A Solana-themed brick-and-mortar store is said to be opening in New York’s Hudson Yards neighborhood, as part of Solana’s plans to enter mainstream culture and as part of its ongoing efforts. Customers can learn how Solana works in-store, experience on-chain transactions and NFT collections for themselves, and start a Web3 journey in the real world. As a gateway to Solana’s culture, the store will also offer a wide range of Solana-branded merchandise, including co-branded products in collaboration with heavyweights within and outside the industry.

The Fed confirmed a 75 basis point hike in interest rates, which was in line with investors’ expectations, and the main cryptocurrency market rose sharply. The Fed is expected to slow the pace of interest rate hikes, which improved the situation in risk markets – stocks closed higher, and major digital assets also rose in tandem. At the time of writing, BTC managed to breach the $23,000 mark after gaining 9% in the past 24 hours. Despite the resumption of upside momentum, the main resistance in the $23,500-$23,700 range remains across the board. The largest cryptocurrency by market capitalization will have to clear these hurdles for a fresh rally. Major non-mainstream currencies also took advantage of the Fed’s interest rate hike announcement to rise all the way. UNI and ETC led the recovery, and both surged by at least 20% in the past 24 hours.

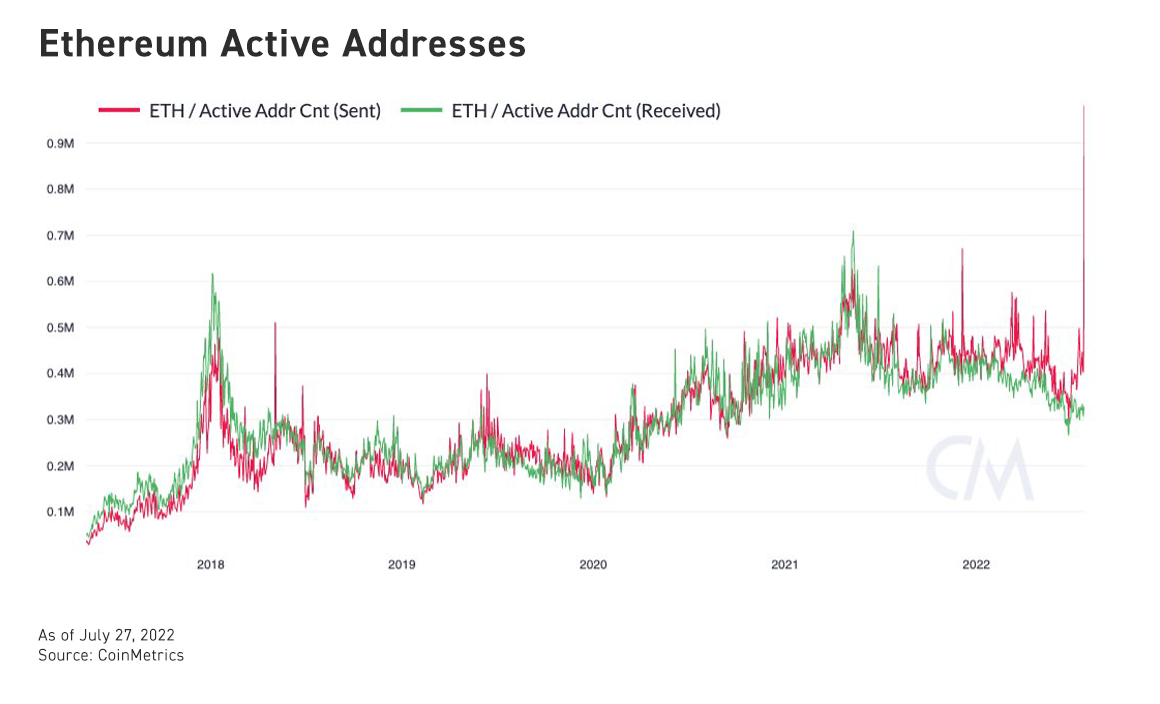

After the Ethereum blockchain completed the mainnet “shadow fork” two days earlier than expected, ETH surged 16% over the same period, regaining its $1,600 position. This successful launch marks another step forward in Ethereum’s transition to the much-anticipated proof-of-stake consensus. On-chain metrics show that Ethereum’s daily active addresses soared above 1 million for the first time since the DDoS attack in 2016. At the same time, small ETH transfers below $1000 have seen a sharp increase, suggesting a round of strong consolidation ahead of The Merge’s upgrade.

Meanwhile, DAI has the highest token velocity among mainstream decentralized stablecoins, thanks to the consistently high transaction volume matched by its excellent supply. This shows that despite recent misgivings about stablecoins, DAI is still the most favored decentralized medium of exchange.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...