Which Cryptocurrency exchange offers the best condition to invest in VTHO and VET Coins?

The Best Exchanges to buy and hold VTHO and VET Coins?

Do you want to buy and hold VTHO and VET Coins? Now you are looking for an exchange to invest in VTHO and VET Coins?

Check out the 4 best exchanges to buy VTHO and VET Coins today.

| Best Exchanges to buy and hold VTHO and VET Coins | Description |

|---|---|

| 1. Bybit | Bybit offers stablecoin-margined Options contracts to help you expand trading opportunities, and Portfolio Margin to help you maximize capital efficiency. |

| 2. Binance | The largest Cryptocurrency exchange in the world. Buy, trade, and hold 600+ cryptocurrencies on Binance |

| 3. Huobi | Huobi, a Leading Digital Asset Trading Platform. A wide array of digital asset trading and management services to satisfy diverse trading needs. |

| 4. BitMEX | Supporting more than 30 Cryptocurrencies. Get crypto’s most advanced trading platform on your device. |

VeChain (VET) is a public blockchain that specializes in solutions for all businesses of all sizes. It uses a block verification method called Proof of Access (PoA), which is technically better than Proof of Work (PoW) and Proof of Stake (PoS).

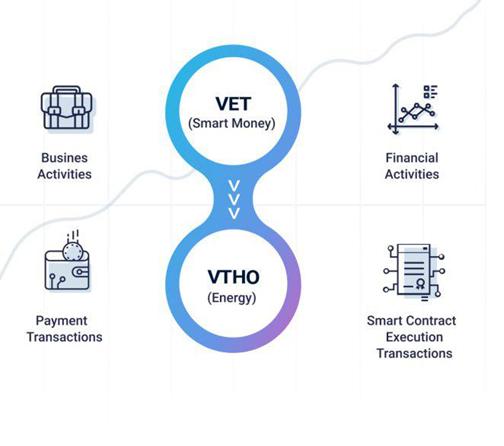

VeChain adopts a dual token form that uses VET, the main cryptocurrency token, and VTHO, a utility token. Although VET is commonly used as a transaction or store-of-value token on the platform, the main function of VTHO is transaction/gas fees on the network.

As of today, VTHO is trading at $0.011 USD, with a total supply of nearly 42 billion tokens and a market cap of approximately $447 million USD. However, since VTHO is a utility token with limited value outside of the VeChain platform, the market capitalization of the project and several key statistics are calculated based on the main token, VET.

Currently, the baseline VET token is trading at $0.17 (USD), with a total supply of nearly 64 billion tokens and a market cap of approximately $10.6 billion (USD).

Invest in VTHO and VET on Bybit

What is VeChain (VET, VeChainThor)?

VeChain is a block chain that is solidifying its position as a public block chain that can be applied to actual business sites. For example, it can be utilized in IoT solutions, NFC, QR code tracking platforms, customer management apps, etc.

The core value proposed by the platform is the technical efficiency achieved through the PoA block proof method. In the PoA model, the network node that verifies the transaction is called the authority node on the VeChain. They are pre-selected based on publicly available “reputation”. This reputation is a feature that shows past activity handled by that node on the network. This selected authority node will have the authority to validate the next block of transactions.

This system is distinctly different from PoW, where validator nodes race against other nodes to perform complex and energy-consuming computational tasks first. Intensifying competition consumes enormous computational power, and as a result, the PoW blockchain slows down, consuming more energy.

In PoA, verification notes are pre-selected, so there is no need for such a slow and exhausting process. Many people say that the PoA model is an evolution of the PoS verification method.

In PoS, a node with a larger stake in cryptocurrency assets (ie, a node with a larger pocket) is more likely to validate the next block. Because of this, a small number of nodes that are stockpiling a large amount of the total supply of cryptocurrencies can usurp authority.

Conversely, PoA selects validator nodes based on transaction reputation rather than cryptocurrency stake. This allows the PoA blockchain to be as efficient as the PoS platform while minimizing the risk of computational power being concentrated.

VeChain adopts a dual-token model in which VET, a token for main transaction and

storage of value, and VTHO, a utility token, are used together.

What is VTHO Token?

The main function of VTHO tokens on the VeChain platform is to pay gas fees. The gas fee is the transaction fee that makes most of the network operation possible.

When a user on the platform wants to transfer crypto assets to another user, the actual transferred assets are expressed in VET tokens. However, the transaction fees that enable the transfer can be paid with VTHO.

In this respect, VTHO is similar to the gas token used on the NEO blockchain. Sending VET while sending VTHO to gas activates transaction processing.

VTHO is a utility token for platform-based trading with limited value as an off-network or store-of-value asset. Therefore, although VeChain platform regulations do not prohibit use in exchanges and P2P virtual currency markets, VTHO is rarely used on exchanges.

