The U.S. Securities and Exchange Commission (SEC) claimed in a recent complaint that at least nine digital assets on the Coinbase platform are unregistered securities. The incident follows the arrest of a former Coinbase product manager on suspicion of wire fraud in an insider trading case. The individuals involved allegedly used the confidential information to conduct illegal transactions involving 25 different encrypted assets before at least 14 listing announcements were made public, and made more than $1.5 million in profits, making it the “first case of insider trading in cryptocurrency.” The SEC’s charges against nine digital assets largely reflect the organization’s longstanding attitude toward treating most cryptocurrencies as securities. In response, Coinbase responded in a blog post saying that U.S. law has not kept pace with the development of the digital world.

Tesla decided to dump 75% of its cryptocurrency holdings after a year of championing the long-term potential of BTC. The main cryptocurrency market pared losses on Thursday as investors began to digest the event. BTC appears to be stuck in a tight range but is still struggling to get closer to the 50-day moving average. At the time of writing, the largest cryptocurrency by market capitalization is holding steady above the $23,000 mark after a modest gain over the past 24 hours. If BTC can close above the $23,900 mark, it will likely accelerate its rise. Conversely, BTC is likely to decline and retest the support near $22,700 and the 100 hourly moving average.

The current biggest pain point in the options market is near $23,000. Options with a notional value of $1.6 billion are due to expire at the end of the month, and despite the volatility, the market expects prices to trend toward the biggest pain point. BTC’s gamma exposure indicator remains range-bound, while ETH’s gamma exposure indicator continues to rise, approaching 1.2 million.

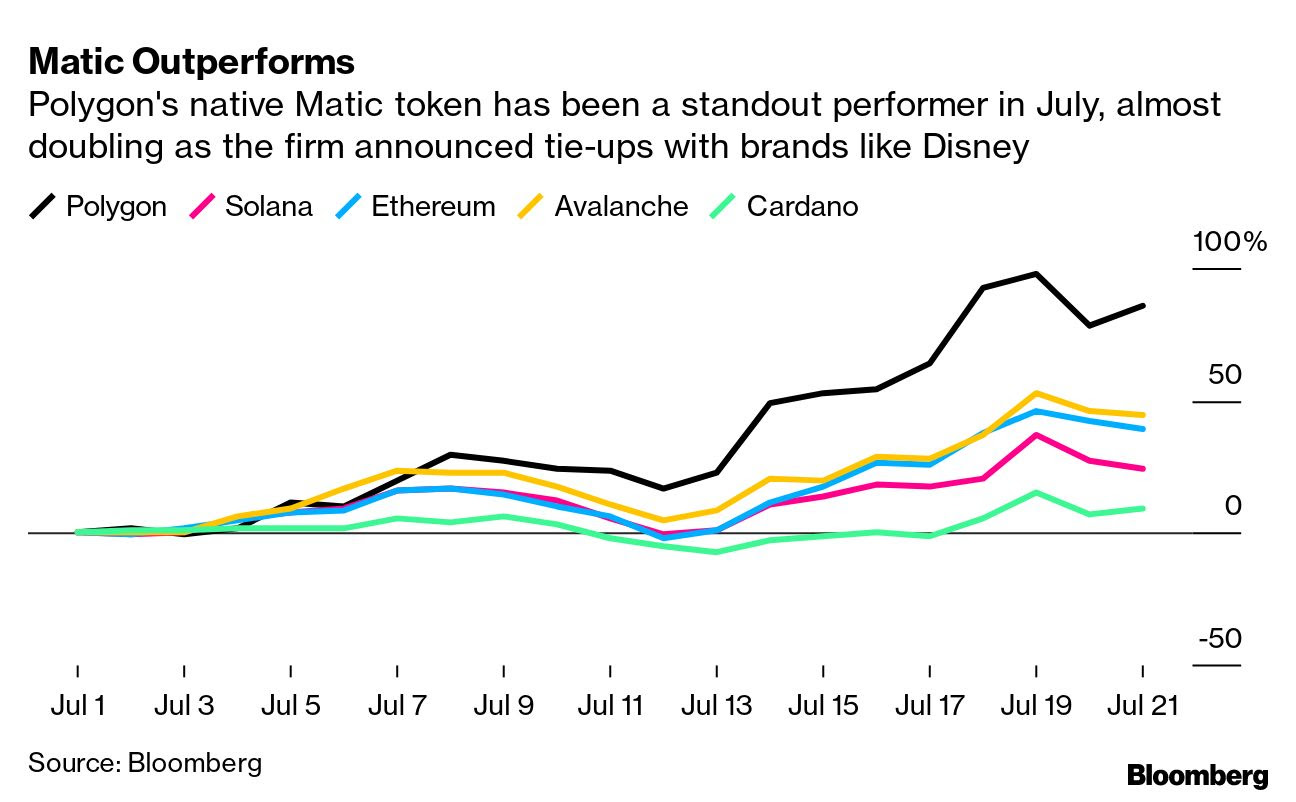

Similar to BTC, ETH recovered above $1,550 after gaining 6.6% over the same period. A key bullish trend line is forming with support near $1,520 on the hourly chart of ETH. A break above immediate resistance at $1,600 could see further gains for the second-largest cryptocurrency by market cap. In the altcoin market, major altcoins have turned from losses to gains, with ETC and NEAR leading the recovery with double-digit percentage gains. Extending the time frame, however, reveals that Polygon’s native token, MATIC, has staged an impressive rally from its late-June technical bottom, outperforming all major L1 tokens so far.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...