Bitcoin dominance is the measurement of the total market capitalization of Bitcoin in relation to the market capitalization of cryptocurrencies as a whole.

Understanding Bitcoin’s Dominance Index

When it comes to trading Bitcoin, users most want to have a handy tool to help them make decisions. For example, we have tools like the Fear and Greed Index to help us make decisions, and this time we’ll take a closer look at Bitcoin’s Dominance Index to see how it can help your trading.

What is Bitcoin’s Dominance Index?

The Bitcoin Dominance Index is the ratio of Bitcoin’s market capitalization to the overall cryptocurrency market capitalization. In other words, the index is the current state of Bitcoin in the cryptocurrency market. We can get Bitcoin’s Dominance Index by this formula:

Bitcoin Dominance Index = Bitcoin Market Cap / Total Cryptocurrency Market Cap

This index is very important because it gives you an idea of which currencies are mainly used in the current market and to what extent. For example, back in 2009, Bitcoin’s dominance index was 100%, which is not difficult to understand, when Bitcoin was the only cryptocurrency. Over time, this 100% index gradually declined as more and more cryptocurrencies were introduced into the market. By June 2022, Bitcoin’s dominance index reached 46%, the highest level since October 2021 (41%).

Throughout its lifespan, Bitcoin has always had a majority share of the total cryptocurrency market capitalization. We can say that this is due to Bitcoin being the first cryptocurrency to come out, but we can also see that Bitcoin’s level of adoption and adoption is also an important factor in its dominance.

What Factors Affect Bitcoin’s Dominance Index?

As mentioned earlier, Bitcoin’s Dominance Index is the ratio of Bitcoin’s market capitalization to the cryptocurrency market capitalization. That said, Bitcoin’s Dominance Index is largely influenced by two main factors – the value of Bitcoin and other tokens.

Bitcoin value

There is no doubt that the value of Bitcoin will play a major role in this index. But to be clear, when we’re talking about Bitcoin’s value, we’re also talking about its volatility. This includes reasons why Bitcoin’s value may fall or rise .

Let’s take the early days of Bitcoin again as an example. Bitcoin was in a steady 95% and above dominance before other coin options increased. As more and more other coins entered the market, Bitcoin gradually increased in value but also lost some of its dominance. Bitcoin’s dominance index is as low as 35%.

Many have pointed out that around this time (2017), initial coin offerings (ICOs) gained popularity. That said, the market shifts more attention (and funds) into these ICOs to buy other tokens. Over time, many of these tokens have either ceased to exist or have little value left, making BTC’s dominance index rise again.

Token value

Similarly, changes in the value of other tokens will also affect Bitcoin’s Dominance Index, because that’s what Bitcoin is measured against. Bitcoin will start to lose its place in the market as the performance and movements of other coins improve.

While a few years ago, other coins seemed to hold a more significant market share, the current crypto winter proves that initial performance is not necessarily indicative of long-term performance. This will also push the pump-and- dump scam out of the market, as sudden fluctuations expose malicious developers. But at the same time, many users who relied on these tokens lost a lot of money.

This does not mean that other coins are wrong in general, just that they are not as mature and widely used as Bitcoin. The utility of the currency remains an important factor in the success of cryptocurrencies, and as long as the usage of the token is limited, there will be more challenges in the market.

Check out Paxful’s trading tools

Bitcoin Dominance Index Chart

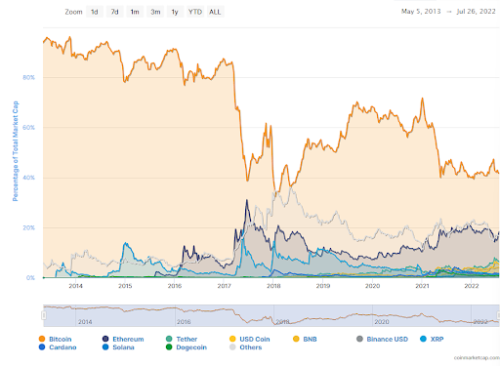

To give you a better understanding of BTC’s Dominance Index, please refer to this chart for a more intuitive understanding of the cryptocurrency’s market share:

This chart gives us a complete picture of how Bitcoin and all other cryptocurrencies have performed over the years. Note that in 2014, Bitcoin’s dominance waned as more and more coins came out. Still, Bitcoin dominates the majority of the market and persists amid panic and uncertainty.

Should I rely on Bitcoin’s Dominance Index when trading?

We must stress that Bitcoin’s Dominance Index is not a one-size-fits-all answer to many trading questions. Essentially, the Dominance Index is just a tool for users to make informed decisions. It is similar to the Fear and Greed Index, which acts as a gauge that shows the current performance of the market and its perception of Bitcoin and other coins.

As far as tools are concerned, the role of the dominance index is very important. It is a good description of market behavior and attitudes in a way that is easy for most people to understand.

While the tools themselves are valuable, the actual research is still more important, after all, tools are just tools. Even the best tools will be difficult to use or function if we don’t have enough information or knowledge ourselves.

Take advantage of all tools

At the end of the day, the most important thing for the Bitcoin community is to understand all the tools that are available and understand how they are best used. By having the right knowledge and information, you won’t make hasty decisions easily.

But only if you do your own research. Imagine that many Bitcoin traders don’t use these tools and rely solely on researching the market. By doing sufficient study and utilizing the tools available, you will make what you learn more effective to your advantage.

Check out Paxful’s trading tools

Please click "Introduction of Paxful", if you want to know the details and the company information of Paxful.

Comment by jetonwhy

February 16, 2025

Anyone else finding it weird that Deriv only allows deposits through Jeton and not bank transfers? They’ve removed crypto too, so now it’s just cards and Jeton. Kinda frustratin...