Invest in VTHO and VET on Bybit

What is a VTHO supply source?

The new supply of VTHO is made when users who have assets in VET on the platform create VTHO. For each VET, users earn 0.000432 VTHO per day. This is called the default spawn rate. These systems encourage long-term storage of VET on the platform. The more VET you hold and the longer you hold it, the more VTHO you can earn and use for trading.

When VTHO is used as gas, 70% of the consumed VTHO is burned and the remaining 30% is given as a reward to the authority node that validates the transaction. VeChain has 101 authorized nodes, and according to platform regulations, this number is fixed. Of course, the number of authority nodes can be changed through governance voting.

Currently, the amount of VTHO burned every day is between 70,000 and 100,000. Last week, about half of a million VTHOs were invited to be used for platform trading.

Another way to create a VTHO is through a so-called Foundation Node Pool. This pool is built by VeChain Foundation, the governing body of the VeChain platform.

5 billion VET and VTHO are locked in the foundation node pool, and these produced assets provide additional stability to the VeChain ecosystem by distributing them to authority nodes, economic nodes, and special nodes to provide liquidity. Unlike authority nodes, economic nodes are not used to prove transactions. Currently, there are 2,047 economic nodes in VeChain.

Go to Bybit’s Official Website

What is a VET token and how is it different from a VTHO?

The VET token is the main token of the VeChain platform and is used not only for storing and exchanging cryptocurrency assets, but also for various decentralized apps (Dapps) that exist on VeChain. Although you can pay gas fees with VTHO, all real crypto assets on the platform are denominated in VET.

These two tokens also have different functions, but the key difference lies in the supply mechanism. While VET, like most other cryptocurrencies, has a certain maximum supply of around 86 billion VET (about $14.6 billion), VTHO has no limit.

Since utility tokens are manufactured and burned every time a transaction is executed on VeChain, VTHO does not set a maximum supply.

Furthermore, setting a maximum amount of VET ownership gives the platform clear governance rights, but VTHOs do not have the authority to participate in governance even though they have ownership. VeChain has a rather complex governance mechanism, and various entities have governance rights.

This includes members of the VeChain Foundation Advisory Committee, Foundation Committee and Steering Committee members, various “Functional Committees,” Authority Nodes, and Economic Nodes. Most platform users who do not belong to project management, foundation members, or authority nodes can participate in governance by becoming an economic node.

You need to stake 1 million VET (approximately $170,000) to meet the economic node minimum criteria. This will allow you to cast 1 vote during the governance voting period. In this way, VET owners can become members of the Economic Node and have access to platform governance. Conversely, VTHO ownership cannot exercise governance rights, no matter how much of the supply it holds.

In addition to differences in function, supply, and governance, VTHO and VET differ significantly in their nature when deriving actual usage statistics from VeChain. The table below summarizes the key differences between VTHO and VET tokens in terms of variable specifications and usage statistics. (Information as of November 11, 2021)

Invest in VTHO and VET on Bybit

VTHO vs. VET

| VTHO | VET | |

|---|---|---|

| Main functionality | Gas fees | Actual crypto asset storage, transfers, and operations |

| Supply mechanism | Created mainly via holding VET, mostly burnt during transaction processing by Authority Nodes | VET supply was generated in the standard way, mostly at the launch, and has a specified max supply limit |

| Governance rights | None | May provide governance rights if at least 1 million VET are locked to create an Economic Node |

| TVL in smart contracts/DApps on the platform (in USD) | $9.9 million | $18.3 million |

| Amount held by normal nodes on the platform (not Authority Nodes, Economic Nodes, or other special nodes) (in USD) |

$148 million | $5.2 billion |

| Amount held externally at known exchanges (in USD) | $245 million | $5.1 billion |

Conclusion

VTHO is a utility token used on the VeChain platform to pay gas fees. This allows transactions to be processed over the network. Another token used on the platform, VET, is used to store real value and transfer cryptocurrencies.

VeChain is positioning itself as an open platform that aims for a common enterprise app that can be applied to all businesses without scale and redemption. VET is the native token of the network, and VTHO is a key part of the overall design of the platform.

Besides their functions, there are important differences between VTHO and VET coins. While the VET supply mechanism is similar to other cryptocurrencies, the VTHO supply is continuously produced and regulated by VET ownership and liquidation whenever a transaction is processed by a privileged node, a special network node that verifies transaction blocks on the VeChain.

Not only that, but owning VET, of course only if you have at least 1 million VET to become an Economic Node, gives you platform governance rights. Conversely, VTHOs do not have governance rights, even if they have ownership.

Go to Bybit’s Official Website

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.

Comment by Hans

April 24, 2024

as I am trading here various assets, for me it's the most important feature. i mean, flexibility in tradable markets. i alternate trading styles, meaning that sometimes I trad...