Invest in Cryptocurrencies with the largest exchanges in the world. Check out the ranking of Crypto exchanges with the deepest market liquidity.

The Best Exchanges with the Deepst Liquidity

Are looking for an exchange to invest in Cryptocurrencies with the Highest Market Liquidity?

Check out the 3 best exchanges with the highest market volume/liquidity today.

| Best Exchanges with the Highest Volume | Description |

|---|---|

| 1. Bybit | Bybit offers stablecoin-margined Options contracts to help you expand trading opportunities, and Portfolio Margin to help you maximize capital efficiency. |

| 2. Binance | The largest Cryptocurrency exchange in the world. Buy, trade, and hold 600+ cryptocurrencies on Binance |

| 3. Huobi | Huobi, a Leading Digital Asset Trading Platform. A wide array of digital asset trading and management services to satisfy diverse trading needs. |

| 4. BitMEX | Supporting more than 30 Cryptocurrencies. Get crypto’s most advanced trading platform on your device. |

Liquidity is one of the most important things to consider before entering the market. It is essential to evaluate these changes and know what it will mean for your trade. Next week, I’ll see how to use it to my advantage.

Liquidity: Meaning of Liquidity in Crypto Markets

Liquidity is a description of the terms of an asset in terms of how easily it can be bought or sold. In other words, whether it can facilitate trading at a stable price. It is, after all, a measure of the amount of current and potential buyers and sellers in the market. Generally, the more liquid the market, the greater the trading volume, but volume alone cannot guarantee liquidity.

More important than volume is the willingness of the participants to buy/sell at an agreeable price that either side of the trader may not incur significant losses. In other words, buyers don’t have to pay too much for what they think is fair, and sellers don’t have to sell too low for what they think is fair.

Go to Bybit’s Official Website

Liquid and illiquid markets

The most important question for a trader is this: “Is there anyone I can trade with or want to do business with?” Therefore, a liquid market refers to a market that is easy to enter and exit, and a market with many buyers and sellers. This is why traders focus on the spread and market depth, which is the difference between the bid -offer/ bid – ask.

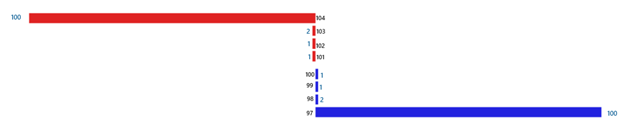

Two bid – ask spreads

The two types of offer spreads are: The first picture is a simplified example of a thin market. When the bid-ask price is $100 and $101, respectively, the spread is 1%. Also noteworthy is the limited quantity that can be bought or sold around the spread. If you want to buy a lot, you need to be prepared to spend a significant amount. Those who want to sell in bulk do the opposite.

The picture below shows a significantly different situation from the above. The spread between the nearest buy and sell is the same 1% as in the first picture, but you can see that the depth has increased. Buyers and sellers are much larger in the vicinity of just off the current price. You can think of it as a much more liquid market compared to the first picture. These markets are called “thick markets”.

In fact, keep in mind that markets cannot be photographed closely as in the example above. Liquidity depends on whether it remains steady over time and whether it can sustain these levels as trading activity increases.

How to measure market liquidity?

You should always evaluate market liquidity before entering or closing a position. Lack of liquidity is associated with increased costs and risks. Markets without liquidity tend to be expensive and volatile. This is because entering and closing positions often means incurring spread costs, and a shortage of buyers and sellers can be interpreted as having a more severe price swing. This is also why exchanges incentivize traders to “provide liquidity” through limit rebates, and discourage traders who “take off liquidity” to pay commissions.

Liquidity in a dynamic crypto market

It is important to keep in mind that various factors can cause illiquid markets to become liquid, and even liquid markets can lose liquidity. It is important to understand that it is dynamic and that even factors such as what time of day can affect liquidity between assets.

For Bitcoin, for example, weekends are generally more liquid than weekdays. Also, sometimes the fluidity evaporates in a good way and sometimes in a bad way. When the FUD is released and people suddenly lose interest in buying all at once, buy-side liquidity disappears. This can result in prices dropping dramatically when sellers start pouring into empty order books.

If the market triggers a FOMO and breaks through, the opposite is the case. Suddenly, the sellers are no longer interested in the current price, and the order disappears, causing the buyer to cause a dramatic price surge.

How can liquidity be measured and used to make trading decisions?

Overall, there are a few things to consider when trading in deep or shallow markets. In shallow markets, limit orders should be used. Using a market order in a shallow market can cost you quite a bit of money as you have to pay a fee to get liquidity and see more downtrends. In shallow markets, the cost of breaking the spread is higher.

