virtual chain and get rewarded. Validators also lock staking for participation, which gives them more profit.

It is to reduce the carbon footprint of the blockchain and achieve long-term sustainability through the PoS system. However, there are some differences as Orbs is powered by Ethereum’s PoW system.

Orbs and Ethereum

The Orbs blockchain is a hybrid blockchain, many of which are powered by Ethereum. For example, ORBS tokens (ERC-20 tokens), staking, delegation, and voting functions all operate as Ethereum contracts and use the Ethereum value as an objective auditor. This increases security as guardians and validators cannot abuse the network or the deployment process. Using Ethereum’s PoW consensus also means that Orbs can avoid long-term cyberattacks that pose a greater risk to PoS, while maintaining great scalability. However, because of this, its independence is slightly compromised, and when Ethereum 2.0 version is released, Ethereum will have to be moved to a PoS system, but there is still a question about how to secure security.

Go to Bybit’s Official Website

What is Orbs Cryptocurrency

The Orbs Token (ORBS) was launched as an ERC-20 token in April 2019 and is used to power the Orbs protocol. It is used as an incentive system to pay fees related to app execution and to ensure decentralization and security of system validators. This is the only form of payment accepted by the platform.

Orbs Token Price Analysis

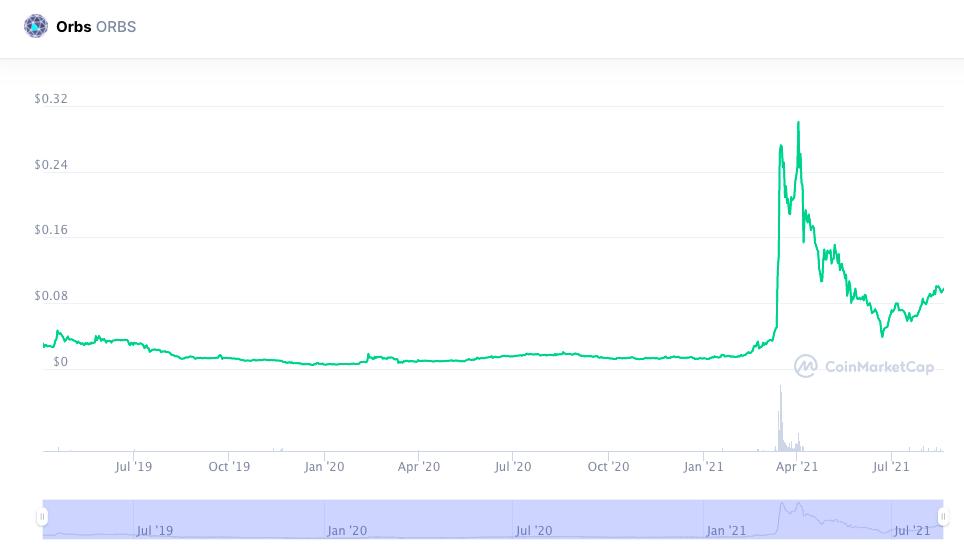

Orbs trades for just under $0.10 and has a market cap of $216.5 million. Although it is a publicly traded increase from the initial launch of $0.03, it has fallen from the April 2021 peak of $0.3.

As you can see in the price chart above, Orbs is following the pattern of BTX. Both cryptocurrencies showed little change in 2019 and were strong in April 2021 before turning bearish again in July. In June-July 2021, both currencies began to show signs of recovery, each showing significant gains from their 2019 values.

This trend was largely driven by the BTC halving in 2020 and the cryptocurrency plunge in 2021. However, unlike BTC, which only has a supply of 21 million, Orbs has a very high issuance of 10 billion. Due to the low supply of BTC, the basic rules of supply and demand keep its value high. So the price of Orbs is kept low due to their sheer size.

What is the future of Orbs?

If you look at the price graph, you can see that April 2021 is when the Orbs price is finally starting to rise. This is also because the cryptocurrency market was in an early boom period in 2021 with a sharp increase in cryptocurrency investment in 2020. In 2020, MicroStrategy invested more than $1 billion in BTC, and Grayscale’s cryptocurrency investment totaled $10 billion as of November 2020.

Not only that, but the movement of businesses and banks to embrace cryptocurrencies and blockchain technology will be of particular relevance to Orbs. Tech giants such as PayPal and Square have been at the forefront of adoption of these technologies, and the U.S. Department of Monetary Policy (OCC) has officially authorized banks to use blockchain technology. This decision by companies has increased the relevance of the Orbs blockchain, which supports approved apps developed by existing for-profit companies, and puts it at the forefront.

Orbs is even better because it provides an approved for-profit app that businesses can control and enjoy the guaranteed security of the blockchain. In addition, multilingual smart contracts: make it easier for small businesses to access and scale. However, the dependence on Ethereum and the fact that Ethereum can create similar products with a high degree of maturity leaves the question of whether companies should choose Orbs. Orbs is clearly an attractive blockchain and aims to increase its competitiveness over other centralized platforms by reducing fees. If it can be done, it seems to be able to maintain a good outlook with convenience, accessibility, security, and economy as weapons. However, it is still unclear whether companies will be persuaded by this or whether they will nevertheless put governance first and use centralized platforms or other more mature decentralized platforms such as Ethereum.

Conclusion

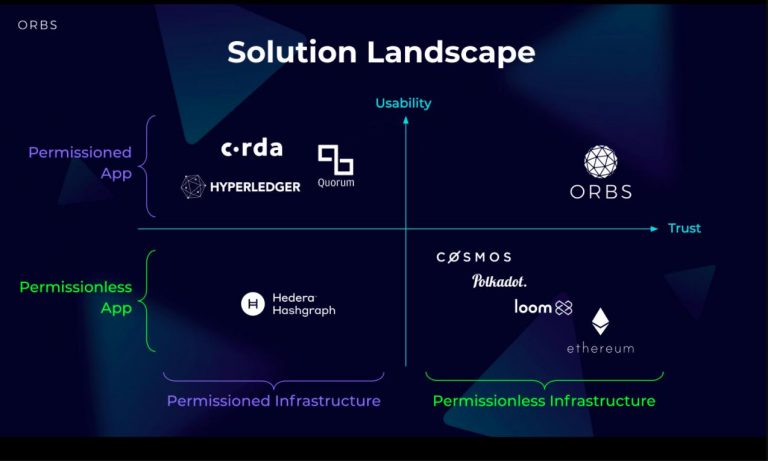

Orbs sits between public blockchains like Ethereum and private blockchains like Hyperledger. It combines the security of a decentralized blockchain with centralized governance and convenience all in one place. However, despite this blockchain stack that covers everything from front to back end, its security and PoW auditing ability still rely heavily on Ethereum. It is unclear what will happen to Orbs once Ethereum 2.0 is fully implemented and moves to a PoW consensus. The ability to deliver apps built with an approved design and move seamlessly to a non-approved architecture would certainly be an added advantage.

In addition to being a multilingual smart contract, it gives businesses a perfect opportunity to migrate to blockchain technology. Orbs’ low and predictable fee structure may be a reason not to move to Ethereum. Cryptocurrency and blockchain technology are gradually becoming mainstream. Orbs boasts a very good advantage at this point. However, it remains to be seen whether companies are still good enough to choose Orbs over more mature blockchains.

Go to Bybit’s Official Website

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...