51% attack on Crypto. Table of Contents

- What is a 51% attack on blockchain?

- How does a 51% attack work?

- Impact on Blockchain and Bitcoin

- How dangerous is a 51% attack?

- What are the downsides of a 51% attack?

- Difference between 51% attack and 34% attack

- Which Blockchain Platforms Are Affected by the 51% Attack?

- How to prevent a 51% attack?

- What is the probability that 51% of attacks will recur?

- Conclusion

What is a 51% attack on blockchain?

The decentralized nature of the blockchain and the encrypted algorithm make it almost impossible to attack. However, Ethereum Classic fell victim to a malicious attack, losing about $1.1 million due to a 51% attack. Let’s take a look at what this dreadful 51% attack is and how it could have happened.

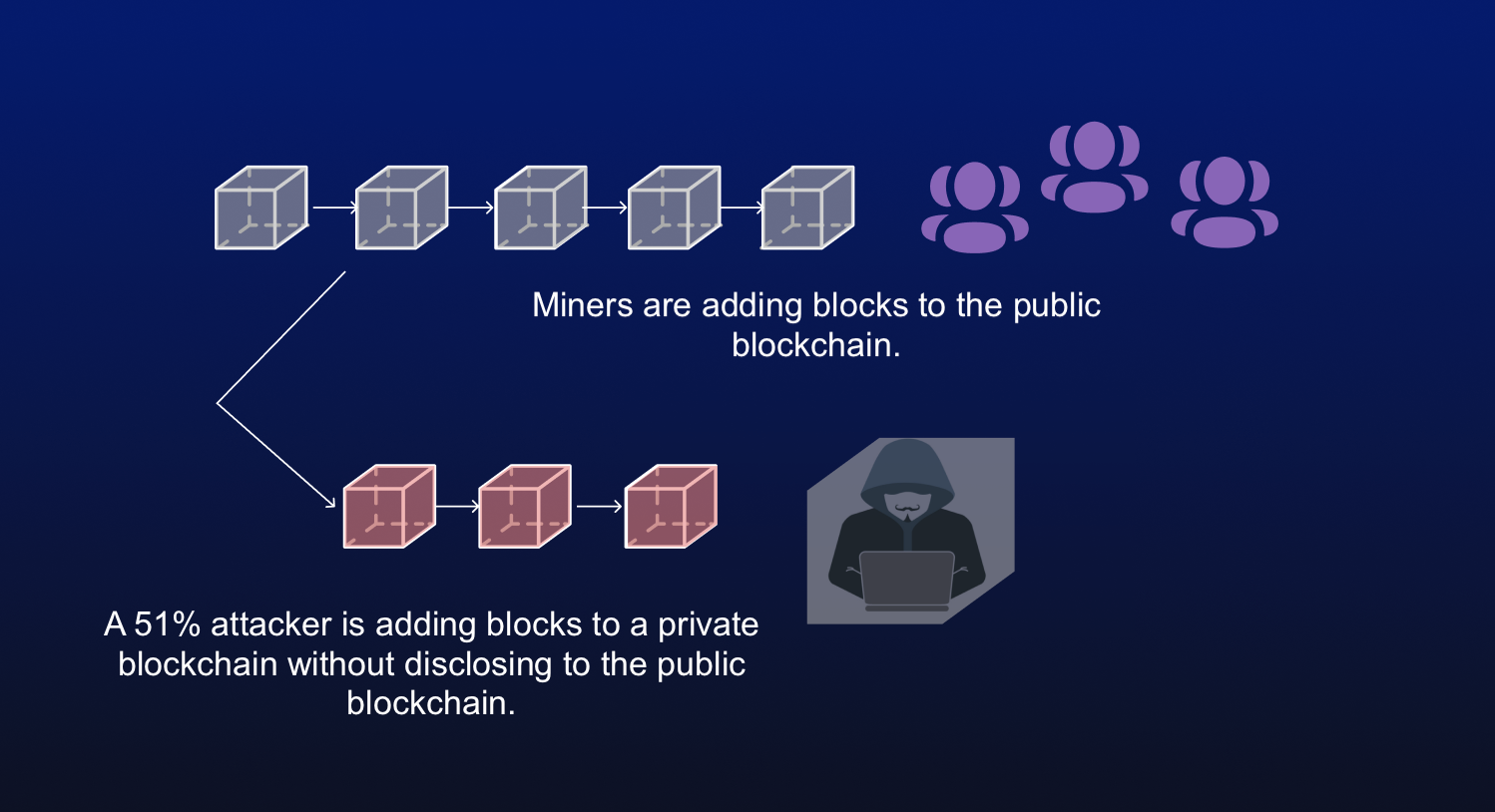

The 51% attack is a type of blockchain penetration that causes network disruption and eventually leads to a mining monopoly. These attacks occur when a miner or organization, or a single entity, gains more than 50% majority control over the hashrate or computing power execution running on a blockchain network.

As a result of the attack, the attacker will prevent the miner from mining, the transaction will be canceled, and eventually, the attacker will have a chance to escape by stealing coins that do not belong to them.

If the blockchain network is intercepted, the attacker will have enough mining power to modify the transaction. This means that trading orders can be modified and all mining operations can be stopped. This is how a 51% attacker can reverse a transaction that causes double-spending within the blockchain.

Let’s say the attacker spends 1 bitcoin in exchange for one thing. In reality, the blockchain records those transactions. However, a 51% attacker can reverse the transaction and induce a refund in order to own both Bitcoin and stuff.

How does a 51% attack work?

A 51 percent attack is achieved by overriding an existing network in order to take over established security protocols. These effects may or may not be severe. But it all boils down to the strength of the attacker.

So the more hash power the attacker has, the easier the attack will be implemented. In the end, the damage is bound to happen. How the 51% Attack Affects Blockchain and Bitcoin

Impact on Blockchain and Bitcoin