In addition to order execution, you might argue that you need to scale down in shallow markets. The shallower the market, the more volatile it tends to be, so it exposes you to unexpected price movements and greater risk associated with them. Even if you only have 2% left until the stop, you won’t be limited to that loss if it’s a market order executed on an empty book.

If the trend is moving fast, a market order is well worth paying for the order as it is guaranteed to execute in the deep market. If you place a limit order in a very deep ask window, it may be difficult to fill the limit if there is no significant reverse trend in the desired direction or if you do not place your order well in advance. When you place a limit order, they are lined up and prioritized based on when you created the order. So essentially you’re waiting in line behind a lot of people who want to sign earlier for the same price.

Go to Bybit’s Official Website

Observe depth and fluidity

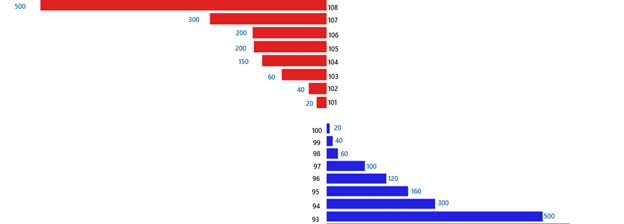

A look at the bid window and market depth gives a quick indication of its depth and liquidity. In the image below, you can see the order book as well as the depth chart with the bid and ask prices. The distance between the nearest bid and ask prices is the spread. This depth chart changes dramatically and frequently as price moves. Still, it is an overall good indication of the availability of dormant liquidity compared to the current market price.

Overall, shallower, more volatile assets can see minimal depth and wide spreads as shown in the ICX chart below.

The spread is about 100 basis points and very shallow. When assets become shallow, market makers are less willing to provide liquidity, making trading much more difficult and dependent on the resources to buy and sell.

The advantage of looking at a large number of bids and bids in depth is that the very previous level can act as a potential support or resistance area. The area is ripe for liquidity, which can slow price movements. It is easy to understand as shallow markets generally move easily and deep markets tend to move slowly.

Moving from an area of low liquidity to a zone of high liquidity changes the way prices speed up or slow down.

As mentioned above, market depth can change very dramatically as price moves. Lines that sometimes appear to be piled up can be an illusion. Again, this type of dormant liquidity is just advertising and can change quickly. Sometimes this type of behavior is used for market manipulation. This will be covered in the next article on spoofing.

How can we observe liquidity and use it to our advantage when we are so vulnerable to false advertising and are constantly changing?

Using CVD (Cumulative Volume Delta)

As a side note, CVD is an advanced indicator and I won’t go into too much detail for the sake of clarity.

What is a CVD Indicator?

CVD stands for Cumulative Volume Delta. Cumulative sum of orders placed on buy and sell. ‘Delta’ is the difference between aggressive buy and sell and ‘aggressive order’ is a market order. So, if you have 6 million sell orders and 4 million buy orders within the 10 million digit contract candle, the delta is +2 million. This means that buying is more aggressive than selling.

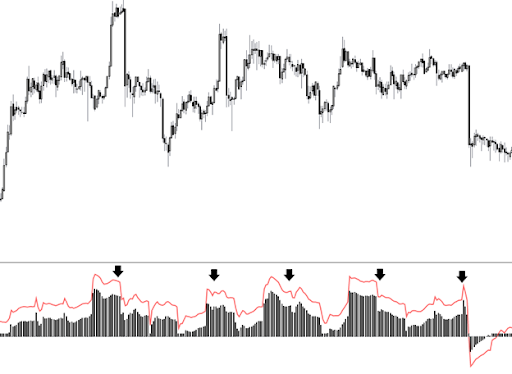

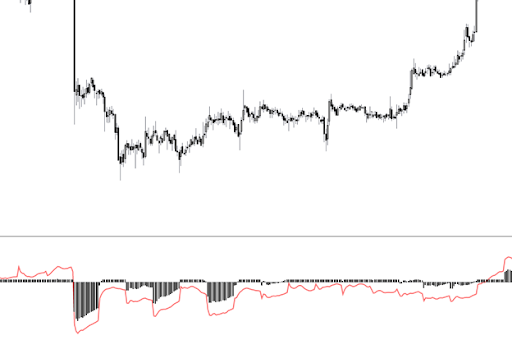

Each candle has its own delta, so the CVD is just the cumulative sum of the set points. It usually tracks the price, but it can tell you where you deviate. In the chart below, we will look at a typical candlestick chart and CVD.

