The sales volume of the NFT collection skyrocketed by a staggering 248% in the last 24 hours.

After iconic jewelry brand Tiffany & Co. launched exclusive products for CryptoPunk holders, there has been a renewed interest in the CryptoPunk Collection, a venerable project in the NFT space. CryptoPunk sales have surged 248% in the past 24 hours, an astonishing increase. Tiffany also revealed that it plans to launch a separate collection of NFTs called NFTiffs as part of its efforts to “take NFTs to the next level.” Previously, the main NFT market had just experienced a downturn in the second quarter, and the monthly market transaction volume further declined in a downward environment. The rise of CryptoPunk can be described as a shot in the arm for the market.

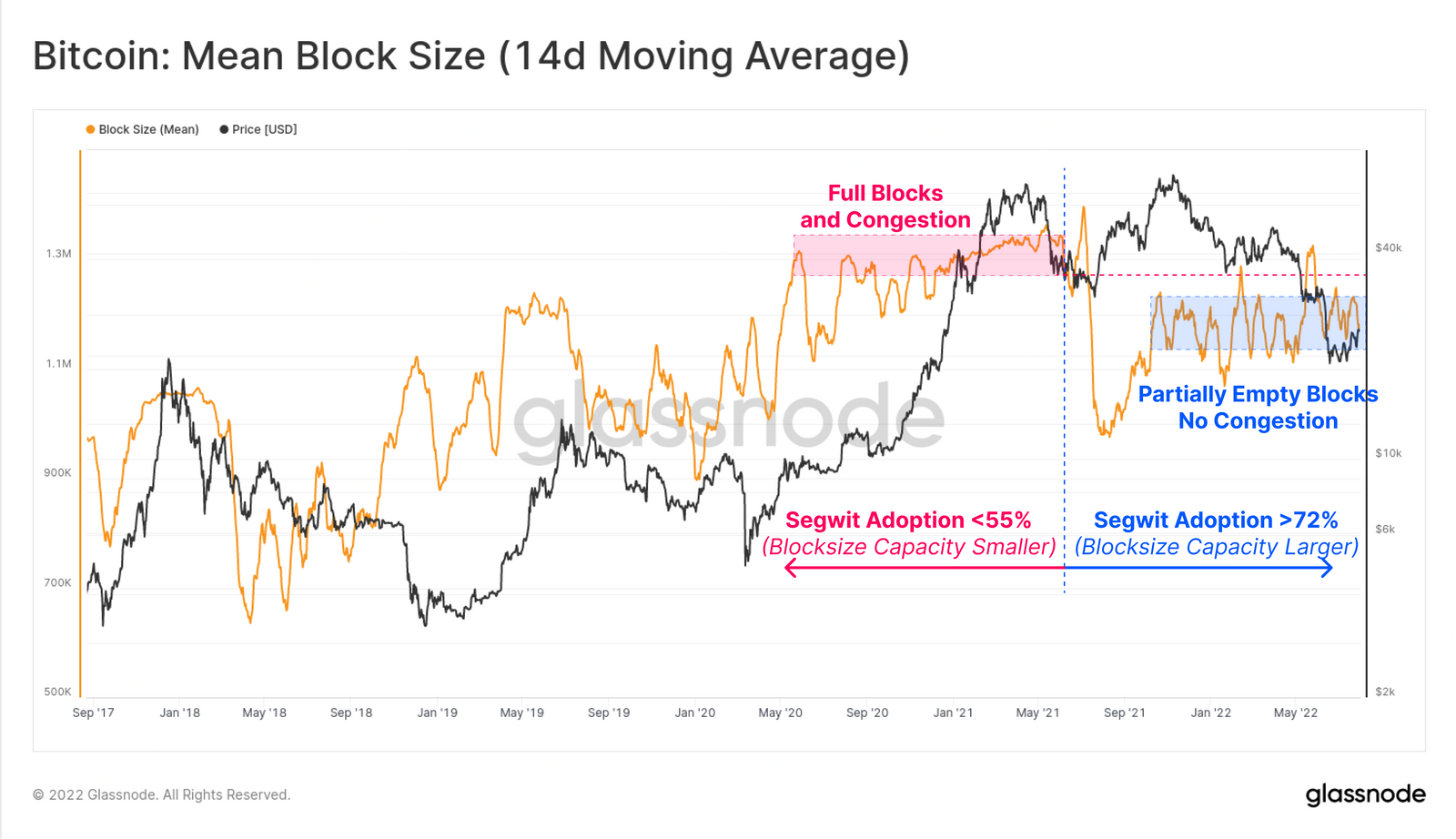

Risk asset markets tumbled in early Asian trade on Tuesday amid heightened geopolitical uncertainty. At the time of writing, BTC has lost 1.7% of its market cap in the past 24 hours, consolidating below the $23,000 mark, and is currently trading below average. The largest cryptocurrency by market cap is facing major resistance near $23,300 and could test support at the $22,000 mark. Demand on the BTC chain is still sluggish, and transaction fees are deep in bear market territory. At the same time, the current block size is even lower than the block size before the adoption of Segregated Witness (Segwit). Block congestion frequency has plummeted to levels seen in May 2021, indicating that the Bitcoin network is still dominated by long-term holders and lack of new demand.

ETH extended losses, suggesting that the recent rally led by the Merge upgrade may have been driven by sentiment and thus lacked solid support. The second-largest cryptocurrency is now sitting below the $1,600 mark after shedding 5.5% of its market cap over the same period. The 7-day implied volatility of ETH options rose again, while the skewness fell further. In the non-mainstream currency market, most major non-mainstream coins turned from positive to negative, with DOT leading the downward correction with a double-digit percentage decline over the same period.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...