When one entity neutralizes the power the blockchain computes, a 51% attack can begin. When the attack penetrates the hash power of Bitcoin, each entity can delay the start of a new transaction and, as a result, manipulate the same coin to be used multiple times.

When blockchains use a proof-of-work (PoW) scheme to authenticate transactions, this penetration delays miners from verifying and agreeing on blocks in chronological order. If the miner’s computing power is reduced, the transaction confirmation of previously scheduled blocks will also be delayed. And finally, the blockchain network collapses. This sequence of steps allows attackers to solve equations faster than miners.

As a result, the attacker gains control to overturn the unconfirmed transaction and double-spend the coin. Furthermore, the attacker even gets a reward for the miner by updating the blockchain. And this is exactly what happened with Ethereum Classic (ETC) and Bitcoin Cash (BCH).

How dangerous is a 51% attack?

51% attacks deal damage to miners. And the collapse of the blockchain network proves that the blockchain is vulnerable. But experts think differently. In fact, an analysis of this attack from a different point of view may prove beneficial.

It is clear that Bitcoin’s hash power is built from the contributions of stakeholders who share the same goal. And these individuals are very rational when making decisions. However, when price discrimination occurs, there is still the risk of collusion to change the distribution method of hash power. This allows other individuals to benefit from the shift in power, or at least avoid significant losses.

Proof-of-Work (PoW) can hold up well on large blockchains like Bitcoin, but it can be different for smaller projects like Ethereum Classic (ETC). This is because companies that want to attack Bitcoin require huge amounts of money to gather mining equipment to create enough computing power to mine Bitcoin. So Bitcoin was placed under a 51 percent attack, but that manipulation attack was futile.

What are the downsides of a 51% attack?

As dangerous as this attack can be, there are also countermeasures in the blockchain to prevent penetration.

Here’s what you need to know:

- There is no way a 51% attack can manipulate a miner’s reward for mining per block.

- The attacker will not be able to create new transactions.

- When reverse trading occurs, attackers can jeopardize private or private transactions.

- It is impossible to raise the upper limit of tokens or coins that exist in a blockchain network.