How to use CVD?

CVD is the cumulative sum of market buys and sells, so you know which side of the market is gaining strength. If one side is putting in a lot of effort, but that effort isn’t reflected in the price, you can think of the area as liquidity or friction. Conversely, there are cases where CVD/Delta shows minimal change but larger price changes.

Suppose you have two candles with the same delta and volume but different ranges. It can be inferred that candles with a larger range occur in a more illiquid environment, resulting in less force against the spell.

Think of it as an attempt to judge work and results. As you can see from the example drawing below, the CVD is actually larger as you go to the right of the structure than to the left. This indicates that there is a more aggressive buy than a sell. Instead of moving up the price, it found resistance faster. This is obviously a deep area of liquidity and therefore acts as a resistance.

The opposite can be said when we see that prices are moving more than CVD, which could indicate a shallow region of liquidity with minimal pressure. This can be seen at the post of the image after the last box where the CVD gradually changes, but leads to a more dramatic drop in prices.

Using indicators such as CVD or observing how prices are affected by changes in volume can be beneficial for monitoring liquidity levels or pockets. CVD is an indicator that many order flow traders especially use to make instances of strong support and resistance levels that could lead to a change of direction. For example, if you see CVD continue to decline during the price formation of the support level, you might think that the sell is much more cornered from the low and thus a reversal could be set.

So far, we’ve looked at some simple methods and indicators you can use to monitor your overall liquidity level, not just specific areas where liquidity is changing. In the next article, we will take a closer look at the concept of ‘spoofing’.

Go to Bybit’s Official Website

How to use funding rate as a psychological indicator

Talking to experienced order flow traders will tell you that they are trying to identify people who are ‘offside’ or are ‘doing something wrong’. What they’re talking about is when an area on one side of the market is crowded. When we talk about positioning, this is the main thing we want to check. Is there a sign that one side of the market is concentrated in one place, long or short? This activity and crowding no longer leads to a move that causes large liquidations in the opposite direction. ‘Liquidation’ means coming out of these positions at once. A very congested long market means sell, while a generally congested short market means a rally or ‘squeeze’.

To seize this opportunity, trays can use a number of tools, some of which are a little more complex, but one of the best is actually the one that anyone who trades on a cryptocurrency derivatives platform has access to. That’s the funding rate. I have explained the funding rate in detail in another post, but the basic purpose of the funding rate is to match the price of derivatives with the price index. ( You can learn more about the concept of a funding rate in What is a funding rate ?) In an uptrend in stocks, most people will want long-term exposure, so the funding rate is either against traders who are on break or liquidate their current positions. It acts as an incentive to In bearish terms, the opposite is true. The purpose is to keep the exchange price within the line and settle against the spot derivative price index. Another important point is that in forwards there are longs per short and shorts per long. What is omitted here is the aggression of both sides and the leverage used. It is also worth noting that the funding rate is normally positive when bullish and negative when bearish.

Psychological and positioning tools

If funding is leaning too far in one direction and the price is no longer moving in that direction, you can use the funding rate as a psychological and positioning tool to seize trading opportunities. As an example, consider the cleanup period after a price increase. During the uptrend, funding was moderate, but as prices ranged, funding started to rise even more. Even if the price stays in the same HTF range.

(The funding rate is black, and the premium indicator, which is a derivative of the basis and the root of the funding rate, is marked in red. These indicators are available for free on TradingView.) The price is no longer rising, but funding is on the rise. is that there is too much concentration in the upper tier of the market. Think of it as trying to prevent the market from seeing any further results. Buyers were aggressively long and there was no further price development. All that was left was for the price to squeeze the longs and the sells. If you look at another example below, you can see that the price drops sharply and then compresses into a range. Funding and basis are increasingly negative as prices range and start trading at slightly higher prices. This is a sign that the shorts are still aggressively trading open positions but the price is no longer falling. After the short is locked, the price must only trade in the opposite direction to lead to an uptrend.

At the very least, you can do a bias check with your funding. If you see significant fluctuations in either direction leading to positive or negative funding, you can check yourself and look for counter-trend opportunities with a continuation trend trade.

Understanding volume in scope and trend

One of the most important things cryptocurrency traders should pay attention to when it comes to assets is volume.

Volume refers to the total number of stocks, issues, contracts, etc. traded over a period of time. A simple way to think about volume is to look at the level of activity in the market.

How to use volume to trade well?

There are many tools and volume indicators derived from trading volume.

In this article, I’m going to keep it simple as the base volume per candle, or a standard histogram usually at the bottom of the chart.

Also, remember that trading volume is not to be confused with liquidity, although increased liquidity can often result in high volume.

When it comes to cryptocurrency trading, the basic idea is that the volume should check the price.

This means that volume should be a leading indicator of this contract when buyers and sellers are looking to find or establish a fair price range.

There are situations in which it is very useful for both traders and investors to observe changes in volume.

Follow a trend

Starting from the trend – Ultimately, the volume should confirm the direction of the trend.

If the price is rising, it should be followed by a clear trend with volume rising, followed by a decline in overall volume in a downtrend.

Remember, part of what volume tells us is that people in the trade have this level of interest.

If the volume continues to rise, it indicates that participants are willing to trade at a higher price.

The declines that occur in these uptrends come with convergence, and we would like to see volume dwindling as a signal to sell us that it is supported only by a minority. A perfect example of this is below.

Conversely, in a downtrend, volume increases when the price goes down, and volume decreases during corrections and consolidation zones.

Remember, one fact that is often misunderstood is that the volume has to keep increasing with that trend.

What is really important is that when a new stage is achieved, renewed attention is needed for the new stage during the period of volatility leading to the next convergence.

From the point at which a new phase is subsequently established, it is completely normal for volume to drop below the previous average level.

This is especially useful for traders who follow the Bitcoin trend.

Go to Bybit’s Official Website

Range Trading

In scope, we face a slightly different situation. Volumes within a range are largely irrelevant.

When the price is within the range, when convergence, classification, and average retracement occur, in a trending environment, if technically more imbalances and disagreements between the two parties occur, in essence, within the range, buyers and sellers have a relative agreement means it is in

Under the in-range conditions, we will either see a decrease in volume at the top of the range or we will lose power at the bottom of the range and a potential signal will continue indicating a reversal of direction. The points within the range where changes in volume are important are the extremes (at both ends).

This means that the volume is important throughout the level. This applies when inverting.

Whether in a higher or lower period, accompanied by volume through the level is a sign that it may continue to break the trend.

An example that fully explains this is given below.

It is only after the level is broken that the trading volume rises to the average level.

The fact that volume came in once the level broke was a clear sign that the trend change was being supported by new entrants.

Remember, the range is just a sideways trend.

A sign of that change is an increase in new trades that appear after a new price level is established.

For example, in this case, the volume continues to increase through support or resistance.

The opposite is the case when we make the wrong escape.

If the lack of trading volume is exactly what it is, it’s a false exit.

This could be interpreted as either a lack of follow-up response to the new price point or a lack of sustained interest.

Deviations from the trend, either downwards or upwards, often result in sharp reversals.

An example of this is when it recently moved upwards from our range, there was a lot of volume initially, but once the level broke, the volume didn’t follow.

Understanding the basics of volume analysis can benefit long-term investors as well as short-term trading strategies.

In a follow-up article, we’ll cover a few more advanced ways we can take a look, especially for volumes with cheats.

Understanding Position Size Trading in Cryptocurrency Trading

Let’s take a quick look at the most important part of which trading system, position size or, in particular, how much money you can bet on one given trading idea.

Much like money management in everyday life, this can make or break your ability to be successful in the long run. You should think of it as a business to master your trading skills.

Improper position sizing will be the number one reason your business goes bankrupt.

Imagine if you were sitting at a poker table.

Do you want to go all-in in the first few times? Even if you have the best skills you can, and you can bet more, you’re not going to bet all the chips (All-in) in a single bet.

What is position sizing in cryptocurrency trading?

In cryptocurrency trading, you can make a loss, this is guaranteed.

Part of the reason we document and book our trades is to know how many trades we need to make in order to predict a loss from given information.

Even a system that wins 3 out of 4 has a 78% chance of losing 4 in a row.

With a 50% win rate, there is a 78% chance of losing 8 in a row.

So, you might be thinking, “I’m fine, I only have 1% risk in my account for every 1 trade”.

The problem is that you don’t always lose exactly 1% by invalidating your trades or making a good reserve sell.

This didn’t even account for transaction costs and sleepy.

Positions should be sized to the extent you can afford the risk, taking into account invalidations and liquidations of trades.

How do you calculate and manage the size of your positions?

There are several ways a trader can calculate and manage the size of a position.

There are four main options – the unit of money supply, the unit model of the unit, the volatility of the rate and the risk rate that most are using.

Go to Bybit’s Official Website

Description of Risk Probability Model

For beginners, the risk probability model is best (to use).

In the risk probabilistic model, we first need to identify what makes us psychologically comfortable taking risks whenever we trade.