Difference between 51% attack and 34% attack

The 34% and 51% attacks pose the same threat to the blockchain, ultimately taking control of its mining power. However, the 34% attack differs from the 51% attack in that it uses the Tangle consensus algorithm by manipulating blockchain transaction history to approve or reject transactions.

Conversely, a 51 percent attack allows the attacker to either stop all mining or give the attacker complete control over the blockchain network from which the coins can be effectively reused.

Which Blockchain Platforms Are Affected by the 51% Attack?

Theoretically, the Bitcoin and Ethereum blockchains are more resistant to 51% attacks than relatively small coins (projects). On the other hand, the 51% attack on many coins is still fatal. Here are some platforms that have suffered from this attack:

1. Green (GRIN):

According to the recent news, the privacy-centric crypto network GRIN was infiltrated by a 51% attack. An anonymous entity had gained a total of 58.1% over the network hash rate recently on 7th Nov 2020, resulting in a quick payout stopped.

According to recent news, a 51% attack has penetrated the privacy-centric crypto network GRIN. An anonymous person (institution) recently gained a total of 58.1% of the hashrate on the network on November 7, 2020, as a result of which the fast payment service was discontinued.

2. Vertcoin (VTC):

Since VTC is a coin focused on ASIC resistance, it seems surprising that the majority of 51% attacks occur on VTC. In October and December 2018, VTC lost $100,000 worth of VTC due to double-spending by an individual (institution) who obtained sufficient computational power from NiceHash. As a result, Vertcoin (VTC) reorganized over 300 blocks and another 600 hard forked blocks on the VTC network.

3. Bitcoin Gold (BTG):

In May 2018, Bitcoin Gold totaled 12,239 BTG ($18 million) in double-spending. More recently, in late January, Bitcoin Gold again fell victim to a 51% attack and eventually suffered double payments of over 7,000 BTG in two days. This attack was the result of two massive blockchain reorganizations that were eliminated.

4. Ethereum Classic (ETC):

The Ethereum Classic blockchain has suffered not one, but three 51% attacks in a month. Each of these attacks took place in August 2020, with the first attack on August 1, the second on August 6, and the last on August 29. The attack even caused cryptocurrency exchange Coinbase to completely suspend ETC deposits and withdrawals.

How to prevent a 51% attack?

The 51 percent attack uses a consensus algorithm based on proof of work (PoW) to prey on cryptocurrencies. The best way to defend against this attack is to use the consensus of stake (PoS). That is also what Ethereum 2.0 is trying to avoid.

When using the consensus of stake (PoS) algorithm, validators can mitigate the risk of penetration by maintaining the operational functions of the network. For example, the consensus of stake (PoS) helps to limit the amount of cryptocurrencies that can be accumulated. In other words, even if a 51% attack is possible, an individual (institution) will have to raise a large amount of money for cryptocurrency initially in order to take control of the system. Taking a closer look at these 51% attacks, it is unlikely that consensus of stake (PoS) cryptocurrencies will be targeted from 51% attacks. Because a large amount of money is invested, the profitability is not very good.

What is the probability that 51% of attacks will recur?

However, if a flaw exists in the blockchain code, a 51% attack is likely and may occur again. When such an event occurs, in order to launch an attack, an attacker can break the blockchain producing new blocks faster. In conclusion, this attack could happen again, but the Bitcoin blockchain is more resilient.

Conclusion

Emerging technologies, including blockchain and cryptocurrencies, can experience all kinds of risks and vulnerabilities. This is also why we need to know what a 51 percent attack is.

While many technologies promise to avoid these weaknesses, cyber penetration is hard to avoid. On the bright side of things, these attacks serve as a catalyst for the industry to always learn and improve to achieve good results. Let’s see what the future holds for this ever-changing industry.

Please check Bybit official website or contact the customer support with regard to the latest information and more accurate details.

Bybit official website is here.

Please click "Introduction of Bybit", if you want to know the details and the company information of Bybit.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...