To illustrate this, let’s start with the 1%.

This value can change as traders become more aware of the system’s performance.

Let’s imagine Trader ABC has an account balance of $10,000 and is willing to take a 1% risk per trade.

The maximum amount ABC is then willing to lose while trading is 1% of the account balance.

The idea that they only spend 1% of their account on stock purchases is wrong.

Instead, they adjust their positions based on the specific risks associated with them.

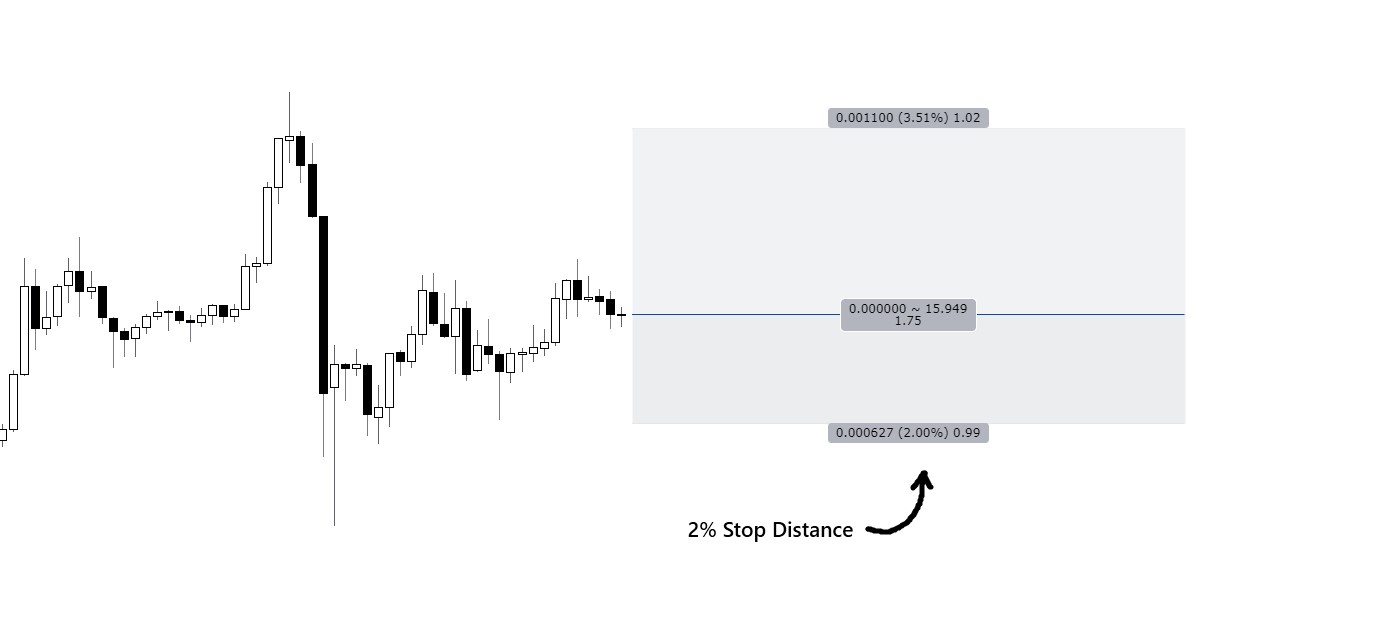

Now, sometimes ABC finds a way to set up a complete stop loss set at 1% off the purchase price, and use all of their account balance on each trade.

This may not be the best idea as it leaves you with no extra cash to add, but you can use it.

However, even if their initial risk is 1%, there are cases where the appropriate stop setting range for a trade is higher than 1% of the balance.

If they trade with the entire balance in their account, they take more risk than the system allows.

Below is an example of setting up a trade that allows ABC to either buy at a low price or stop below the asking price.

In this example, ABC is willing to risk 1% of its account per trade, but the appropriate sell interval for the trade is 2% of the buy price. And their account balance is $10,000.

What we’re going to do in this case is divide the initial risk by the interval to sell.

Risk % ÷ Stop % = Position Size %, or 1/2 = .5

We now multiply this value by our account balance to get a value of $5,000.

Now if we took a position worth that amount and the price moved 2% and the trade ended, we would still only lose 1% of the value of our account.

Stop spacing and risk can now be incorporated into location scaling.

Consolidation is a great starting point, but keep in mind that costs and slippage may not be taken into account, and traders may want more size and risk in their bets for more profitability.

As someone who trades cryptocurrencies, I hope you stay tuned for more helpful articles that can help you progressively improve your trading skills.

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.